what is option Greek interactions:

Option Greek interactions refer to the way in which the various Greek parameters used in options pricing models are interrelated and affect one another. The five main option Greeks are:

- Delta: measures the sensitivity of the option price to changes in the underlying asset price.

- Gamma: measures the rate of change of the option delta in response to changes in the underlying asset price.

- Theta: measures the sensitivity of the option price to changes in time until expiration.

- Vega: measures the sensitivity of the option price to changes in volatility.

- Rho: measures the sensitivity of the option price to changes in interest rates.

These option Greeks interact with each other in complex ways, and changes in one Greek parameter can affect the values of the other Greeks. For example, changes in delta can affect gamma, theta, and Vega, while changes in Vega can affect delta and theta.

Understanding the interactions between these Greek parameters is essential for option traders and investors, as it can help them to better analyze and manage the risks associated with their positions. By monitoring the changes in these Greeks over time, traders can adjust their positions and take advantage of market movements to maximize their profits and minimize their losses.

Table of Contents

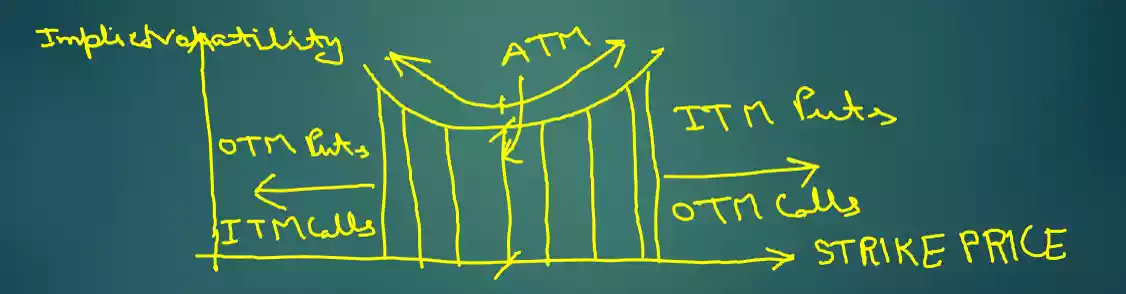

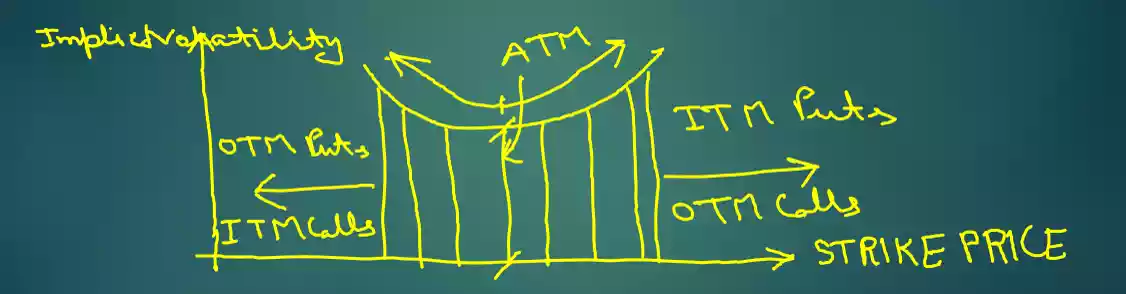

Volatility smiles:

A volatility smile is a common graph shape that results from plotting the strike price and implied volatility of a graph of options with the same underlying asset and expiration date the volatility smile is so named because it looks like a smiling mouth. Implied volatility rises when the underlying asset of an option is further out of the money or in the money compared to at the money. The volatility smile does not apply to all options.

The black-Scholes model predicts that the implied volatility curve is flat when plotted against varying strike prices based on the model, it would be expected that the implied volatility would be the same for all options expiring on the same date with the same underlying asset, regardless of the strike price. Yet, in the real world this is not the case.

Volatility smirk/skew :

Volatility smile not always happen some times it is make a smirk due to unequal implied volatilities of ITM and OTM options for same underlying and same expiration date. Curve shifted left or right said to be skewed.

Implied volatility rank:

IV rank= (current IV-1y low IV)*100/(1y high IV-1y low IV)

Example- if current IV= 17, 1y high IV= 40, 1y low IV= 12

Then, IVR= (17-12)*100/(40-12)= 500/28= 17.85%

If current IV= 12

Then, IVR= (12-12)*100/(40-12)= 0/28= 0%

Means that implied volatility rank vary from 0% to 100%, 0% means low IV and 100% means high IV.

