Table of Contents

Option Greek Theta (θ):

Option Greek theta is a measure of an options sensitivity to time decay. Theta is the change in option price given a one day decrease in time to expiration it is a measure of time decay.

Option Greek Theta= change in option premium/change in time to expiry

Usually theta is negative for a long option and positive for a option seller other things being equal options tend to lose time value each day throughout their life.

♣ I know that premium has made by two component-

Premium= intrinsic value + time value

Call option intrinsic value= max(0,spot price-strike price)

Put option intrinsic value= max(0,strike price-spot price)

I know that intrinsic value not considered less than zero value. If intrinsic value zero then, time value is equal to premium that means ATM and OTM options only have time value. Now suppose that spot price and volatility constant then remain value is time value and its decay daily till expiry date and on expiry it will become zero.

Example:

Contract- Nifty 04 Aug 17300 CE (on date 2/8/2022)

ATM option premium= 85

Strike price= 17300,

Spot price= 17290

Intrinsic value= spot price-strike price= 17290-17300= -10

Hence, intrinsic value never be negative so, intrinsic value=0

Expiry date-4/8/2022

Remaining days=3 days

So, theta= change in option premium/change in time to expiry

=Time value / 3days =-(85-0)/3

= -28.33(negative for long options)

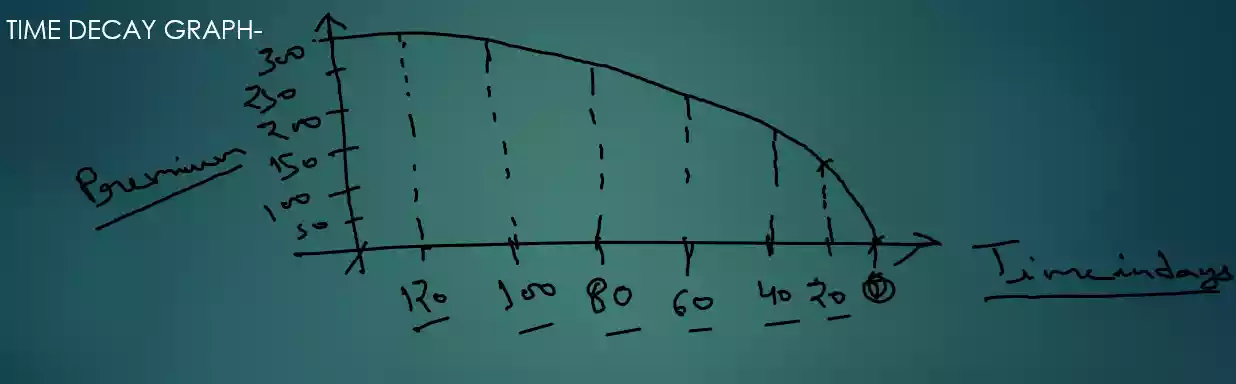

So premium daily decay at 28.33 rupees. Its not always same it will more early expiry days than far expiry days. Theta for option buyers is negative and for option sellers is positive.

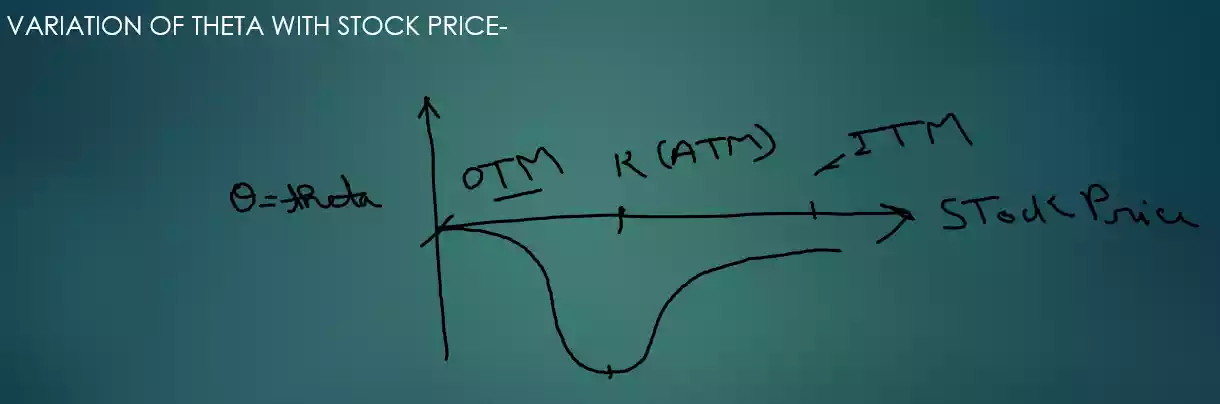

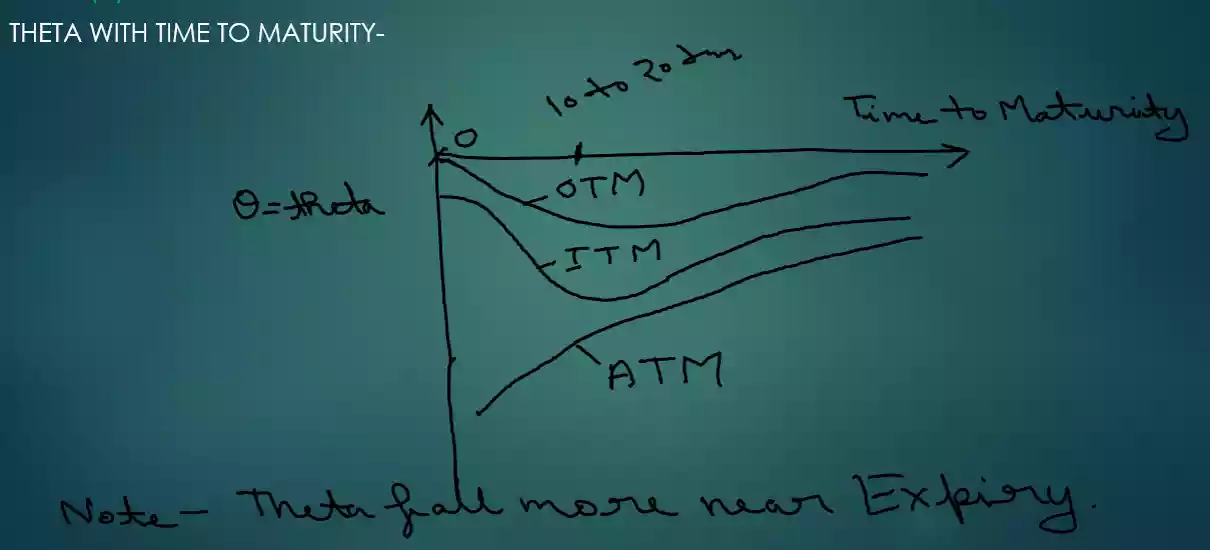

Variation of Option Greek Theta image:

♣ We observe from graph that closer to expiry falling rate of premium is more than far expiry. So if you want to sell options then suggestion sell near expiry in OTM moneyness. I know near expiry premium is very less but risk is also very less.

♣ Risk on time value known as time risk it compensate to option sellers.

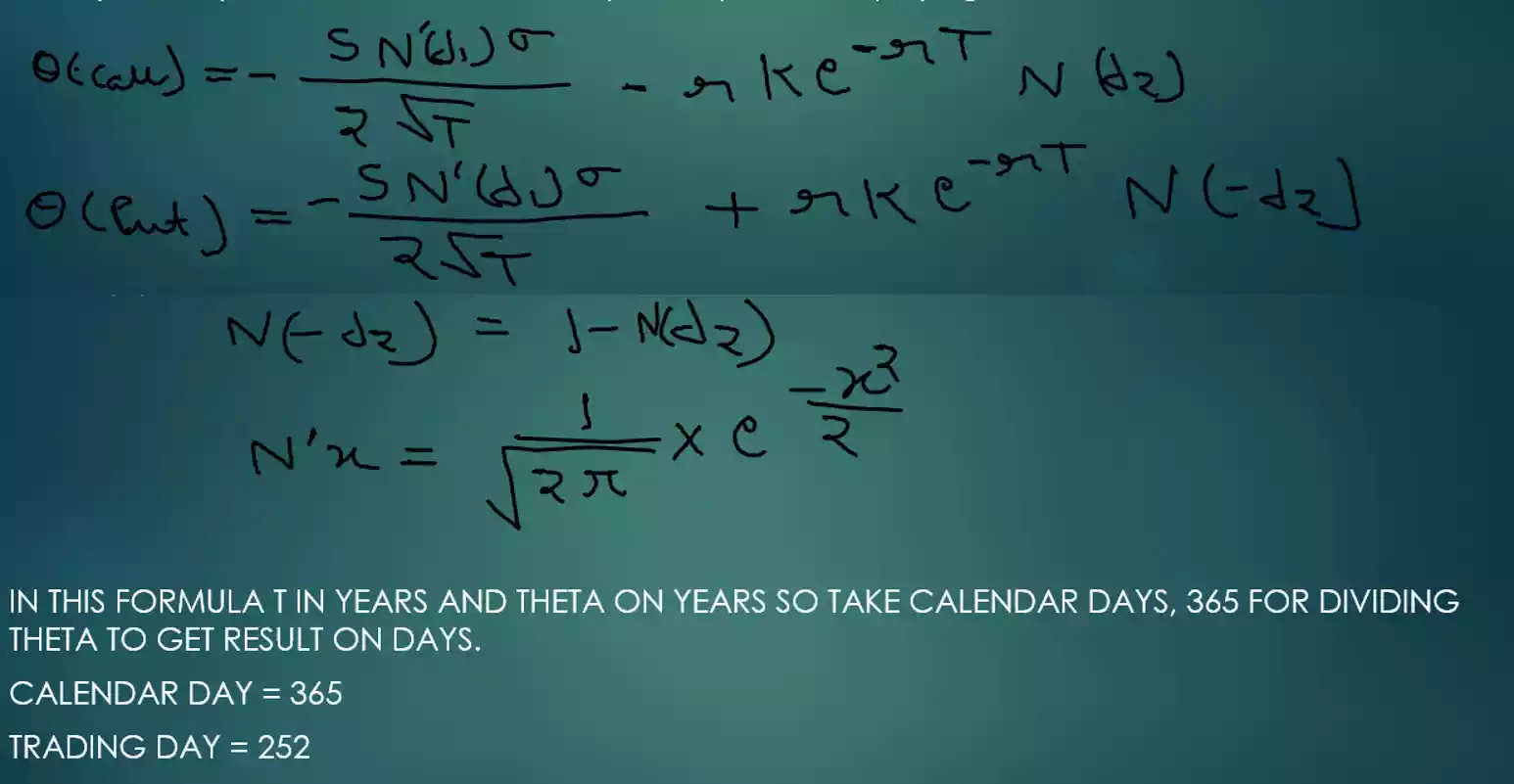

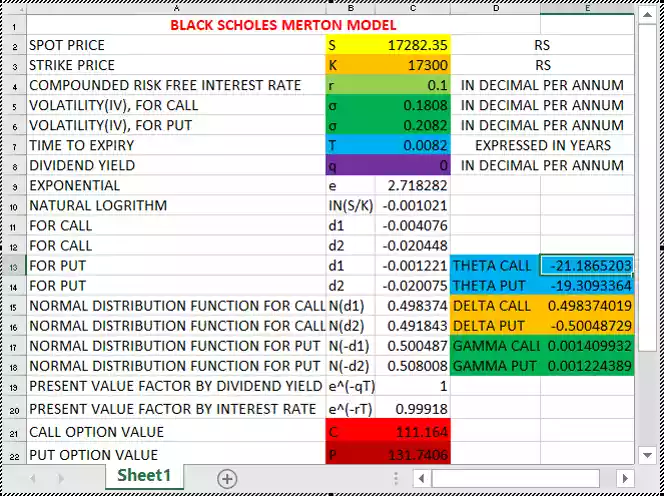

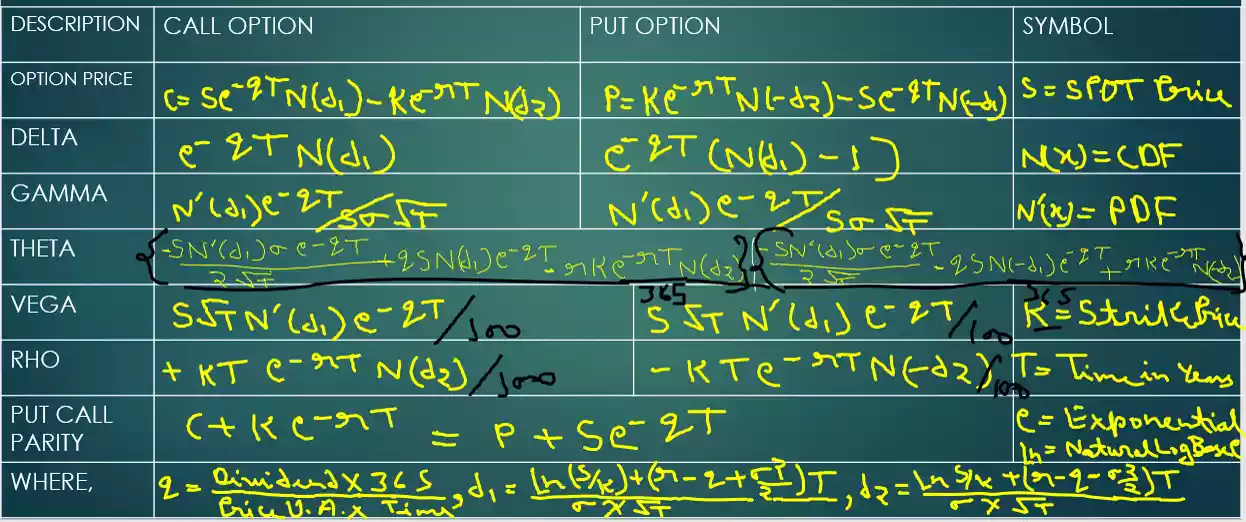

Option Greek Theta by Black-Scholes model:

The theta of a portfolio of options is the rate of change of the value of the portfolio with respect to the passage of time will all else remaining the same. Theta is sometimes referred to as the time decay of the portfolio. Theta for a European option non dividend paying stock is-

Example:

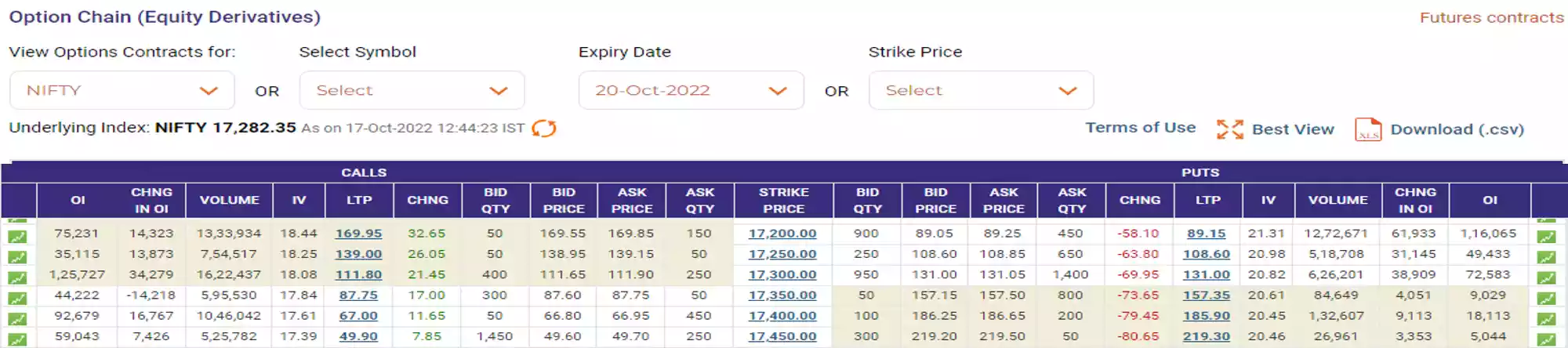

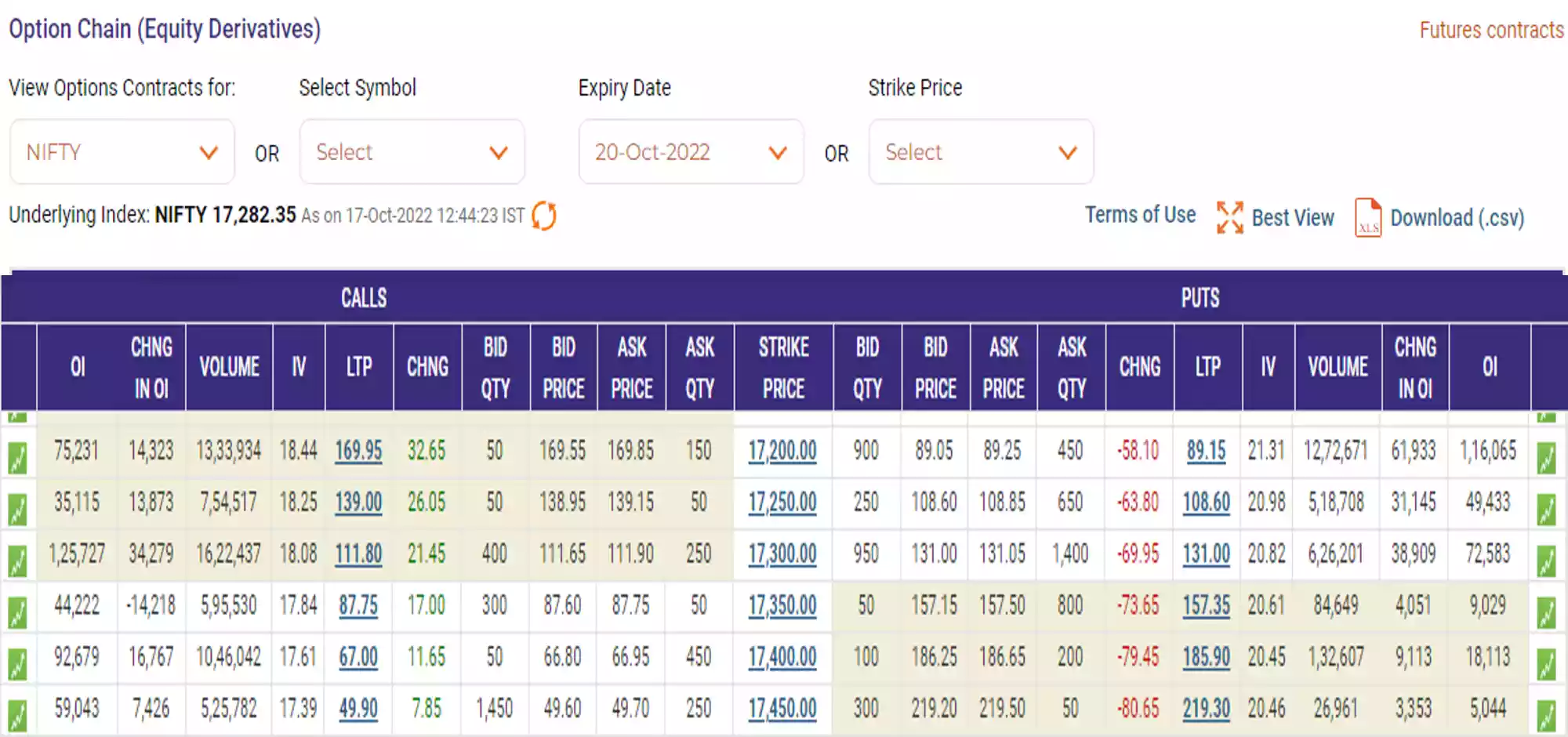

Contract- Nifty 20 Oct 17300 CE/PE

K=17300, S=17282.35, r=0.1,

T=(510+930+2880)/525600=4320/525600=0.0082

IV Call=18.08, IV Put=20.82

P=131,C=111.8

Option theta=?

