Futures pricing and margin:

Futures pricing refers to the process of determining the price of a futures contract, which is a legally binding agreement to buy or sell an underlying asset at a specified price on a specified date in the future. The price of a futures contract is influenced by a number of factors, including the supply and demand for the underlying asset, changes in market conditions, and expectations about future events that may impact the asset’s value.

Margin in futures trading refers to the amount of money that a trader must deposit with their broker to cover any potential losses from their futures trades. The margin acts as a performance bond, ensuring that the trader can fulfill their obligation under the futures contract.

The margin requirement for a futures contract is determined by the exchange on which the contract is traded, and is typically a small percentage of the value of the underlying asset. By using margin, traders can leverage their capital and potentially generate larger returns, but they must also be prepared to accept the risk of larger losses if their trades move against them.

Table of Contents

Futures contract Pricing:

Pricing of futures contract depends on the characteristics of underlying asset. But different assets have different demand and supply patterns, different characteristics and cash flow patterns. So no single way to price futures contracts. Here two popular models of futures pricing- cash and carry model and expectancy model.

Cash and carry model for futures pricing:

Cash and carry model is also known as non-arbitrage model. This model assumes that in an efficient market arbitrage opportunities cannot exist.

Let us understand by example-

Practically, forward/futures position in A stock can be created in following manners.

Enter in to a forward/ futures contract

Or

Create A synthetic forward/futures position by buying in the cash market and carrying the asset to future date.

Cost of creating A synthetic forwards/futures contract= spot price + cost of carrying the asset from today to the future date.

The cost of creating a synthetic futures position is a fair price of futures contract.

Cost of carrying a financial asset from today to the future date= transaction cost, custodial charges, financing cost, for commodities warehousing cost, insurance cost etc.

For non arbitrage cost of future contract (fair price) is equal to cost of futures market future price.

Suppose that 10gm gold price is Rs. 50000/- today if you purchase it from cash market for three month then cost of storage, financing, and insurance is Rs. 500/- then gold price overcome of 10gm is Rs. 50500/-

Now assume that in futures market for 3-month futures contract gold price is Rs. 51000/- more than fair price.

Due to price of futures contract more than price of fair price so we can take advantage of arbitrage but how?

Purchase gold in cash market=Rs 50000/-

Cost of carry =Rs 500/-

Total cost =Rs 50500/-

Sell on gold futures contract=Rs 51000/-

After 3 moth doesn’t matter price go up or down or equal due to convergence futures contract price will be equal to cash market gold price.

After 3 month sell the gold in cash market and buy the gold in futures market now he will earn profit from this=51000-50000+50000-50500=Rs 500/-

This profit get without any risk it is happen by mispricing of futures contract price. This arbitrage opportunity called as A cash and carry arbitrage.

Similarly if future price is less than fair price then it will make profit by reverse cash and carry arbitrage how?

Reverse cash and carry arbitrage:

Buy gold on future market and sell gold on cash market by borrow gold.

Suppose that in cash market gold price=Rs 50000/-

Borrow gold charge(cost) =Rs 500/-

So sell gold on cash market then money get=50000-500=Rs 49500/-

Buy gold in futures market= Rs 49000/-

After 3 month suppose price movement is zero so due to convergence futures contract gold price is equal to cash market gold price.

Now make a reverse trade-

Due to convergence futures contract gold price after 3 month(expiry)=Rs 50000/-

So now sell gold future contract on futures market=Rs 50000/-

And buy gold on cash market= Rs 50000/- (return gold and unborrowed)

Profit= futures market profit or loss + cash market profit or loss

Profit= (future sell price-future buy price)+(cash sell price-cash buy price)

Profit=(50000-49000)+(49500-50000)=1000-500=Rs 500/-

Extension of cash and carry model to the assets generating returns:

Extend the concept of cash and carry model by adding the inflows during the holding period of underlying assets.

Inflows= dividend on equity, interest on debt instruments.

