What is naked option strategy?

Naked option strategy is an option strategy in which only one position is taken. That is to say such buying and selling positions which are not covered by any market, neither by the same market nor by other markets. Means neither is covered by option market nor by equity market and future market.

Buying/selling a naked position means buy/sell a single position in option market for particular underlying asset without having other position in other market or same market. naked position option strategy is the most basic of all option strategy.

One thing more in option strategy is when we paid premium after opening a position known as debit option strategy and when we received premium known as credit option strategy. its rule followed by all options trading strategies.

Naked option strategies are typically used by experienced traders who have a high tolerance for risk and are willing to accept the potential for significant losses. It is important to note that naked option strategies should only be used by investors who fully understand the risks involved and have a solid understanding of options trading.

Table of Contents

Types of naked option strategy:

There are generally 4 types of naked option strategies in the options market. This is also called naked position. which is-

1.Long call

2.Long put

3.Short call

4.Short put

Long call naked option strategy:

Long call or buying a call is the most basic of all options strategy. When share market trader familiar with stocks trading and he want to enter in options market then buying a call is an easy strategy to understand.

When you buy or want to take position of long call means you are very bullish and expect the underlying stock/index to rise in coming future. Underlying asset to rise in future so this option strategy also known as bullish option strategy. Long call naked option strategy is the excellent way to capture the upside potential and limit, down side risk by pay premium to opposite side trader.

A long call option strategy is a bullish options strategy that involves buying a call option with the expectation that the price of the underlying asset will rise before the option expires.

When to select long call naked option strategy:

When investor or trader is very bullish on the underlying asset (stock/index). Means when underlying asset go up in time cycle of options contract more than premium value which you pay to seller for buying a option contract.

Strategy for long call naked option strategy:

A strategy in options trading refers to a plan of action that an investor uses to achieve a particular objective, such as maximizing profits or minimizing risks. Options trading strategies typically involve combinations of buying and selling options contracts, as well as other financial instruments such as stocks or futures contracts.

But for long call naked option strategy there is no any combination required because of this option strategy happen only alone position.

for long call strategy is buy call option.

Risk for long call naked option strategy:

In an option contract, risk refers to the potential loss that an option holder may incur due to adverse movements in the price of the underlying asset.

For a long call risk is limited to the premium value or minimum as a premium value for a time frame.

Reward for long call naked option strategy:

In an option contract, reward refers to the potential gain that an option holder may achieve if the price of the underlying asset moves in a favorable direction.

Reward for a long call is unlimited (maximum rise value of underlying stock/index in a time frame after deduction of premium value).

Break even point for long call naked option strategy:

The break-even point in an options contract refers to the underlying asset price at which the option contract neither makes a profit nor incurs a loss for the holder of the option.

For a long call, Break even point= Strike price + Premium

Which underlying asset to select for long call naked option strategy:

When selecting an underlying asset for a long call naked option strategy, it’s important to consider the following factors:

- Liquidity: The underlying asset should be liquid, meaning that there should be a high volume of trading activity in the underlying asset. This ensures that the investor can buy and sell the option contract at a fair price.

- Volatility: The underlying asset should have a history of volatility, as this increases the potential profit potential of the long call option strategy. Higher volatility means that the price of the underlying asset is more likely to move in a favorable direction, increasing the value of the call option.

- Market direction: The investor should have a bullish outlook on the underlying asset, meaning that they expect the price to rise in the future. A long call option strategy is designed to profit from a rising price of the underlying asset.

- Industry and Company Fundamentals: The investor should consider the underlying asset’s industry and company fundamentals, such as earnings, financial health, and competitive position. A strong industry and company fundamentals can provide a more stable and predictable price movement in the underlying asset.

- Options pricing: The investor should consider the current price of the option contract relative to the underlying asset price and other relevant factors such as implied volatility, time to expiration, and interest rates.

Overall, the underlying asset selected for a long call naked option strategy should be liquid, volatile, and have a bullish outlook, with strong industry and company fundamentals. By carefully evaluating these factors, an investor can select an underlying asset that is suitable for a long call option strategy.

By the way, many stocks/indices are listed for trading in the options market. This list can be seen on the website of NSE.

But for long call naked option strategy we have to select that stock or index which will rise in the near term and the price of the underlying will increase. For this we have to do fundamental analysis, technical analysis, sector analysis, and economy analysis along with keeping an eye on current news and events.

After doing all this analysis, we will select any one stock or index. Here we are giving a selection of Nifty 50 which is an index option contract.

One of the advantages of selecting index option contracts for naked option strategy is that we do not need to do fundamental analysis as we are not exposed to systematic risk/specific risk due to diversification on index. Thus, the index option contract is safer than the stock option contract.

