Futures contract example:

Here’s a futures contract example. Let’s say a farmer grows wheat and wants to sell it in the future, but is concerned about the price fluctuations that may occur before the crop is ready to be harvested. The farmer can enter into a futures contract to sell a certain quantity of wheat at a predetermined price at a specified date in the future.

For example, the farmer might enter into a contract to sell 1,000 MT of wheat at a price of Rs. 3800 per metric ton, to be delivered in three months’ time. The farmer is guaranteed the price of Rs. 3800 per metric ton, regardless of what the market price of wheat is at the time of delivery.

On the other side of the transaction, there might be a flour miller who is concerned about the future price of wheat and wants to lock in a price to ensure a stable cost of production. The miller could enter into a contract to buy 1,000 MT of wheat from the farmer at the same price and delivery date.

In this example, the futures contract provides both the farmer and the flour miller with price certainty, allowing them to plan their business operations and minimize their exposure to price risk. At the time of delivery, the farmer delivers the wheat to the flour miller, and the contract is settled based on the agreed-upon price.

Now detailed example of futures contract we will discussed in next paragraph.

Table of Contents

Understand The Futures Trade Before Open A Position:

We learnt various terminology about futures market. Opening a position in futures market for anybody make a benefit from trade and for which the traders needs to have a directional view on the price of the underlying asset.

We will discuss here with stock futures example with Wipro ltd.

Today 07th September 2022 Wipro limited price will go up in next coming month due to previous quarter he has make a loss due to less other income from previous quarter but still sales is high in last quarter so more chances to Wipro profit go up in September quarter (Q2).

By technical analysis I have seen that Wipro chart make bottom with sideways so more chances to revert trend from here.

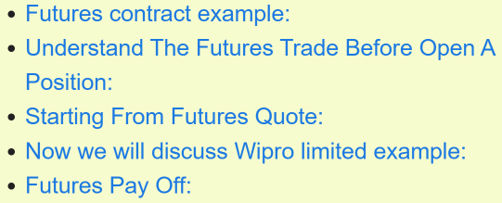

Quarterly result (standalone) of Wipro limited:

A quarterly result refers to a company’s financial performance over a three-month period, typically referred to as a quarter. Quarterly results are usually reported by publicly traded companies and include information such as revenue, earnings, and other key financial metrics.

Investors, analysts, and other stakeholders closely follow quarterly results as they provide insight into a company’s financial health and growth prospects. Companies often issue earnings reports and hold conference calls to discuss their quarterly results with the public and answer questions from analysts.

Quarterly results are important because they provide a more up-to-date view of a company’s financial performance than annual financial statements, which are typically released several months after the end of the fiscal year. By analyzing quarterly results, investors can get a better understanding of a company’s financial position, its growth prospects, and any potential risks or challenges it may be facing.

SOURCE-https://www.bseindia.com/stock-share-price/wipro-ltd/wipro/507685/financials-results/

1Year chart of Wipro limited:

A chart is a visual representation of data or information, typically used to display trends or patterns over time. Charts can take many different forms, including line charts, bar charts, candlestick charts, pie charts, and more, and are used in a wide range of fields, including finance, economics, science, and statistics.

In finance and economics, charts are often used to display stock prices, exchange rates, commodity prices, and other market data. By plotting data over time, charts can help investors and traders to identify trends and make informed investment decisions.

