What is in naked option strategy- part2?

The detailed explanation about the call naked option strategy is given in Naked Option Strategy Part 1. Here we will understand in detail about the Put Naked Option Strategy. As we know that put naked option strategy have two types. One is long put naked option strategy and second one is short put naked option strategy.

What is put naked option strategy?

A “long put” option strategy is a bearish options trading strategy that involves buying a put option on a specific underlying asset. A put option is a contract that gives the holder the right, but not the obligation, to sell the underlying asset at a specific price (strike price) within a specified time frame (expiration date). A long put is profitable if the price of the underlying asset falls below the strike price before the option expires.

A “short put naked” option strategy, on the other hand, is a bullish options trading strategy that involves selling a put option on a specific underlying asset without owning the underlying asset. This is also known as a “naked put” because the seller is not hedging the position with another option or underlying asset. The seller of the put option is obligated to buy the underlying asset at the strike price if the buyer exercises their option. The short put naked strategy is profitable if the price of the underlying asset remains above the strike price until the option expires, or if the seller can buy back the option at a lower price than they sold it for.

It’s important to note that naked options strategies can be riskier than other options strategies because they involve selling options without owning the underlying asset or hedging the position. This can lead to significant losses if the price of the underlying asset moves against the seller’s position.

Table of Contents

Long put naked option strategy:

A long put option is typically used by traders who believe that the price of the underlying asset will decrease in the future. By buying a put option, the trader can profit if the price of the underlying asset falls below the strike price of the option. The profit potential is theoretically unlimited if the price of the underlying asset goes to zero, although in reality, the price of an asset rarely goes to zero.

The main advantage of a long put option is that it limits the trader’s potential loss to the premium paid for the option. This means that the trader’s risk is limited, even if the price of the underlying asset goes up instead of down.

When a participant is bearish on any stock/index, he/she can buy put option. A long put is a bearish strategy when participants want to take advantage of a falling market then participants buy a put option contract.

When to select long put naked option strategy:

When participants (trader/investor) is bearish on the underlying asset (stock/index). Means when underlying asset go down in time cycle of options contract more than premium value which you pay to seller for buying a put option contract.

Strategy:

For long put naked option strategy, there is no any combination required because of this option strategy happen only alone position.

for long put strategy is buy put option.

Risk:

For a long put risk is limited to the paid premium amount or minimum as a premium value for a time frame.

Reward:

Reward for a long put is unlimited (maximum fall value of underlying stock/index in a time frame after deduction of premium value).

Break even point for long put naked option strategy:

For a long put, Break even point= Strike price – Premium

Which underlying asset to select for long put naked option strategy:

When selecting an underlying asset for a long put naked option strategy, it’s important to consider the factors such as liquidity, volatility, market direction, option pricing, industry/sector analysis, economy analysis, technical analysis, fundamental analysis etc. If buying a long put its confirmed that underlying price go down in near term, that means bearish directional movement of spot prices (underlying asset price).

By the way, many stocks/indices are listed for trading in the options market. This list can be seen on the website of NSE.

For here we are selecting Nifty 50 index option contracts for a long put naked option strategy.

Availability of Nifty 50 option contracts:

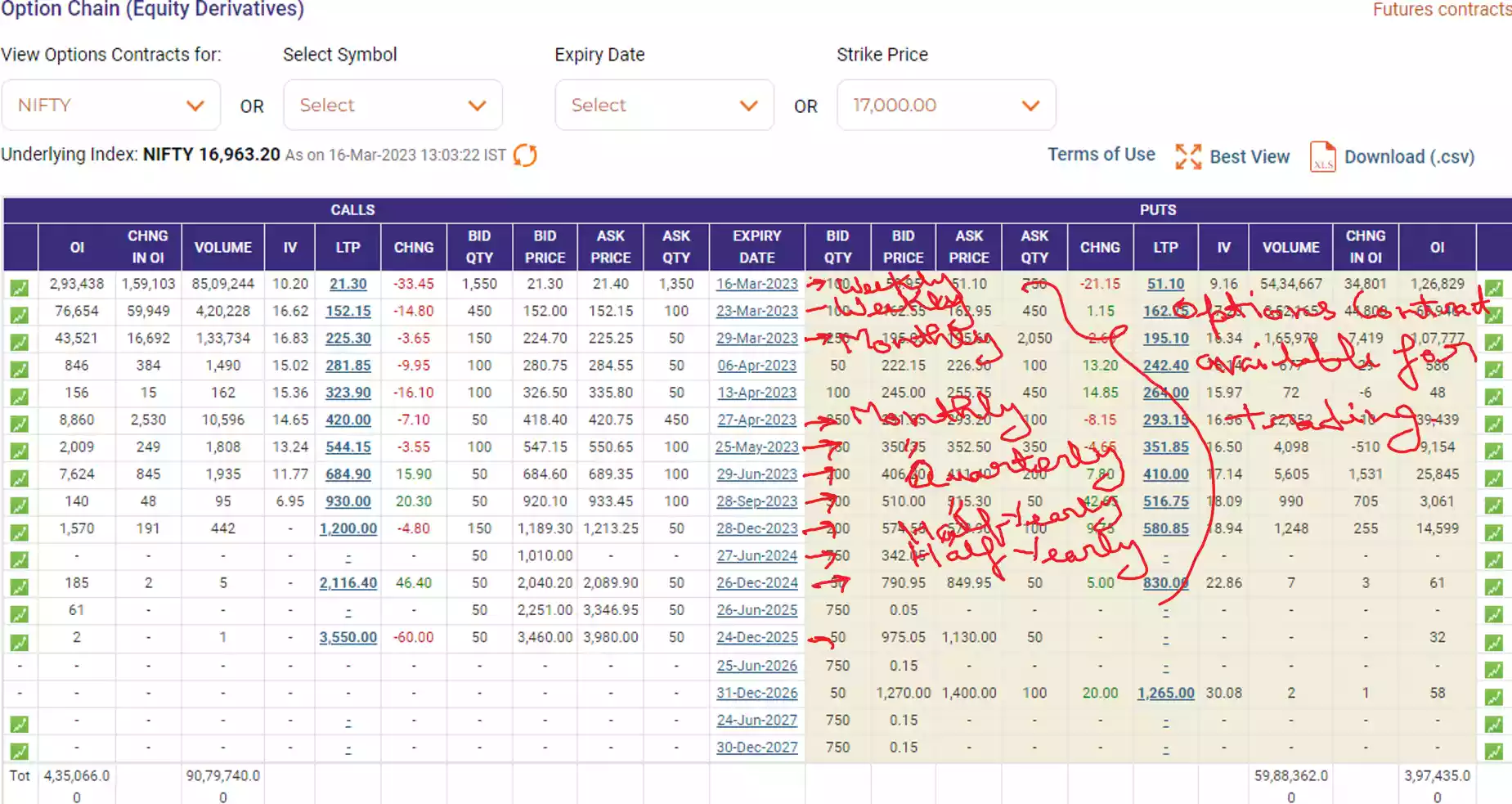

As we know, depending on the time frame, there are many option contracts available for any underlying asset. Such as Weekly Options Contract, Monthly Options Contracts, Quarterly Options Contract etc.