Solution-

Theta(call)= {-S*N’(d1)*σ /(2*√T)-r*K*e-r*T *N(d2)}/365

Theta(put)= {-S*N’(d1)*σ /(2*√T)+r*K*e-r*T *N(-d2)}/365

Theta(call)=-21.2 per calendar days

Theta(put)=-19.3 per calendar days

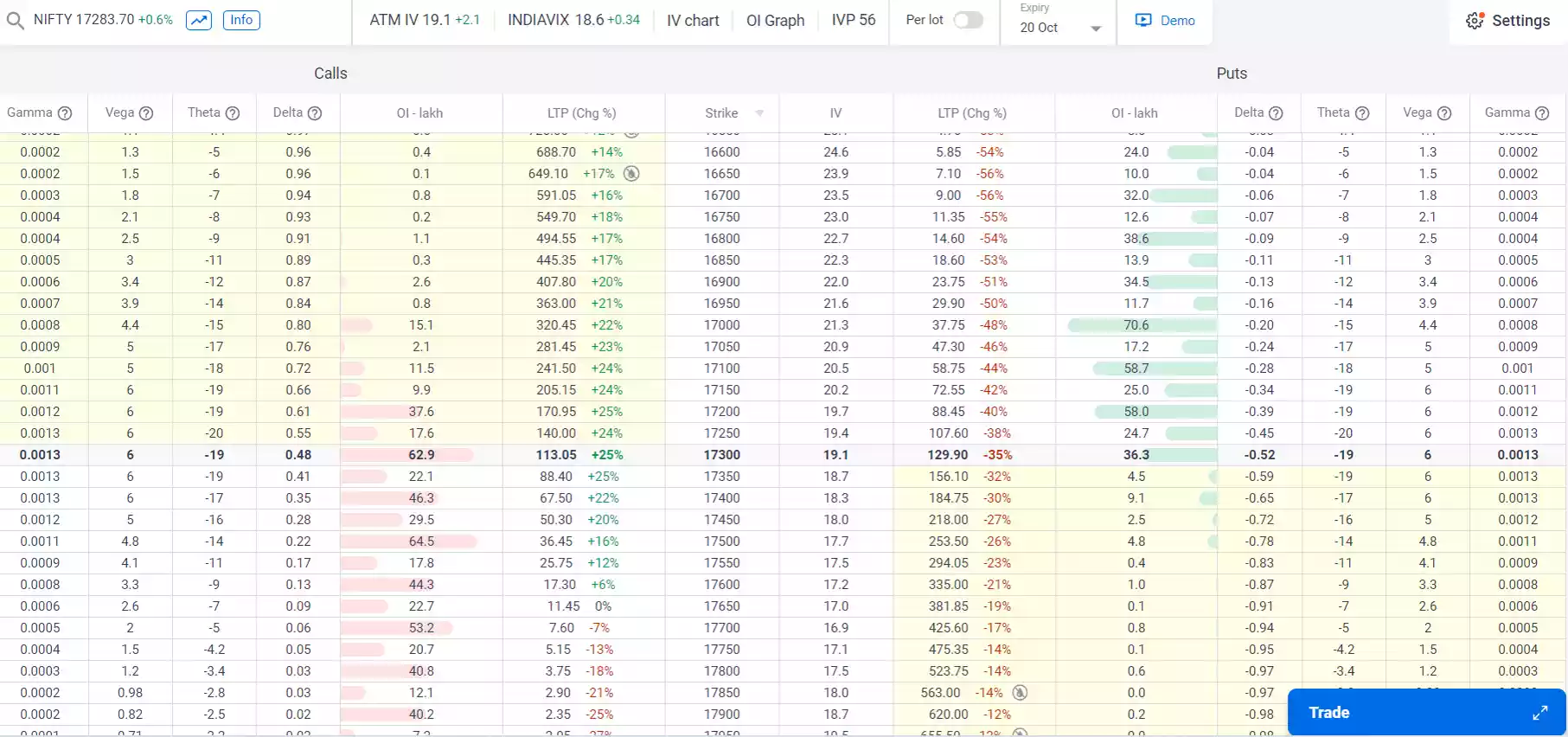

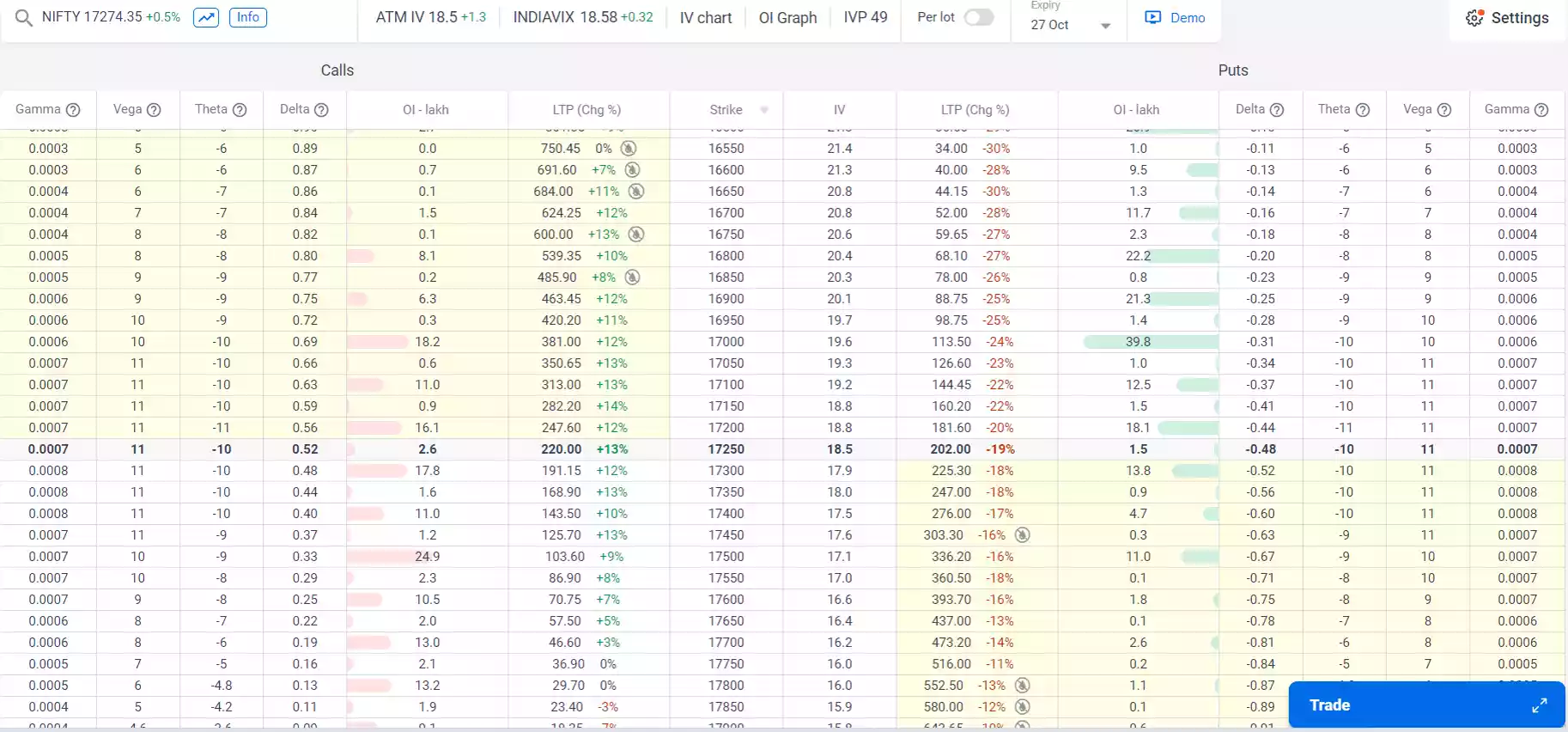

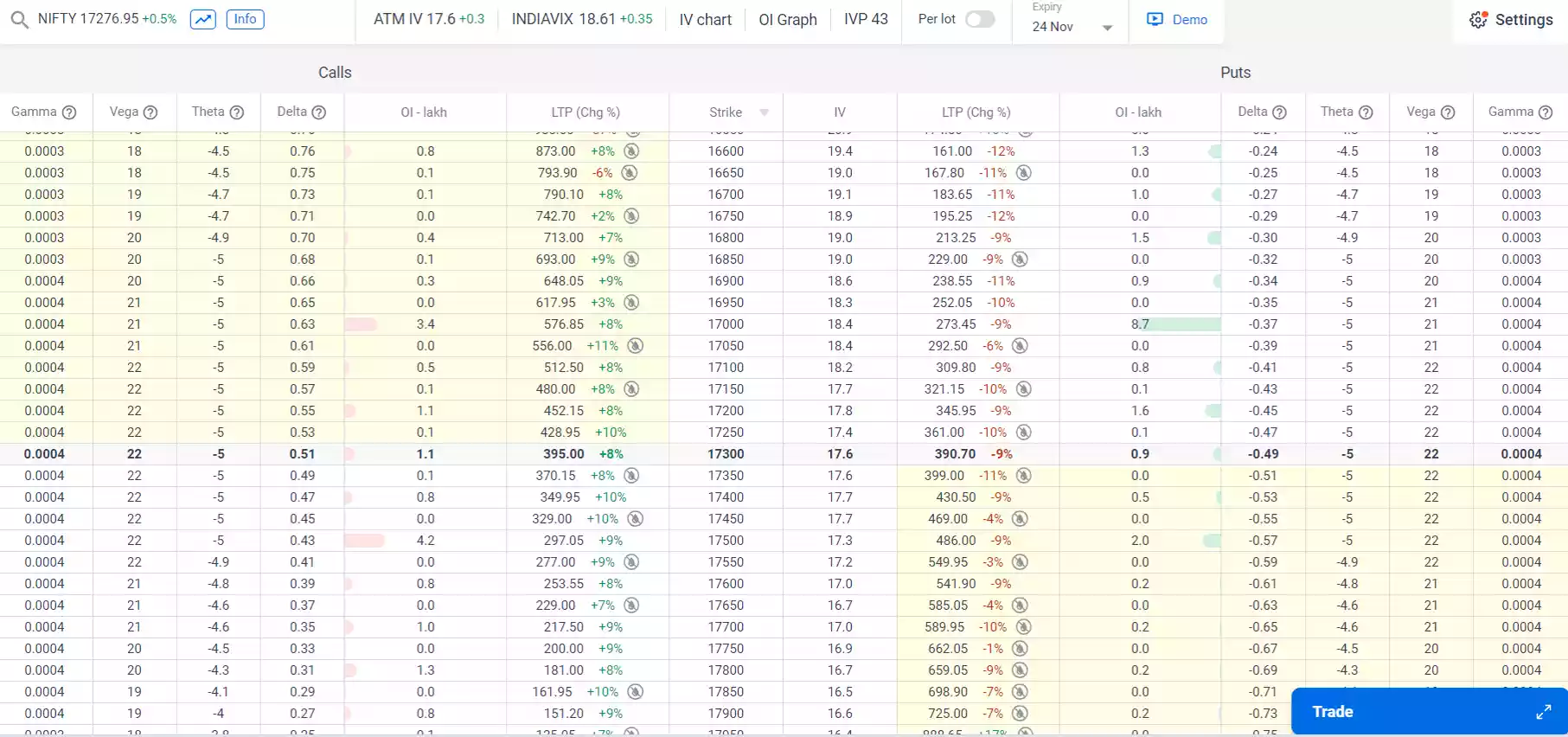

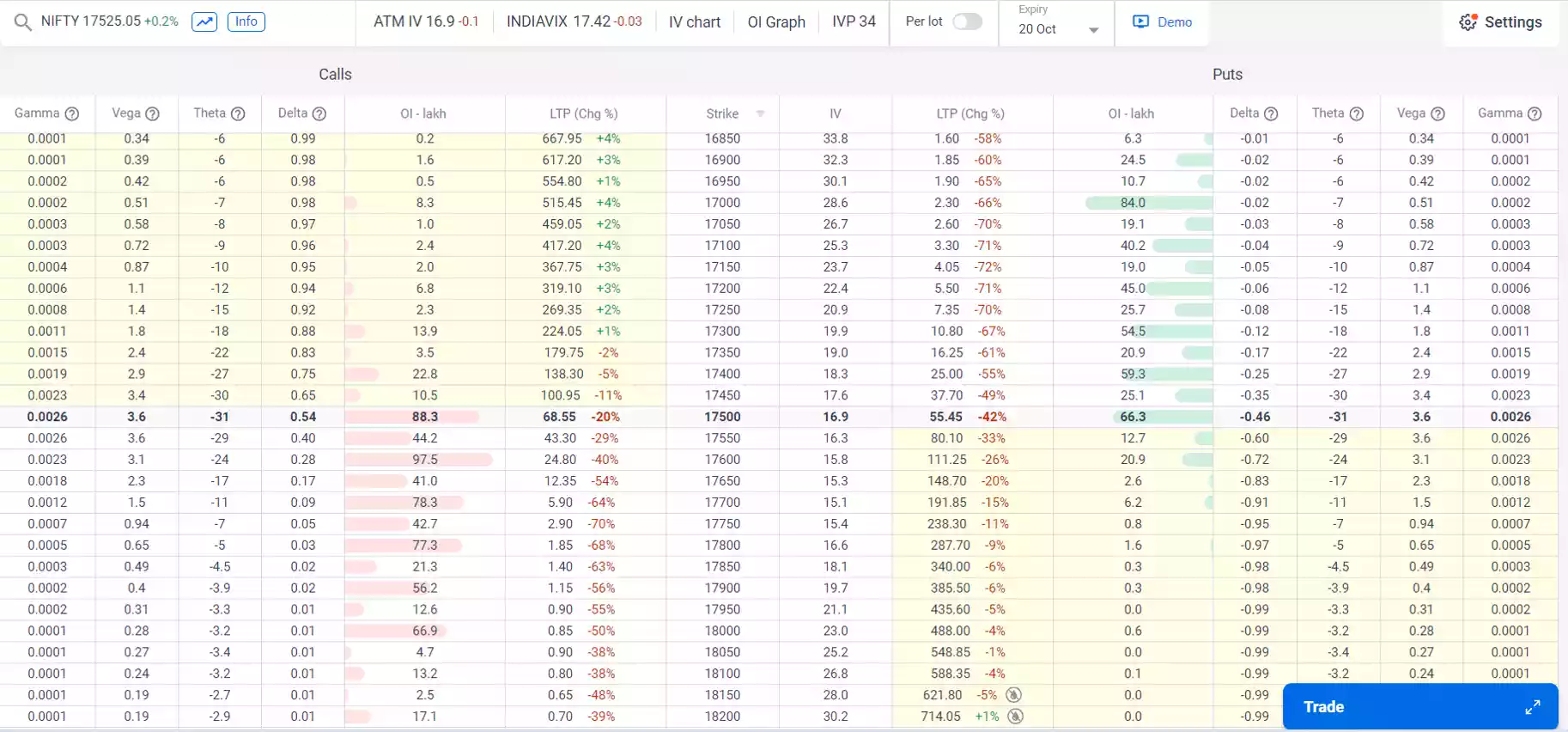

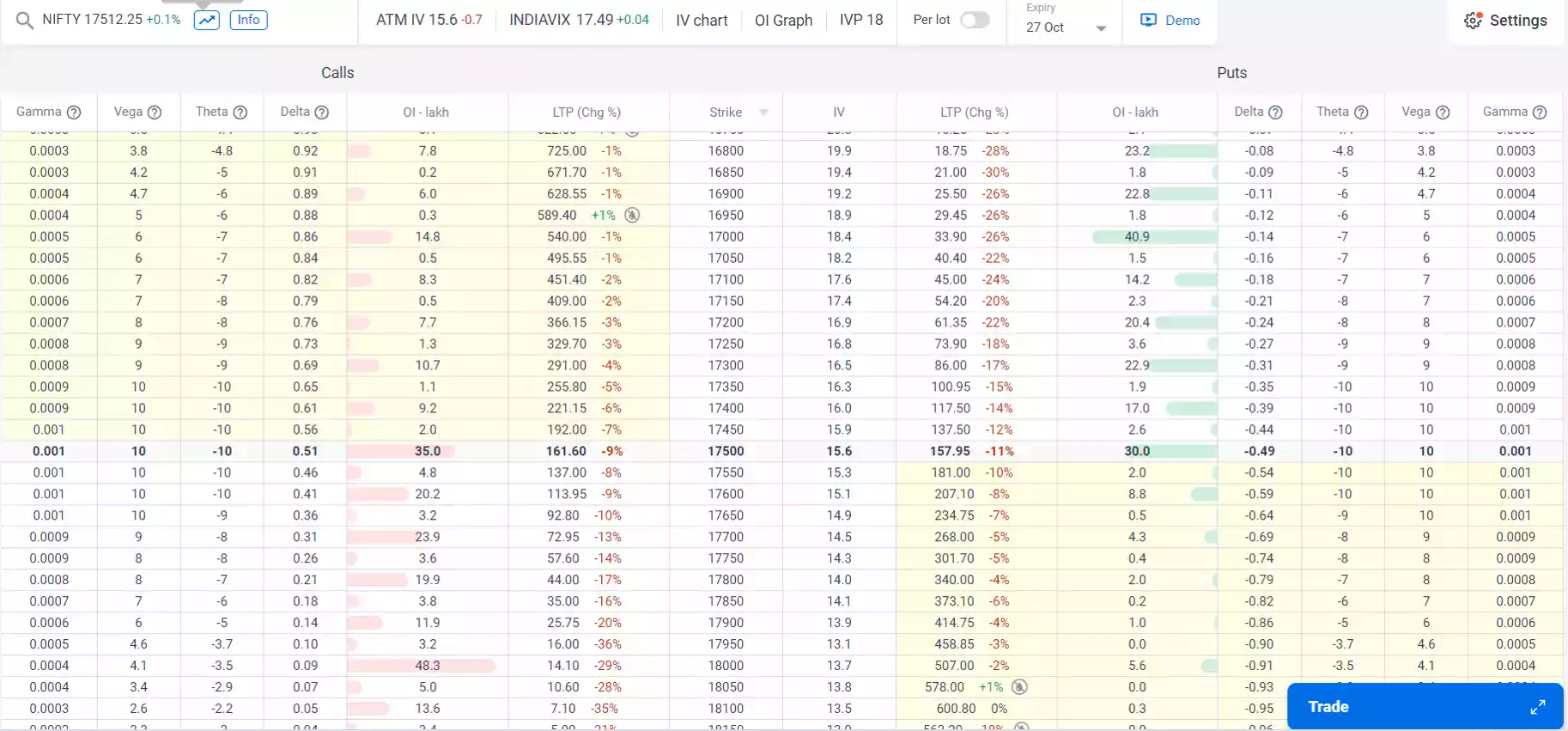

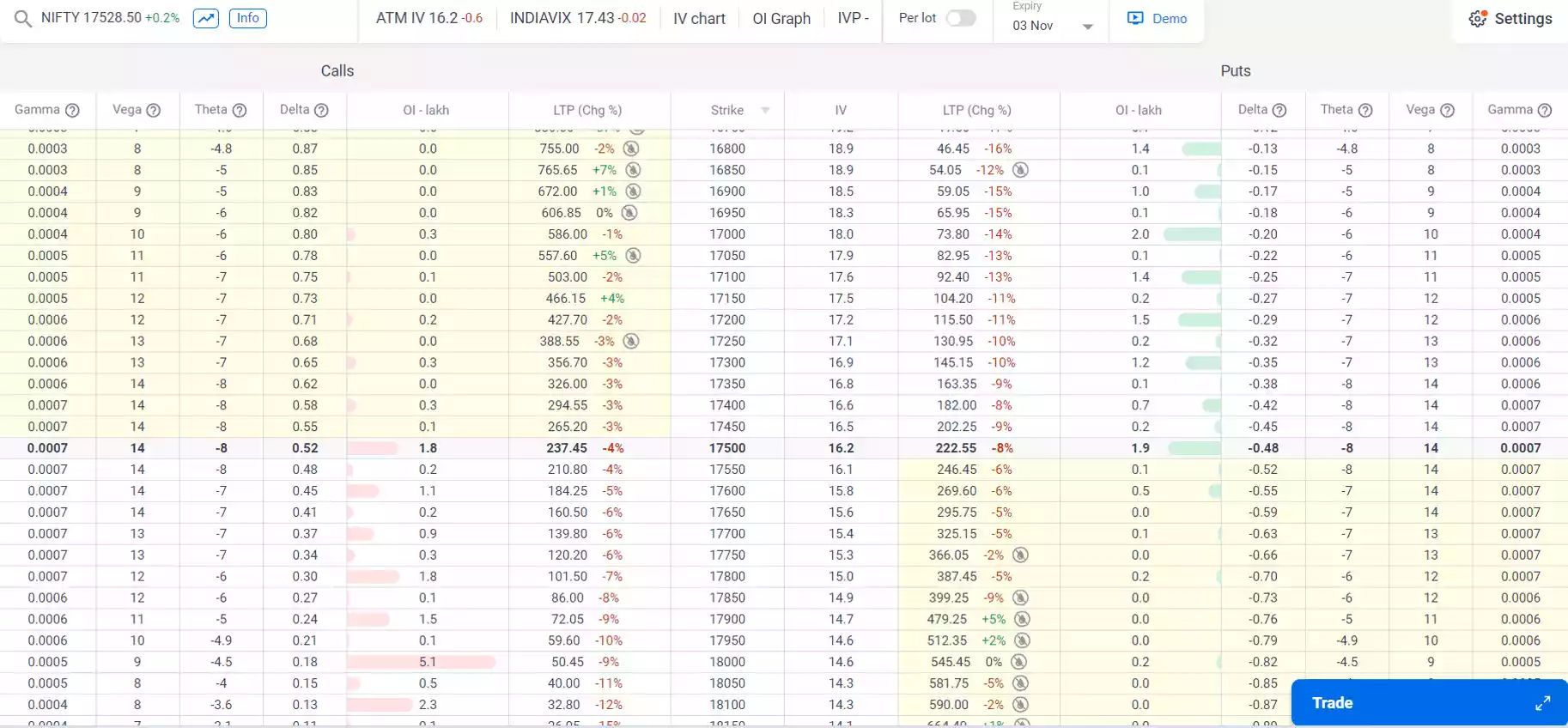

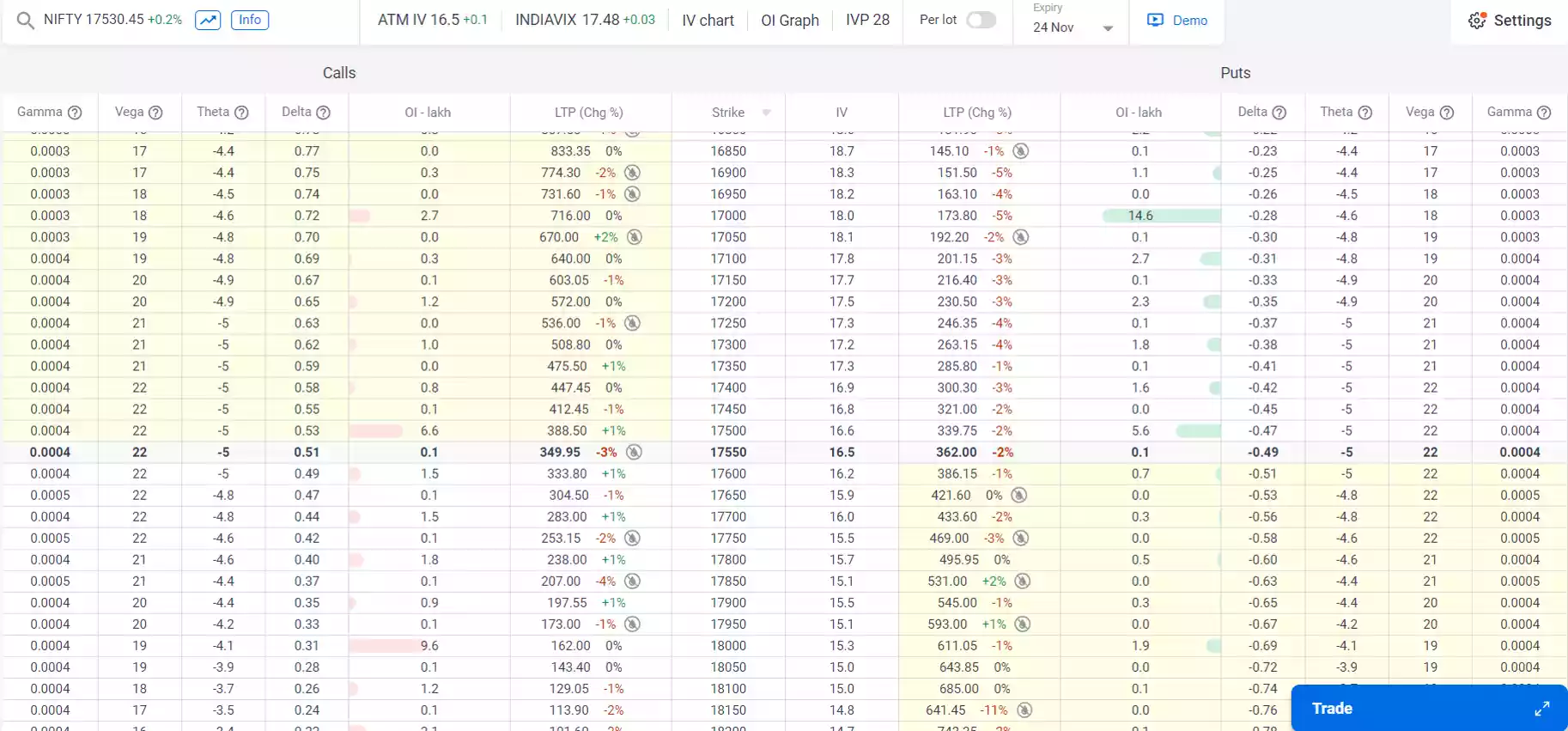

Some snapshot of Option Greek Theta value for various strike price with different expiry:

Option Greek Vega (v):

Option Greek Vega is a measure of the sensitivity of an option price to changes in market volatility it is the changes of an option premium for a given change (typically 1%) in the underlying volatility.

Option Greek Vega= change in an option premium/change in volatility

Vega is positive for a long call and a long put. An increase in the assumed volatility of the underlying increases the expected payout from a buy option, whether it is a call or a put.

Volatility basics:

Volatility of any security or index is a statistical measure of the dispersion of returns. Volatility can be measured by standard deviation. Commonly higher the standard deviation higher is the risk.