Implied volatility percentile:

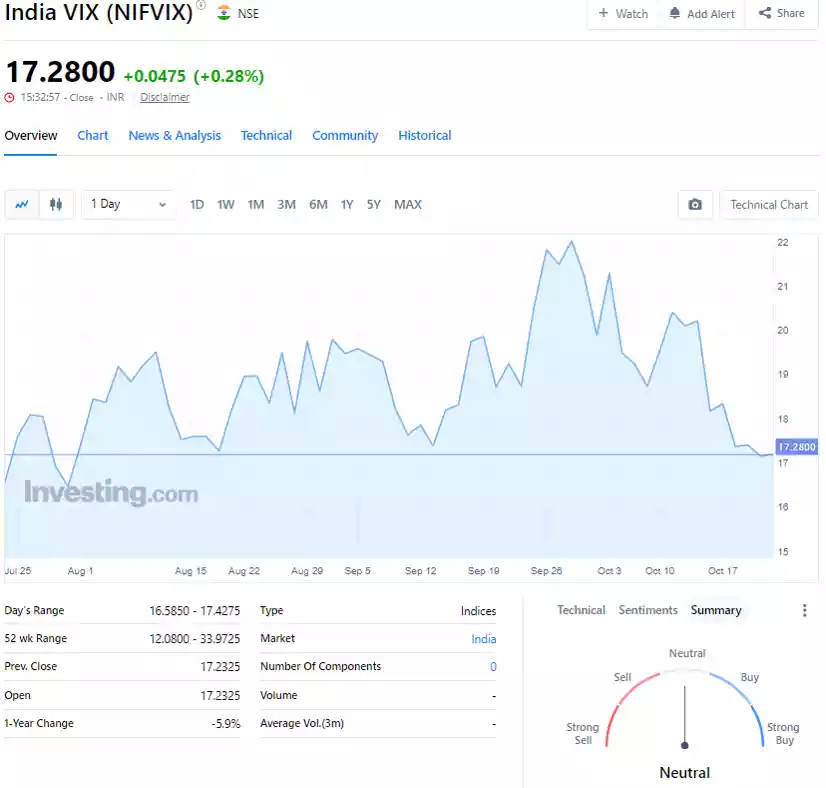

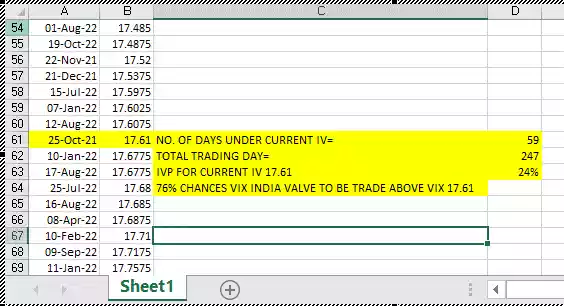

Implied volatility percentile reports the percentage of days over the last 52 weeks that implied volatility traded below the current level of implied volatility.

IVP= no of days under current IV*100/ no of trading days in a 1 year

You have required all day of 1 year data of implied volatility for calculation if get then,

Todays IV=20%

Now suppose below IV 20% trading days is 150

Then IVP= 150/252*100= 59.52%~60%

60% percentile means that 60% time trading days in a year implied volatility below the value of 20% so more chances(60% chances) to option trade below 20% implied volatility and less chance(40% chances) to option trade above 20% implied volatility.

