What is the option Greeks:

Option Greeks are a set of mathematical measures used in options trading to help understand the sensitivity of an option’s price to various factors. Or Option premiums change with changes in the factors that determine option pricing. Factors such as spot price, strike price, volatility, time to expiry, risk free interest rate etc. The option Greeks are the tools that measure the sensitivity of the option price to the above mentioned factors. Option Greeks represented by Delta(∆ ), Gamma(γ), Theta(θ), Vega(v), Rho(ρ). The five primary option Greeks are:

- Delta (Δ): Delta measures the change in the price of an option for every 1unit change in the underlying asset’s price. Delta can range from 0 to 1 for a call option and from -1 to 0 for a put option.

- Gamma (γ): Gamma measures the rate of change of an option’s delta for every 1unit change in the underlying asset’s price. Gamma is positive for both call and put options.

- Theta (θ): Theta measures the rate of change of an option’s price with respect to time. It shows how much value an option loses each day due to the passage of time.

- Vega (ν): Vega measures the change in an option’s price for every 1% change in the implied volatility of the underlying asset. Vega is positive for both call and put options.

- Rho (ρ): Rho measures the change in an option’s price for every 1% change in the risk-free interest rate. Rho is positive for both call and put options.

Table of Contents

Delta(∆):

The most important of the ‘Greeks’ is the options ‘delta’ this measures the sensitivity of the option value to a given small change in the price of the underlying asset. It may also be seen as the speed with which an option moves with respect to price of the underlying asset.

Delta= change in option premium/unit change in price of the underlying asset

Delta by black-Scholes model:

For a European call option on a non-dividend-paying stock,

For call option buyer, Delta(∆)= N(d1)

For call option seller, Delta(∆)= -N(d1)

For put option buyer, Delta(∆)= N(d1)-1

For put option seller, Delta(∆)= 1-N(d1)

Where, d1 = {In(S/K)+(r+σ2/2)t}/σ*√t

S= spot price

K= strike price

r= risk free interest rate annualized in decimal

σ= Historical volatility/Implied volatility annualized in decimal

t= time to expiry in years

ln= logarithm on base e

N(x)= Standard normal distribution function

If, ∆S= Change in spot price of underlying asset

Then, call option buyer price change= N(d1)* ∆S

For call option seller price change= -N(d1)* ∆S (negative symbol indicates that value of position in inverse)

New option price for call options(for both call buyer & seller)= Previous premium ± N(d1)*∆S(+ sign when underlying price up,- sign when underlying price down)

New option price for put options(for both put buyer & seller)= previous premium±{N(d1)-1}*∆S(+ sign when underlying price up,- sign when underlying price down)

♦ Delta for call option buyer is positive

♦ Delta for call option seller is negative but same in magnitude for call option buyer delta

♦ Delta for put option buyer is negative

♦ Delta for put option seller will be same in magnitude but with the positive sign

♦ The delta is often called the hedge ratio, e.g.- if you have a portfolio of N-shares of a stock then N divided by the delta gives you the number of calls you would need to be sell to create a hedge in such a delta neutral portfolio, any gain in the value of the shares held due to a rise in the share price would be exactly offset by a loss on the value of the calls written(sell) and vice versa.

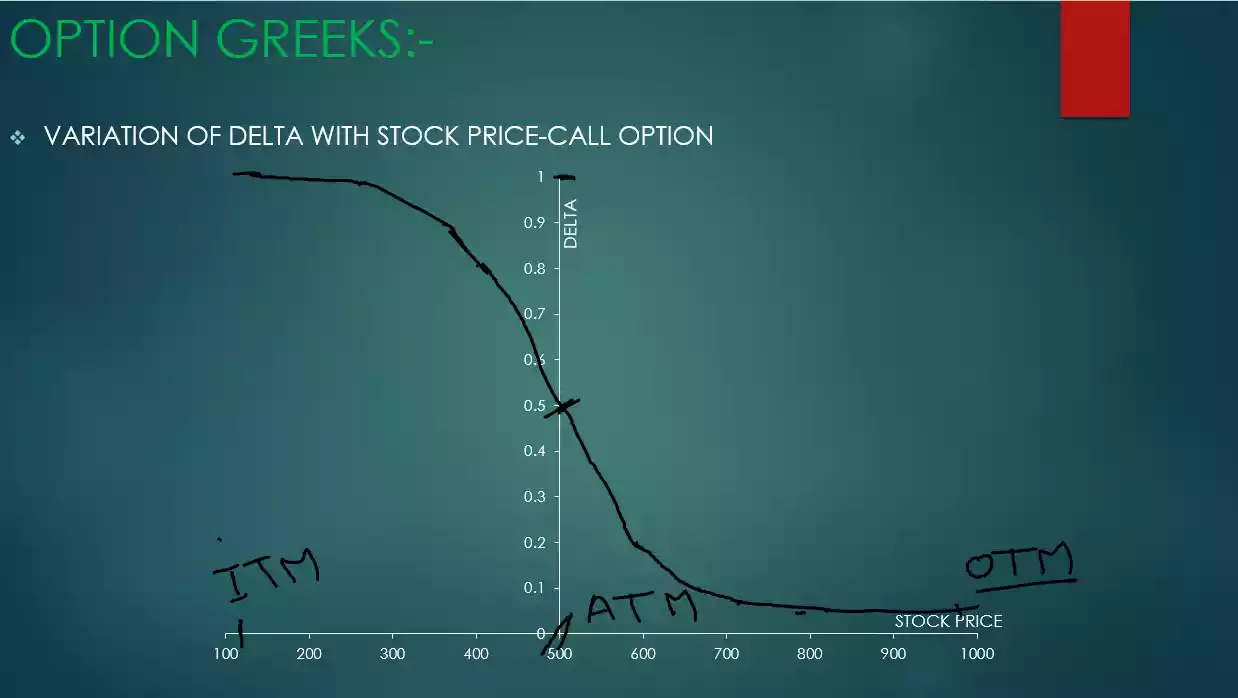

♦ Call option delta varies between 0 to 1, some trader prefer to use 0 to 100

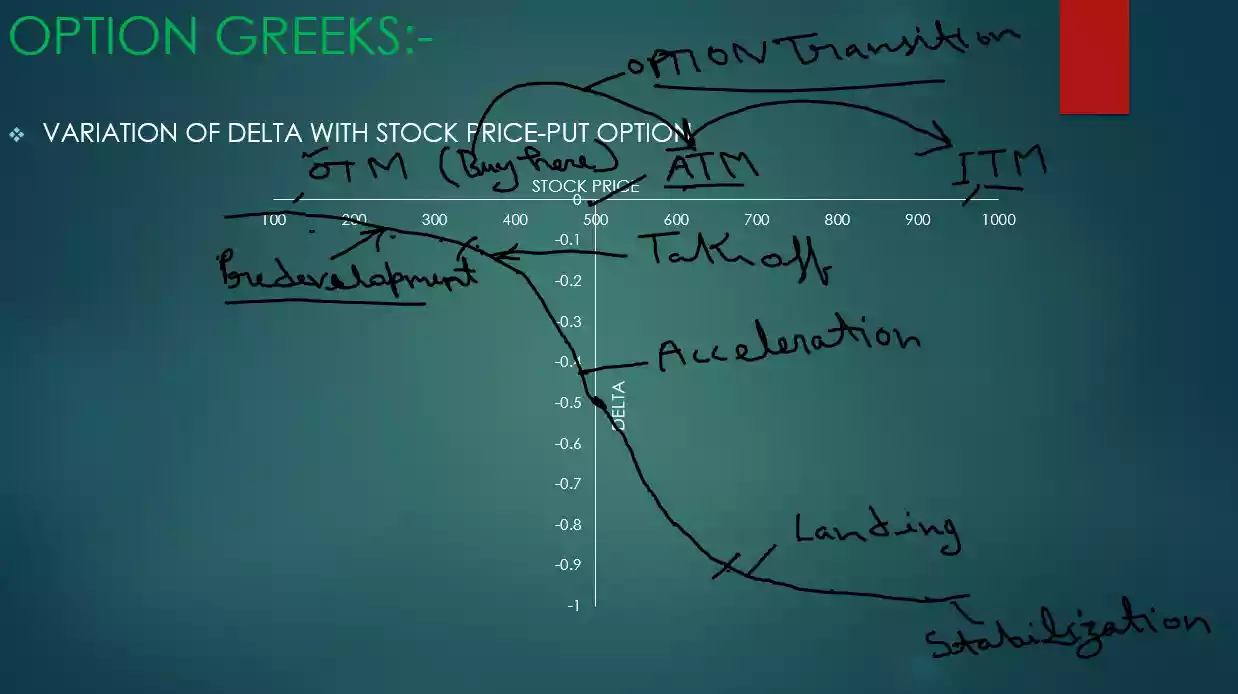

♦ Put option delta varies between -1 to 0 (-100 to 0)

The negative delta value for a put option indicates that the option premium and underlying value moves in the opposite direction.