Availability of Nifty 50 option contracts:

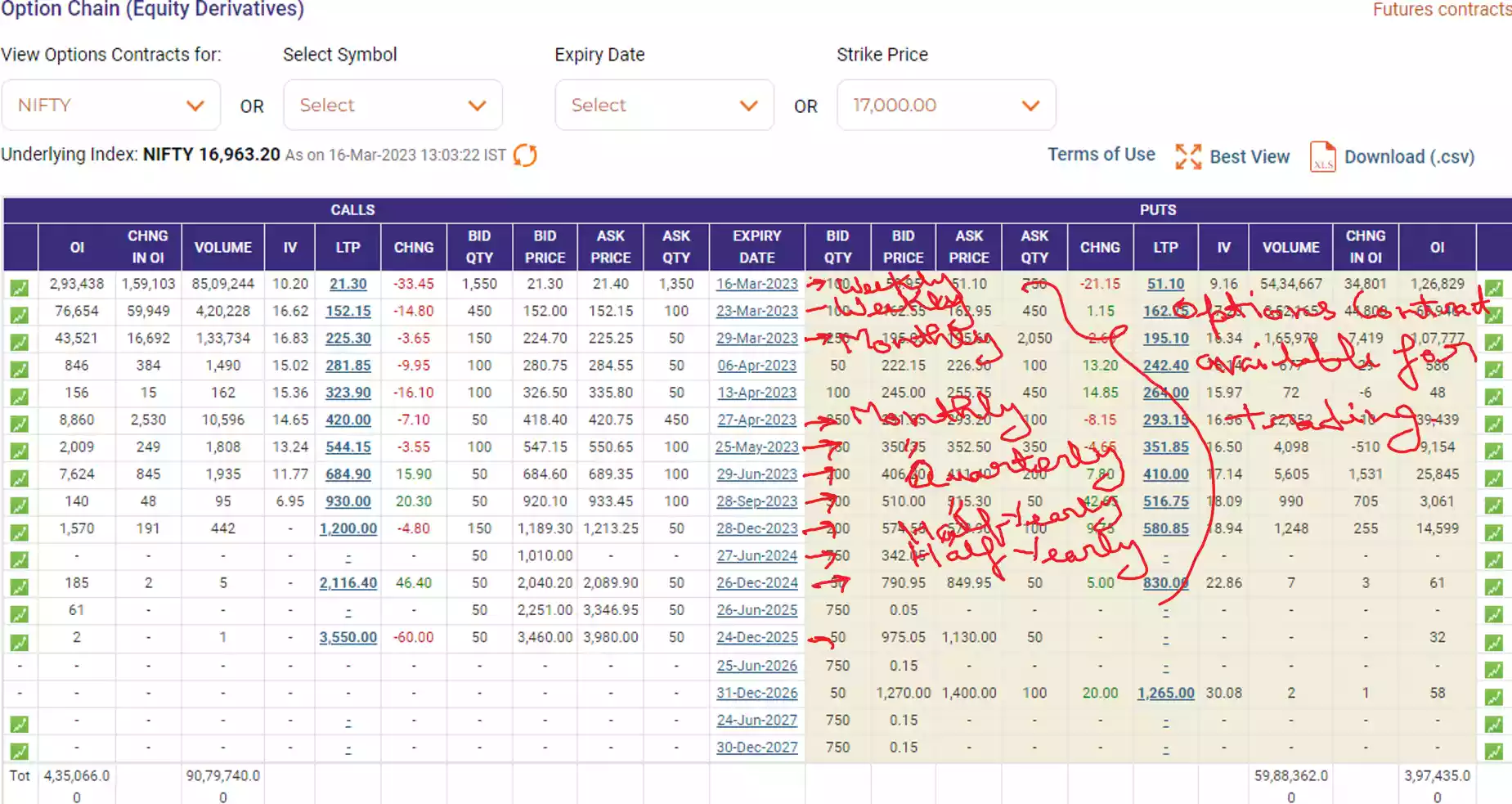

As we know, depending on the time frame, there are many option contracts available for any underlying asset. Such as Weekly Options Contract, Monthly Options Contracts, Quarterly Options Contract etc.

Now we have to select the time frame (expiry date) in which our target price is achieved. For this, we have to calculate the target price and time frame of Nifty price with the help of technical analysis, for this we need the price chart of Nifty 50 for at least 1 year. Following is the snapshot of Nifty 50 chart-

After doing technical calculation of 1 year Nifty 50 chart we have come to the conclusion that price of Nifty 50 will reach 17750 approximately in 15 to 30 days after moving sideways for some time. So here we will make a selection of options contract between 1 month or within 2 months.