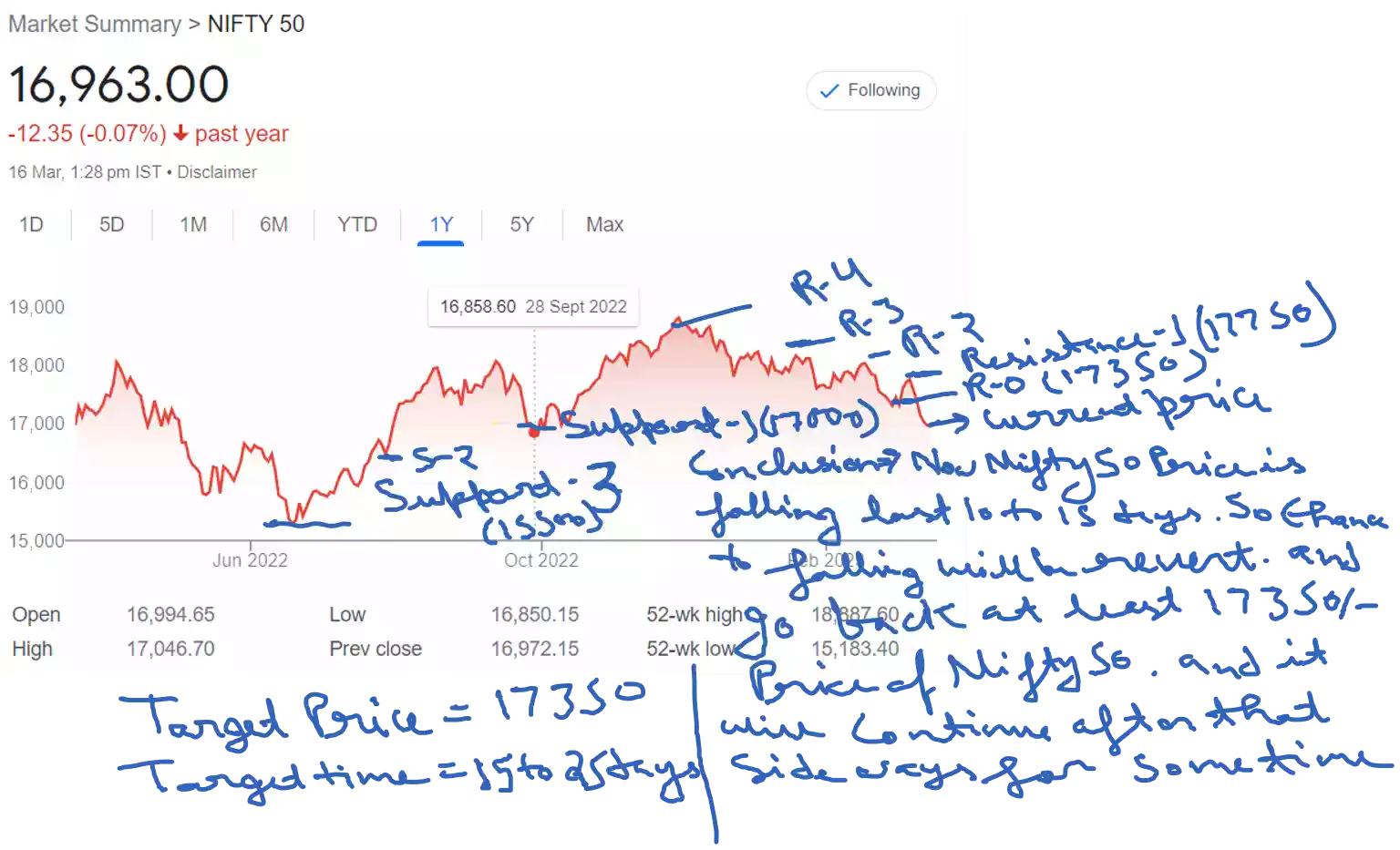

Now we have to select the time frame (expiry date) in which our target price is achieved. For this, we have to calculate the target price and time frame of Nifty price with the help of technical analysis, for this we need the price chart of Nifty 50 for at least 1 year. Following is the snapshot of Nifty 50 chart-

After doing technical calculation of 1 year Nifty 50 chart we have come to the conclusion that price of Nifty 50 will fall 16500 approximately in 10 to 15 days. So here we will make a selection of options contract between 1 month or within 2 months.