Calculation of standard deviation:

For calculation of standard deviation any security required historical data. By historical data we can calculate standard deviation by statistical process. Look below explanation of standard deviation(S.D.) With example-

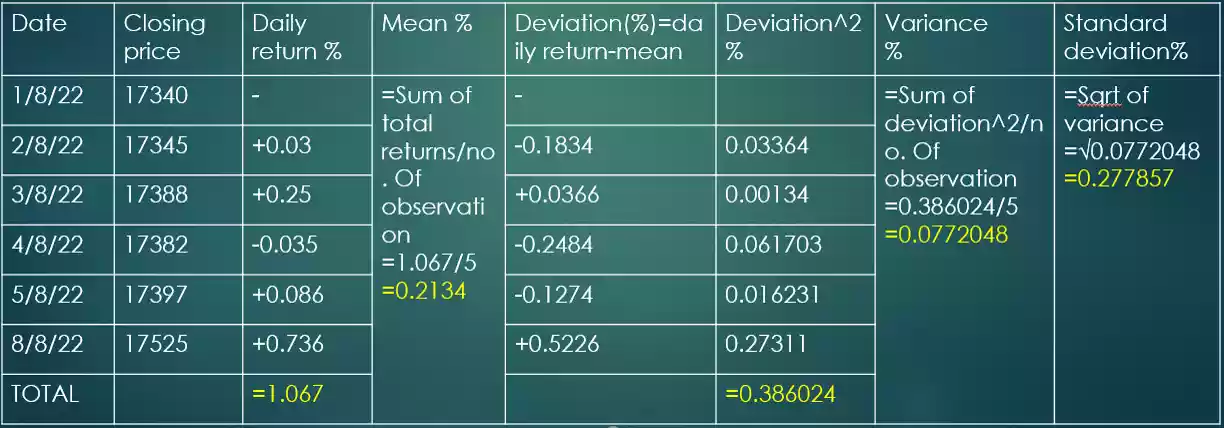

Suppose that Nifty closing price of last 6 days is according to below table-

Return= (current day closing price-previous day closing price)*100/previous day closing price

Sigma (sum of return)=0.03+0.25-0.035+0.086+0.736

∑=1.067%

Mean=sigma of return/no of returns=1.067/5=0.2134%

Deviation= day return-mean

Variance= sum of deviation^2/no of observation=0.386024/5=0.0772048

Standard deviation, σ=√0.0772048=0.277857%

So volatility of security is=0.278%, this standard deviation is per day

For 5 day standard deviation= σ*√t=0.278*√5=0.621%

Now if we calculate what will be price of nifty on 9/8/2022. So here we can calculate that price will go any side are up side or down side on 9/8/22. So nifty on 9/8/22 is- 17525±1sd=17525±0.278%, here we have calculated nifty range on 9/8/22 but it is only 68% possibility to move nifty within range in next session we will discuss why 68% possibility.