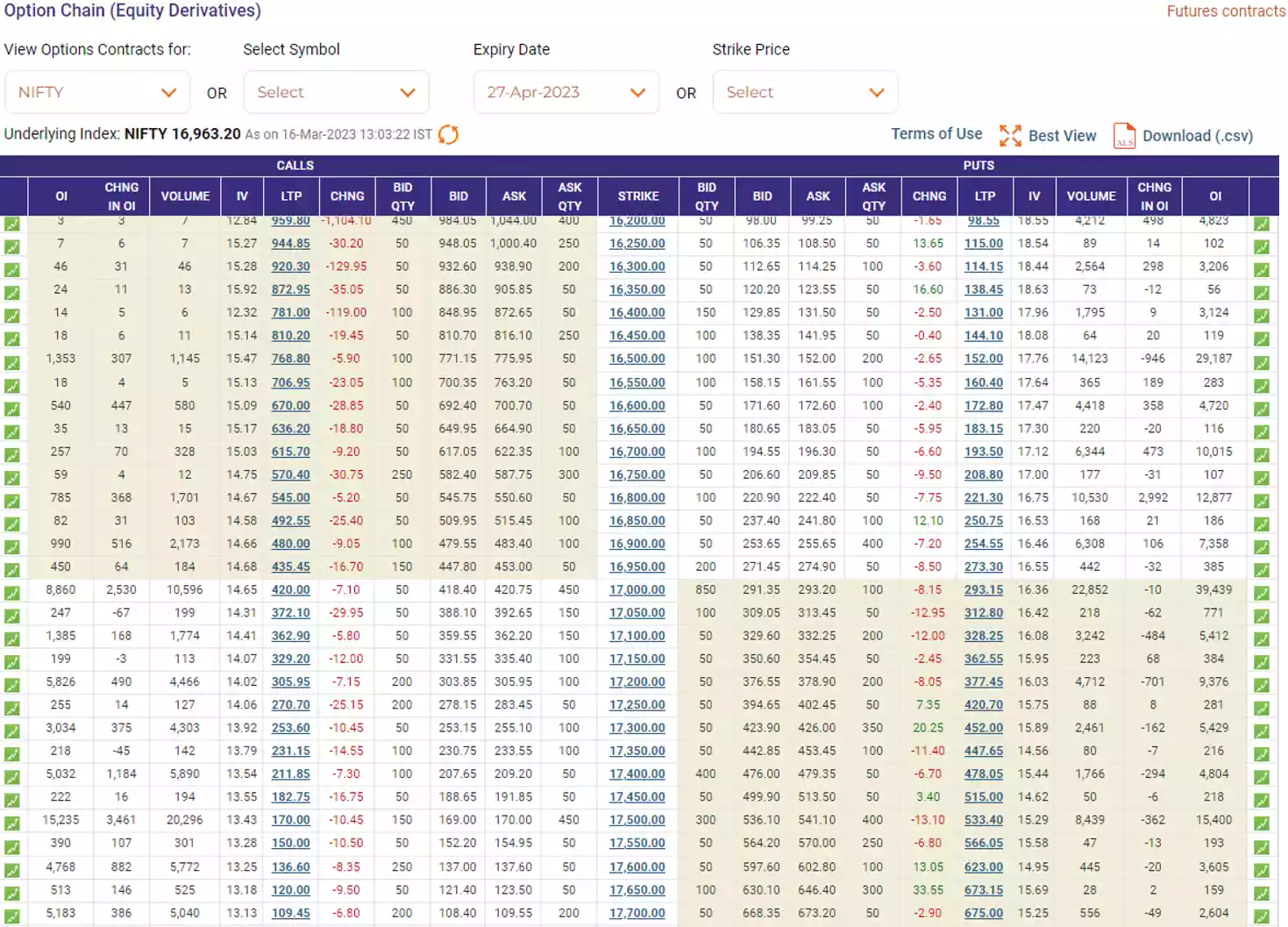

The availability of options contracts today on 16th March 2023 are as follows 23rd March 2023, 29th March 2023, 06th April 2023, 13th April 2023, 27th April 2023, 25th May 2023 etc. As per our requirement we will select monthly option contracts on expiry 27th April 2023. we can also select option contracts with expiry 13th April 2023, but due to illiquidity we are not selecting it.

