What is option pricing:

Options pricing refers to the calculation of the theoretical value for a financial contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specified time period. The pricing is based on a number of factors, including the price of the underlying asset, the time remaining until expiration, the volatility of the underlying asset, and the cost of borrowing money. The most widely used method for options pricing is the Black-Scholes model.

Table of Contents

Snapshot of option chain:

I have seen that for different strike price have different premium also different premium in different time duration then what is the calculation method for option value(option premium)

Option premium have two component intrinsic value ant time value. Intrinsic value is the difference of spot price and strike price but time value depends on various variables. So for it option value (premium) also depend on variables. Thus there are six fundamental parameters on which the option price depends-

1.Spot price of the underlying asset

2.Strike price of the option

3.Volatility of the underlying asset price

4.Time to expiration

5.Interest rates

6.The dividends that are expected to be paid

These factors affect the premium/price of options in several ways.

Spot price:

The option premium is affected by the price movements in the underlying instrument if price of the underlying asset goes up the value of the call option increases while the value of the put option decreases. Similarly if the price of the underlying asset falls, the value of the call options decreases while the value of put options increases.

Strike price:

If all the other factors remain constant but the strike price of option increases, intrinsic value of the call option will decrease and hence its value will also decrease. On the other hand, with all the other factors remaining constant, increase in strike price of option increases the intrinsic value of the put option which in turn increases its option value.

Volatility:

It is the magnitude of movement in the underlying asset’s price, either up or down it affects both call and put options in the same way higher the volatility of the underlying stock, higher the premium because there is a greater possibility that the option will move in the money during the life of the contract. Higher volatility = higher premium, lower volatility = lower premium for both call and put options.

Time to expiration:

The effect of time to expiration on both call and put options is similar to that of volatility an option premiums. Generally, longer the maturity of the option greater is the uncertainty and hence the higher premiums. If all other factors affecting an options price remain same, the time value portion of an options premium will decrease with the passage of time. This is also known as time decay. Thus option sellers are at a fundamental advantage as compared to option buyers as there is an inherent tendency in the price to go down also in a view of options buyers known as ‘wasting assets’ due to this property where the time value gradually falls to zero.

Interest rates:

Interest rates are slightly complicated because they affect different options, differently. In a simpler way high interest rates will result in an increase in the value of a call option and a decrease in the value of a put option.

Dividends:

Dividends have the effect of reducing the stock price on the ex-dividend date. This is bad news for the value of call options and good news for the value of put options.

Option pricing models:

there are various option pricing models which traders use to arrive at the right value of the option most popular models-

1.The binomial pricing model

2.The Black-Scholes model

The binomial pricing model:

The binomial option pricing model was developed by William Sharpe in 1978. It has proved over time to be the most flexible, intuitive and popular approach to option pricing.

The binomial model represents the price evolution of the options. Underlying asset as the binomial tree of all possible prices at equally spaced time steps from today under the assumption that at each step, the price can only move up and down at fixed rates and with respective simulated probabilities.

This is a very accurate model as it is iterative, but also very lengthy and time consuming.

The Black-Scholes-Merton model:

The Black-Scholes-Merton model was published in 1973 by fisher black, Myron Scholes and Robert Merton. It is one of the most popular, relative simple and fast modes of calculation. Unlike the binomial model, it does not rely on calculation by iteration.

This model is used to calculate a theoretical call price (ignoring the dividends paid during the life of the option) using the five key determinants of an options price- stock price, strike price, volatility, time to expiration, and short term risk free interest rate(91day T-bill interest rate).

The original formula for calculating the theoretical option price is for European options-

C, Call value= S*N(d1) – K*e-rt*N(d2)

P, Put value= K*e-rt*N(-d2) – S*N(-d1)

d1= {In(S/K) + (r + σ2/2)t}/(σ*√t)

d1= {In(S/K) + (r – σ2/2)t}/(σ*√t)

d2 = d1-σ*√t

Where,

S= Stock price / spot price

K= Exercise price/ strike price

t= Time remaining until expiration (expressed in years)

r= Current continuously compounded risk free interest rate

σ= Annual volatility of stock price ( the standard deviation of the short term returns over one year)

In= Natural logarithm

N(x)= Standard normal cumulative distribution function ( normsdist function in excel provide a N(x) value)

e= The exponential function

Example & solution:

Example1-The stock price 6 months from the expiration of an option is Rs.42, the exercise price of the option is Rs.40, the risk free interest rate is 10% per annum and the volatility is 20% per annum. Calculate call and put value.