SOURCE-https://kite.zerodha.com/chart/web/ciq/NSE/WIPRO/969473

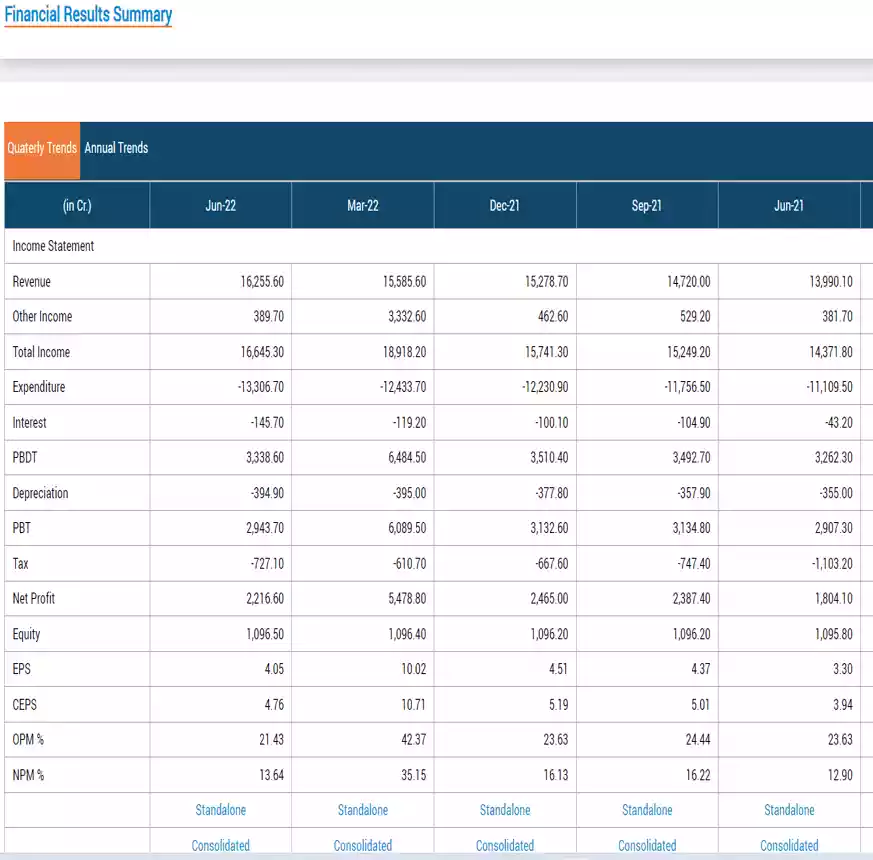

Quote of Wipro limited:

Stock quotes are a reflection of the current market price for a specific stock. They typically include information such as the latest trading price, the highest and lowest prices for the day, and the volume of shares traded.

SOURCE-https://www1.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=WIPRO

According to above quote and after technical and fundamental analysis i am bullish on Wipro limited price 402.60 for September month so buy Wipro ltd shares or Wipro futures on market. I will go through Wipro ltd futures due to less margin money and also futures price should always mimic the spot price.

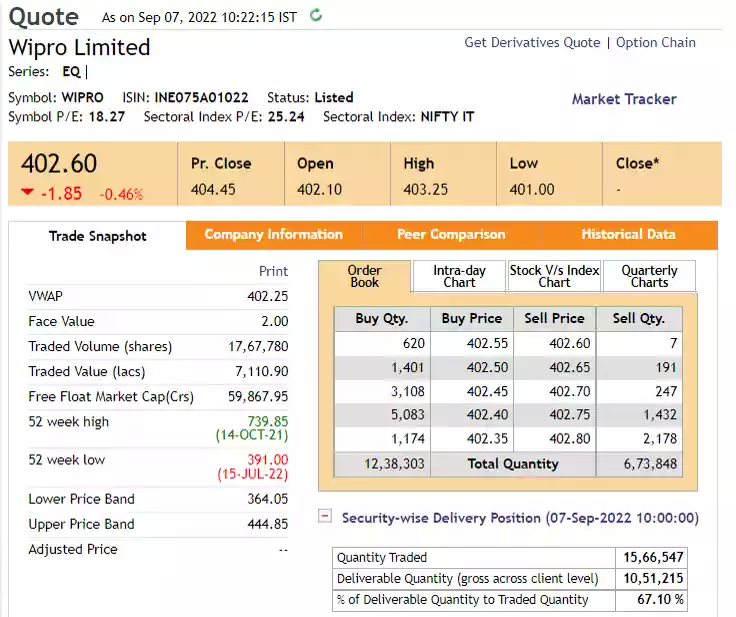

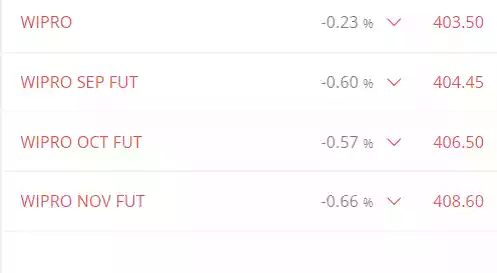

Quote of Wipro limited futures:

Futures contract quotes are similar to stock quotes, in that they reflect the current market price for a specific futures contract. Futures contract quotes typically include information such as the latest trading price, the daily high and low prices, and the volume of contracts traded.

As expected the future price has mimicked the spot price but-

1.Difference in spot price and future price why?

2.And also difference in fall percentage why?

Future price is generally greater than spot price due to cost n carry, financial cost etc. We will discuss further future price calculation.

And fall percentage difference due to convergence of furures.

Starting From Futures Quote:

Instrument Type- Stock futures

Symbol- Wipro

Expiry Date– 29 Sep 2022

Underlying Value-404.20

Futures Price-405.20

Market Lot-1000

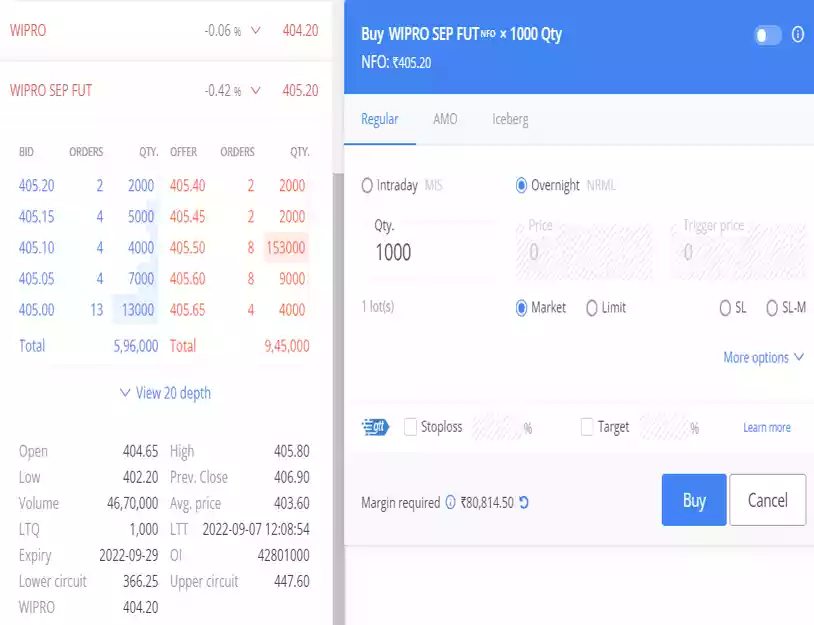

Contract Value-1000*405.20=405200

Margin Money Required- 80814.50 now I know futures price-405.20/- and minimum number of shares or Lot size-1000nos to one lot of Wipro futures.

So how do we buy the futures contract?:

For buy, to call your broker and ask him to buy 1lot of Wipro futures at Rs 405.20/- with expiry September month.

Or

We can buy it ourselves through the broker trading platform. In trading platform you should make watchlist and when to buy, login and buy own self. When you buy some couple of things happen in the background-

1.Margin validation– required some margin amount as a percentage of contract value.

2.The counterparty search– it is done by system scouts for a relevant counterparty match.

3.Sign off– buyer and seller digitally sign the futures agreement this is mainly a symbolic prices.

4.Margin block– after the signoff is done, the required margin is blocked in our trading account. This money blocked up to square off position now we have the owner of 1000 Wipro September future contract which expires on 29 Sep. 2022. On the date of expiry 3-possible scenarios will come is future price go up, come down, or same.

Scenario 1– Wipro stock price go up by 29 Sep. 2022 according to my directional view underlying asset price will go up suppose on expiry Wipro closing price is 450.20/-

So profit is= 450.20-405.20=Rs. 45/-

But a total profit for 1lot = 45*1000=rs.45000/-

This profit comes from sellers loss.