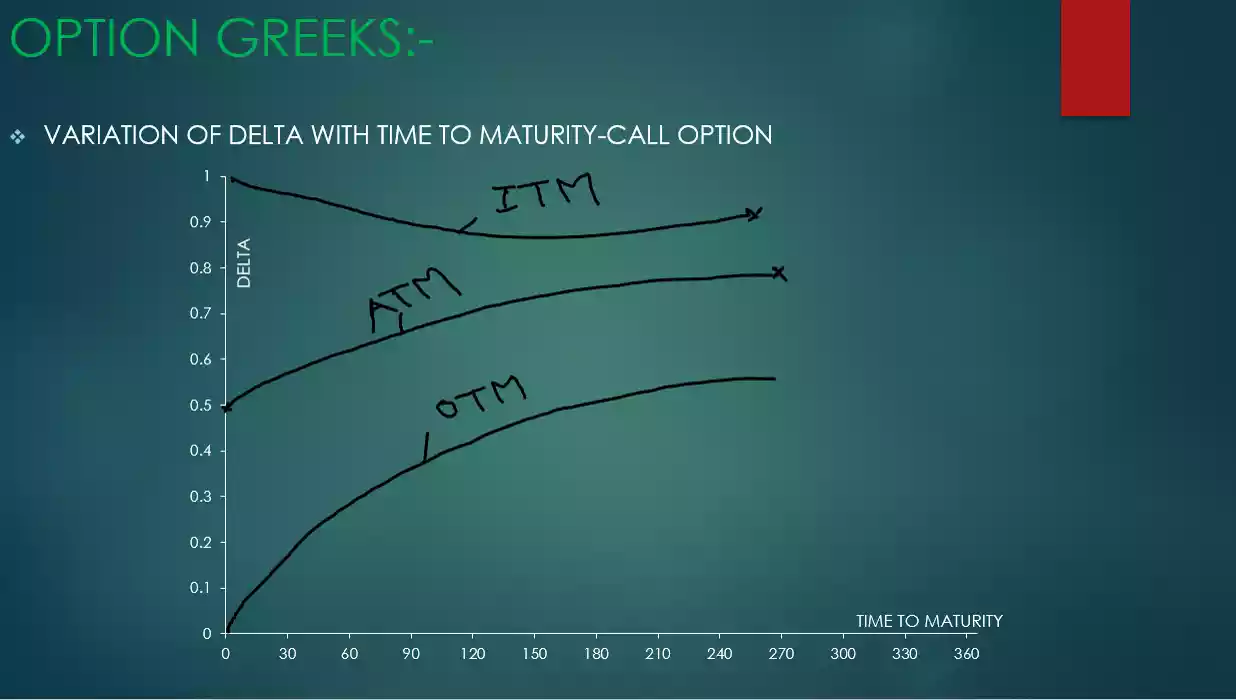

♦ ATM options have a delta of 0.5

♦ ITM options have a delta of close to 1

♦ OTM options have a delta of close to 0

♦ When the spot value changes, the moneyness of an option changes, also delta value changes.

♦ Why delta vary between o to 1

Explanation- Delta= change in premium/change in underlying asset

I know that premium does not change more than underlying asset change due to option premium derived by underlying value.

Variation of delta image:

Example of option Greeks delta:

Delta by proportional method:

Example1:

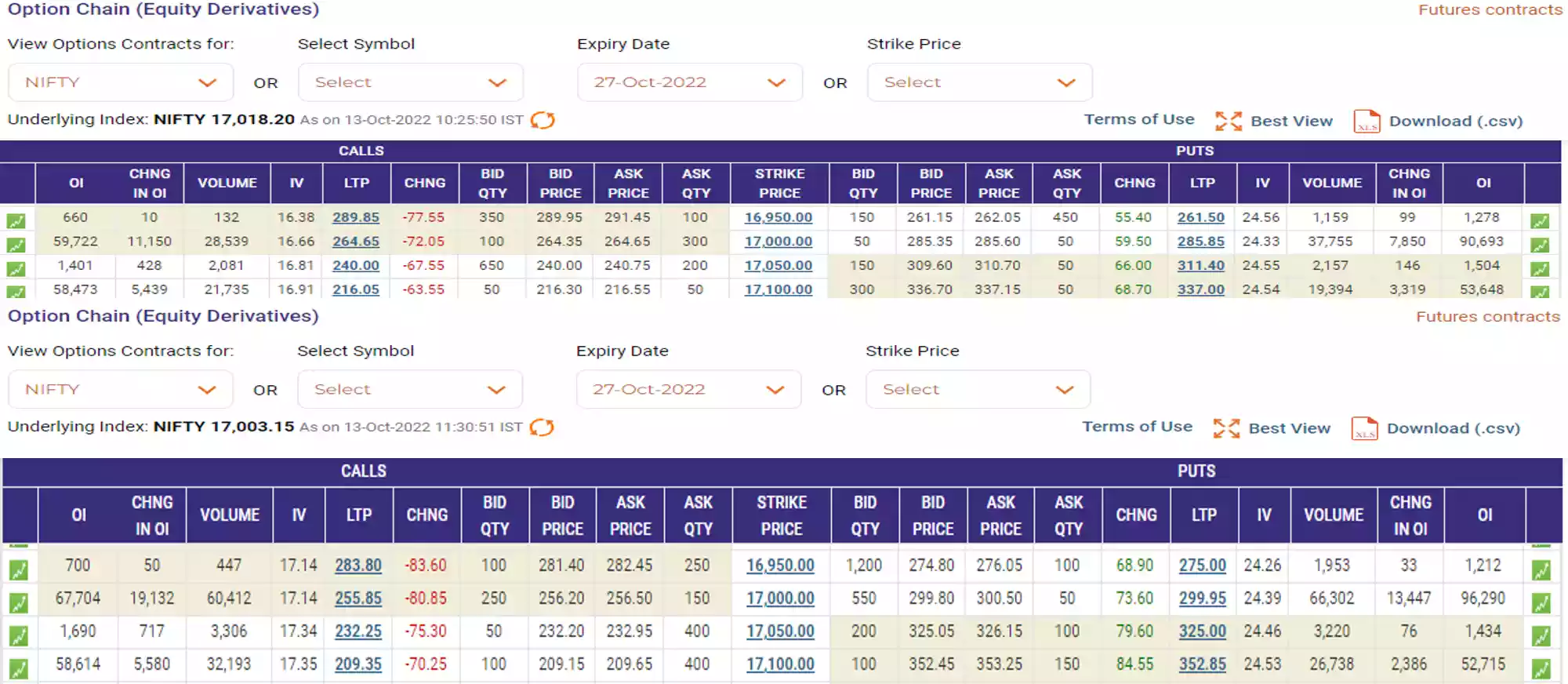

Contract- Nifty Oct 17000 CE (today date- 13/10/2022)