Solution-This means that,

S= 42, K= 40, r= 10/100=0.1, σ= 20/100=0.2, t= 6/12=0.5

C, Call value= S*N(d1) – K*e-rt*N(d2)

P, Put value= K*e-rt*N(-d2) – S*N(-d1)

d1= {In(S/K) + (r + σ2/2)t}/(σ*√t)

d1= {In(S/K) + (r – σ2/2)t}/(σ*√t)

d1= {In(42/40) + (0.1 + 0.22/2)0.5}/(0.2*√0.5)

d1= (0.04879 + 0.061)/0.14142

d1= 0.76926

d1= {In(42/40) + (0.1 – 0.22/2)0.5}/(0.2*√0.5)

d2=(0.04879 – 0.04)/0.14142

d2= 0.6278

k*e-rt= 40*e-0.1*0.5

k*e-rt= 38.049

Hence, if the option is a European call,

C= 42*N(0.7693) – 38.049*N(0.6278)

If option is European put,

P= 38.049*N(-0.6278) – 42*N(-0.7693)

By excel using Normdist function

Then, N(0.7693)=0.7791

N(0.6278)=0.7349

N(-0.7693)=0.2209

N(-0.6278)=0.2651

So that,

C=42*0.7791-38.049*0.7349=32.7222-27.9622=4.76

P=38.049*0.2651-42*0.2209=10.0867-9.2778=0.809

Dividends- up to now, we have assumed that the stock on which the option is written pays no dividend. The date on which the dividend is paid should be assumed to be the ex-dividend date on this date the stock price declines by the amount of the dividend.

Example2– consider a European call option on a stock when there are ex-dividend dates in two months and five months the dividend on each ex-dividend date is expected to be Rs. 0.50/- the current share price is Rs. 40/- the exercise price is Rs. 40/-, the stock price volatility is 30% per annum, the risk-free interest is 9%per annum, and the time to maturity is six month. So calculate call value.

Solution- the present value of the dividend is,

q= 0.5*e-0.09*2/12 + 0.5*e-0.09*5/12

q= 0.9742

Then, adjusted spot price, S= 40-0.9742=39.0258

K=40, r=0.09, t=6/12=0.5, σ=0.3

d1= {ln(39.0258/40) + (0.09 + 0.32/2)0.5}/(0.3*√0.5)

d1= 0.2020

d2= d1 – σ*√t

d2= 0.2020 – 0.3*√0.5

d2= -0.010132

N(0.2020)= 0.58004

N(-0.010132)= 0.49596

C= 39.0258*0.58 – 40*e– 0.09*0.5*0.4959

C= 3.67

Option pricing formula and example for dividend paying stock by Black-Scholes model:

Option price for European option on a dividend paying stocks on an asset that provides a dividend yield at rate q. Option price formula by Black-Scholes model is-

For call option,

C, Call value= S*e-qt*N(d1) – K*e-rt*N(d2)

For put option,

P, Put value= K*e-rt*N(-d2) – S*e-qt*N(-d1)

ln(S*e-qt/K)= ln(s/k)-qt

d1= {In(S/K) + (r – q + σ2/2)t}/(σ*√t)

d1= {In(S/K) + (r – q – σ2/2)t}/(σ*√t)

d2 = d1-σ*√t

Dividend yield(%)= dividend amount*100/stock or index price

q= Equal to the average annualized dividend yield during the options

q= Dividend during the options life*365/(stock price during the option life*expiry in days)

Example 3- consider a European call option on a stock when there are ex-dividend dates in two months and five months the dividend on each ex-dividend date is expected to be Rs. 0.50/- the current share price is Rs. 40/- the exercise price is Rs. 40/-, the stock price volatility is 30% per annum, the risk-free interest is 9%per annum, and the time to maturity is six month. So calculate call value.