Scenario 2– Wipro stock price goes down on expiry my directional view on Wipro has gone wrong. Stock price on expiry is 395.20/-

So loss= 405.20-395.20=Rs. 10/-

Total loss= 10*1000=Rs. 10000/-

So sellers gain the buyers loss

Scenario 3– Wipro stock price remains unchanged. Under such a situation, neither the buyer nor the seller benefit. Hence there is no financial impact on either party.

Get A Trading Opportunity In Futures:

I have buy a Wipro futures one lot on 07 Sep. 2022 at a price of Rs. 405.20/- per share if next trading day price will go up Rs. 425.20/- then we make profit 20rs per share and over all profit 20000 Rs/-

Suppose if you are happy this money that I have made overnight, can I closeout the agreement? Yes you can close the agreement because of I am nor more bullish on Wipro so I will exit from position.

Closing an existing futures position is called “square off”, I offset an existing open position for square off you can call our broker or make exit by own self by broker trading platform. The following things happen when I opt to square off the Wipro position-

1.The broker via trading platform scouts for a counterparty to buy position from me. In simple words “ my existing buy position will simply be transferred to someone else.” That someone else buying the contract from me, now bears the risk of Wipro price movements hence this is simply referred to as the “risk transfer”.

2. The transfer will happen at the current future price in the market 425.20/- per share.

3. My position is considered offset or squared off after the trade is executed.

4. Once the trade is executed my blocked margin now unblocked. I can use for other transactions.

5. Profit and loss made on the transactions will be credited or debited to my trading account.

If we will hold till expiry then I gain profit 45000/- but if square off next trading day I have gain profit only 20000/- so is it overall good for me or bad for this decision.

If we will get better opportunity then good decision. And if we will not get any opportunity so it is bad decision.

Rate of return if get next trading day opportunity=overall profit*100/margin blocked=20000*100/80815=24.74%, avg per day rate of return=over all profit rate of return/time in days between open and closing a position=24.74/2=12.37%.

Rate of return on expiry=4500000/80815=55.68%, avg per day rate of return=55.68/(29-6)=2.42%

Leverage In The Futures:

Leverage in futures contracts refers to the ability to control a large amount of an underlying asset with a relatively small amount of capital. In other words, it allows traders to trade with more capital than they actually have in their accounts.

Leverage in futures trading can magnify gains, but it also increases the risk of losses. If the price of oil moves against the trader, their deposit could quickly become insufficient to cover the losses, leading to a margin call, where the trader is required to deposit additional funds to maintain their position.

In general, leverage in futures trading should be used carefully and with a clear understanding of the risks involved. It’s important to have a solid trading plan and to manage risk by using stop-loss orders and position sizing.

Leverage by a example- you suppose that you have taken 3bhk ongoing apartment on 07 Sep. 2022 at the price of Rs 100lakh/- but now you have to pay only booking amount 10% of apartment value which is Rs 10lakh/- this apartment situated in Lucknow city posh area at Gomti Nagar after 1month apartment price go up by 12% so now apartment value is 100lakh*1.12=Rs. 112lakh/- now if you exit this deal then you sell it on Rs 112 lakh and you buy it 100lakh/- by 10 lakh booking amount so your net profit=112-100=Rs. 12lakh/- so your return on investment is =12*100/10=120%

If you taken it by full payment of then return on investment = 12*100/100=12%

Few things in this transaction:

1.You able to participate in a large transaction by paying only 10% of the transaction value.

2.To enter into the transaction you pay only 10% of the actual value called as a contract value.

3.Initial value you paid (10lakh) can be considered as a token advance or in terms of future agreement it would be the initial margin deposit.