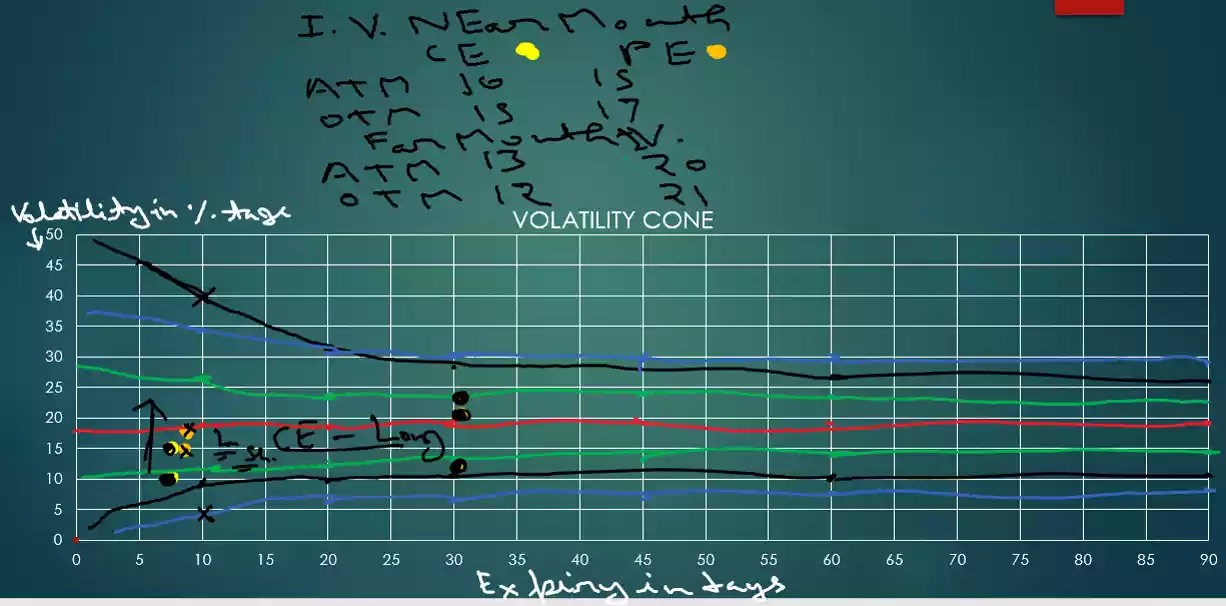

Volatility cone:

Suppose today Nifty is trading at 17000/- and current implied volatility of option position is 15% then a 17000 CE (ATM) and 17200 CE (OTM) bull call spread (buy ATM option and sell OTM option then bull call spread is 17200-17000=200) would cost 90 (premium pay-premium received) with a potential profit (200-90=110) of 110. However if the implied volatility is 30% instead of 15% the same position would cost 108 with potential profit of 92. So with higher volatility a bull call spread not only costs higher but the profitability greatly reduces.

For example nifty ATM options currently have an IV of 20%, where as reliance ATM options have an IV of 40% given this should you choose to trade Nifty options because IV is low or should you go with Reliance options?

This is where the volatility cone comes handy- it addresses these sorts of questions for option traders volatility cone helps the trader to evaluate the cost lines of an option i.e. Identify options which are trading costly/cheap you can do it not only across different strikes of a security but also across different securities as well.

Let’s figure out how to use the volatility cone:

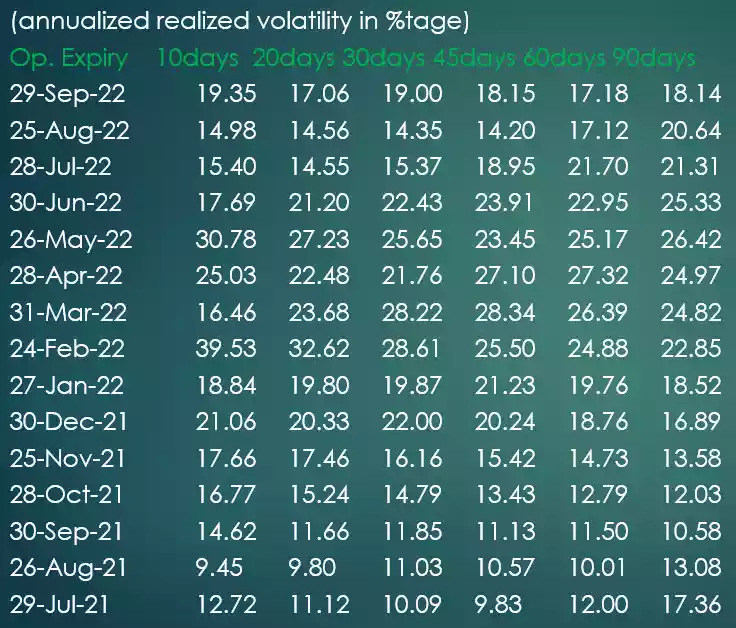

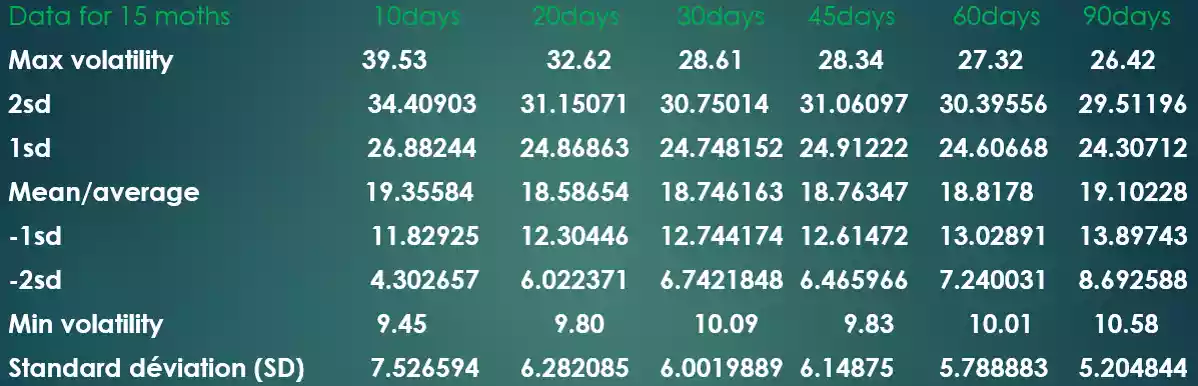

♣ 1st calculate the past month options contracts 10days, 20days, 30days, 45days, 60days, 90days prior annualized realized volatility of underlying asset. And also look past 15month option contracts realized volatility with maximum, minimum, mean/average, 1sd, and 2sd realized volatility separate for 10days, 20days, 30days, 45days, 60days, and 90days etc.

♣ For calculation of prior days realized volatility first download underlying asset closing prices of last 15+3 month. And mark expiry date of monthly option contract. From expiry date mark data prior 10days, 20days, 30days, 45days, 60days, and 90days consecutively and calculate log return after that annualized standard deviation. Its do for all 15 month option contract.

♣ Now calculate from this 15month data mean, variance, standard deviation, maximum, minimum, 1sd, 2sd for all selected days.

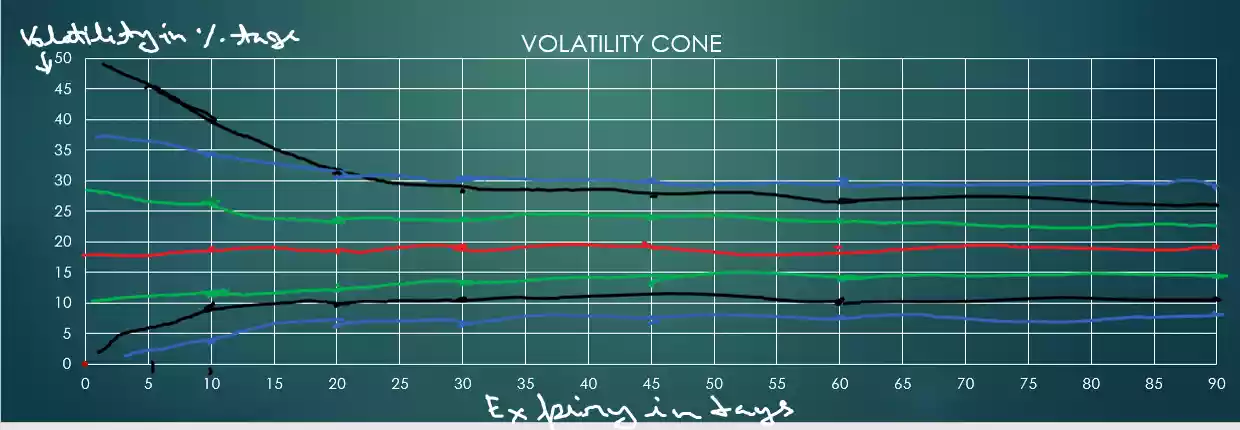

♣ Now plot it in chart by x-axis with expiry days and y-axis with realized volatility in percentage.

If for This data we represent the graphical would like a cone as shown below, hence the name ‘volatility cone’.

How to read volatility cone:

The way to read the graph would be to first identify the number of days to expiry and then look at all the data points that are plotted right now above it. For example if the number of days to expiry 30days then observe the data points (representing realized volatility) right above it to figure out the minimum, -2sd, -1sd, average implied volatility etc. Also do bear in mind the volatility cone is a graphical representation on the historical realized volatility and also represent that volatility increased in low expiry days.