Time1- 10:25,

Expiry-27/10/2022, K1=17000, S1=17018.20, C1=264.65, IV1=16.66, r1=0.1, t1=15/365=0.0411

Time2-11:30

K2-17000, S2=17003.15, C2=255.85, IV2=17.14, r2=0.1, t2=0.0411

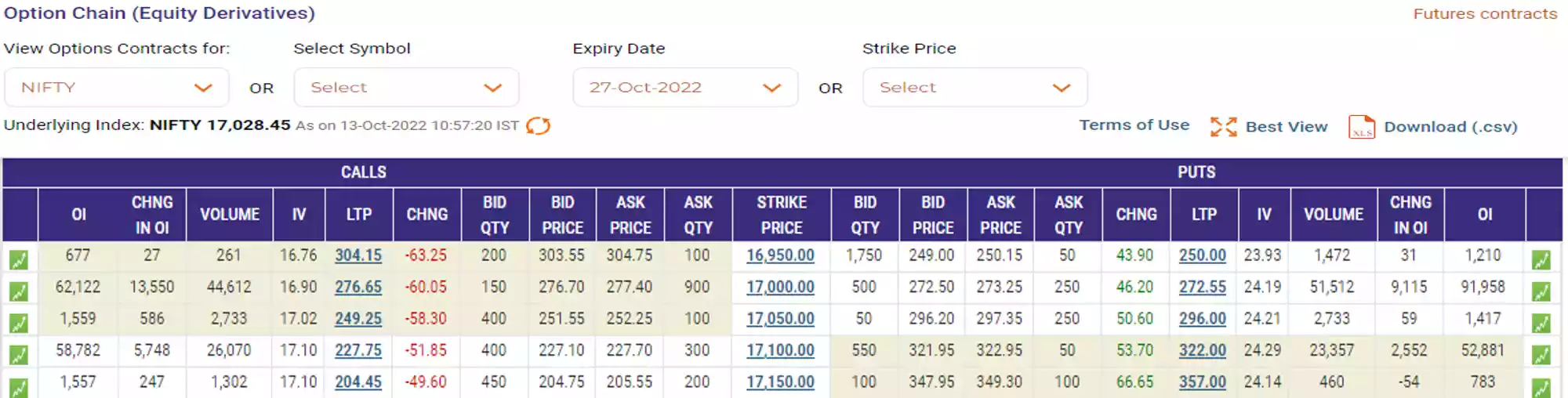

Time3-10:57

S3=17028.45, C3=?

Explanation:

Delta=change in premium(C1-C2)/change in underlying(S1-S2)

=(264.65-255.85)/(17018.20-17003.15)=8.8/15.05=0.5847

Delta=0.5847

New premium for S3, (C1-C3)=delta*spot change(S1-S3)

264.65-C3=0.5847*(17018.20-17028.45)

C3=264.65-0.5847*(-10.25)=264.65+5.99=270.64

Example2:

Contract- Nifty Oct 17000 PE (today date- 13/10/2022)

Time1- 10:25,

Expiry-27/10/2022, K1=17000, S1=17018.20, P1=285.85, IV1=24.33, r1=0.1, t1=15/365=0.0411

Time2-10:34

K2-17000, S2=17003.15, P2=299.95, IV2=24.39, r2=0.1, t2=0.0411

Time3-10:57

S3=17028.45, P3=?

Explanation:

Delta=change in premium(P1-P2)/change in underlying(S1-S2)

=(285.85-299.95)/(17018.20-17003.15)=-14.1/15.05=-0.9368

Delta= -0.9368

New premium for S3, (P1-P3)=delta*spot change(S1-S3)

285.85-P3=-0.9368*(17018.20-17028.45)

P3=285.85+0.9368*(-10.25)=285.85-9.602=276.248

C3=270.64 (Real value-276.65)

P3=276.248 (Real value-272.55)

Why difference- difference due to acceleration of delta, and other factors such as implied volatility. But main consent is delta not same in all moneyness so difference in delta change known as acceleration we will discuss in next section for delta acceleration.

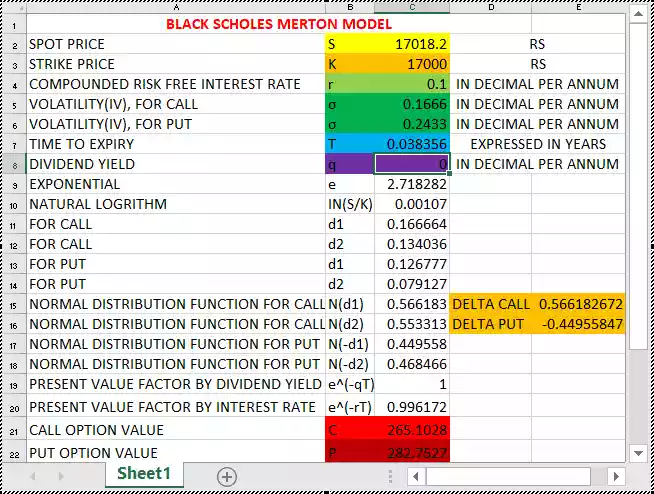

Delta by Black-Scholes model:

Example3:

Contract- Nifty Oct 17000 CE (today date- 13/10/2022)

Time1- 10:25,

Expiry-27/10/2022, K1=17000, S1=17018.20, C1=264.65, IV1=16.66, r1=0.1, t1=14/365=0.0384

Time3-10:57

S3=17028.45, C3=?

C3=C1+delta*(S3-S1)

C3=264.65+.5661*10.25=270.45

Example4:

Contract- Nifty Oct 17000 PE (today date- 13/10/2022)

Time1- 10:25,

Expiry-27/10/2022, K1=17000, S1=17018.20, P1=285.85, IV1=24.33, r1=0.1, t1=14/365=0.0384

Time3-10:57

S3=17028.45, P3=?

P3=P1+delta*(S3-S1)

P3=285.85+(-.4495*10.25)=281.24

Negative delta of put options due to opposite directional movement if underlying asset price rise the put option premium fall.

If two call options available with different delta value suppose call option 1 delta has-0.20 and call option 2 delta has-0.40 then which one buy for better:

Let suppose underlying change 100 points then call option 1 premium change 20 points like that in call option 2 change in premium 40 points so if you bullish for call option buy call option 2 but if you bearish in call option sell call option 1.

Which call options or put options in which strike to select for maximum advantage according to delta?

When you buy OTM options you get advantage of acceleration and percentage of return will be huge but not all expiry its for up to 10 days expiry means OTM come in ITM moneyness within 10 days but avoid buying deep OTM because of mostly expires worthless due to theta(time decay) we will discuss about theta in next sections.

Put option- date-13/10/2022, spot price-17020,contract- Nifty Oct .. PE, expiry-20/Oct/2022 & 27/Oct/2022

Below you can look table of P&L for various spot prices with different strike prices and make better understanding comparison with percentage return on expiry. And explore selection of strike by your own risk.

| Strike(K) | Premium Exp-20Oct | Spot(S) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. | Spot(S) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. | Spot(s) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. |

| 16700 (OTM) | 81 | 16300(ret.=4.23%) | 319 | 394% | 16600(ret.=2.47%) | 19 | 23% | 16900(ret=0.71%) | -81 | -100% |

| 17000 (ATM) | 187 | 16300 | 513 | 274% | 16600 | 213 | 114% | 16900 | -87 | -47% |

| 17300 (ITM) | 369 | 16300 | 631 | 171% | 16600 | 331 | 90% | 16900 | 31 | 8% |

| Strike(K) | Premium Exp-27oct | Spot(s) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. | Spot(s) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. | Spot(s) On exp. | P&L=max(0,K-S)-pp | %Return=P&L*100/pre. |

| 16700 (OTM) | 152 | 16300 | 248 | 163% | 16600 | -52 | -34% | 16900 | -152 | -100% |

| 17000 (ATM) | 270 | 16300 | 430 | 159% | 16600 | 130 | 48% | 16900 | -270 | -100% |

| 17300 (ITM) | 438 | 16300 | 562 | 128% | 16600 | 262 | 60% | 16900 | -38 | 9% |

Conclusion– for option buyer if directional movement strong(trend bullish or bearish) and underlying return more in less time buy OTM. If less speed or weak directional movement go for ATM or ITM strike. For option seller, just do opposite short OTM options for maximum chances of profit with favorable directional movement. Short ATM only if strong directional movement with high speed of return and also consider volatility of underlying asset.