4. A small change in the asset value impacts the return massively.

5. This is quite obvious a 10% increase in asset value resulted in a 100% return on investment.

6. A transaction of this type is called a “leveraged transaction”.

Now we will discuss Wipro limited example:

We assume that buy on date 07 Sep. 2022

Spot price- 404.20/-

Future price-405.20/-

Future lot-1000nos

Margin money-80815/-

Sell on expiry 29 Sep. 2022

Spot price on 29 Sep. 2022 =450.20/-

Future price on expiry=450.20/- ( future price on expiry= closing spot price on expiry date)

Now we have two options:

Option 1– buy Wipro stock in the spot market.

Option 2– buy Wipro futures on the futures market.

In option 1 we will take shares by same amount of margin money used in futures market for 1lot so-

| Option-1 | Option-2 |

| Stock In Spot Market Invested Money-80815/-, Spot Price-404.20, Shares=80815/404.20=199.93~200, Square Of Position On Date-29 Sep 2022, Spot Price-450.20/-, Profit=200*(450.20-404.20)=9200/-, Return=9200*100/80815=11.38%, Settlement T+2 Trading Days | Future In Future Market Margin Money-80815/-, Future Price-405.20, Lot Size-1000, Expiry Settlement Date -29 Sep 2022, Future Price On Expiry-450.20/-, Profit=1000*(450.20-405.20)=45000/-, Return=45000*100/80815=55.68%, Margin Unblocked Immediate And Profit In Next Trading Days. |

| Return 1month-11.38%, Absolute Annualized Return=136.56% | Return 1month-55.68%, Absolute Annualized Return-55.68*12=668.16% |

So we know the profit return in futures market to much more from spot market so mostly trader interested in future market for huge return if your directional view is right if wrong then you loss also in huge amount. So trade any contract with strong directional view. By virtue of margins, we can take positions much bigger than the capital available, this is called leverage. Leverage is a double edged sword if used in the right spirit and knowledge, leverage can create wealth, if not it can destroy wealth.

Leverage calculation:

Leverage= contract value(lot size*future price)/margin money blocked by broker

In previous section Wipro future example-

Leverage=1000*405.20/80815=5.01~5

This leverage value means you can buy 5 rs value by paying only 1rs. It is read as a ratio of 1:5

If you know leverage then you can calculate margin as a percentage of contract value=100/leverage=100/5=20%

That means if you loose Wipro share price 20% then you can loose all margin money.

Margin money= contract value*20/100

So, higher the leverage, higher is the risk, and the higher is the profit potential. Personally suggest you don’t go beyond of leverage more than 1:10