Then, modified future price(fair price)= spot price+ cost of carry-inflows

In math’s terms, F = s*(1+r-d)t

Here, F= fair price

S= spot price

r=cost of carry in % of years

d= return in holding period in % of years

t= time in years

If continuous compounding then formula is, F= S*e(r-d)*t

e= exponential

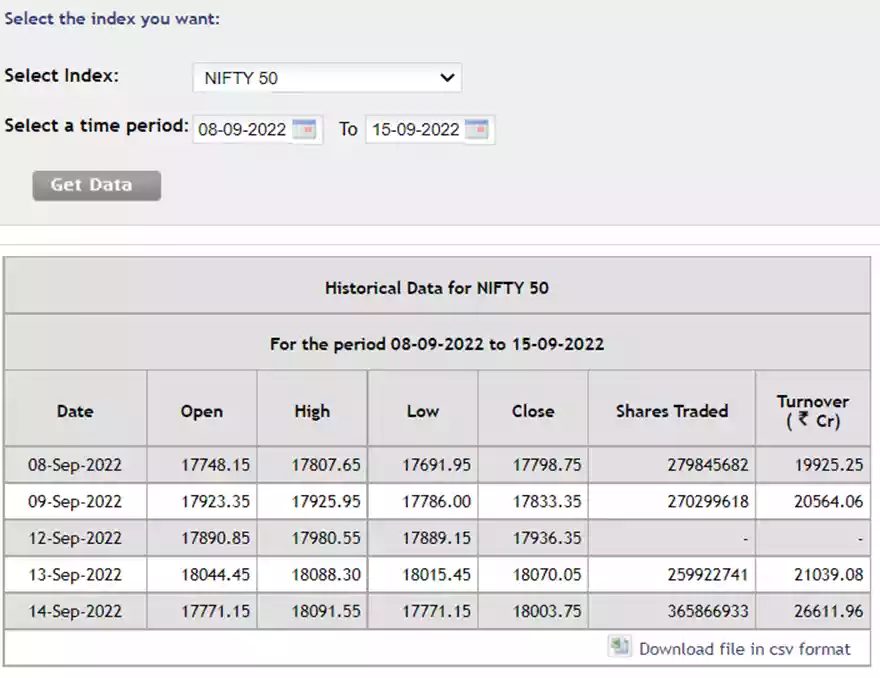

Let us assume for nifty futures-

Spot price, S=18004/- (on 14/9/2022, closing price)

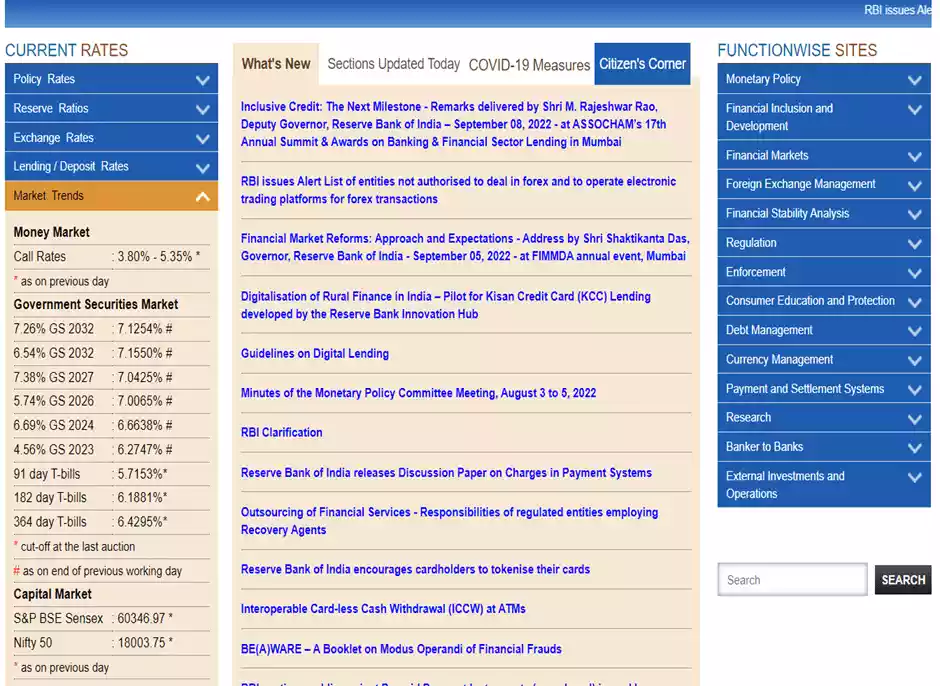

Suppose, cost of carry/financing, r= risk free interest rate

Note- for risk free interest rate get from RBI home page 91day treasury bill for 3 month holding period futures