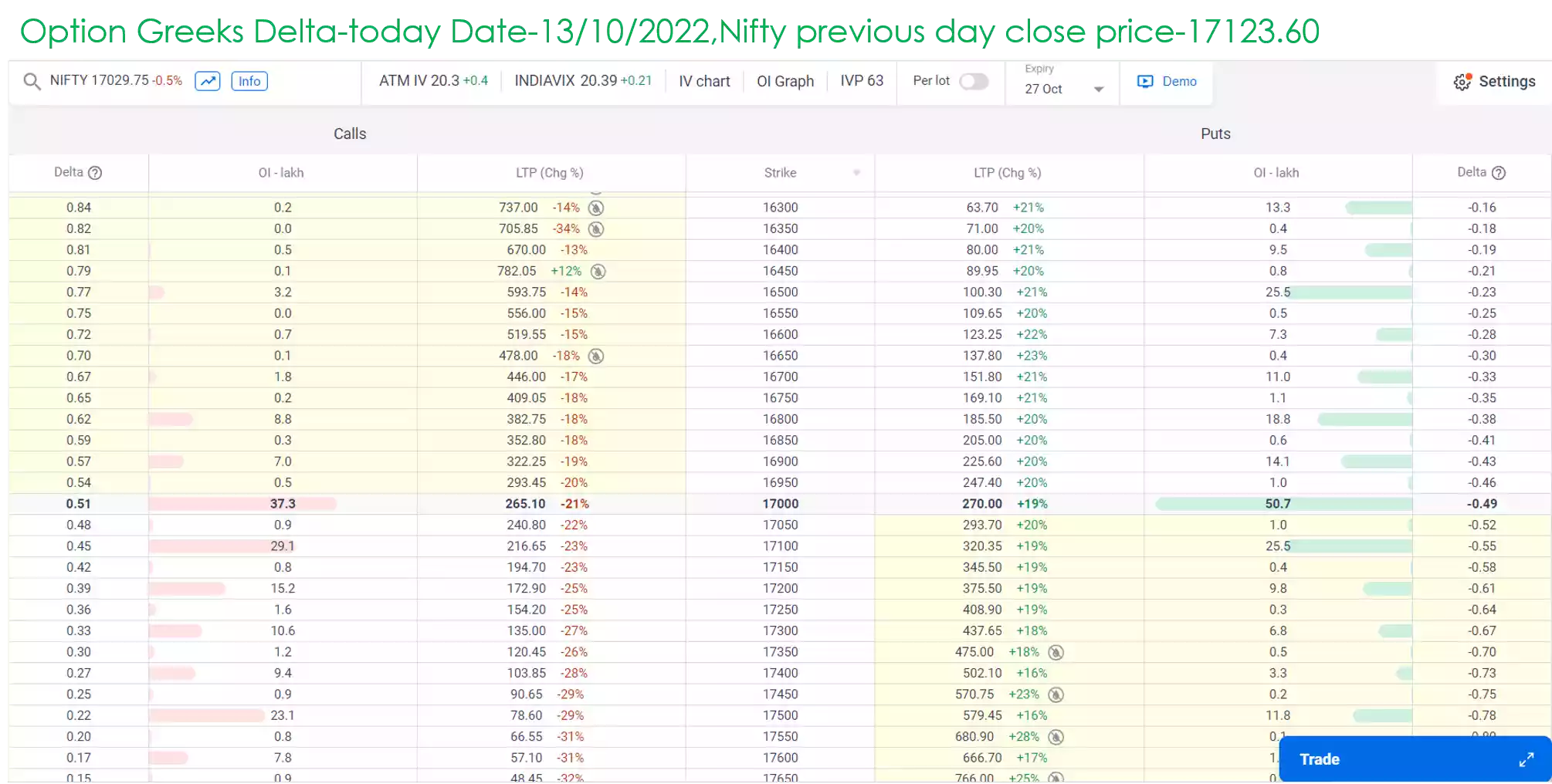

Approximate delta value of option on behalf of Moneyness:

| Option type | Approximate delta value for call options | Approximate delta value for put options |