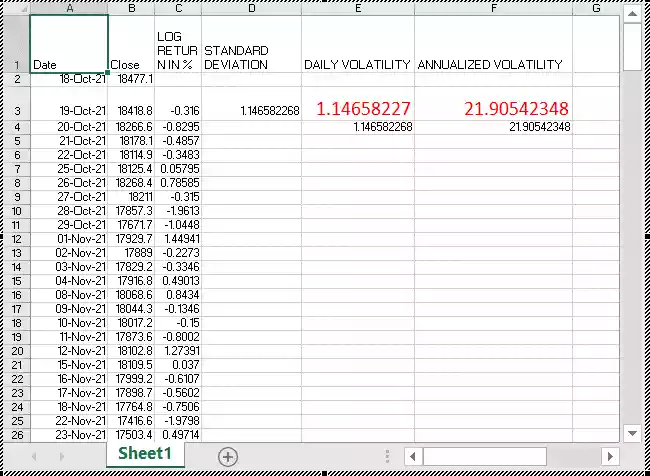

Calculating volatility on excel:

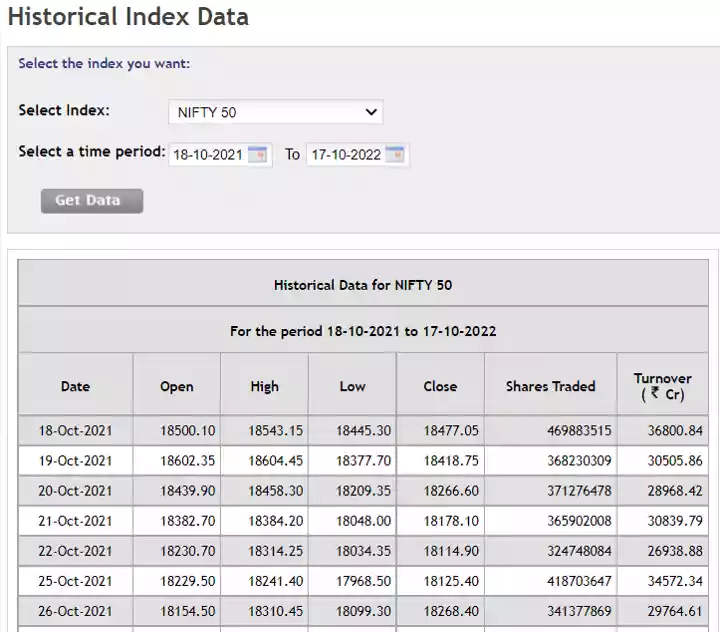

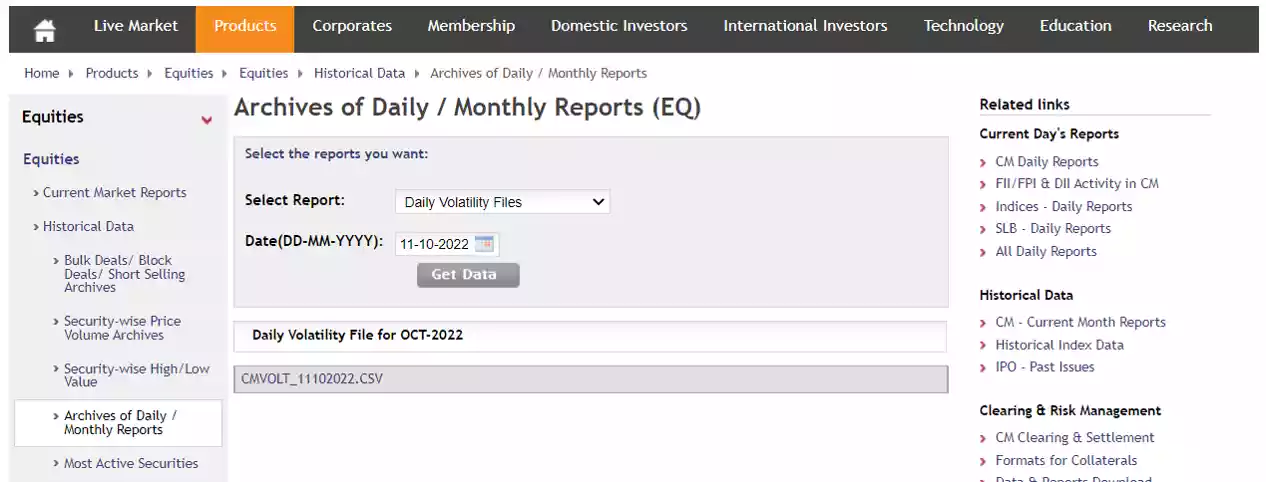

Step 1- Download the historical closing prices of security or index for last 1year from NSE website

Step 2- Calculate daily returns by traditional formula= end price/start price-1

Or

For excel use log return= ln(ending price/starting price)

Where, ln denotes logarithm to base e

Step 3 – use the stdev function

Use formula on excel =stdev(…..;…..)

By this formula calculated value is daily standard deviation or daily volatility on numeric value. So calculate percentage value by multiply100. Or calculate log return in percentage by multiply 100.

Now for annualized volatility= day volatility*square root time in days

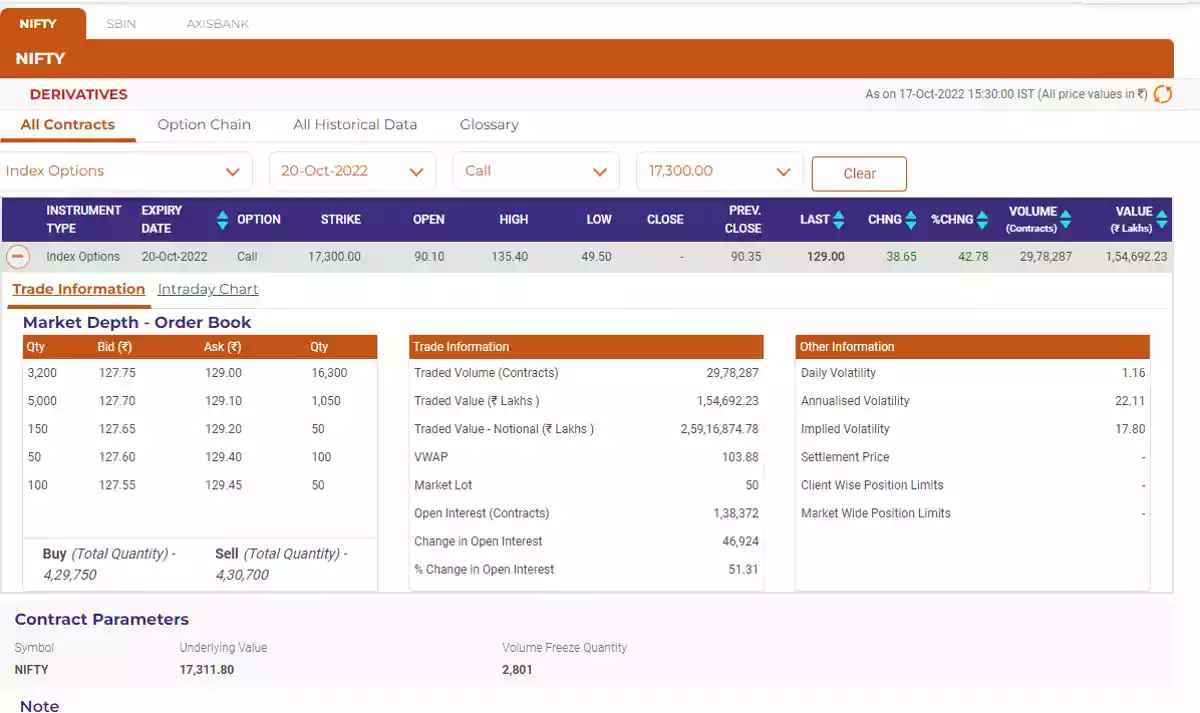

Note-check in quote on NSE website for volatility.

Daily volatility=annual volatility/square root time in days

or Download daily volatility files from NSE website.

1year=365 calendar days

1year= 252 trading days

Volatility and normal distribution:

Standard deviation or volatility of any security says that price will vary plus or minus of standard deviation on price (price+_1sd). So if price range declare by 1sd then what is the chances of that price will be trade within range for probability of price range first we understand about random walk.

Random walk:

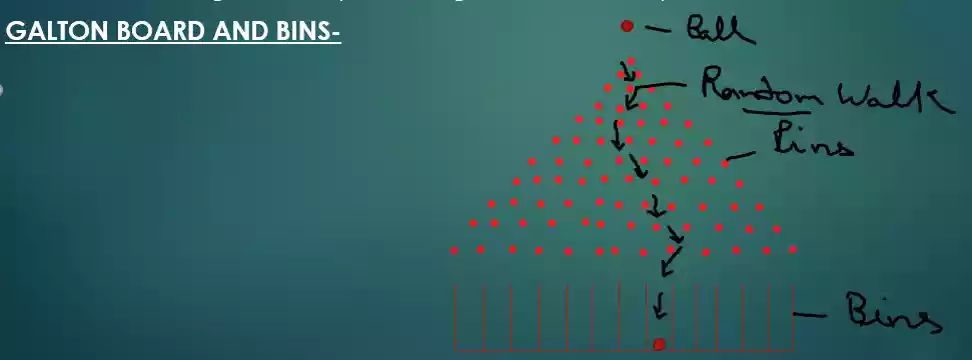

For random walk we will use Galton board. A Galton board has pins stuck to a board. Collecting bins are placed right below these pins.

When I will put a small ball on top then ball hit to pin and go right or left and hit 2nd pin go left or right like that ball go down without any artificial control he takes path for go down known as random path and the path that the ball takes is called the ‘random walk’ now can you imagine what would happen if you were to drop several such balls one after the other obviously each will take random walk before it falls into one of the bins however what do you think about the distribution of these balls in the bins?

♣ Will they all fall in the same bin? Or

♣ Will they all get distributed equally across the bins? Or

♣ Will they randomly fall across the various bins?

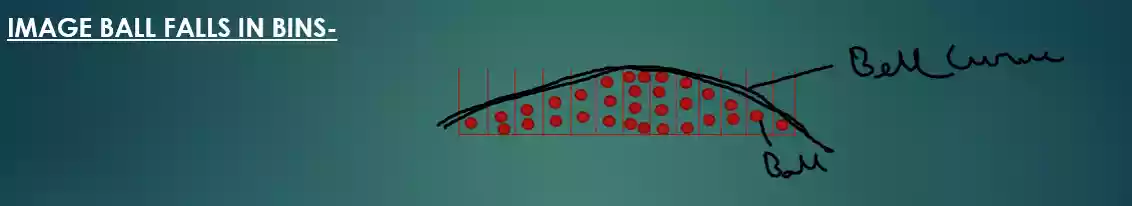

But according to experiment ball not fall on same bin or equally distributed or randomly fall in any bin. Its make a particular pattern and all ball get distributed in a particular way-

♣ Most of the balls tend to fall in the central bin

♣ As you move further away from the central bin either to the left or right, there are fewer balls

♣ The bins at extreme ends have very few balls

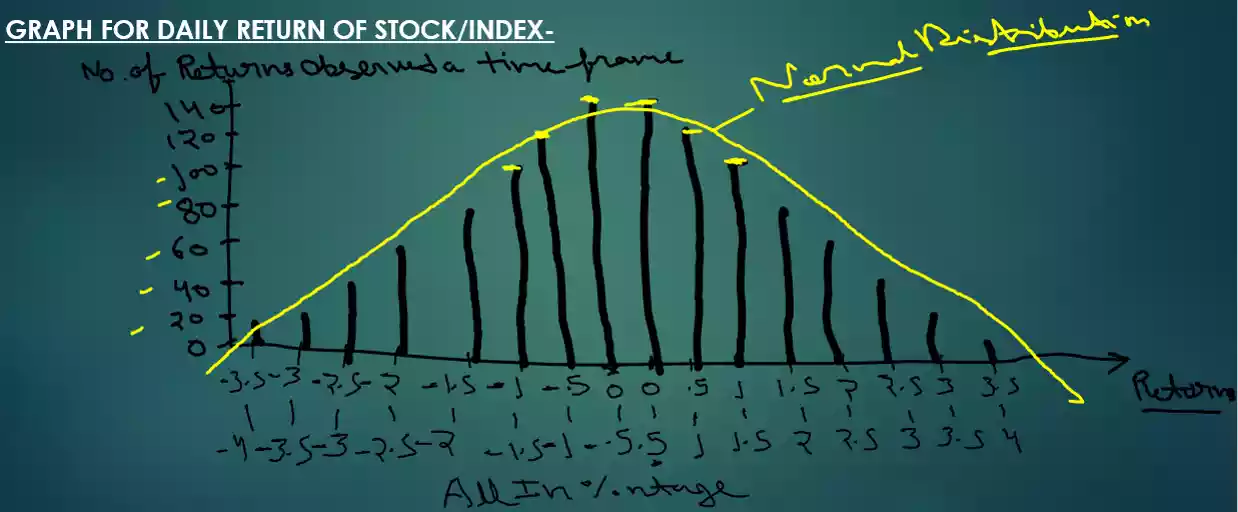

A distribution of this sort is called the ‘normal distribution’ now here is the best part, irrespective of how many times you repeat this experiment the balls always get distributed to form a normal distribution why I am looking a Galton board experiment because of if we distribute any stock or index price daily returns then they follows a normal distribution or the bell curve. You can plot a any stock or index on a daily return up to 1 year to 10 year with no. Of time return repeat and plot graph you get a normal distribution with little change with one to another security.