Solution- average annualized dividend yield, q= {(0.5+0.5)*12}/(40*6)=0.05

S= 40, K=40, r=0.09, t=6/12=0.5, σ=0.3

d1= {In(40/40)+(0.09-0.05+0.32/2)0.5}/(0.3*√0.5) = 0.0425/0.212132=0.2003469

d2= {In(40/40)+(0.09-0.05-0.32/2)0.5}/(0.3*√0.5) =-0.0025/0.212132=-0.0117851

C= S*e-qt * N(d1) – K*e-rt * N(d2)

P= K*e-rt * N(-d2) – S*e-qt * N(-d1)

N(0.2003469)= 0.58

N(-0.0117851)= 0.495

C=40*e-0.05*0.5 *0.58-40*e-0.09*0.5 *0.495

C=40*0.975*0.58-40*0.956*0.495

C=22.62-18.93

C=3.69

Example 4- European call option on that is two months from maturity the current value of index is 930, the exercise price is 900, the risk free interest rate is 8% per annum and the volatility of the index is 20% per annum. Dividend yields of 0.2% and 0.3% are expected in the first month and the second month.

Solution- respectively in this case,

S= 930, K=900, r=0.08, t=2/12=0.166, σ=0.2

The total dividend yield during the option life=0.2%+0.3%=0.5%

So per annum dividend yield=0.5%*12/2=3%

So dividend yield, q= 0.03

d1= {In(930/900)+(0.08-0.03+0.22/2)0.166}/(0.2*√0.166) = 0.0444098/0.081486=0.544999

d2= {In(930/900)+(0.08-0.03-0.22/2)0.166}/(0.2*√0.166) =0.544999-0.081486 =0.46351

C= S*e-qt * N(d1) – K*e-rt * N(d2)

P= K*e-rt * N(-d2) – S*e-qt * N(-d1)

N(0.544999)=0.7071

N(0.46351)=0.6785

C=930*e-0.03*0.166 *0.7071-900*e-0.08*0.166 *0.6785=930*0.995*0.7071-900*0.9868*0.6785=654.315-602.589=51.726

So one contract could cast=51.73*No. Of share in one contract

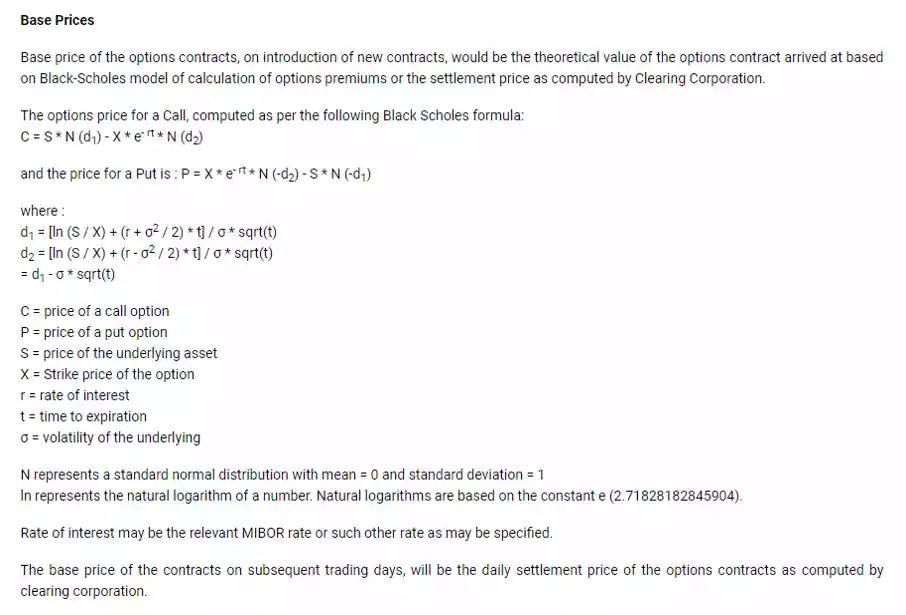

Base prices and time to expiration from NSE India:

Option price comparison with option chain:

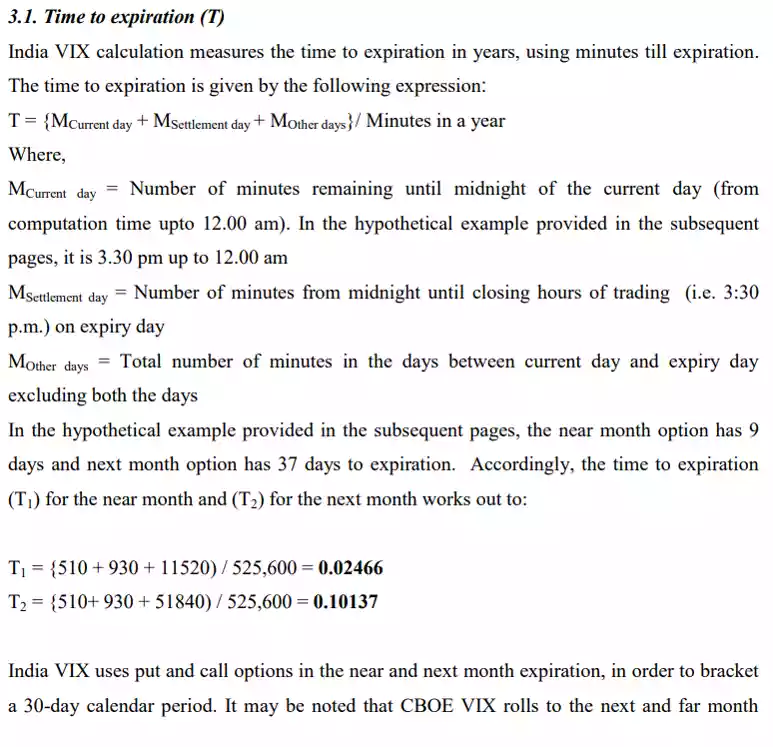

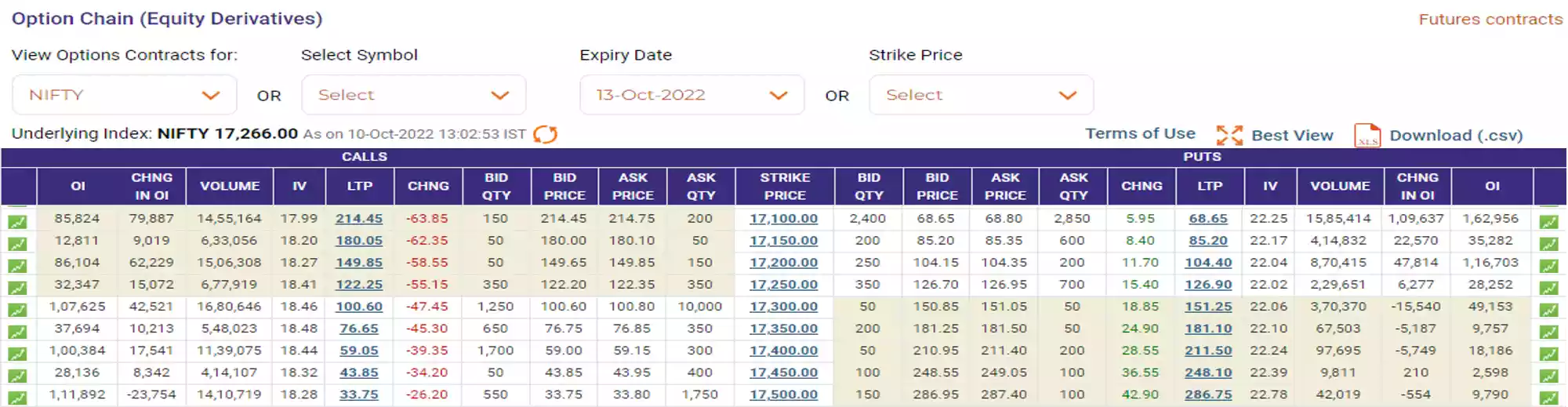

Example- Option chain data-

S=17266, K=17250, Call, IV=0.1841, Put, IV=0.2202, t=3/365=0.008219, r= 0.1 Call value=122.25, put value=126.90