| Deep ITM | Between 0.8 to 1.0 | Between -0.8 to -1.0 |

| Slightly ITM | 0.55 TO 0.8 | -0.55 TO -0.8 |

| ATM | 0.45 TO 0.55 | -0.45 TO -0.55 |

| Slightly OTM | 0.3 TO 0.45 | -0.3 TO -0.45 |

| Deep OTM | 0.0 TO 0.3 | -0.0 TO -0.3 |

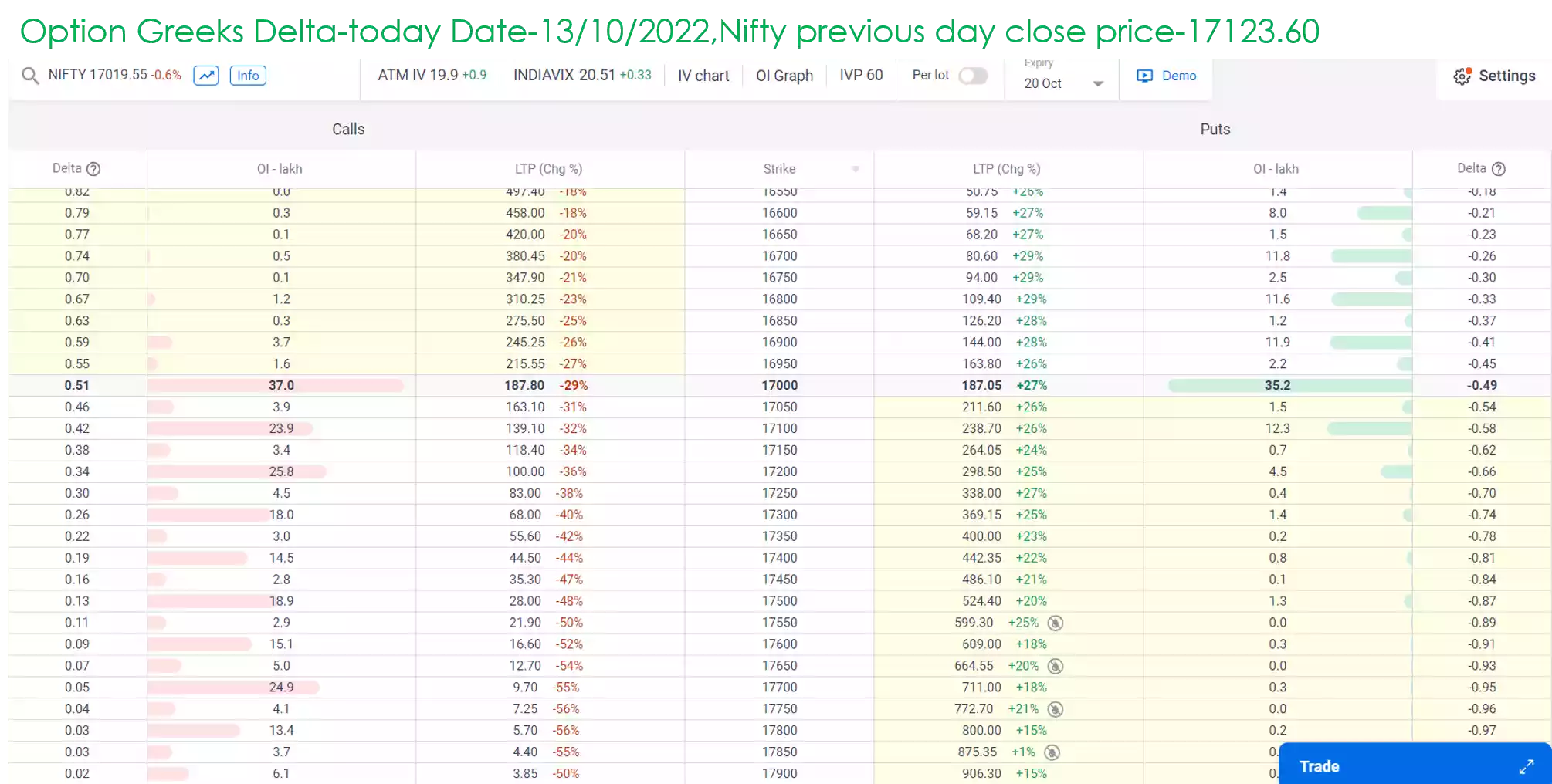