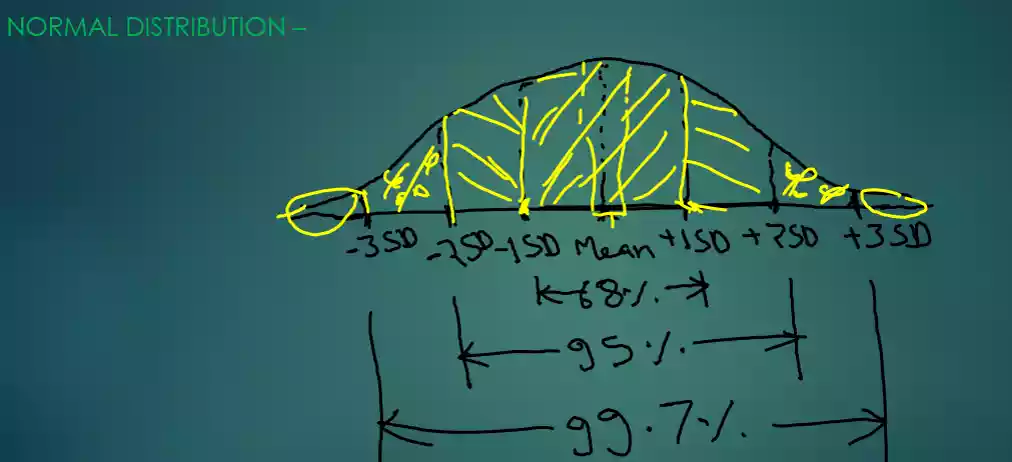

Normal distribution:

The normal distribution curve can be fully described by two numbers- the distribution mean (average) and standard deviation. The mean is the central value where maximum values are concentrated. This is the average value of the distribution for instance in the Galton board experiment the mean is that bin which has the maximum numbers of balls in it and known as average bin. Keeping the average bin as a reference, the data is spread out on either sides of this average reference value. The way the data is spread out is quantified by the standard deviation. And in stock market known as volatility.

Here is something you need to know when someone says standard deviation(SD) by default they are referring to the 1st SD likewise there is 2nd standard deviation(2SD), 3rd standard deviation(3SD).

Here is the general theory around the normal distribution which you should know-

♣ Within the 1st standard deviation on can observe 68% of the data.

♣ Within the 2nd standard deviation one can observe 95% of the data.

♣ Within the 3rd standard deviation one can observe 99.7% of the data.

Mean±1SD means if 100 ball fall in Galton board then 68% ball of 100 get in within 1SD range and 95% ball within 2SD range and 99.7% ball within 3SD range after 3SD only 0.3% chances that ball fall outside of 3SD range it is the chance as low as spotting a ‘black swan’ in a river this is known as black swan event.

Normal distribution and stock/index returns:

Suppose that Nifty50 daily volatility is 1.2% and mean if annual return 12% then daily=12/252=0.047%~0.04%, so daily mean is 0.04%.

Now if 1month (30days) range required then-

Mean=0.04*30=1.2%

SD=1.2*sqrrt30=6.57%~6.6%

Today Nifty price, S=16000/-

So, 68% chances to nifty vary within 1month between range mean±1SD.

Then upper range, mean+1SD=1.2+6.6=7.8% of nifty current price

So nifty upper range within month=16000+16000*7.8/100=17248/-

And lower range=1.2-6.6=-5.4%

So nifty lower range within month =16000-16000*5.4/100=15136/-

So nifty vary between from range 15136/- to 17248/- in 30days but only 68% correct 32% it will go outside of range.

Like that I will calculate 2SD and 3SD range and also for 1year, 6month etc.

Use of volatility in option market:

Mostly volatility uses by option writer than he is choose correct strike for writing option to expire worthless by calculation of range with mean and SD. And also you can get stoploss by calculating daily volatility. And also one thing that avoid put options write because of fear fall sudden to much and also avoid shorting on any events like as monetary policy, policy decision, corporate announcements etc. For calculation of stoploss use daily volatility multiplication with square root of remaining days and calculate stock/index stop value from current price.

Suppose that if nifty is=16000,

Days remaining to expire contract is 5days,

And daily volatility is 1.2%,

Then 5days volatility=1.2*sqrrt5=2.68%

Then the stoploss level is= 16000(1±2.68%)

Types of volatility:

Different types of volatility that exist-

1.Historical volatility

2.Forecasted volatility

3.Implied volatility

4.Realized volatility

Historical volatility:

In stock market we take the past closing prices of the stock/index and calculate the historical volatility. I have discussed volatility calculation in above section.

Forecasted volatility:

In stock market analysts forecast the volatility. Forecasting the volatility refers to the act of predicting the volatility over the desired time frame. Arbitrarily declaring forecast volatility to better use mathematical/statistical model to predict volatility. There are a few good statistical models such as ‘generalized auto regressive conditional heteroskedasticity (GARCH) process’. There are several GARCH process to forecast volatility like as GARCH(1,1) or GARCH(1,2) etc.

Implied volatility:

Implied volatility represents the market participants expectation on volatility so on one hand we have the historical and forecasted volatility both of which are sort of ‘manufactured’ while on the other hand we have implied volatility which is in a sense ‘consensual’ implied volatility can be thought of as consensus volatility arrived amongst all the market participants with respect to the expected amount of underlying price fluctuation over the remaining life of an option.

Implied volatility is reflected in the price of the premium for this reason amongst the three different types of volatility, the implied volatility is usually more valued. These are the volatilities implied by option prices observed in the market. Implied volatility calculated by black Scholes model input all variables with option premium and calculate implied volatility by iteration method.

Implied volatility are used to monitor the markets opinion about the volatility of a particular stock. Where as historical volatilities are backward looking, and implied volatilities are forward looking. Trader often quote the implied volatility of an option rather than its pricing. This is convenient because the implied volatility tends to be less variable than the option price.

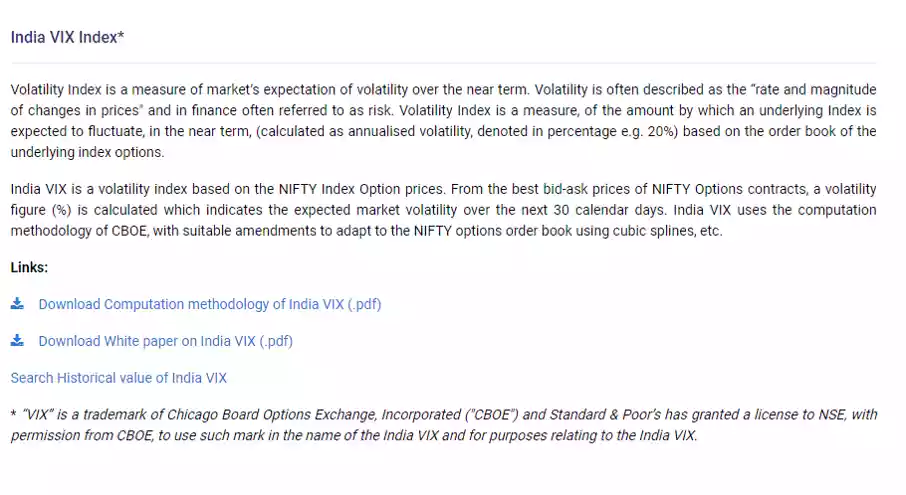

VIX:

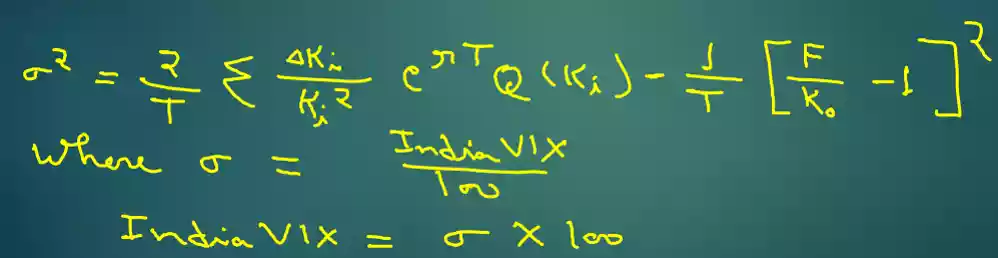

VIX is a volatility index it is a measure of markets expectation of volatility over the near term. First time the Chicago board of options exchange (CBOE) introduce the volatility index for the U.S. markets in 1993 based on S&P100 index option prices. In 2003, the methodology was revised and the new volatility index was based on S&P500 index options. In India volatility index known as India VIX computed by NSE based on the order book of Nifty options. India VIX uses the computation methodology of CBOE, with suitable amendments to adapt to the Nifty options order book. The formula used in the India VIX calculation is-

Where,

T= time to expiration on in years using minutes till expiration

Ki=strike price of ith out of the money option; A call if ki>F and a put if Ki<F

∆Ki= Interval between strike prices half the distance between the strike on either side of Ki

∆Ki=(Ki+1 – Ki-1)/2

r= risk free interest rate to expiration

Q(Ki)= midpoint of the bid ask quote for each option contract with strike Ki

F= forward index taken as the latest available price of nifty future contract of corresponding expiry.

Ko= first strike below the forward index level, F

Note- for detail information about India VIX download whitepaper from NSE website.

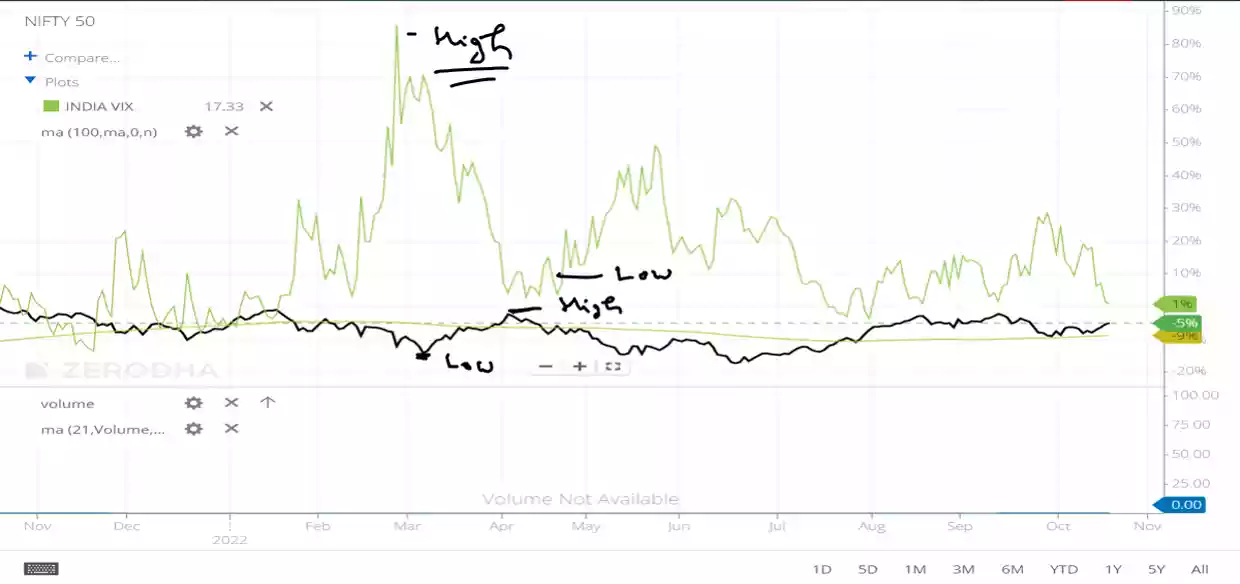

India VIX and Nifty50 chart comparison:

Some points uses in India VIX calculation:

♣ NSE computes India VIX based on the order book of Nifty options

♣ The best bid-ask rates for near month and next month Nifty options contracts are used for computation of India VIX

♣ India VIX indicates the investor’s perception of the markets volatility in the near term(next 30 day calendar days)

♣ Higher the India VIX values, higher the expected volatility and vice-versa

♣ When the markets are highly volatile market tends to move steeply and during such time the volatility index tends to rise

♣ Volatility index decline when the markets become less volatile. Volatility indices such as India VIX are sometimes also referred to as the ‘fear index’ because as the volatility index rises, one should become careful as the markets can move steeply into any direction.