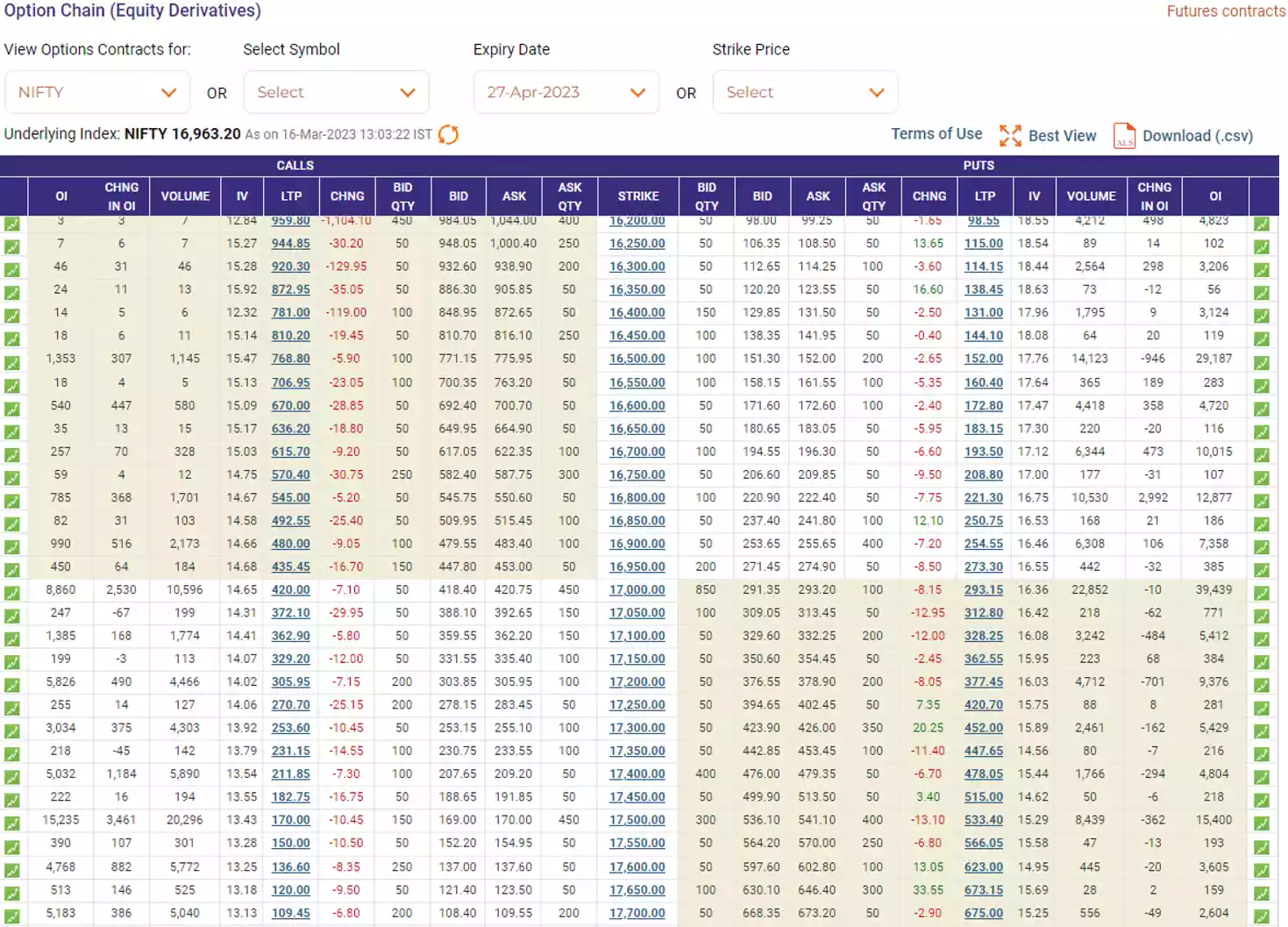

Selection of strike for long call naked option strategy:

Now we will select the strike of the selected option contract. so that we get the most profit or the least loss.

Selected options contract- Nifty Apr … CE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

| Moneyness | Strike price (K) | Premium |

| ITM | 16700/- | 615.70/- |

| ATM | 17000/- | 420.00/- |

| OTM | 17300/- | 253.60/- |

Now for selection of strike price we will compare profit and loss according to our calculated target price of Rs. 17750/- on expiry.

So profit and loss for strike 16700-

Profit and loss for long call= Max(Spot price on expiry-strike price,0) – premium

P&L= max(17750-16700,0) – 615.70

P&L= max(1050,0) – 615.70

P&L= 1050 – 615.70

P&L= 434.30/-

Profit if target achieved= 434.30/-

Maximum loss if target not achieved= 615.70/-

Profit and loss (P&L) table-

| Moneyness | Strike price (K) | Premium | Profit if target achieved | Maximum loss if target not achieved |

| ITM | 16700/- | 615.70/- | 434.30/- | –615.70/- |

| ATM | 17000/- | 420.00/- | 330.00/- | -420.00/- |

| OTM | 17300/- | 253.60/- | 196.40/- | -253.60/- |

According to above table OTM option with strike 17300/- looking good on investment off premium 253.60/- rupees per unit I will gain 196.40/- rupees, but if Nifty 50 target price missed only 196.40 points, you will make a zero and OTM options contract expires worthless.

Now for ITM option with strike 16700/- initial investment (premium-615.70/- rupees) to much so if target not achieved then loss occurs maximum as much premium.

So here we are selecting ATM options with strike price 17000/- which one is with moderate premium with moderate profit.