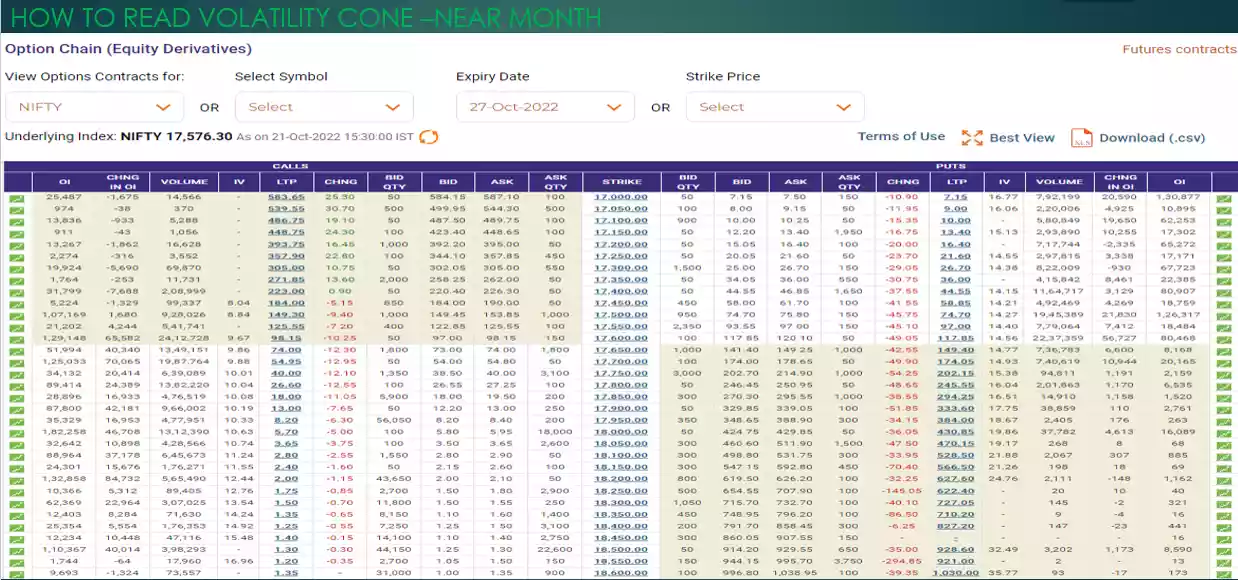

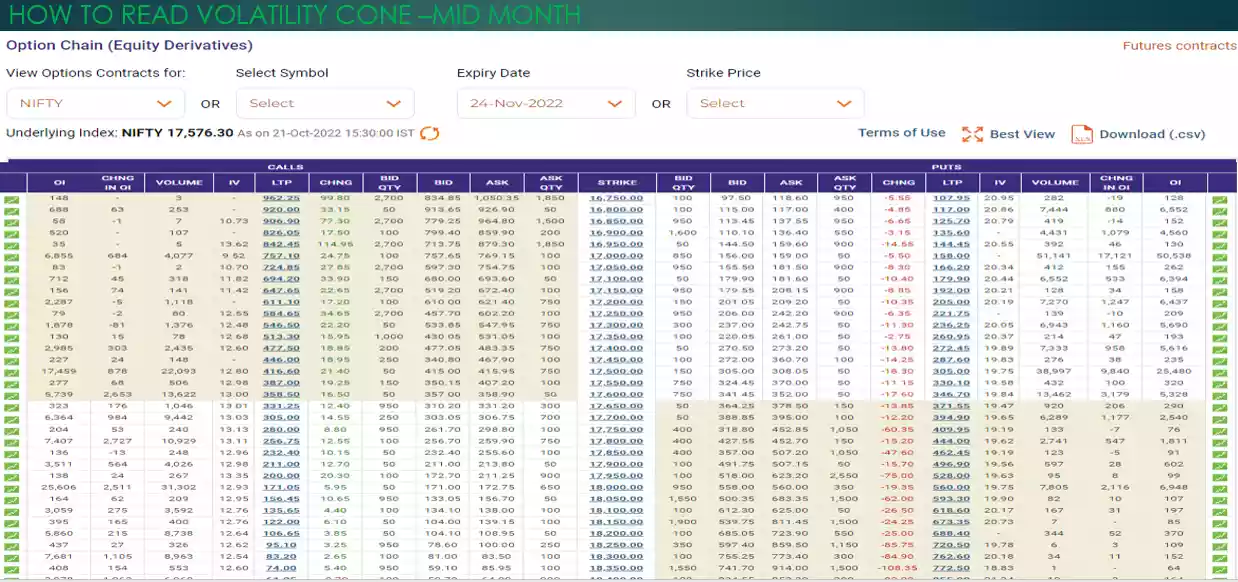

Now you can plot actual near and mid month expiry option implied volatility on volatility cone graph and look this is where in graph if near +2sd means volatility is high make short options trade and if near -2sd line means low implied volatility it get make long position trade.

