Option traders:

An important decision that a option trader needs to make is which option he should trade- ITM, ATM, or OTM among other things a trader must also consider the premium of these three options in order to make an educated decision.

As discussed earlier there are two components in the option premium- intrinsic value and time value if the option is deeply ITM, the intrinsic value will be higher and so is the option value/premium in the case of ATM or OTM options there is no intrinsic value but only time value. Hence these options remain cheaper compared to in the money options therefore, option buyer pays higher premium for in the money option compared to ATM or OTM options and thus the cost factor largely influences the decision of an option buyer.

For ATM options the uncertainty is highest as compared to ITM or OTM options. This is because we know that all Greeks effect more on ATM options comparison to ITM or OTM options in the function of directional movement in any direction effect put by delta and gamma, time to expiry as a theta and volatility also.

Table of Contents

Analysis of call option trading from buyers perspective (call option trader):

I have seen above section that ITM are very expensive than ATM or OTM options then which moneyness buy to make maximum profit or high chance of profit.

The spot price of Nifty on dated 22/8/2022 time 11:16am is 17560/-

Option contract Nifty Sep CE

Expiry date- 29/Sep/2022

Option type- call option

Underlying asset- Nifty 50

| Moneyness | Strike price (K) | Premium (P) | Intrinsic value + time value |

| ITM | 17100 | 742.10 | 460+282.10 |

| ATM | 17550 | 446.00 | 10+436 |

| OTM | 18000 | 220.70 | 0+220.70 |

Payoff for call options buyer with different strikes and premiums:

| K | 17100 | 17550 | 18000 |

| P | 742 | 446 | 221 |

| NIFTY CLOSING PRICE ON EXPIRY \ BEP | 17842 | 17996 | 18221 |

| 17000 | -742 | -446 | -221 |

| 17100 | -742 | -446 | -221 |

| 17200 | -642 | -446 | -221 |

| 17300 | -542 | -446 | -221 |

| 17400 | -442 | -446 | -221 |

| 17500 | -342 | -446 | -221 |

| 17600 | -242 | -396 | -221 |

| 17700 | -142 | -296 | -221 |

| 17800 | -042 | -196 | -221 |

| 17900 | +58 | -96 | -221 |

| 18000 | +158 | +4 | -221 |

| 18100 | +258 | +104 | -221 |

| 18200 | +358 | +204 | -21 |

| 18300 | +458 | +304 | +79 |

| 18400 | +558 | +404 | +179 |

| 18500 | +658 | +504 | +279 |

Profitability for call options buyer:

profitability of call options is return on investment so

ROI= return*100/investment

ITM, ROI= return for spot 18500*100/investment for strike 17100(P)

ROI= 658*100/742= 88.68%

ATM, ROI= 504*100/446= 113%

OTM, ROI= 279*100/221= 126%

I have seen that OTM options given extra return if target achieved but if not then loss. I have seen that on 18200 underlying price OTM option make loss but ITM and ATM make profit but if direction movement go opposite then you have to make loss more on ITM and ATM comparison to OTM options. So selection of moneyness very important because ITM, ATM options given more chances of profit in low speed of underlying but OTM options only given profit when underlying speed is very high. So I will suggest you always take contract ATM or slightly ITM options.

Seller of call option:

If you have bearish perspective on underlying price then.

Payoff for call options seller with different strikes and premiums:

| K | 17100 | 17550 | 18000 |

| P | 742 | 446 | 221 |

| NIFTY CLOSING PRICE ON EXPIRY \ BEP | 17842 | 17996 | 18221 |

| 17000 | +742 | +446 | +221 |

| 17100 | +742 | +446 | +221 |

| 17200 | +642 | +446 | +221 |

| 17300 | +542 | +446 | +221 |

| 17400 | +442 | +446 | +221 |

| 17500 | +342 | +446 | +221 |

| 17600 | +242 | +396 | +221 |

| 17700 | +142 | +296 | +221 |

| 17800 | +042 | +196 | +221 |

| 17900 | -58 | +96 | +221 |

| 18000 | -158 | -4 | +221 |

| 18100 | -258 | -104 | +221 |

| 18200 | -358 | -204 | +21 |

| 18300 | -458 | -304 | -79 |

| 18400 | -558 | -404 | -179 |

| 18500 | -658 | -504 | -279 |

Profitability for call options seller:

profit of call option seller same as premium.