r=5.7153%

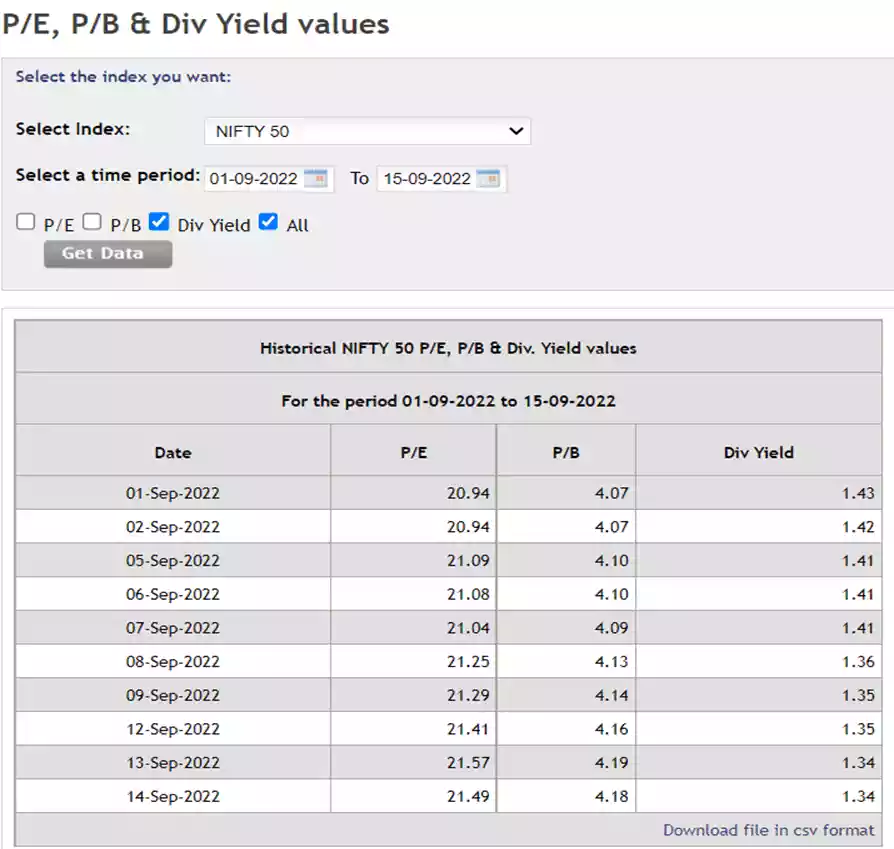

Return by dividend, d=1.34% (dividend yield during contract period)

Time period=3month=90days

Fair price=spot price(1+cost of financing-return in holding period)^(time to expiration/365) =18004(1+5.7/100-1.34/100)^(90/365)

=18004(1.0436)^0.246

=18004*1.01055366

=18194/-

or

Fair price=spot price(1+(r-d)/100*(t/365)

t=holding period in days

Or

fair price=s*e(r-d)*t

=18004*e(.057-.0134)*0.246

=18198.14/-

Compare that future price to less than fair price in futures market.

Source of risk free interest rate and snapshot:

Source-https://www.rbi.org.in/

Future pricing source and snapshot and Comparison:

SOURCE-https://www1.nseindia.com/products/content/equities/indices/historical_pepb.htm

Dividend Yield-1.34% (On 14/07/2022)

Dividend Yield= Gross Dividend*100/Index M. Cap.

Future pricing comparison:

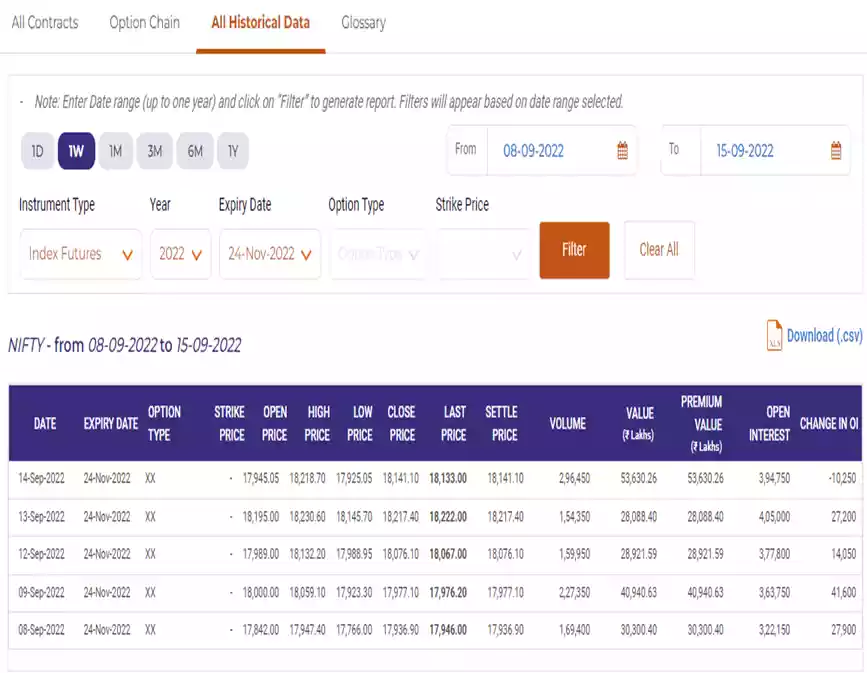

SOURCE-https://www.nseindia.com/get-quotes/derivatives?symbol=NIFTY&identifier=FUTIDXNIFTY24-11-2022XX0.00

Future price on 14/9/2022 (Closing)=18141/-

Expiry date-24/11/2022

Time period-14/9/2022 To 24/11/2022=17+31+24=72days

Fair price=18004*e^((0.057-0.0134)*(72/365))

Fair price= 18159/-

It is fair future price by formula.

Assumptions in cash and carry model:

-Underlying asset is available in abundance in cash market.

-Demand and supply in the underlying asset is not seasonal.

-Holding and maintaining of underlying asset is easy and flexible.

-Underlying asset can be sold short.

-No transaction costs.

-No taxes.

-No margins requirement.

This model can not work on seasonal assets like commodities. Not work in which not easy to hold or store and maintain underlying asset.

Expectancy model of futures pricing:

According to the expectancy model it is not the relationship between spot and futures prices but that of expected spot and futures prices, which moves the market, especially in cases when the asset cannot be sold short or cannot be stored.

According to this model,

-Futures can trade at A premium or discount to the spot price of underlying asset.

-Futures price give market participants an indication of the expected direction of movement of the spot price in the future. For instances, if future price more than spot price the market participants may expect the spot price go up in near future. This expectedly rising market is called “contango market”. Similarly if futures price less than spot price of an asset, market participants may expect the spot price to come down in future. This expectedly falling market is called “backwardation market”.

Convenience yield:

In case of natural disaster like flood in A particular region, people starts storing essentials commodities like grains, vegetables, and energy products(heating oil, cooking oil) etc. As A human tendency we store more than consumption requirement during crisis. If every persons behave like this then assets demand increase in cash market. So its increase the assets price. In such situations people are deriving convenience, just by holding the assets this is termed as convenience return or convenience yield.

Convenience yield sometimes may dominate the cost of carry, which leads futures to trade at a discount to the cash market. In this case reverse arbitrage is also not possible because no one lends trader the assets to sell short in the cash market. In such situations, practically, the cash and carry model breaks down and can not be applied for pricing the underlying assets.

What is margin in futures contract:

A futures contract margin is a deposit made by a trader to secure the obligations under a futures contract. The margin requirement is set by the exchange where the futures contract is traded, and it serves as a performance bond that ensures that the trader has the necessary funds to cover any potential losses. The margin requirement can vary depending on the volatility of the underlying asset, and traders may be required to post additional margin if the price of the underlying asset moves against their position.

The margin requirement is calculated based on the notional value of the futures contract and the initial margin rate, which is the minimum amount of capital required to enter into the contract. The initial margin rate is determined by the exchange and takes into account factors such as the volatility and liquidity of the underlying asset. The initial margin is typically a small percentage of the notional value of the futures contract, allowing traders to take on significant market exposure with relatively limited capital.

It is important for traders to regularly monitor their futures positions and to ensure that they have sufficient margin to cover any potential losses. If the margin balance falls below the required level, traders may be required to deposit additional funds or their positions may be liquidated to protect the exchange and other market participants.

Why margin charged:

let us rewind forward contract example Mr. A want to buy 1mt wheat from Mr. B at the price of Rs. 50/- per kg for 3-month time period but after 3 month on expiry price go up by Rs. 60/kg then in cash settlement Mr. A who is buyer got Rs. 10000/- benefit it will pay by Mr. B (seller) but what if Mr. B default?