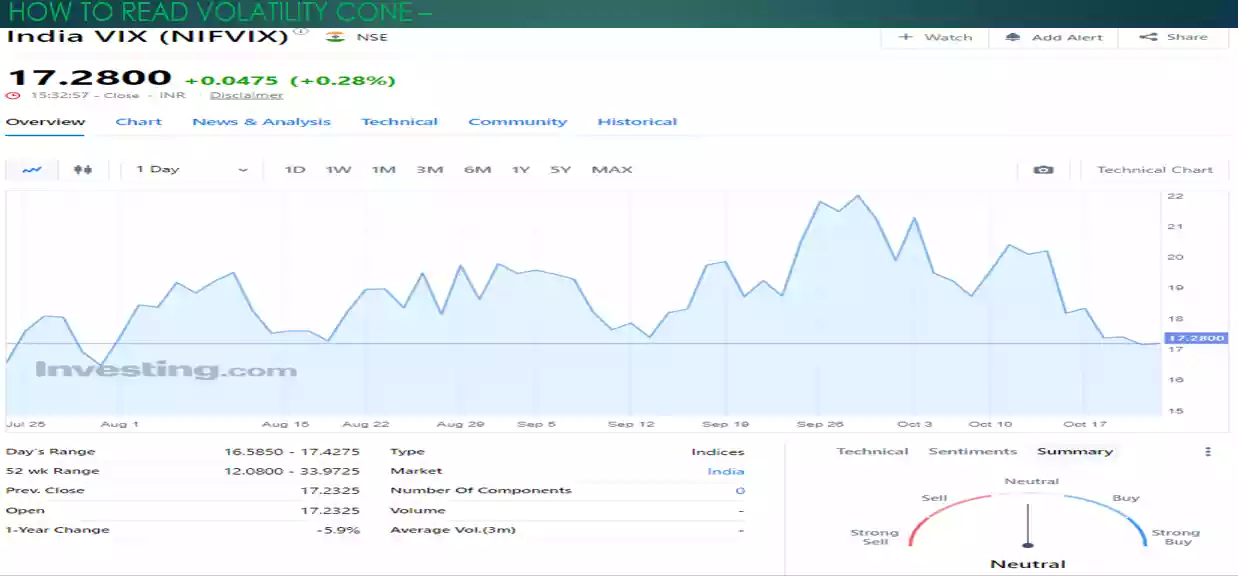

Also look a directional movement like if VIX is high then implied volatility is also high but nifty price is low so make a bullish position like put sell and when VIX is low mean nifty is high make bearish position like for cheap premium make put buying because of maximum chances to fall also you get call premium cheap but cautions about directional movement of nifty will be continue or not.

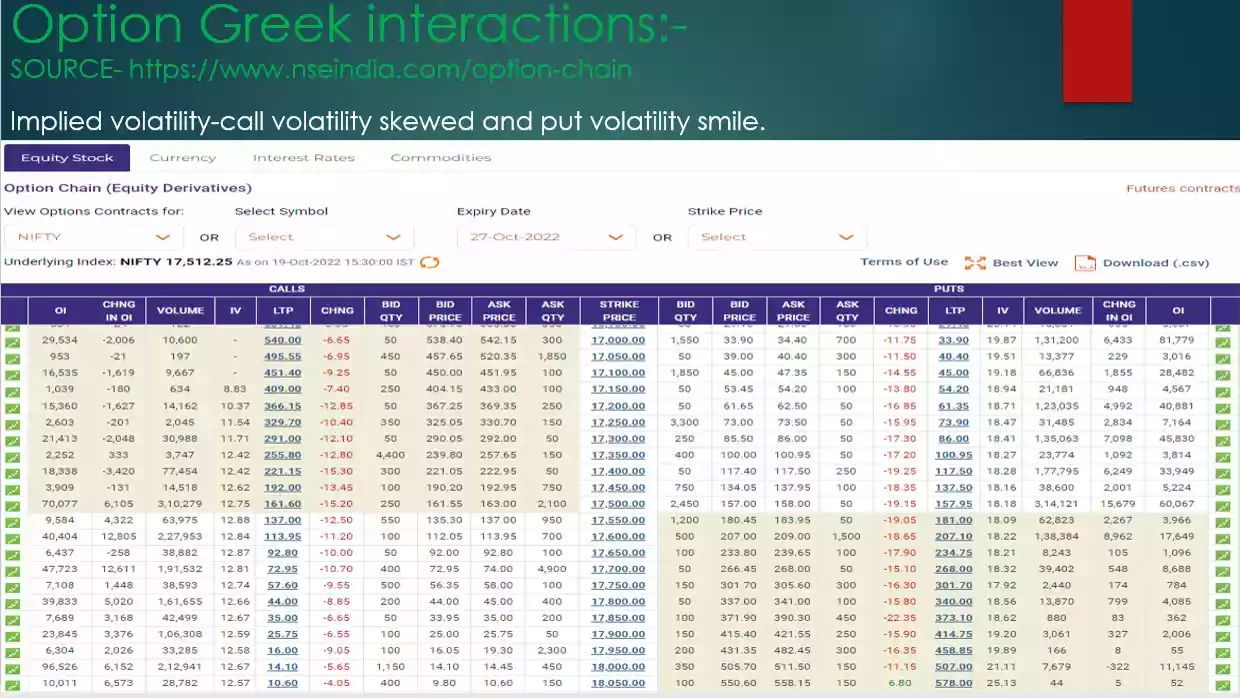

Historical volatility and implied volatility relations:

Implied volatility tends to historical volatility if historical volatility is greater than implied volatility then implied volatility tend to equal historical volatility and if implied volatility is less than historical volatility then also tend to historical volatility means implied volatility go to same as historical volatility now if implied volatility is different from ATM to ITM & OTM due to its demand and supply or fear and greed so higher implied volatility (ITM & OTM implied volatility) tends to ATM implied volatility for make a relation with underlying asset price.