By payoff of call seller look that OTM options profit low (same as premium) but underlying range more than ITM and ATM options up to 18200 spot price of Nifty as a profit. Means OTM options very safe comparison to ATM and ITM options so I will suggest you select OTM strike for option call selling purpose.

Analysis of put option trading from a buyers perspective (put option trader):

Take same as above contract- Nifty Sep ….PE

Expiry date- 29/Sep/2022

Underlying price- 17560(22/8/22)

Option type- put option,

underlying asset- Nifty 50

| Moneyness | Strike price (K) | Premium (P) | Intrinsic value + time value |

| ITM | 18000 | 563.90 | 440+123.90 |

| ATM | 17550 | 342 | 0+342 |

| OTM | 17100 | 194.55 | 0+194.55 |

Payoff for put options buyer with different strikes and premiums:

| K | 17100 | 17550 | 18000 |

| P | 195 | 342 | 564 |

| NIFTY CLOSING PRICE ON EXPIRY \ BEP | 16905 | 17208 | 17436 |

| 16500 | +405 | +708 | +936 |

| 16600 | +305 | +608 | +836 |

| 16700 | +205 | +508 | +736 |

| 16800 | +105 | +408 | +636 |

| 16900 | +05 | +308 | +536 |

| 17000 | -95 | +208 | +436 |

| 17100 | -195 | +108 | +336 |

| 17200 | -195 | +8 | +236 |

| 17300 | -195 | -92 | +136 |

| 17400 | -195 | -192 | +36 |

| 17500 | -195 | -292 | -64 |

| 17600 | -195 | -342 | -164 |

| 17700 | -195 | -342 | -264 |

| 17800 | -195 | -342 | -364 |

| 17900 | -195 | -342 | -464 |

| 18000 | -195 | -342 | -564 |

| 18100 | -195 | -342 | -564 |

Profitability for put options buyer:

ROI for underlying spot price on closing 16500/-

ITM (K-18000), ROI= 936*100/564= 165.95%

ATM (K-17550), ROI= 708*100/342= 207%

OTM (K-17100), ROI= 405*100/195= 207.69%

I have seen that OTM options ROI is more than ITM and ATM options and premium is also less but underlying profit range is very less so ITM options very safe than OTM options but due to high premium if directional movement will go wrong then loss maximum happen so advice you make position in strong calculation of underlying movement and select ATM options for buying of put options.

Seller of put options:

On bearish view then.

Pay off for put options seller with different strikes and premiums:

| K | 17100 | 17550 | 18000 |

| P | 195 | 342 | 564 |

| NIFTY CLOSING PRICE ON EXPIRY \ BEP | 16905 | 17208 | 17436 |

| 16500 | -405 | -708 | -936 |

| 16600 | -305 | -608 | -836 |

| 16700 | -205 | -508 | -736 |

| 16800 | -105 | -408 | -636 |

| 16900 | -05 | -308 | -536 |

| 17000 | +95 | -208 | -436 |

| 17100 | +195 | -108 | -336 |

| 17200 | +195 | -08 | -236 |

| 17300 | +195 | +92 | -136 |

| 17400 | +195 | +192 | -36 |

| 17500 | +195 | +292 | +64 |

| 17600 | +195 | +342 | +164 |

| 17700 | +195 | +342 | +264 |

| 17800 | +195 | +342 | +364 |

| 17900 | +195 | +342 | +464 |

| 18000 | +195 | +342 | +564 |

| 18100 | +195 | +342 | +564 |

Profitability for put options seller:

profit of put option seller same as premium.

I have seen that OTM options have Nifty profit range more comparison to ATM and ITM options so I will suggest you always go on OTM options for option seller purpose because of its less risky even that low premium.