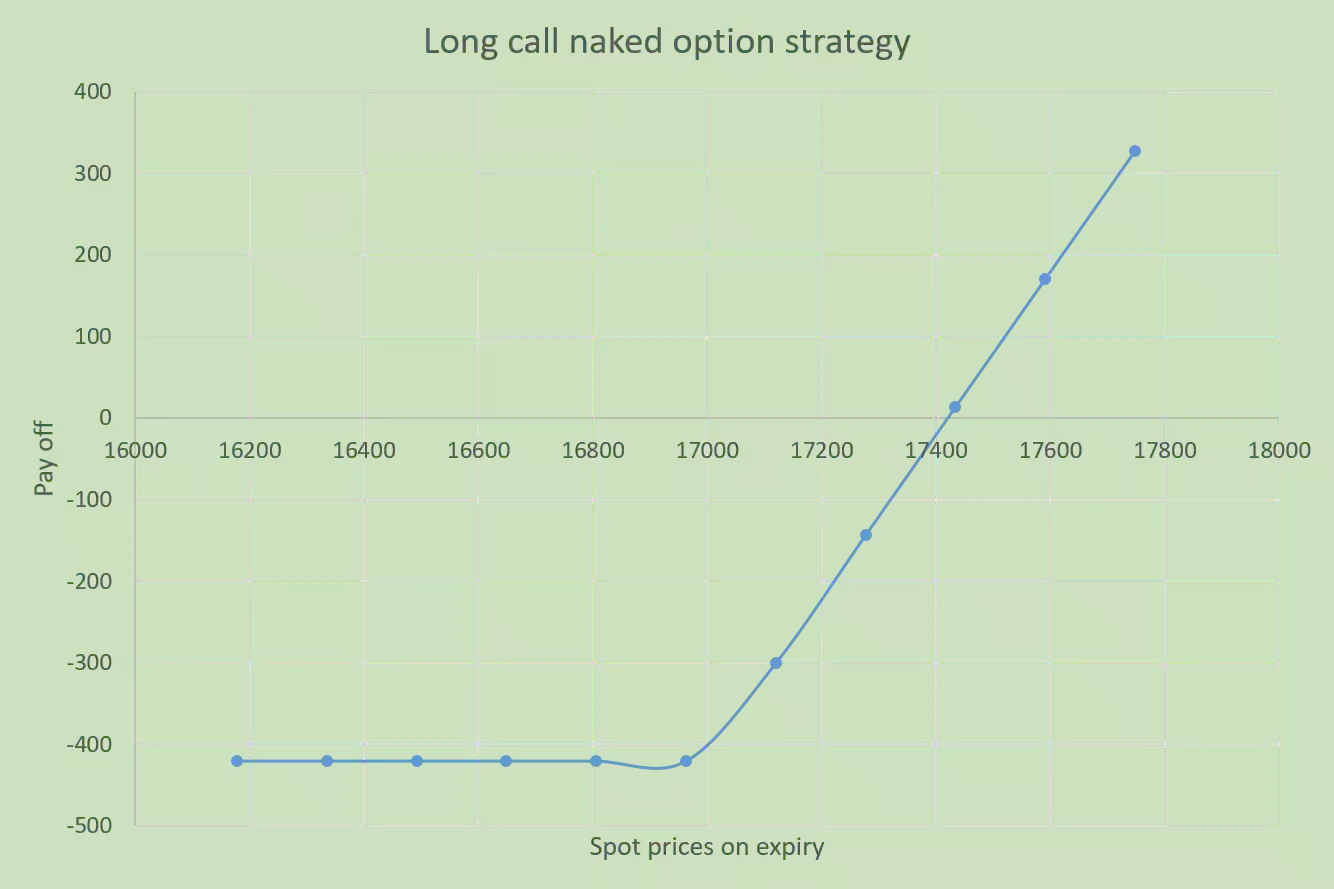

Pay off schedule for long call naked option strategy:

Above we have considered target price 17750/- rupees of Nifty 50 underlying index option contract achieved on expiry. But if target price not achieved or get any price on expiry, different from target price, then what would be pay off (P&L) on expiry for various spot prices.

So, option contract- Nifty Apr 17000 CE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Strike price (K)- 17000/-

Premium (P)- 420/-

Break even point= 17000 + 420= 17420/-

For calculation of pay off schedule use calculator Call naked option strategy pay off (P&L)–

Pay of schedule:

| On expiry Nifty closes at (Sf) | Net pay off for long call with 1 no of share unit |

| 16178 | -420 |

| 16335 | -420 |

| 16492 | -420 |

| 16649 | -420 |

| 16806 | -420 |

| 16963 | -420 |

| 17120 | -300 |

| 17277 | -143 |

| 17434 | 14 |

| 17591 | 171 |

| 17748 | 328 |

Pay of chart for long call naked option strategy:

Pay off chart is the graphical representation of pay off schedule (P&L).