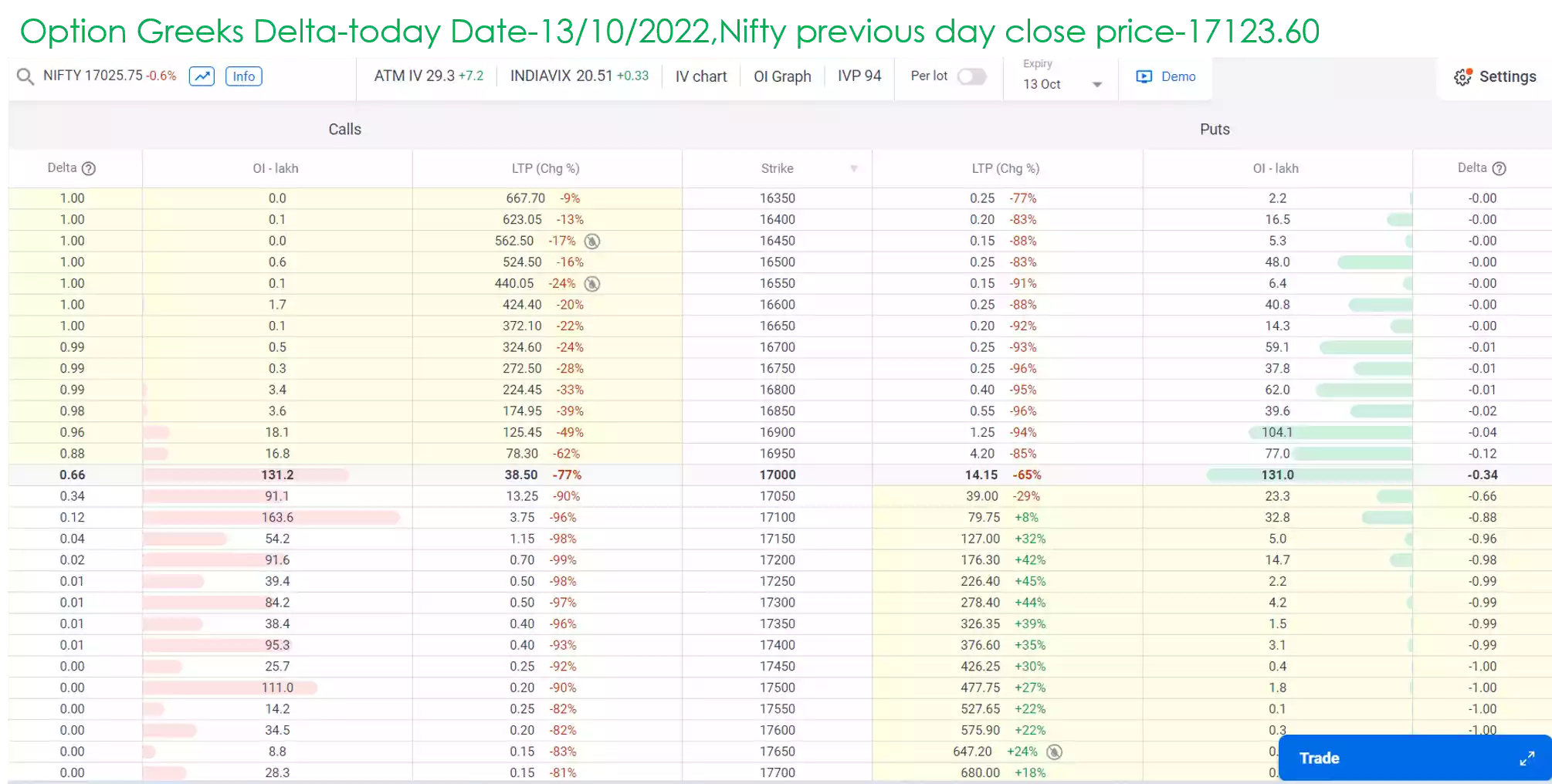

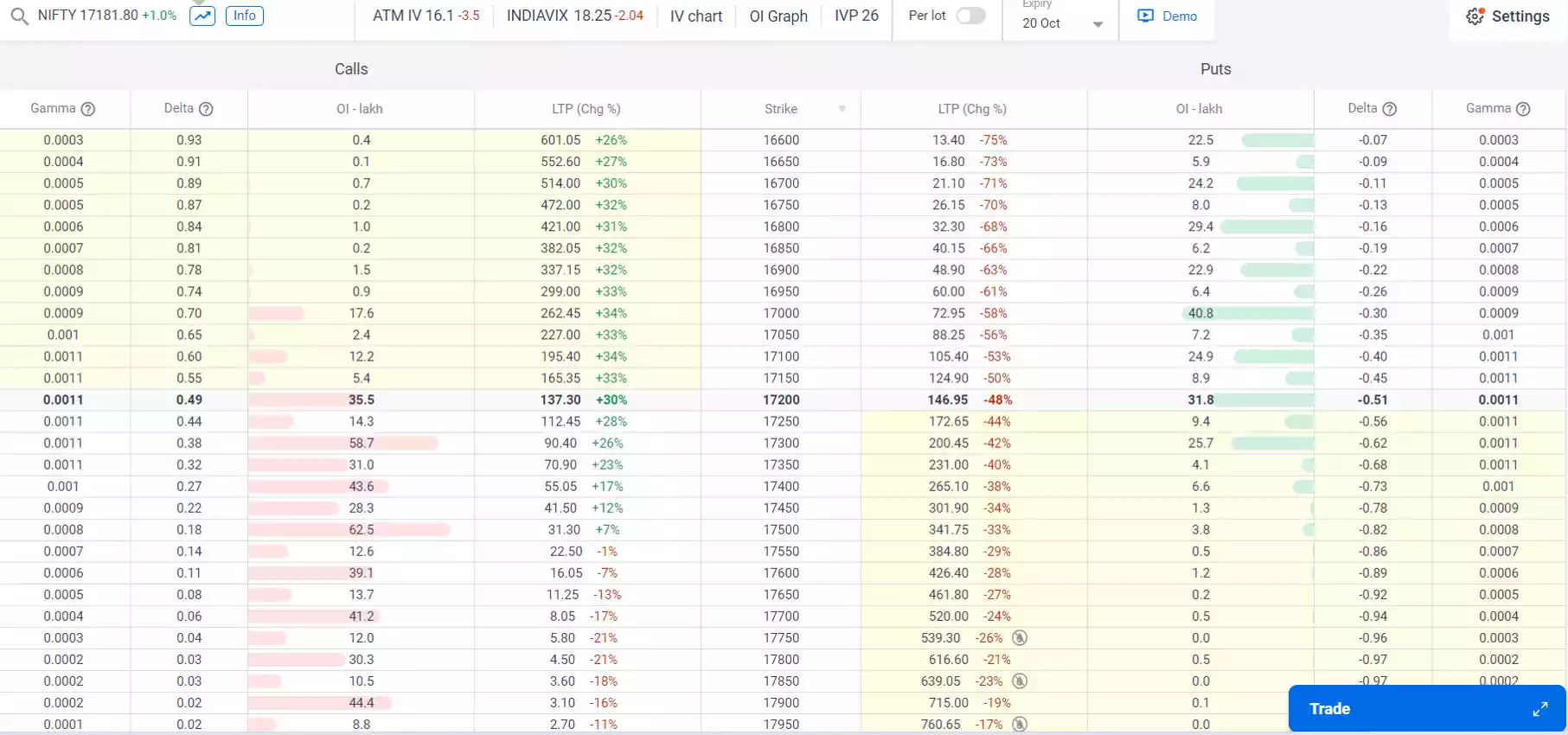

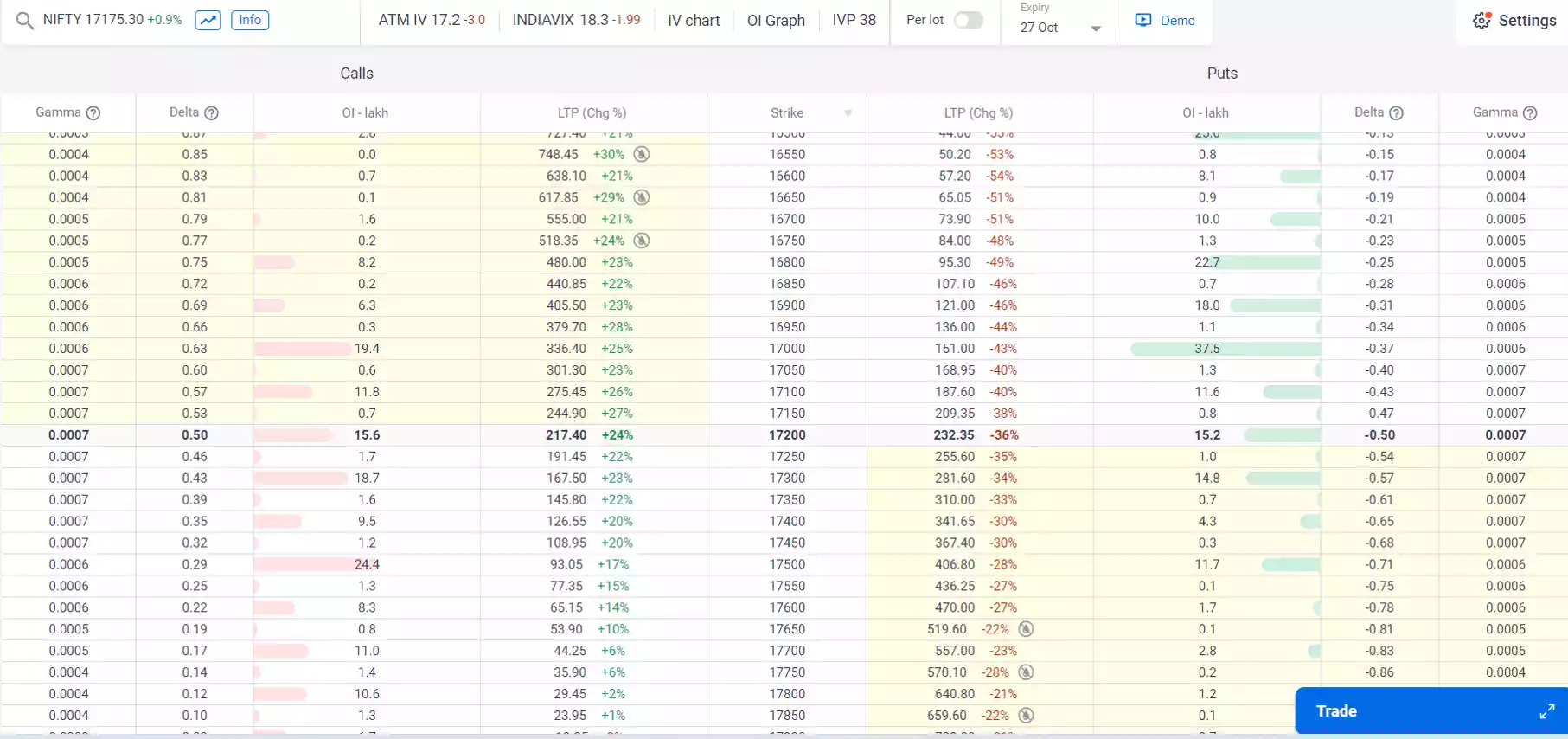

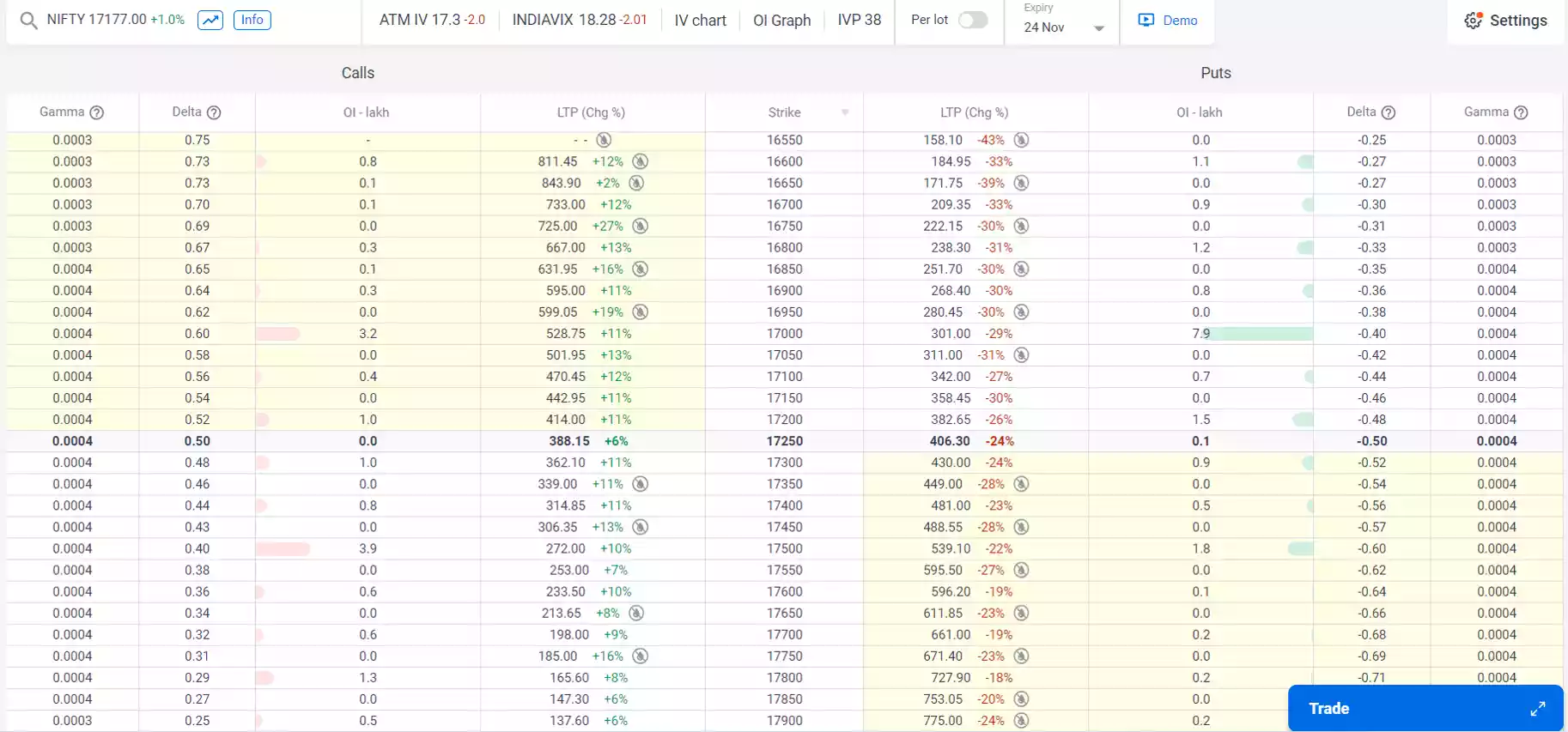

Some snapshot of delta value for various strike price with different expiry:

Delta combination:

If you hedge any portfolio or want to move option premium same as spot price then you have to know combination of delta you suppose that-

If option positions available with-

1OTM option with 0.2Delta and 1ATM options with 0.5Delta then Delta combination of two positions is equal to addition of both delta, means Delta=0.7(0.2+0.5)

So if you buy a 1OTM and 1ATM option and combined delta is o.7 means if your spot vary 100 points then your premium vary 70 points if you want to same then you have to buy 2 ATM (0.5*2=1) options or combined as add is equal to 1 if add all options. But it is not always if moneyness change then your delta change and also other Greeks effects premium so you have consider all together.

If you want to hedge futures or portfolio by options then you add delta of option and equal to 1 because of futures delta is 1 and spot delta is 1 if contract value or portfolio value is mismatch then equate it with delta multiplication for hedging.

Portfolio value*delta of portfolio* beta value of portfolio=option delta for hedging*contract value of option*beta value of option

P.V.*∆p*βp=C.V.* ∆o*βo

Example: Suppose, portfolio value = 5lakh

Delta of portfolio = 1

Beta value of portfolio = 1.1

If use nifty option contract for hedging then,

Option spot price= 16000, lot size=50

Notional contract value= lot size * spot price= 50* 16000=800000/-=8lakh

Options delta for hedging=?

Explanation- P.V.*∆p*βp=C.V.* ∆o*βo

500000*1*1.1=800000*1* ∆o

∆o=550000/800000=0.6875

Means you have to buy 1 slightly itm put option or 1atm plus 1otm options for hedging portfolio.

Note- also consider moneyness and other variables with premium.

In case hedging by futures contract then formula is-

Portfolio value*beta of portfolio=lot size of future contract*future price*beta of future contract underlying*No of Lots required for hedging

Delta as a probability:

When we look delta for any strike price then delta also represent of probability of transition in moneyness i.e. Suppose spot price of nifty option is 16000 and buy a 0.2 delta value of call option which strike price 16700. So means as a probability to only 20% chance to change in OTM to ITM moneyness and 80% chance to expire in OTM. So here you can conclude don’t buy OTM options because of profit chances is very less (only 20%).

Gamma (γ):

It measures change in delta with respect to change in price of the underlying asset. This is called a second derivative option with regard to price of the underlying asset. It is calculated as the ratio of change in delta for a unit change in market price of the underlying asset.

Gamma= change in an option delta/ unit change in price of underlying asset

Gamma works as an acceleration of the delta i.e. It signifies the speed with which an option will go either in the money or out of the money due to a change in price of the underlying asset.

♦ Change in premium with respect to change in underlying is captured by delta and hence delta is called the 1st order derivative of the premium.

♦ Change in delta is with respect to change in the underlying value is captured by gamma, hence gamma is called the 2nd order derivative of the premium.

♦ Change in premium= delta*change in spot

New premium= old premium + change in premium

Change in delta= gamma* change in underlying/spot

New delta= old delta + change in delta

♦ In reality the gamma also changes with the change in the underlying this change in gamma due to changes in underlying is captured by 3rd derivative of underlying called ‘speed’ or ‘gamma of gamma’ or ‘digamma o spot’

♦ Gamma is always a positive number for both call and put option. Therefore when a trader is long options the trader is considered ‘long gamma’ and when he is short options he is considered ‘short gamma’

♦ Example- for call option-

The gamma of an ATM call option is 0.0045 if the underlying moves 20 points then new delta=? Assume ATM delta is 0.5

Solution- change in delta= gamma*change in underlying

If move up 20 points

Change in delta= 0.0045*20=0.09

New delta= old delta + change in delta=0.5+0.09=0.59(ITM)

If down 20 points

Change in delta=0.0045*(-20)= -0.09

New delta = 0.5-0.09=0.41(OTM)

♦ Example- for put option-

The gamma of an ATM put option is 0.004, if the underlying moves 20 points then new delta=?, And new premium=?, Assume delta of ATM put option=-0.5, and premium=100 for underlying price=10000/-

Solution- change in delta= gamma*change in underlying

If move up 20 points

Change in delta= 0.004*20=0.08

New delta= old delta + change in delta=-0.5+0.08=0.42(change in moneyness-OTM)

Change in premium= delta*change in spot= -0.5*20= -10

New premium= old premium + change in premium=100+(-10)=90

If down 20 points

Change in delta= 0.004*(-20)= -0.08

New delta= old delta + change in delta=-0.5-0.08=0.58(change in moneyness-ITM)

Change in premium= delta*change in spot= -0.5*(-20)= 10

New premium= old premium + change in premium=100+10=110

♦ Short gamma & long gamma- short gamma means when short (sell) call option then also short gamma when market move against shorting then gamma also add up so it is very riskier for trader which take short position also when buy call option means buy gamma means when markets go up then gamma increase and go down then gamma decrease.