♣ Volatility index is different from a market index like nifty while nifty is a number, India VIX is denoted as an annualized percentage.

♣ You can track implied volatility by using option chain by NSE website and for India VIX visit NSE website or third party website

Realized volatility:

Realized volatility is looking back in time and figuring out the actual volatility that occurred during the expiry series. Realized volatility matters especially if you want to compare todays implied volatility (for 1month-3month time period) with respect to the historical implied volatility (1year time period).

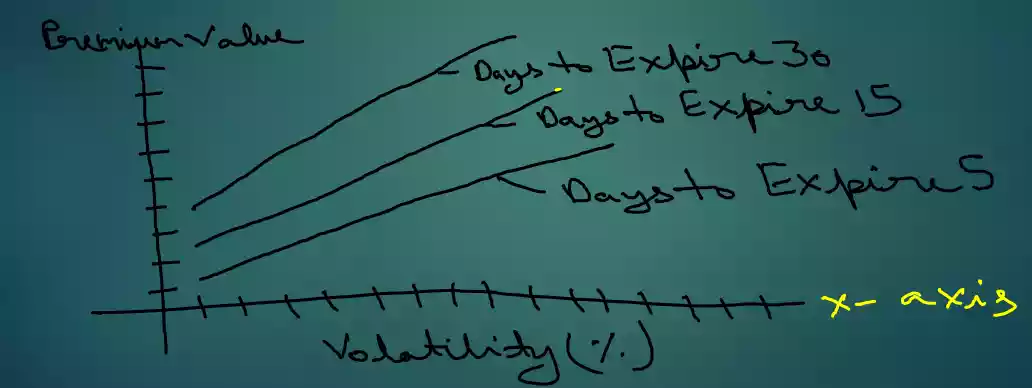

Option Greek Vega (v):

The Option Greek Vega of an option measures the rate of change of options value(premium) with every percentage change in volatility since options gain value with increase in volatility, the Vega is a positive number for both calls and puts for example- if the option has a Vega of 0.18, then for each %tage change in volatility, the option will gain or lose 0.18 in its theoretical value.

X-axis represents volatility in %tage and Y-axis represents the premium value in rupees. Clearly as we can see when the volatility increases the premium also increase this holds true for both call and put options but behavior’s of option premium with respect to change in volatility and the number of days to expiry means in higher expiry days option premium change more than in lower days option expiry. Generally 30days more expiry change in volatility 100% change in premium 100% and 15days expiry change in volatility 100% change in premium 50% and less than 1week expiry change in premium 47% approximate value. But its not only by volatility other variable also effected its premium value.

Option Greek Vega by black-Scholes model:

For European call and put options on a non-dividend-paying-stock,

Vega (v)= S*√T*N’(d1)

Here vega value in decimal means if change volatility 1% then change premium =0.01*vega

Where N’(x)=e(-x^2/2)/√(2pie)

d1= (ln(S/K)+(r+σ2/2)t)/(σ*√t)

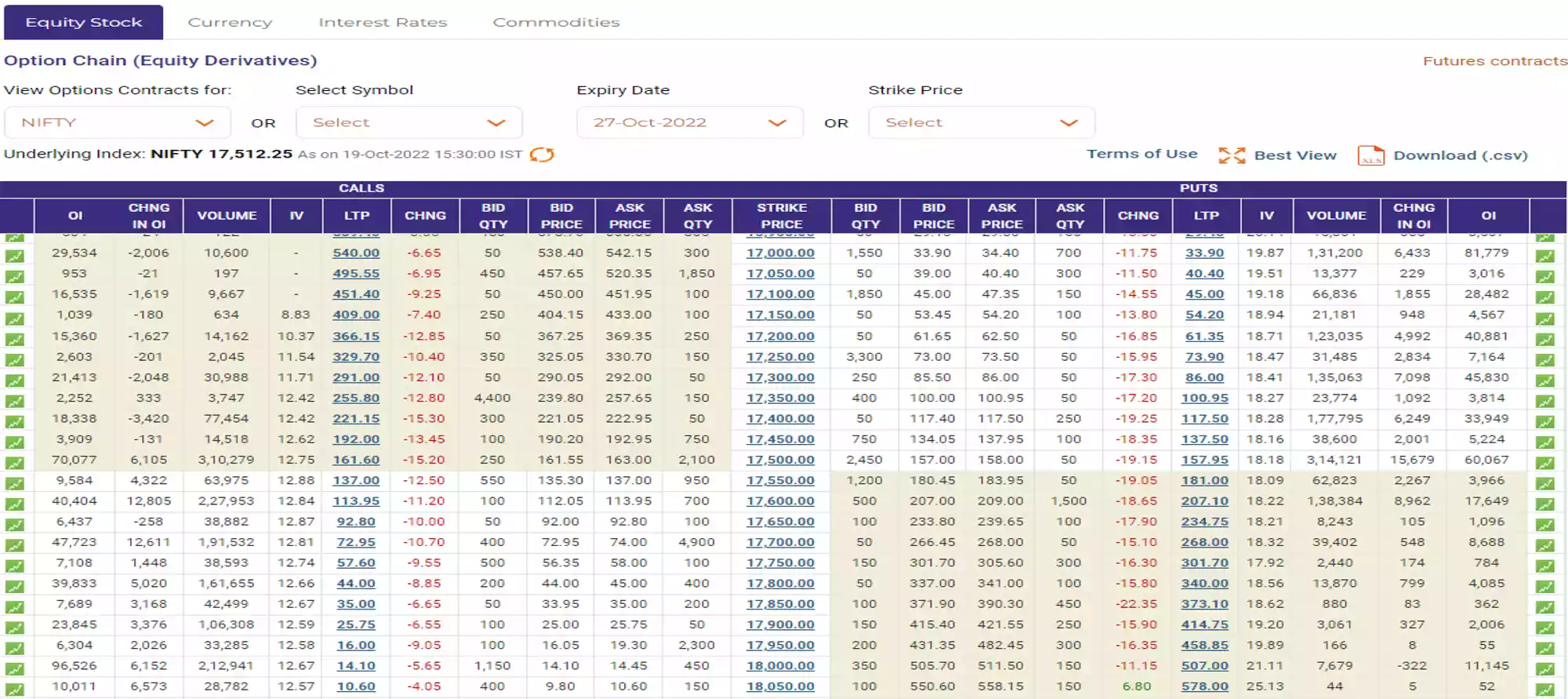

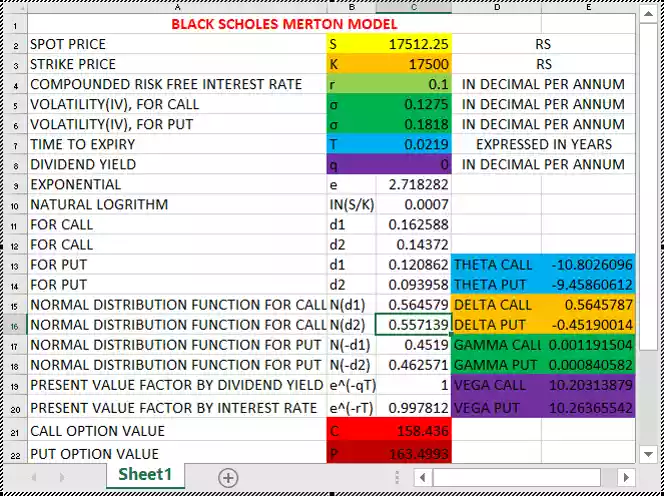

Example:

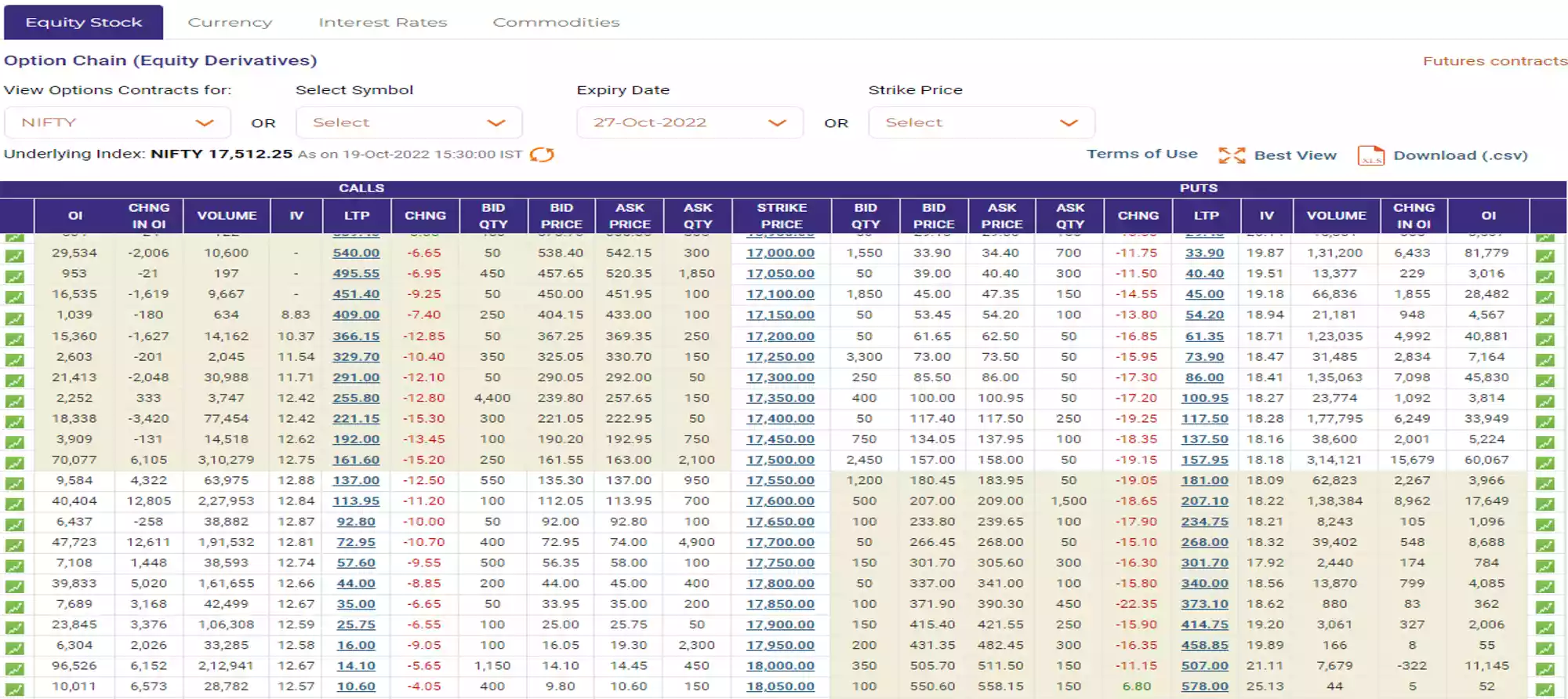

Contract- Nifty 27 Oct 17500 CE/PE

K=17500, S=17512.25, r=0.1,

T= (510+930+10080)525600=11520/525600=0.0219year (from today-19/10/22, 9day)

IV call=12.75, IV put=18.18

P=157.95, C=161.60

Option Vega=?

Solution:

Vega (v)= S*√T*N’(d1)/100

Vega for call= 10.20

Vega for put= 10.26

Note- if implied volatility change 1% then premium increase or decrease by 10.2 rupees for call option.