Review of long call naked option strategy:

On the view of pay off schedule/pay off chart for long call participants have maximum profit unlimited if Nifty price go up from 17420/- (break even point), and maximum loss as equal to premium price, if Nifty price is equal to 17000/- (strike price), or below 17000/- (strike price).

Short call naked option strategy:

When you expect the underlying asset (stock/index) to fall you short a call option contract. Means when participants very bearish about underlying asset, he can sell call options. selling a call option is just the opposite of buying a call option.

When to select short call naked option strategy:

When participants very aggressive and very bearish or sideways on the stock/index.

Strategy for short call naked option strategy:

for short call strategy is sell call option.

Risk for short call naked option strategy:

For a short call risk is unlimited (As much as it increases till the expiry time)

Reward for short call naked option strategy:

Reward for a short call is limited to the amount of premium.

Break even point for short call naked option strategy:

The break-even point in an options contract refers to the underlying asset price at which the option contract neither makes a profit nor incurs a loss for the holder of the option.

For a short call, Break even point= Strike price + Premium

The break even point is the same for both long call option contracts and short call option contracts.

Which underlying asset to select for short call naked option strategy:

Here we are taking a selection of Nifty 50 which is an index option contract.

Selection of Nifty 50 option contracts:

As we know Nifty 50 option contracts are available for multiple expiry dates. here we are selecting same as above monthly options contract Nifty 27Apr … CE.

Selection of strike for short call naked option strategy:

Now we will select the strike of the selected option contract. so that we get the fixed profit or the least loss.

Selected options contract- Nifty 27Apr … CE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Target price- 16500/-

| Moneyness | Strike price (K) | Premium |

| ITM | 16700/- | 615.70/- |

| ATM | 17000/- | 420.00/- |

| OTM | 17300/- | 253.60/- |

Now for selection of strike price we will compare profit and loss according to our calculated target price of Rs. 16500/- on expiry.

So profit and loss for strike 16700-

Profit and loss for short call= premium – Max(Spot price on expiry-strike price,0)

P&L= 615.70 – max(16500-16700,0)

P&L= 615.70 – max(-200,0)

P&L= 615.70 – 0

P&L= 615.70/-

Profit if target achieved= 615.70/-

Maximum loss if target not achieved- unlimited.

Here what do mean by unlimited?

If we are selling a call options contract then profit when price go down and loss when profit go up. And for call option contracts buyers just opposite profit and loss.

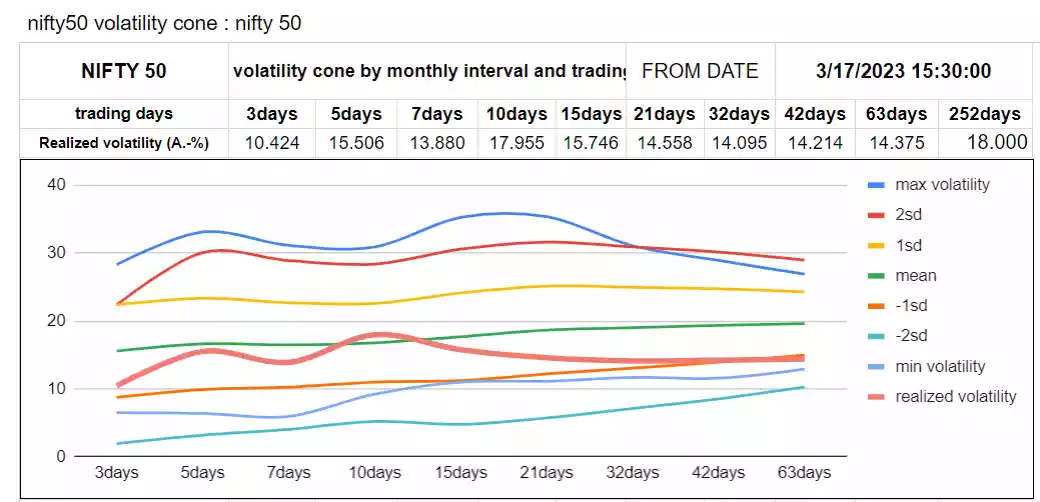

So how do we decide that if the price goes up, then how much will it go up on a certain time frame/expiry or if it goes down, then how much will it go down. So to calculate this, we will calculate the realized volatility, after that with the help of volatility, we will also calculate the price, where and how much it will go.

So, Today’s date- 16-03-2023

Expiry date- 27-04-2023

Time remaining= (27-04-2023) – (16-03-2023)= 42days

Expected annual return of selected underlying asset (Nifty 50)= 10% (avg. for last 10 year or take own decision by market analysis)

So, mean= 10%*42/365= 1.15%

Realized volatility= Calculate same as historical volatility difference only in realized volatility and historical volatility is time. Meaning for historical volatility take last 1calendar year closing price of underlying asset and for realized volatility take time according to time remaining to expire selected contract.