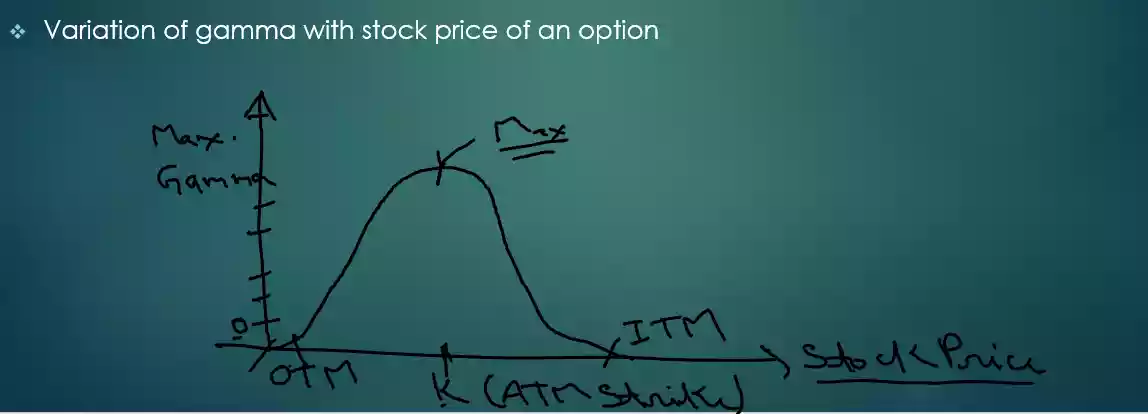

♦ Variation of gamma with stock price of an option-

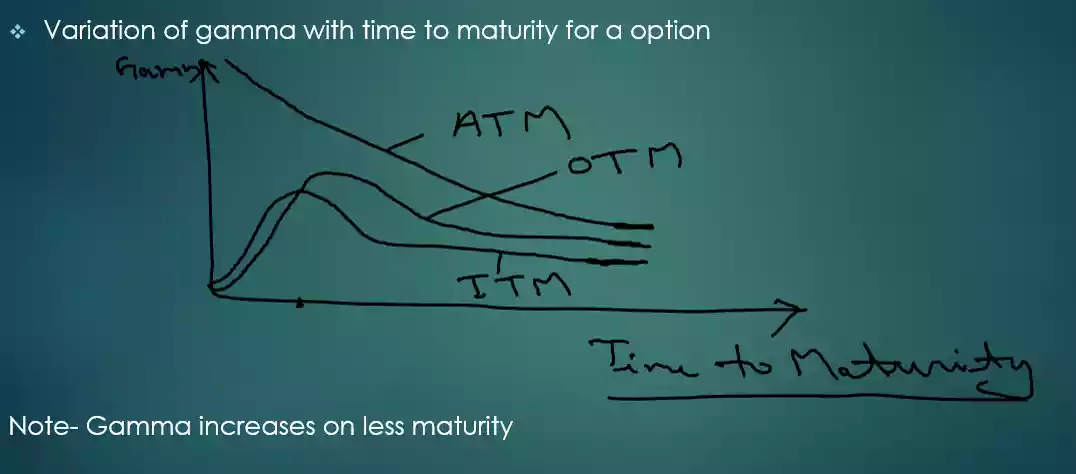

♦ Variation of gamma with time to maturity for a option-

♦ Some snapshot of gamma value for various strike price with different expiry:

Summary points of gamma:

♦ Due to less gamma value in OTM options premium doesn’t change much in terms of absolute point terms however in % terms the change is higher so short OTM options less risky.

♦ The gamma peaks when the option hits ATM moneyness so rate of change of delta is highest when the option is ATM

♦ Due to highest gamma in ATM options avoid shorting ATM options

♦ Gamma value is also low for ITM options hence change in the underlying the rate of change of delta is much lesser compared to ATM options.

♦ Delta changes rapidly for ATM options

♦ Delta changes slowly for OTM and ITM options

♦ Never short ITM or ATM options short only OTM options with other Greek consideration

Gamma by Black-Scholes model:

By black-Scholes model gamma is for a European call or put option on a non dividend paying stock,

Gamma, Y= N’(d1)/(S*σ*√t)

where,

d1 = {In(S/K)+(r+σ2/2)t}/σ*√t

S= spot price

K= strike price

r= risk free interest rate annualized in decimal

σ= Historical volatility/Implied volatility annualized in decimal

t= time to expiry in years

ln= logarithm on base e

N’(x)=Standard normal probability density function

IF N’(x)=e-x*x/2/√(2*pie)

Example by black-Scholes model:

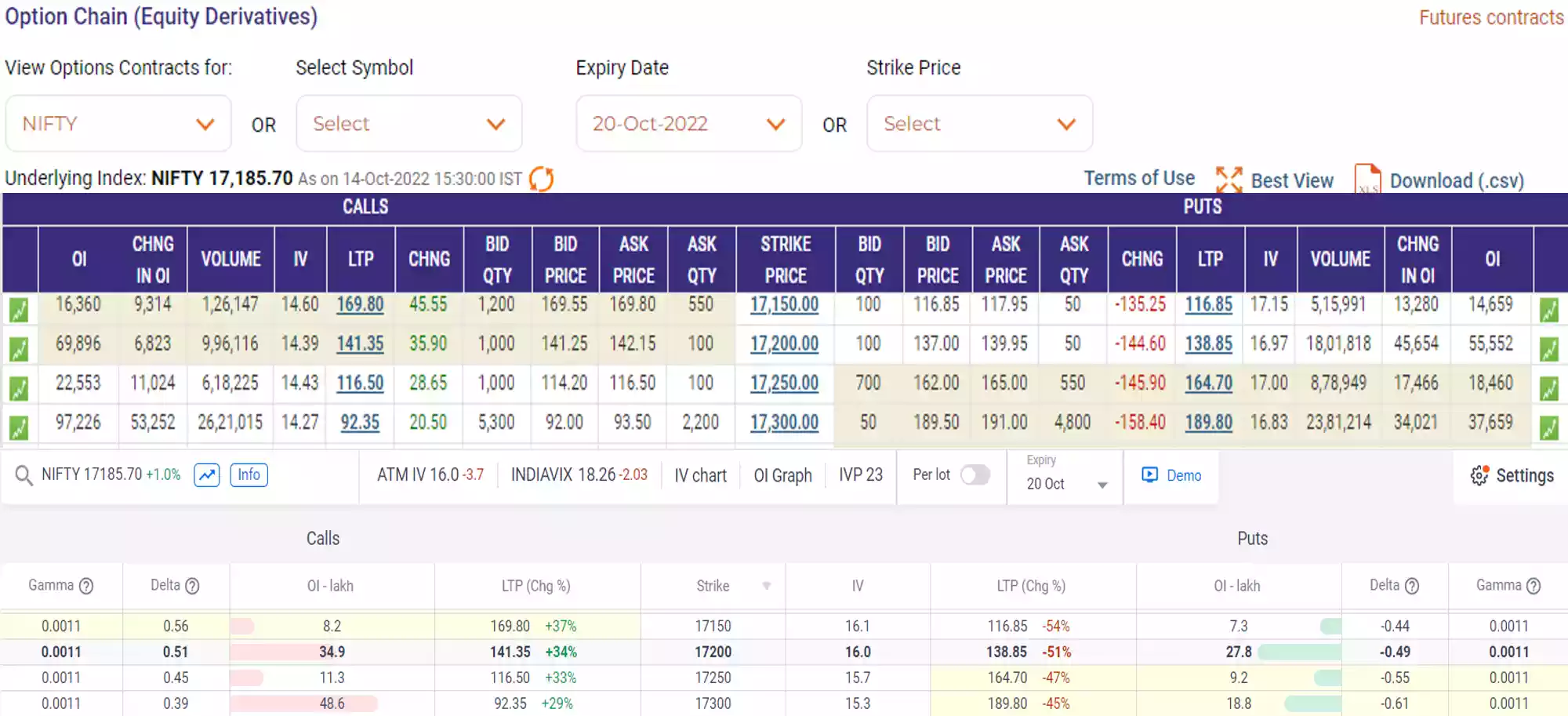

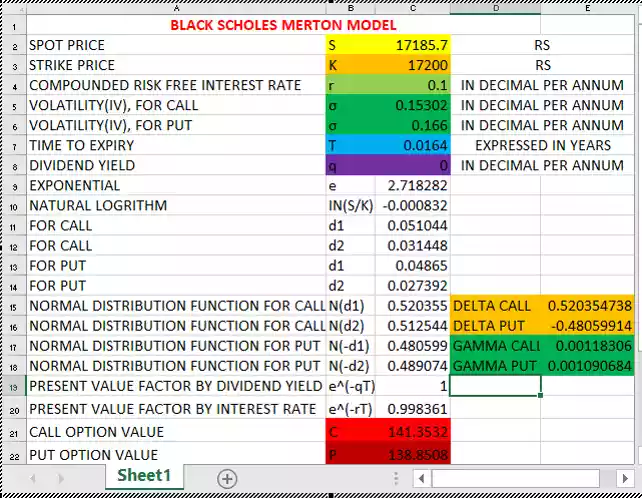

Contract- Nifty 20 Oct 17200 CE

Stock price, S= 17185.70 (Date-14/10/22)

Strike price, K=17200

Risk free interest rate, r= 10%=0.1

Time to maturity, t= 1current day + 1settlementday + 5other Days

=(510+930+7200)/365*24*60= 0.0164384years

Volatility, σ Call=14.39% = 0.1439

Volatility, σ Put=16.97% = 0.1697

C=141.35

P=138.85

Option gamma,Y=?

Solution-

Gamma, Y= N’(d1)/(S*σ*√t)

d1= {In(S/K)+(r+ σ2/2)t}/σ*√t

Y, Call= 0.0012

Y, Put= 0.0011