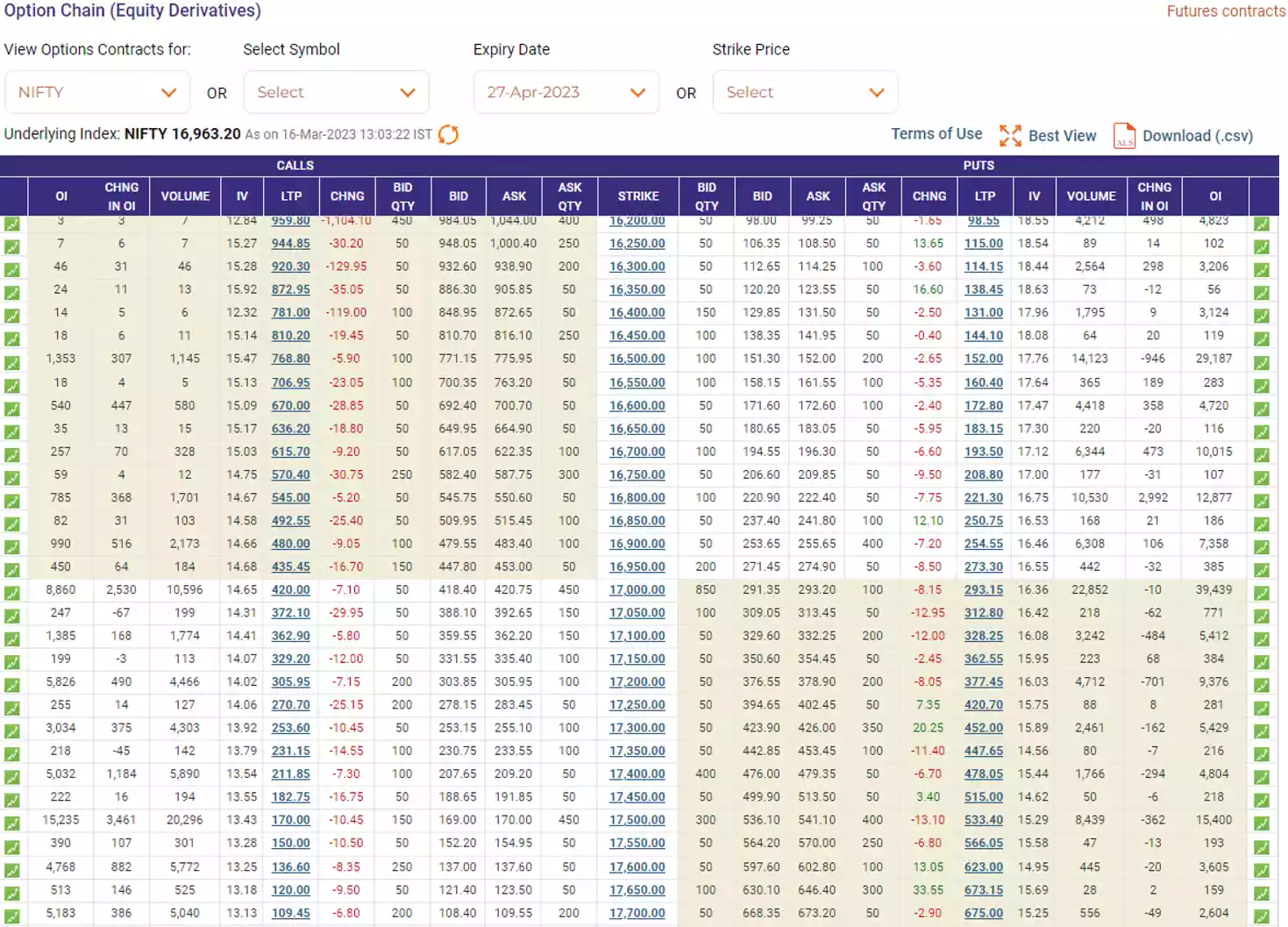

The availability of options contracts today on 16th March 2023 are as follows 23rd March 2023, 29th March 2023, 06th April 2023, 13th April 2023, 27th April 2023, 25th May 2023 etc. As per our requirement we will select monthly option contracts on expiry 27th April 2023. we can also select option contracts with expiry 13th April 2023, but due to illiquidity we are not selecting it.