For here selected contract time remaining is 42days so we can calculate realized volatility by last 42 calendar days of closing price of nifty.

Here we are getting annual realized volatility for Nifty 50 with 32 trading days ( 32 trading days equivalent to 42 calendar days) from click here= 14.1%

Note- 365 calendar days= 252 trading days

So, 42 calendar days= 252*42/365= 29 trading days

Spot price (S)- 16963/-

So Nifty price go up or go down in 42 calendar days according to realized volatility (realized standard deviation(SD))

Annual realized volatility= 14.1%

So, for 42 calendar days realized volatility (SD)= 14.1*square root(42/365)= 14.1*0.3392= 4.78%

Now for upper range of Nifty 50 (numerical method)-

With 68% chances= Spot price + Spot price*(mean+1SD)

With 68% chances= 16963 + 16963*(1.15% + 4.78%)= 16963 + 16963*5.93/100= 16963 + 1006= 17969/-

With 95% chances= Spot price + Spot price*(mean+2SD)

With 95% chances= 16963 + 16963*(1.15% + 2*4.78%)= 16963 + 16963*10.71/100= 16963 + 1817= 18780/-

With 99.7% chances= Spot price + Spot price*(mean+3SD)

With 99.7% chances= 16963 + 16963*(1.15% + 3*4.78%)= 16963 + 16963*15.49/100= 16963 + 2628= 19591/-

This is the numerical method (traditional method). Here we will use practical method, difference between numerical method and practical method is mean, In the practical method mean is equal to zero and in numerical method mean is equal to last calendar days return ( at least 10 year average).

But return is not a fixed value its depend on market condition and in standard deviation (SD or volatility) calculation we are taking daily returns and SD is equivalent to daily return. And also falling of return in Galton board taking mean is equal to zero because of taking daily return with previous day value not fixed value so practical method is correct method when mean will be zero.

So here we will use practical method for underlying asset range calculation.

Now for upper range of Nifty 50 (practical method)-

With 68% chances= Spot price + Spot price*1SD

With 68% chances= 16963 + 16963*4.78%= 16963 + 811= 17774/-

With 95% chances= Spot price + Spot price*2SD

With 95% chances= 16963 + 16963*2*4.78%= 16963 + 1622= 18585/-

With 99.7% chances= Spot price + Spot price*3SD)

With 99.7% chances= 16963 + 16963*3*4.78%= 16963 + 2433= 19396/-

Now for lower range of Nifty 50 (practical method)-

With 68% chances= Spot price – Spot price*1SD

With 68% chances= 16963 – 16963*4.78%= 16963 – 811= 16152/-

With 95% chances= Spot price – Spot price*2SD

With 95% chances= 16963 – 16963*2*4.78%= 16963 – 1622= 15341/-

With 99.7% chances= Spot price – Spot price*3SD)

With 99.7% chances= 16963 – 16963*3*4.78%= 16963 – 2433= 14530/-

So, If directional view go wrong then for short call Nifty price go up with 99.7% chances is equal to or below 19396/-

Profit and loss for short call= premium – Max(Spot price on expiry-strike price,0)

P&L= 615.70 – max(19396-16700,0)

P&L= 615.70 – max(2696,0)

P&L= 615.70 – 2696

P&L= -2080.3/-

Loss if go wrong direction= -2080.3/-

Maximum loss can be till expiry= -2080.3/-

Profit and loss (P&L) table-

| Moneyness | Strike price (K) | Premium | Profit if target achieved (16500/-) | Maximum loss if price go up till +3SD, maximum price go up can be till expiry (19396/-) |

| ITM | 16700/- | 615.70/- | 615.70- | –2080.30/- |

| ATM | 17000/- | 420.00/- | 420.00/- | –1976.00/- |

| OTM | 17300/- | 253.60/- | 253.60/- | -1842.40/- |

According to above table OTM option with strike price 17300/- is less loss with compare to ITM and ATM option strike.

So here we are selecting OTM options with strike price 17300/- which one is with low premium (low profit) with low loss.