Can I trade in options and futures before expiry:

Yes you can exit position before expiry your profit and loss will be your option premium difference.

Example= if you buy call option in X premium and after 3 days premium is Y then

Profit and loss= ±(Y-X) Or ±(Y-premium decay in 3days – X)

Generally if your target achieved prior to expiry then you have to get more return of investment (ROI) because of premium (time value) tends to zero on expiry means Y is more prior expiry.

Conclusion points for option trader:

♣ Directional movement support to options and futures.

♣ Maximum time falling underlying speed more than rising underlying speed so in bearish trend make position put buyer very helpful on mind reversal. Put seller is risky on falling market (fear always over the greed).

♣ If underlying speed very high go OTM options, if medium go ATM options and if low go ITM options if you want to buy options with respect to directional movement of underlying asset.

♣ If you want to sell options then go high and medium opposite speed of underlying asset on only OTM options with SD (volatility) calculation avoid in low speed because of its may be reversal time or position unwinding time. So it will be risky for any position.

♣ Underlying speed= last expiry days underlying rise or fall/remain expiry in trading days.

Minimum required speed of underlying= premium of ATM options/remain expiry days.

♣ Expiry days underlying rise or fall/remain expiry in trading days.

Minimum required speed of underlying= premium of atm options/remain expiry days.

Example- Nifty 25 Aug CE

Premium ATM options= 124/- (on 22/8/2022, 11:16am)

Minimum required speed of Nifty (underlying)= 124/4= 31points per day or average.

Nifty(underlying) speed last 4 days= (nifty current day price-nifty last 4 day price)/4

= (17759-17825)/4= -66/4= -16.5 average points last 4 days

Now if Nifty speed is equal to or slightly more than 31 points make position in ITM moneyness option if double choose ATM options if triples make position in OTM option with calculation of support and resistance if negative make position in selling options.

♣ If VIX near 52 week high try to select bullish trend options if VIX near 52 week low try to select bearish trend options.

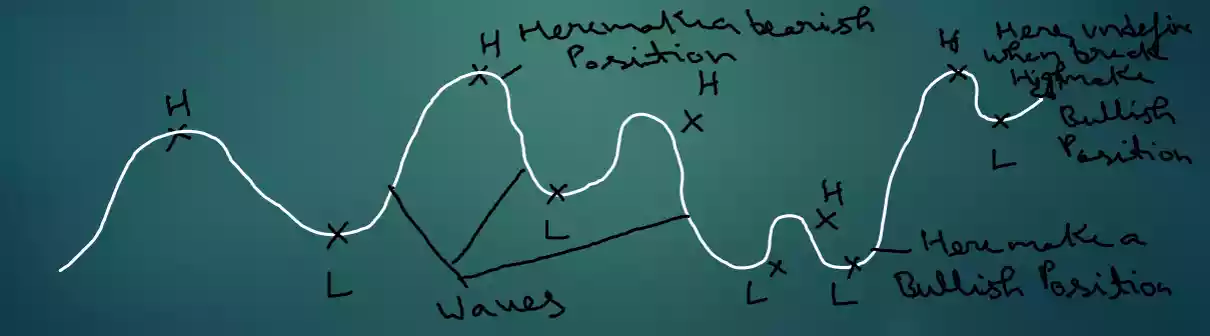

♣ For selection of options go on 1day chart last 1year and put high and lows of trends and look current position. If current position of underlying more than last waves low try to bullish option if current position less than last waves high try to bearish position of options.

Expiry days= last waves days if less than weekly expiry contract for option buyer and seller both

Or

If more than 1 month expiry options look directional movement with long waves like 1 year time maturity take (wave1+wave2+wave3+……..) Time period is equal to 1year and look H & L.

♣ Go on index options because of there is only technical analysis required with Indian economy analysis and for fundamental analysis is very low importance for index options like as Nifty, midcap Nifty etc. Avoid sectoral indices options if you want to go then you have to knowledge of industry also like as Banknifty and for stock options you have to fundamental, technical and sectoral analysis knowledge before making position in stock options.