If implied volatility is high from historical volatility means over valued and implied volatility is less from historical volatility means under valued. You can also make trade strategy according to historical volatility and implied volatility interpretation or comparison. I will suggest you to use historical volatility by calculation of last 1 month past history for near month option and take 2 month for next month option means use historical volatility and implied volatility for which options if expiry days remain 90 days then use 90 days past history to calculate historical volatility.

Vega and zeta relations:

Vega is the change of option price if change in 1% historical volatility but Zeta is change in option price if change in implied volatility generally used for calculation of option price is implied volatility. In option pricing model used historical volatility for calculation of theoretical option price or first time to introduce options in market but after that due to fear and greed or demand and supply option price to be change by trading so for this change practical option price we get but what to change in option price model?

Change in option price model is volatility and now this volatility calculate by reverse or iteration method and known as implied volatility. Implied volatility is calculated by practical option price with Black-Scholes model and historical volatility calculated by underlying asset past history closing price with statistical formula of standard deviation. Generally for option price movement take implied volatility and underlying price movement take historical volatility for calculation.

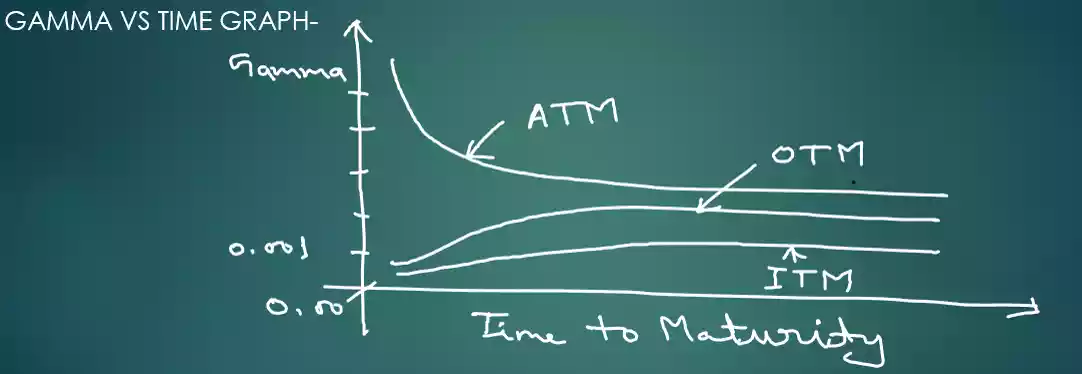

Gamma vs time:

Gamma points-

♣ Gamma measures the rate of change of delta.

♣ Gamma is always a positive number for both calls and puts.

♣ Large gamma can translate to large gamma risk (directional risk).

♣ When you buy options (calls or puts) you are long gamma.

♣ When you short options (call or puts) you are short gamma.

♣ Avoid shorting options which have a large gamma.

Now I am shorting options with long gamma but shorting options with low gamma value but I don’t know that all life of options gamma value will be low or change it with passing time. Let us understanding behavior’s of gamma versus time to expiry.

The graph above shows how the gamma of ITM, OTM, ATM options behave as the time to expiry starts to reduce.

The graph above drives across these points:

♣ When there is ample time to expiry all three options ITM, ATM, OTM have low gamma values. ITM options gamma tends to be lower compared to OTM or ATM options

♣ The gamma value for all three strikes (ATM, OTM, ITM) remain fairly constant till they are half way through the expiry.

♣ ITM and OTM options race towards zero gamma as we approach expiry

♣ The gamma value of ATM options shoot up drastically as we approach expiry.

From these points it is quite clear that, you really do not want to be shorting ATM options especially close to expiry as ATM gamma tend to be very high.