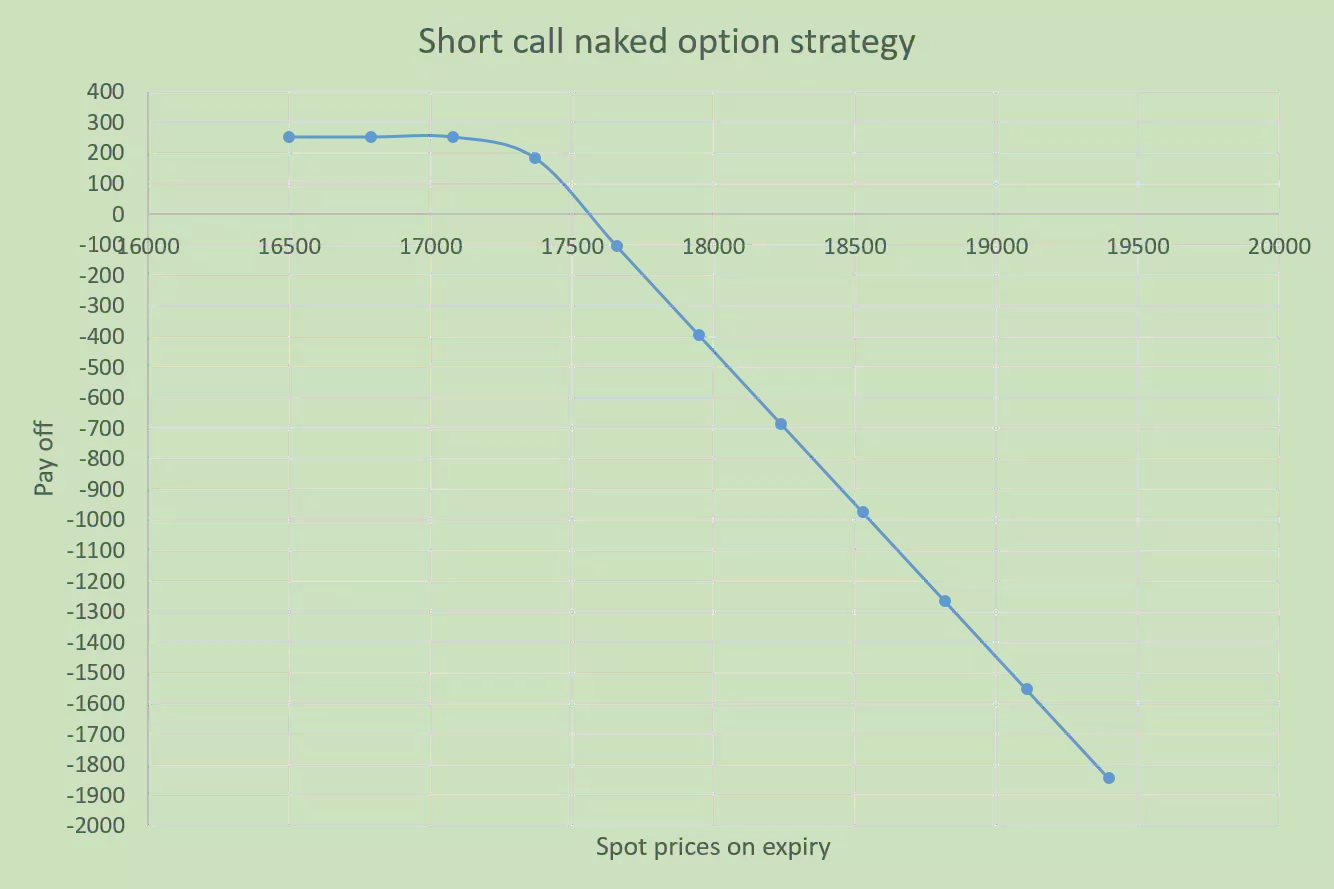

Pay off schedule for short call naked option strategy:

Above we have considered target price 16500/- rupees of Nifty 50 underlying index option contract achieved on expiry. But if target price not achieved or get any price on expiry, different from target price, then what would be pay off (P&L) on expiry for various spot prices.

So, option contract- Nifty Apr 17300 CE

Today’s date- 16-03-2023

Underlying asset- Nifty 50

Expiry date- 27-04-2023

Spot price (S)- 16963/-

Strike price (K)- 17300/-

Premium (P)- 253.60/-

Break even point= 17300 + 253.60= 17553.60/-

For calculation of pay off schedule use calculator Call naked option strategy pay off (P&L)–

Pay of schedule:

| On expiry Nifty closes at (Sf) | Net pay off for short call with 1 no of share unit |

| 16500 | 253.60 |

| 16789.7 | 253.60 |

| 17079.4 | 253.6 |

| 17369.1 | 184.5 |

| 17658.8 | -105.20 |

| 17948.50 | -394.90 |

| 18238.20 | -684.60 |

| 18527.90 | -974.3 |

| 18817.60 | -1264.00 |

| 19107.30 | -1553.70 |

| 19397 | -1843.4 |

Pay of chart for short call naked option strategy:

Pay off chart is the graphical representation of pay off schedule (P&L).

Review of short call naked option strategy:

On the view of pay off schedule/pay off chart for short call, if Nifty price go down beyond 17300/- (strike price), participants have maximum profit limited, and profit vary between breakeven point to strike price consecutively zero to premium value, and the maximum loss is if the underlying asset price moves above the break even point 17553.60/- till the expiry.