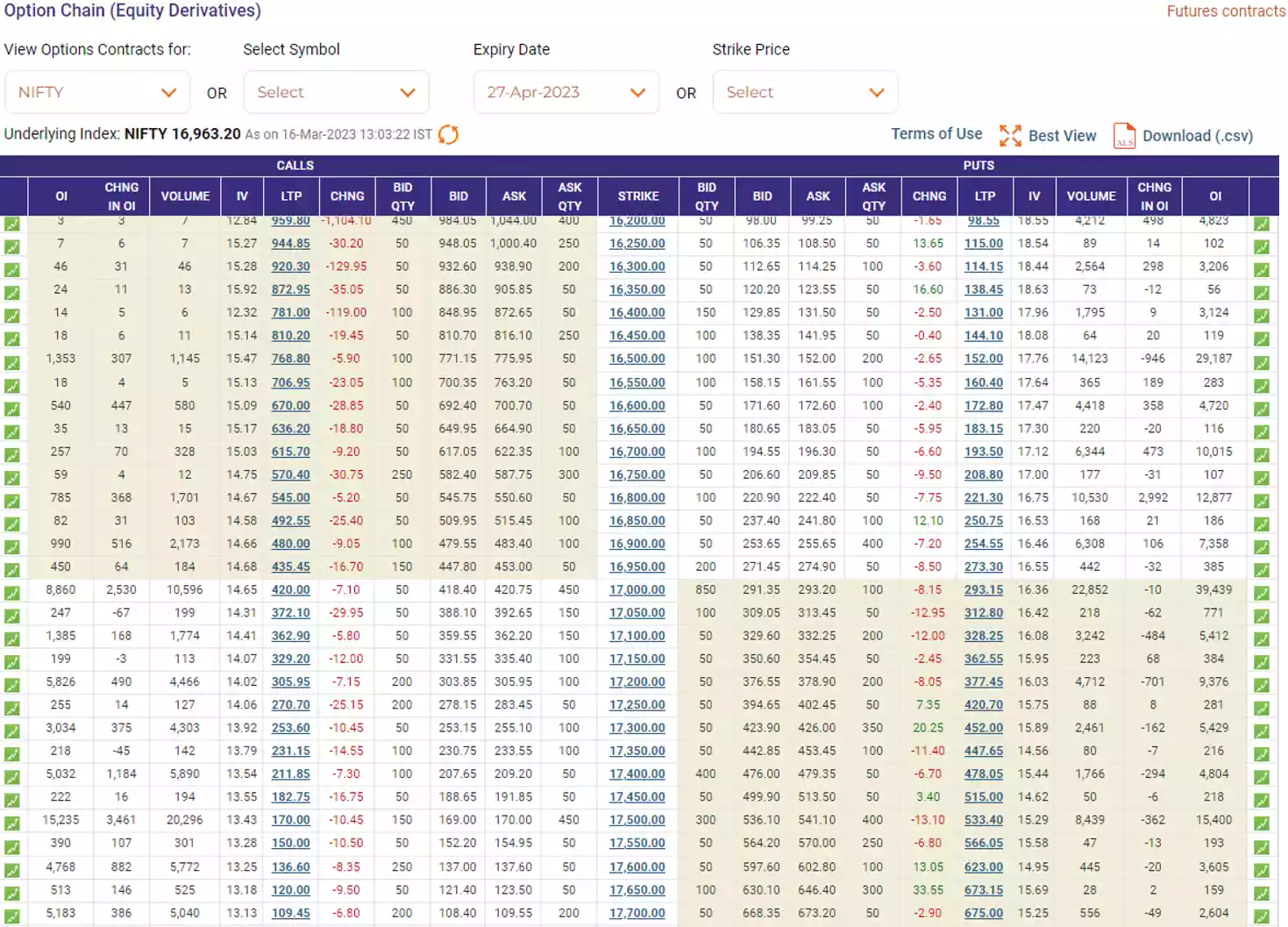

Selection of strike for long put naked option strategy:

Now we will select the strike of the selected option contract. so that we get the most profit or the least loss.

Selected options contract- Nifty Apr … PE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

| Moneyness | Strike price (K) | Premium |

| OTM | 16700/- | 193.50/- |

| ATM | 17000/- | 293.15/- |

| ITM | 17300/- | 452.00/- |

Now for selection of strike price we will compare profit and loss according to our calculated target price of Rs. 16500/- on expiry.

So profit and loss for strike 16700-

Profit and loss for long put= Max(strike price – spot price on expiry,0) – premium

P&L= max(16700-16500,0) – 193.5

P&L= max(200,0) – 193.5

P&L= 200 – 193.5

P&L= 6.5/-

Profit if target achieved= 6.5/-

Maximum loss if target not achieved= 193.50/-

Profit and loss (P&L) table-

| Moneyness | Strike price (K) | Premium | Profit if target achieved | Maximum loss if target not achieved |

| OTM | 16700/- | 193.50/- | 6.5/- | –193.5/- |

| ATM | 17000/- | 293.15/- | 206.85/- | -293.15/- |

| ITM | 17300/- | 452.00/- | 348.00/- | -452.00/- |

According to above table OTM option with strike 16700/- looking very less profit because of our target price is not very aggressive. For ITM option with strike 17300/- initial investment (premium-452.00/- rupees) to much so if target not achieved then loss occurs maximum as much premium.

So here we are selecting ATM options with strike price 17000/- which one is with moderate premium with moderate profit.

Pay off schedule for long put naked option strategy:

Above we have considered target price 16500/- rupees of Nifty 50 underlying index option contract achieved on expiry. But if target price not achieved or get any price on expiry, different from target price, then what would be pay off (P&L) on expiry for various spot prices.

So, option contract- Nifty Apr 17000 PE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Strike price (K)- 17000/-

Premium (P)- 293.00/-

Break even point= 17000 – 293= 16707/-

For calculation of pay off schedule use calculator Put naked option strategy pay off (P&L)–