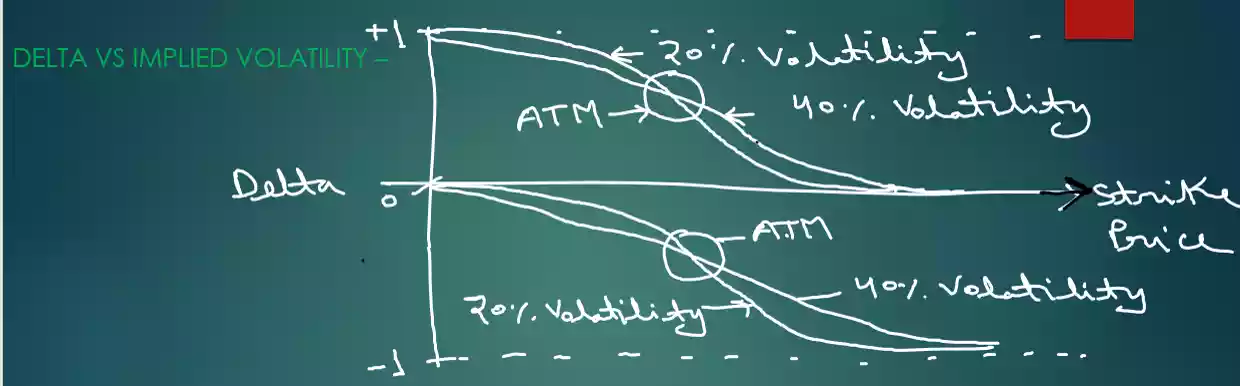

Delta vs implied volatility:

The graph represents the movement of delta with respect to strike price-

♣ Delta has an effect on lower range of options around ATM when implied volatility is low and its influence increases when volatility is high.

♣ When the volatility is high, the far OTM options to tend to have a non zero delta value.

Greeks and options with all together:

I have learned all about Greeks but still confusion to what to buy when to buy which strike to buy and what is effect of Greeks on them and what to do eliminate negative effect of Greeks or take advantage of Greeks I know that I can execute or make position by basic 4-types in options.

like I can buy call option, sell call option, buy put option and sell put option and also we can execute together like buy 1 call and 1put or many types this known as strategy I will understand about it in next sections. Here I will look Greek effects on options.

Option buyer:

I know about option Greeks delta is the speed of option premium but we doesn’t discuss about underlying speed because of if underlying not rise with suitable speed then I can not make profit suppose that Nifty-50 option price trading at 300 rupees for 1 month expiry for 16000 strike price and also 16000 underlying price then when to call buyer makes profit when underlying price increase more than 16000+300=16300 point then we will make profit means per day Nifty rise =300/trading days, 300/(30-holidays), 300/(30-10), 300/20, 15 points.

Means that if nifty daily rise average more than 15 points then I will make profit from buyer on expiry. But average rise according to past history return of Nifty is 12% so for 1 month return is 1% of Nifty mean return is=16000*1/100=160 points which one is less than option premium so profit making is not so easy for that make a good plan.

If you are a trader exit before expiry then you have to consider all Greeks suppose Nifty go up 300 points in just 15days then profit will be more on expiry comparison.

But if it is not raise 300 points in 1 month only gain 200 points (speed less) then will make loss for option buyer case. Then what to do? Buy which options where premium (time value) is less than 200 points means I can go in ITM options when we will go on ITM then premium go on two factor intrinsic value + time value in this total premium more but if time value less than 200 then you can execute that.

In OTM options also less premium but due to shortfall in strike price we have to move more. Suppose 16200 strike premium is 100 then total Nifty if move more than 100+200=300 points then I can make profit so only less speed I can make profit only ITM options so before execute any option for buying you calculate first underlying asset rising or falling speed and then select strike if speed is to more then take slightly OTM/ATM, if speed less then go on slightly ITM options.

Option seller:

In option sell case just opposite option buying. In this premium decay make profit so theta Greek is so important and opposite speed is important like if sell call then when Nifty fall and sell put when Nifty rise due to unlimited risk in option selling make proper plan and right strike for that and always select OTM strike with less expiry time with calculation of realized volatility of underlying asset with implied volatility of particular option or VIX-India value.

Implied volatility put effect on option two types first is when volatility is high then more chances Nifty will below and if volatility (VIX) is low then more chances Nifty is high means reversal chances is very high. 2nd is when implied volatility is high then option price is also high in this situation option selling is very suitable but not for call for only put because most chances to implied volatility to be fall and Nifty rise but reversal important.

So before plan look market very carefully or go long maturity options for put selling if go opposite directional view then you can wait for that and take profit by directional movement in put option selling. Like that buy option when volatility low and chance to high in coming days than when you buy less premium due to low implied volatility and when volatility increase then option price also increase due to price increase of call option you can make profit but when volatility low, mean Nifty on high, means more chances to fall Nifty, means buy only put options. In summary of implied volatility support only put options. So very careful.