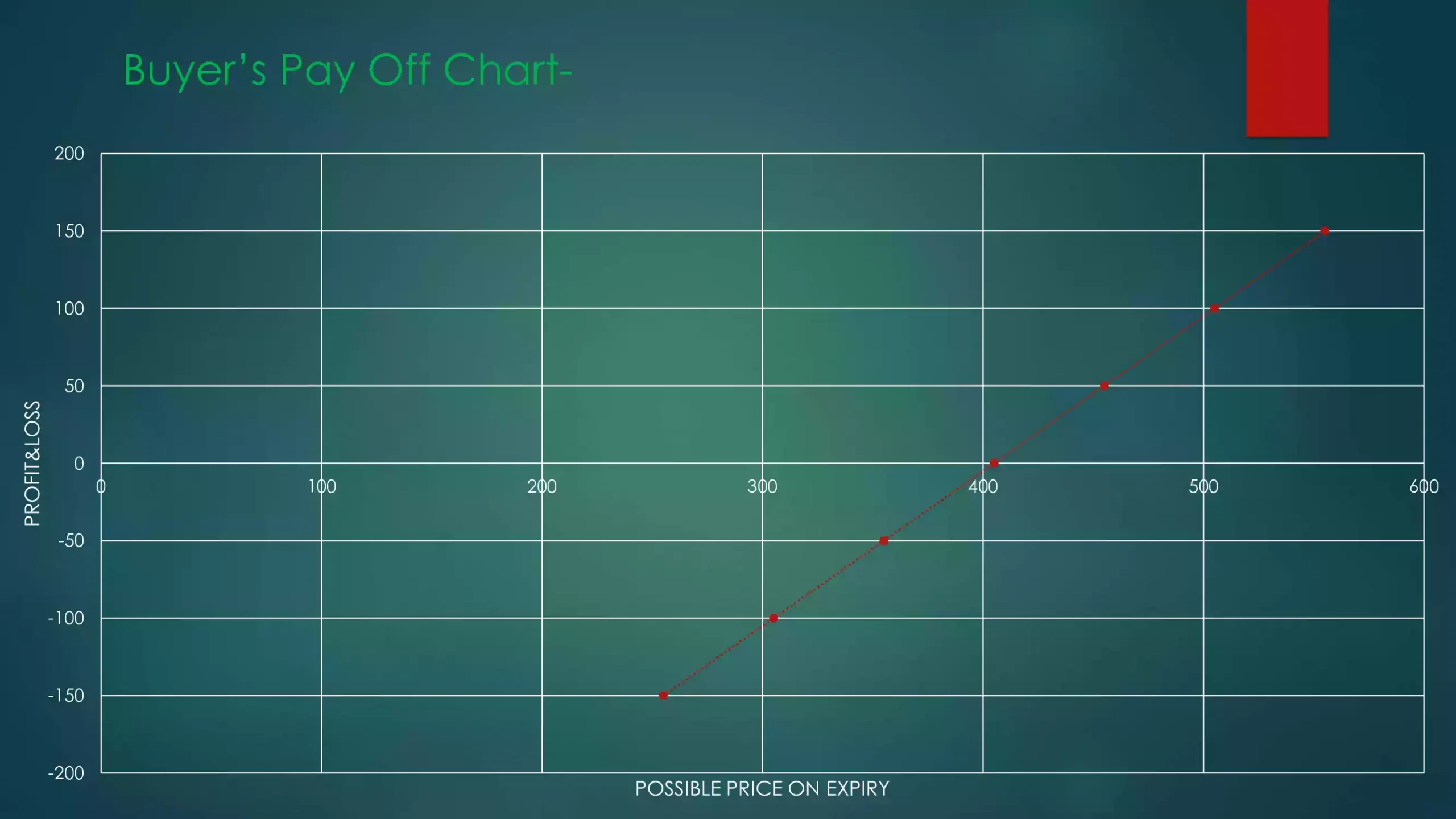

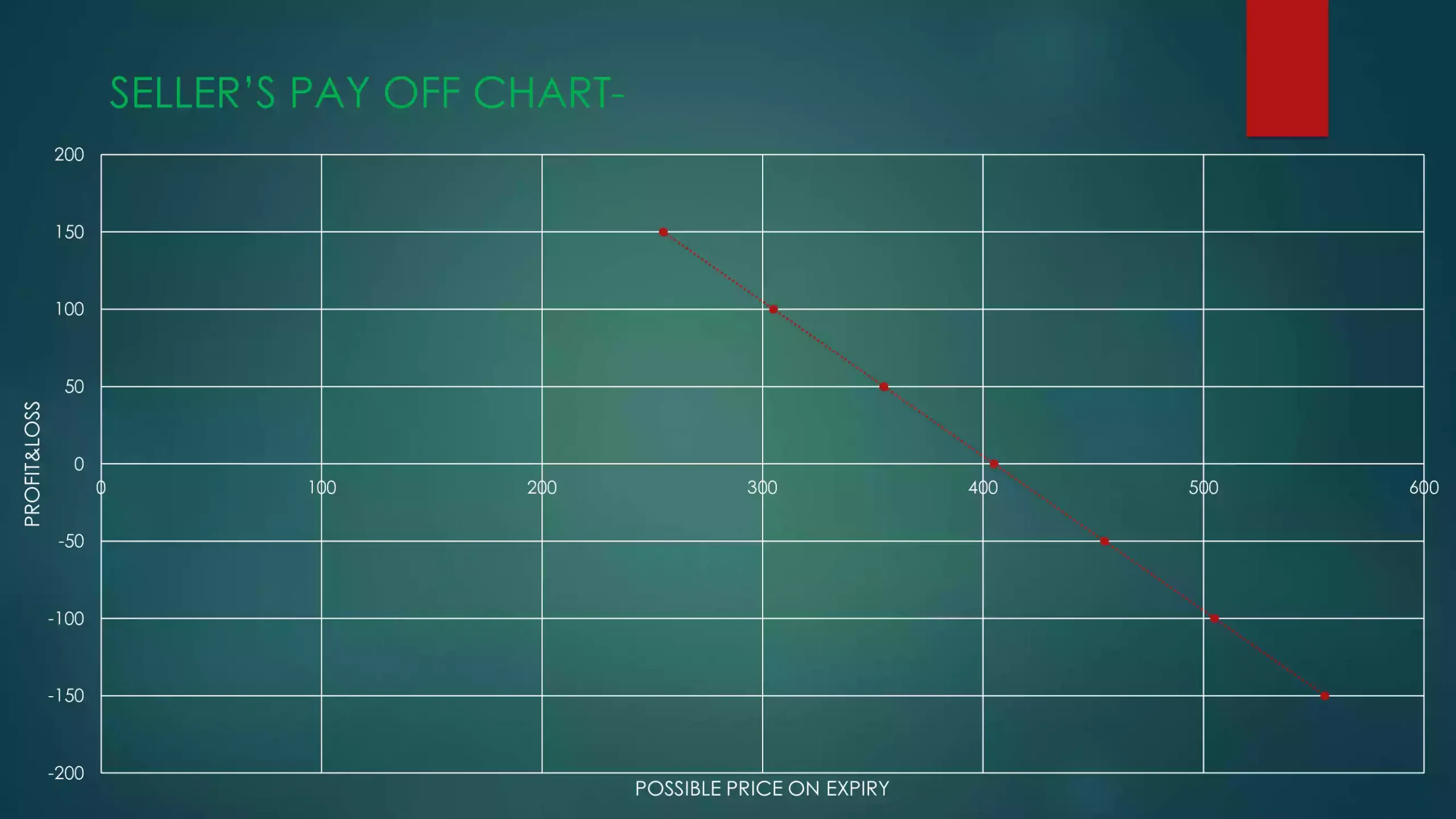

Futures Pay Off:

A pay off is the likely profit loss that would accrue to a market participant with change in the price of the underlying asset. Futures contracts have linear pay offs. Linear pay off means that the losses as well as profits. Profit and loss unlimited for both buyer and seller of futures contract. In future contract profit of one party is exactly equivalent to the losses of the other party. The payoff for a person who buys a futures contract is similar to the pay off for a person who holds an asset.

Here two conditions overcome in payoff-

Condition 1– pay off when buy a future contract.

Condition 2– pay off when sell a future contract.

Example of Wipro futures we will take here-

Pay off list for future contract buyer and also with future contract seller-

| Pay Off For Buyer (P&L) | Pay Off For Seller (P&L) | ||

| Possible Price On Expiry | Future Price On Opening Day-405(buy) | Possible Price On Expiry | Future Price On Opening Day-405(sell) |

| 255 | 255-405=-150(sell Price-buy Price) | 255 | 405-255=150(sell Price-buy Price) |

| 305 | 305-405=-100 | 305 | 405-305=100 |

| 355 | 355-405=-50 | 355 | 405-355=50 |

| 405 | 405-405=0 | 405 | 405-405=0 |

| 455 | 455-405=50 | 455 | 405-455=-50 |

| 505 | 505-405=100 | 505 | 405-505=-100 |

| 555 | 555-405=150 | 555 | 405-555=-150 |

Buyer’s pay off chart:

Let us now plot a graph of the possible price on expiry of contract versus the buyers profit & loss. This is also called the pay off structure.

Seller’s pay off chart:

Let us now plot a graph of the possible price on expiry of contract versus the sellers profit & loss. This is also called the pay off structure.

Most Importantly, Because The Profit And Loss Is A Smooth Straight Line, It Is Said That The Futures Is A “Linear Pay Off Instrument”.