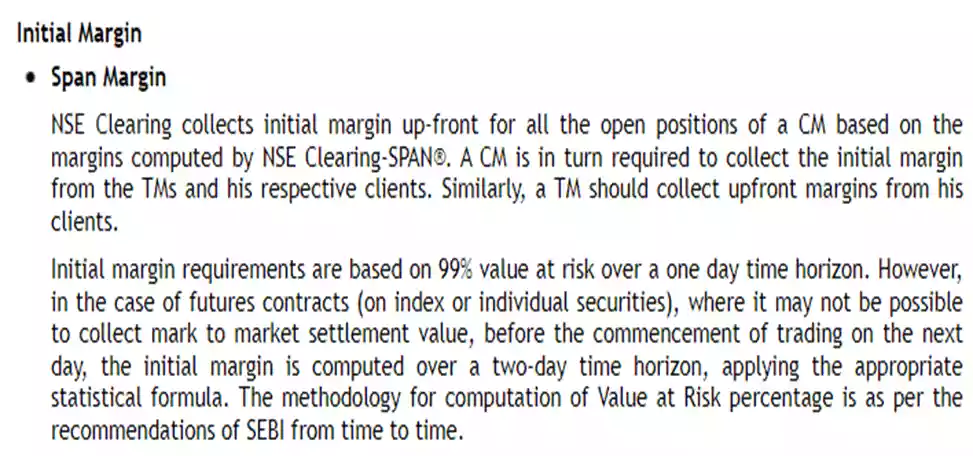

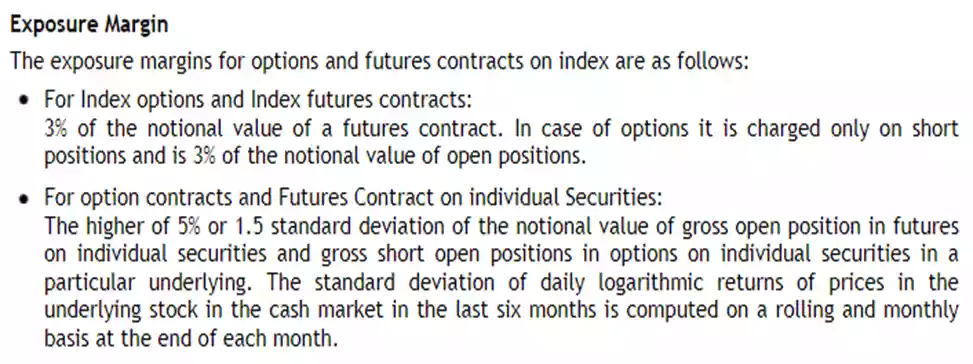

Now buyer can not do anything for default of seller because of it forward contract done by both parties mutual consent so any can default very easily but in futures market margins blocked both the parties for eliminate default risk. This margin money charged be exchange from broker and broker from me so exchange in return takes the onus of guaranteeing the settlement of all the trades. This margin blocked by exchange called as A initial margin initial margin is made up of two components i.e. Span margin and the exposure margin.

Margins, detail explanation:

Initial margin= span margin + exposure margin

Initial margin= % of contract value

Contract value= lot size*future price

Due to future price varies everyday so initial margin also varies everyday each and every time A trader initiates A futures trade there are few financial intermediaries who work in the background making sure that the trade carries out smoothly. The two prominent financial intermediaries are the broker and the exchange.

Client <===> broker <===> exchange

Now if the client defaults on an obligation, obviously it has A financial repercussion on both the broker and the exchange. Hence if both the financial intermediaries have to be insulated against A possible client default, then both of them need to be covered adequately by means of A margin deposit.

Span margin is the minimum requisite margins blocked as per the exchanges mandate and exposure margin is the margin blocked over and above the span to cushion for any MTM losses. Do note both span and exposure margin are specified by the exchange. So at the time of initiating A futures trade the client has to adhere to the initial margin requirement. The entire initial margin (span + exposure) is blocked by the exchange.

Span margin is more important as not having this in your account means A penalty from the exchanges. The span margin requirement has to be strictly maintained as long as the trader wishes to carry his position overnight/next day. In fact for this reason, span margin is also some times referred to as the “maintenance margin”.

So how does the exchange decide what should be the span margin requirement for a particular futures contract? Well, they use an advance algorithm is the ‘volatility’ of the stock. Volatility is A very crucial concept, if volatility is expected to go up the span margin requirement also goes up. Exposure margin, which is an additional margin, varies between 4% to 5% of the contract value.

Mark to market (M2M):

We know that futures price fluctuates on A daily basis, so we will make A loss or profit. M2m is A simple accounting procedure which involves adjusting the profit and loss daily basis from the closing price of futures contract till time we hold futures contract.