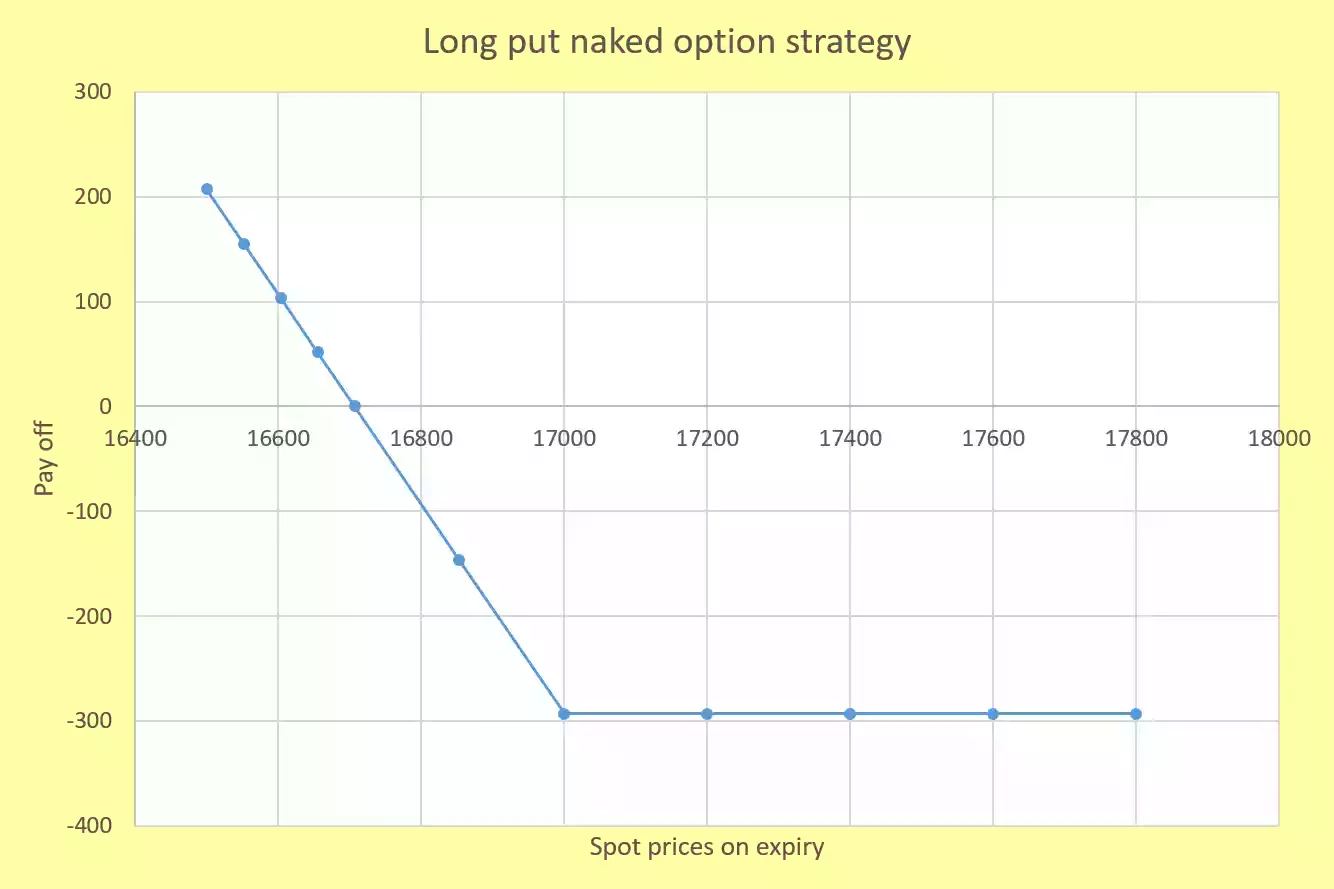

Pay of schedule:

| Various spot prices on expiry (Sf) | Net pay off P&L for long put with 1 no of share unit |

| 16500 | 207 |

| 16551.75 | 155.25 |

| 16603.50 | 103.50 |

| 16655.25 | 51.75 |

| 16707 | 0 |

| 16853.50 | -146.50 |

| 17000 | -293 |

| 17200 | -293 |

| 17400 | -293 |

| 17600 | -293 |

| 17800 | -293 |

Pay of chart for long put naked option strategy:

Pay off chart is the graphical representation of pay off schedule (P&L).

Review of long put naked option strategy:

When Nifty (underlying asset) price go down below break even point then profit unlimited and if Nifty price go up from more than selected strike then maximum loss is as a premium amount.

Short put naked option strategy:

When participants (trader/investor) bullish on stock/index then he sell a put. In bullish situation, I can also select long call option strategy then why I will take short put naked option strategy? Because of when underlying asset price go up moderately bullish or sideways in expiry term, then we have to select short put naked option strategy.

Due to premium received from buyer in this strategy so this strategy also known as credit option strategy.

When to select short put naked option strategy:

When investor/trader is moderately bullish or sideways on the underlying asset price in near expiry time frame, then they select short put naked option strategy.

Strategy:

for short put strategy is sell put option.

Risk:

For a short put risk is unlimited (As much as it decreases till the expiry time)

Reward:

Reward for a short put is limited to the amount of premium.

Break even point for short put naked option strategy:

For a short put, Break even point= Strike price – Premium

The break even point is the same for both long put option contracts and short put option contracts.

Which underlying asset to select for short put naked option strategy:

Here we are taking a selection of Nifty 50 which is an index option contract.

Selection of Nifty 50 option contracts:

As we know Nifty 50 option contracts are available for multiple expiry dates.

According to our technical analysis we have to select 15days expiry time to 1month expiry time. But for safer side here we are selecting same as above monthly options contract Nifty 27Apr … PE.

Selection of strike for short put naked option strategy:

Now we will select the strike of the selected option contract. so that we get the fixed profit or the least loss.

Selected options contract- Nifty 27Apr … PE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Target price- 17350/-

| Moneyness | Strike price (K) | Premium |

| OTM | 16700/- | 193.50/- |

| ATM | 17000/- | 293.15/- |

| ITM | 17300/- | 452.00/- |

Now for selection of strike price we will compare profit and loss according to our calculated target price of Rs. 17350/- on expiry.