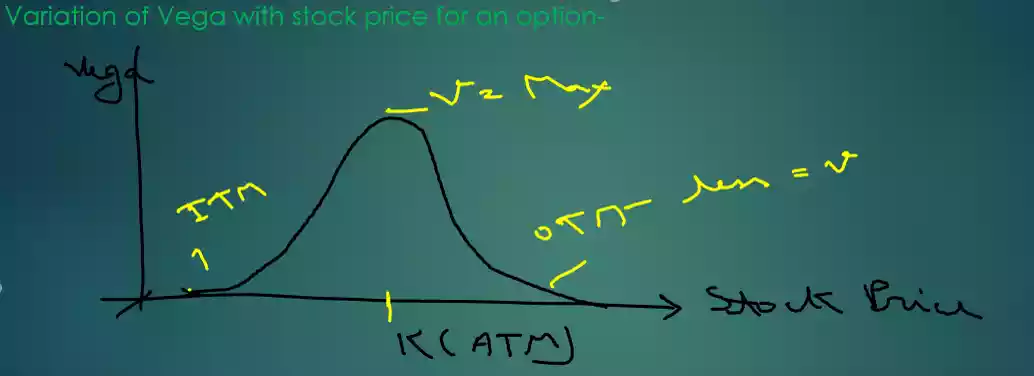

Variation of Option Greek Vega with stock price for an option:

Note- When historical volatilities change the implied volatilities of short dated options tend to change by more than the implied volatilities of long dated options

Some snapshot of Option Greek Vega value for various strike price with different expiry:

Option Greek Rho(ρ):

Option Greek Rho is the change in option price given a one percentage point change in the risk-free interest rate. Rho measures the change in an option price per unit increase in the cost of funding the underlying.

Option Greek Rho= change in an option premium/change in cost of funding the underlying

Call rho is positive and put rho is always negative, for call high risk free interest rate to high premium and for put high risk free interest rate to low premium.

Option Greek Rho by Black-Scholes model:

It measures the sensitivity of the value of a portfolio to a change in the interest rate when all else remains the same for a European options on a non-dividend paying stock,

Rho for call= K*T*e(-rt)*N(d2)

Rho for put= -K*T*e(-rt)*N(-d2)

Where rho in a decimal means change 1% in risk free interest rate change in premium=0.01*rho value.

Example:

Contract- Nifty 27 Oct 17500 CE/PE

K=17500, S=17512.25, r=0.1,

T=(510+930+10080)525600= 11520/525600=0.0219years (from today-19/10/22, 9day)

IV call=12.75, IV put=18.18

P=157.95, C=161.60

Option rho=?

Solution:

Rho for call= K*T*e(-rt)*N(d2)/100

Rho for put= – K*T*e(-rt)*N(-d2)/100

Rho for call= 2.13

Rho for put = -1.76

Note- if interest rate change 10% to 11% then premium increase by 2.13 rupees for call option.

Dividend paying stock/index option price and option Greek formulae by black-Scholes model:

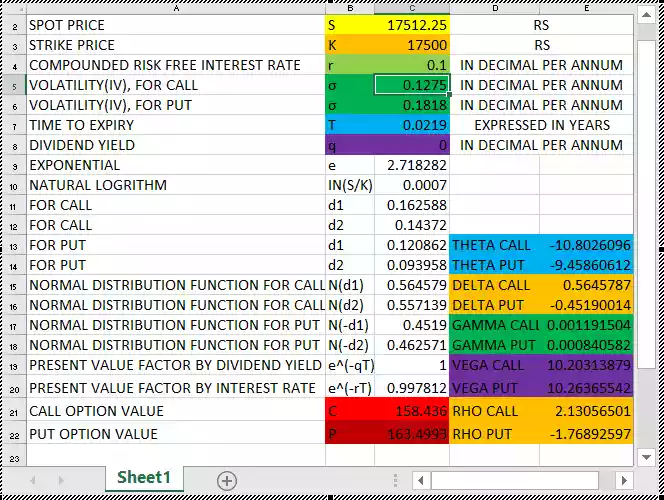

Greek calculator:

This is based on black-Scholes model for options pricing and for Greek calculations. We know that how to calculate Greeks and its interpretation but if we have required quick result means like a calculator calculation so we look here it in excel for Greeks calculation. In pricing model we input the spot price, strike price, interest rate, implied volatility, dividend and number of days to expiry. The pricing model churns out the required mathematical calculation and gives out a bunch of outputs. The output includes all the option Greeks and the theoretical price of the call and put option for the strike selected.

For Greek calculator click on here

Implied volatility calculation:

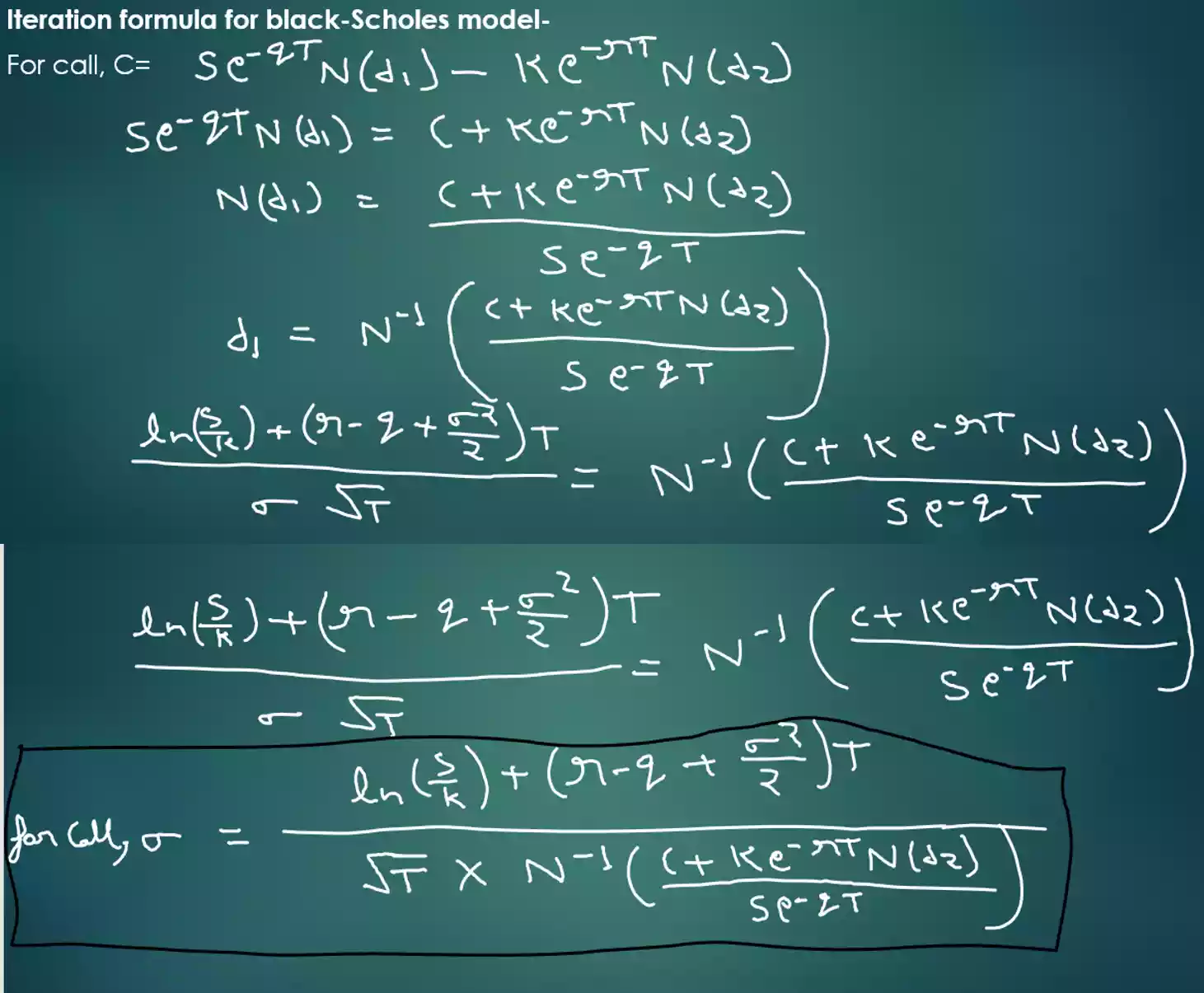

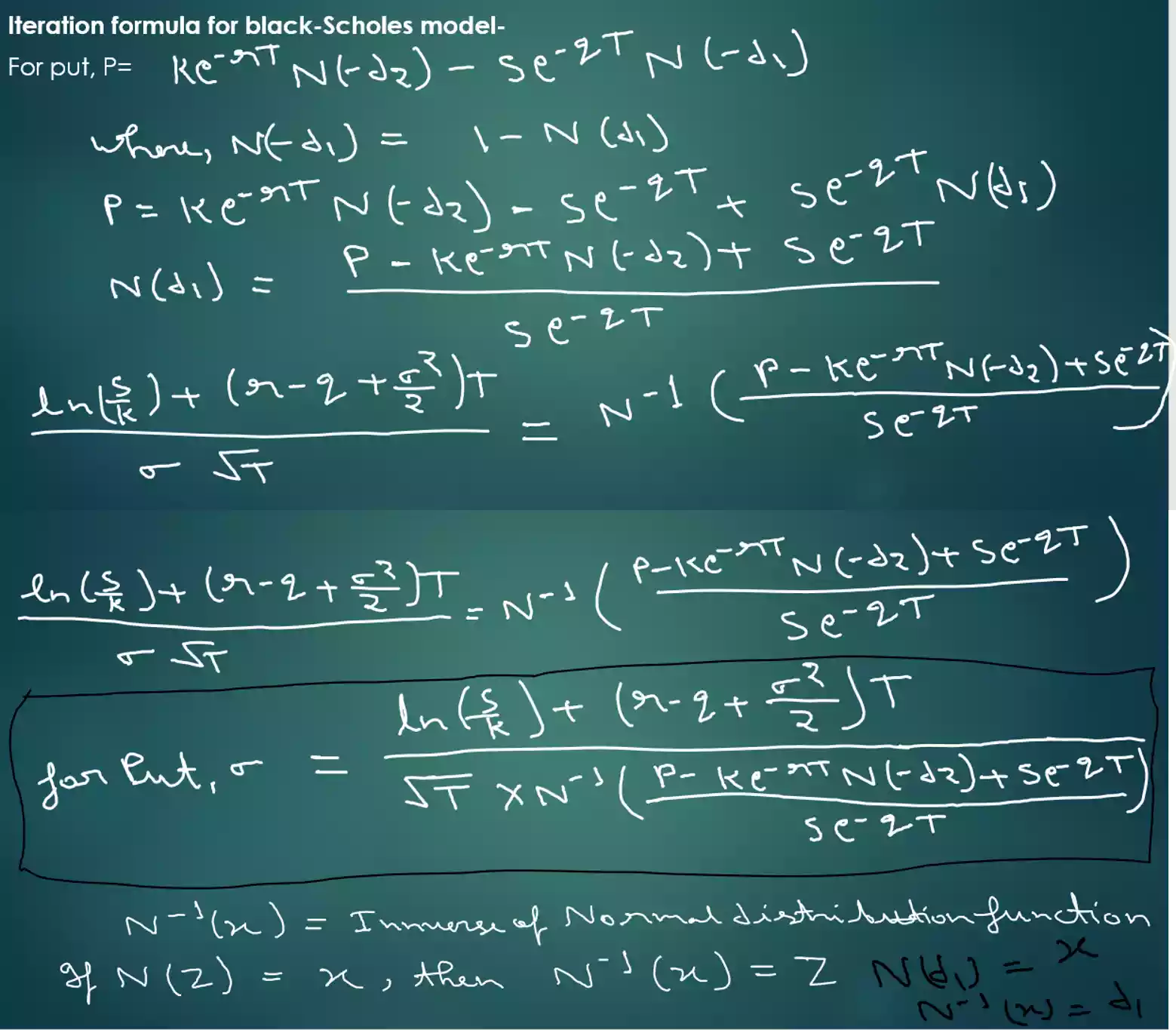

We know that implied volatility calculation is biggest challenge because of there is no direct formula to calculate them. First time in option pricing we use historical volatility to calculate option price but after that due to supply and demand option price, mispriced its above or low option price calculation by black-Scholes model with all variables including historical volatility. So this misprice of option value measured by volatility in reverse calculation of black-Scholes model. Volatility calculated by reverse method known as implied volatility.

But in actual reverse calculation not so easy. So for its calculation, we look iteration method.

Iterative method- the iterative method is a mathematical way of solving a problem which generates a sequence of approximations this method is applicable for both linear and non linear problems with number of variables.

Iteration for black-Scholes model- we know that volatility for call options and put options is same but implied volatility is not same due to its separate demand and supply of put and call options so we look for both implied volatility calculation formula-