Let us explain by example:

suppose that reliance today future price= 2400/- open a position and buy at the Rs of 2400/-

On the expiry 5th day from today future price will go up Rs 2500/-

Lot size-250, sell price=2500/-

Profit=250*(2500-2400)=25000/-

This profit come by 5th day but what happen in 1st, 2nd, 3rd, 4th, 5th day in m2m process. M2M settlement done daily basis on the future closing price.

| Day | Open price of A day | Closing price of A day | Daily M2M | Money? |

| 1st day | 2400 (buy price) | 2450 | +12500 | Come from seller |

| 2nd day | 2450 (open price) | 2380 | -17500 | Pay to seller |

| 3rd day | 2380 | 2410 | +7500 | Come from seller |

| 4th day | 2410 | 2480 | +17500 | Come from seller |

| 5th day | 2480 | 2500 (sell price) | +5000 | Come from seller |

| Total profit | =25000 |

Money is either credited or debited also called daily obligation based on how the future price behaves. The previous day close price is taken in to consideration to calculate the present day M2M.

Now, we look A example with both margin and M2M calculation:

Symbol-Reliance

Trade type-buy

Buy date-today (14/07/2022)

Buy price-2400/- (per share future price)

Sell date – 18/07/2022

Sell price- 2500/-

Lot size-250

Contract value- 250*2400=600000/-

Span margin – 7.5% of cv= 45000/-

Exposure margin- 5% of cv = 30000/-

Initial margin (span + exposure) – 75000/- (45000+30000)

Profit and loss per share – 2500-2400=100/-

Net profit- 250*100=25000/-

| Day | Open Price | Close Price | C.V. | Span | Exposure | Total IM | M2M | Cash Balance | Remarks |

| 1st Day Open A Position-14/7/2022 | B-2400 | – | 600000 | 45000 | 30000 | 75000 | – | 75000 | Cash Blocked |

| 1st Day Close | – | 2450 | 612500 | 45937.50 | 30625 | 76562.50 | +12500 | 87500 | ,, |

| 2nd Day | 2450 | 2380 | 595000 | 44625 | 29750 | 74375 | -17500 | 70000 | ,, |

| 3rd Day | 2380 | 2410 | 602500 | 45187.50 | 30125 | 75312.50 | +7500 | 77500 | ,, |

| 4th Day | 2410 | 2480 | 620000 | 46500 | 31000 | 77500 | +17500 | 95000 | ,, |

| 5th Day (18/7/22) | 2480 | S-2500 | 625000 | 46875 | 31250 | 78125 | +5000 | 100000 | Cash Released |

The initial margin considered as the initial cash blocked by the broker.

The total cash balance in the trading account = cash balance+_ M2M.

If cash balance more than margin requirement then there is no problem. But what if less?

According to 2nd day M2M is negative so cash balance in account is 70000/- but initial margin is required 74375/- so now we have required to deposit some money for maintain to minimum cash balance 74375/- ?

No not required because of initial margin made by two components span + exposure margin if money (cash balance) come less than span margin (44625) then we have required a deposit money if you don’t deposit then your broker will force the close position. Before closing position broker request to you via call, message, or email to pump margin money is also popularly called the “margin call” for continue position to fulfill margin call need.

Profit and loss calculation many ways:

Method 1- sum up all M2M’s

P&L=12500-17500+7500+17500+5000=25000/-

Method 2 – cash release

P&L=final cash balance-cash blocked initially(IM)

P&L=100000-75000=25000/-

Method 3- contract value

P&L= final contract value-initial contract value

P&L=625000-600000=25000/-

Method 4- future price

P&L=lot size*(difference between buy and sell future price

P&L= lot size*(sell price of future contract- buy price of future contract)

P&L=250*(2500-2400)=25000/-

Margin call:

If suppose you don’t exit on 5th day you go on next day 6th day and reliance price down by approximate 6% it is 2250/- then.

| Day | Open Price | Close Price | CV | Span | Exposure | Total IM | M2M | Cash Balance | Remarks |

| 5th Day (18/7/22) | 2480 | 2500 | 625000 | 46875 | 31250 | 78125 | +5000 | 100000 | |

| 6th Day | 2500 | 2250 | 562500 | 42187.50 | 28125 | 70312.50 | -62500 | 37500 |

On 6th day my cash balance come down 37500/- but span margin requirement is 42187.50/- it is less than span margin so broker will give A margin call to the client, or in fact some brokers will even cut the position real time as and when the cash balance drops below the span requirement.

Margin source:

Source- https://www1.nseindia.com/products/content/derivatives/equities/margins.htm

source snapshot-