So profit and loss for strike 16700-

Profit and loss for short put= premium – Max(strike price – spot price on expiry,0)

P&L= 193.50 – max(16700-17350,0)

P&L= 193.50 – max(-650,0)

P&L= 193.50 – 0

P&L= 193.50/-

Profit if target achieved= 193.50/-

Maximum loss if target not achieved- unlimited.

Here unlimited means how much. We will calculate unlimited price of underlying, if price falling continue, by calculation of underlying asset range with the help of volatility.

So, Today’s date- 16-03-2023

Expiry date- 27-04-2023

Time remaining= (27-04-2023) – (16-03-2023)= 42days

For volatility of underlying asset we can use realized volatility or historical volatility. But due to calculation of volatility is time taken so we will take historical volatility of underlying asset which one is easily get on NSE website. Daily volatility files on NSE website link for stock, and for index volatility go on NSE website homepage then derivative and click on index.

Spot price (S)- 16963/-

Annualized historical volatility= 19.07%

So, for 42 calendar days annualized volatility (SD)= 19.07*square root(42/365)= 14.1*0.3392= 6.5%

Now for upper range of Nifty 50 (practical method)-

With 68% chances= Spot price + Spot price*1SD

With 68% chances= 16963 + 16963*6.5%= 16963 + 1102.6= 18065.6/-

With 95% chances= Spot price + Spot price*2SD

With 95% chances= 16963 + 16963*2*6.5%= 16963 + 2205.2= 19168.2/-

With 99.7% chances= Spot price + Spot price*3SD)

With 99.7% chances= 16963 + 16963*3*6.5%= 16963 + 3307.8= 20270.8/-

Now for lower range of Nifty 50 (practical method)-

With 68% chances= Spot price – Spot price*1SD

With 68% chances= 16963 – 16963*6.5%= 16963 – 1102.6= 15860.4/-

With 95% chances= Spot price – Spot price*2SD

With 95% chances= 16963 – 16963*2*6.5%= 16963 – 2205.2= 14757.8/-

With 99.7% chances= Spot price – Spot price*3SD)

With 99.7% chances= 16963 – 16963*3*6.5%= 16963 – 3307.8= 13655.2/-

As we know that, we have calculated upper range of underlying price by technical analysis which is 17350/-. Its does not mean that, price will not go above it.

And for lower range of underlying price we take value of 2SD formula calculated value as a price of 14757.8/-. its doesn’t mean price will not go down from it (price-14757.8/-) but 95% surety Nifty 50 price don’t go down beyond it.

premium – Max(strike price – spot price on expiry,0)

P&L= 193.50 – max(16700-14757.8,0)

P&L= 193.50 – max(1942.2,0)

P&L= 193.50 – 1942.2

P&L= -1748.7/-

Loss if go wrong direction= -1748.7/-

Maximum loss can be till expiry= -1748.7/-

Profit and loss (P&L) table-

| Moneyness | Strike price (K) | Premium |

| OTM | 16700/- | 193.50/- |

| ATM | 17000/- | 293.15/- |

| ITM | 17300/- | 452.00/- |

| Moneyness | Strike price (K) | Premium | Profit if target achieved (17350/-) | Maximum loss if price go down till +2SD, maximum price go down can be till expiry (14757.8/-) |

| OTM | 16700/- | 193.50/- | 193.50/- | -1748.7/- |

| ATM | 17000/- | 293.15/- | 293.15/- | –1949.05/- |

| ITM | 17300/- | 452.00/- | 452.00/- | -2090.2/- |

According to above table OTM option with strike price 16700/- is less loss with compare to ITM and ATM option strike.

So here we are selecting OTM options with strike price 16700/- which one is with low premium (low profit) with low loss.

Pay off schedule for short put naked option strategy:

Above we have considered target price 17350/- rupees of Nifty 50 underlying index option contract achieved on expiry. But if target price not achieved or get any price on expiry, different from target price, then what would be pay off (P&L) on expiry for various spot prices.

So, option contract- Nifty Apr 16700 PE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Strike price (K)- 16700/-

Premium (P)- 193.50/-

Break even point= 16700 – 193.5= 16506.5/-

For calculation of pay off schedule use calculator put naked option strategy pay off (P&L)–

Pay of schedule:

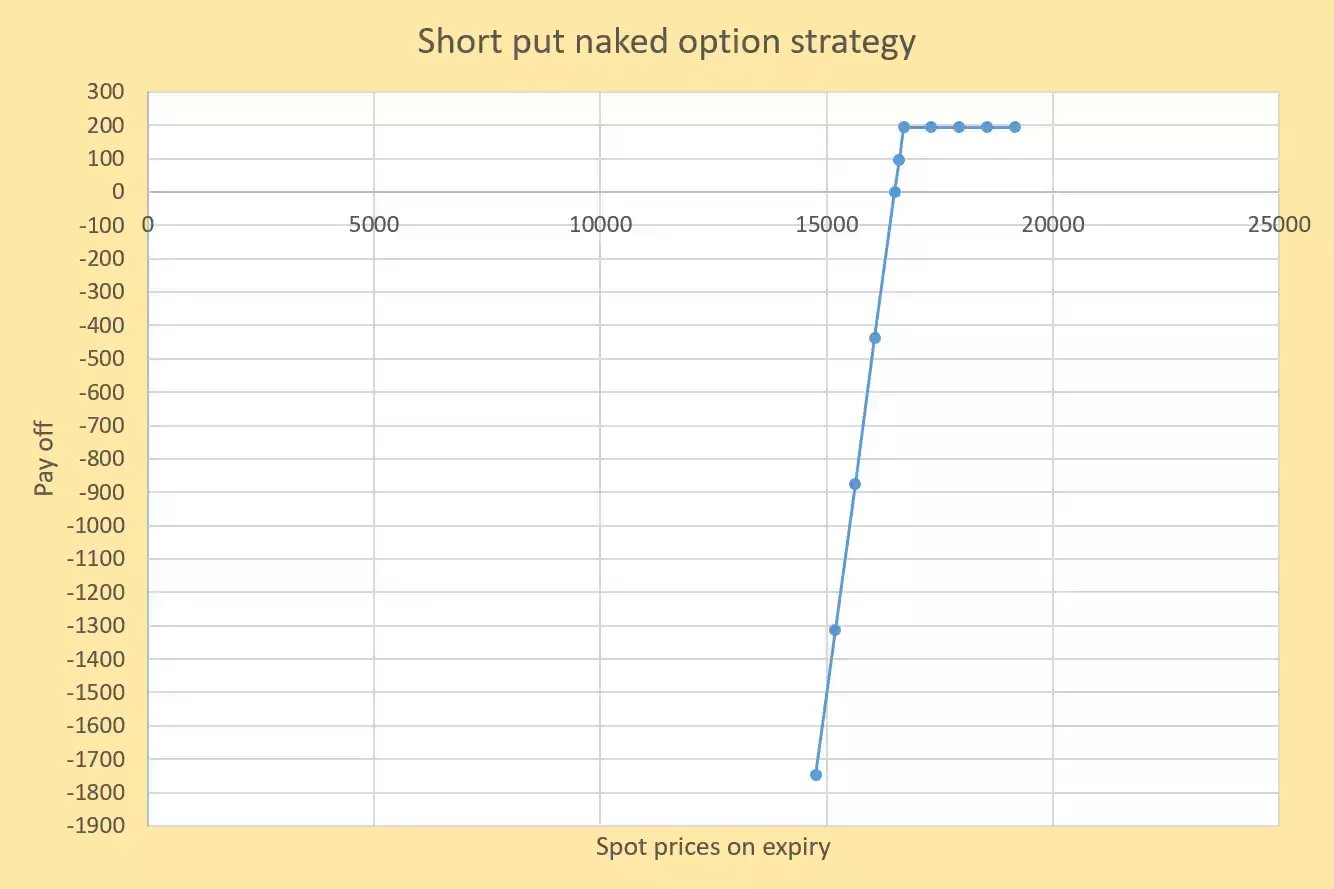

| Various spot prices on expiry (Sf) | Net pay off P&L for short put with 1 no of share unit |

| 14757.78 | -1748.72 |

| 15194.96 | -1311.54 |

| 15632.14 | -874.36 |

| 16069.32 | -437.18 |

| 16506.50 | 0 |

| 16603.25 | 96.75 |

| 16700 | 193.5 |

| 17314.41 | 193.5 |

| 17928.82 | 193.5 |

| 18543.25 | 193.5 |

| 19157.64 | 193.5 |

Pay of chart for short put naked option strategy:

Pay off chart is the graphical representation of pay off schedule (P&L).

Review of short put naked option strategy:

When Nifty 50 fall, then unlimited risk. And when rise at least more than selected strike on expiry, then get profit maximum as premium amount received. So this type of (credit strategy) strategy can be said as an income generating strategy.

About Pay off (P&L) calculator for naked option strategy:

As we know that SOV market call and put naked option strategy calculator easy to use for calculation of profit and loss of selected strike with various spot prices. And also you can get in this calculator, range of underlying asset, with input of- expiry days, spot price, and historical or realized volatility.

Risk/reward ratio is the division of risk and reward with your upper and lower range of underlying prices P&L.

In Strategy generalization section with id-“S+E (Editable spot price)” is for any spot price, which you want on expiry, input value of spot prices below input box and get calculated P&L for that spot price.