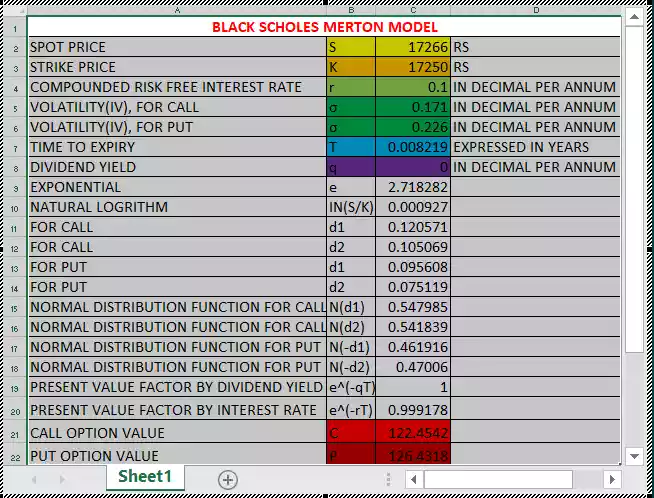

Solution- Calculated by excel:

Why difference– Actually difference is very less but I do not know, I am assuming that value of implied volatility calculated by reverse method so may be reason for this difference.

First time when option contract created that time premium is calculated by black Scholes model formula with annualized volatility of underlying asset.

But after that premium vary due to demand and supply so volatility known as implied volatility calculated by reverse method (iteration method) so IV show in option chain is calculated by iteration method with option premium etc.

Put call parity:

While we are discussing the topic on option pricing, it perhaps makes sense to discuss ‘put call parity’ (PCP), PCP is a simple mathematical equation which states-

Put value + spot price = present value of strike price(invested to maturity) + call value

The equation holds assumptions-

- Both the put and call are ATM options

- The options are European

- They both expire at the same time

- The options are held till expiry

If, put value= P

Spot price= S

Strike price= K, So present value of strike= K*e-rt

Call value= C

Then PCP formula, P + S = K*e-rt + C

Realize if you hold the present value of the strike and hold the same to maturity, you will get the value of strike itself, hence the formula is-

Put options value + spot price = strike price + call options value

P + S = K + C

Means put call parity states that the pay off from a put option value plus the spot price equals the pay off from call option value plus the strike price.

Example-

100(PE- buy at strike price 100)+100(in spot market buy share)=100(hold cash equivalent to strike price)+100(CE- buy at strike 100)

If market down 20Rs on expiry

Then, 20+80=100+0

If market up 20Rs on expiry

Then, 0+120=100+20

Arbitrage:

Price difference of underlying asset in one market to another market known as arbitrage. Black Scholes Merton model option pricing formula designed for non arbitrage opportunity but in actual options life sometimes we get arbitrage opportunity due to mispricing of options by demand and supply so for this we get arbitrage opportunity to take advantage.

If, P + S ≠ K + C, Either P+S>K+C Or P+S<K+C

If you did not get equal put pair and call pair then means you have to get arbitrage opportunity, in this situation you have to make money by arbitrage method how?

Explanation-

If, P + S = K + C (Non arbitrage opportunity)

P + S > K + C (Arbitrage opportunity)

Or

P + S < K + C (Arbitrage opportunity)

P+S (Understand as a put pair or put market)

K+C (Understand as a call pair or call market)

Arbitrage example when P+S>K+C:

Put pair- put option price at strike 17250 + spot price(S)=126.90+17266=17392.90

Call pair- call option price at strike 17250 + strike price(K)=122.25+17250=17372.25

Now put pair does not equal to call pair so we get arbitrage opportunity for advantage price=17392.90-17372.25=20.65 Rupees per share.

P+S(17392.90)>C+K(17372.25)

P+S>K+C

so, sell put pair and buy call pair, for K consider as a 0% interest rate coupon bond

Suppose on expiry nifty go up, go down or will be same lets calculate for all scenario-

Nifty go up- Nifty price on expiry 17550

P&L, Put pair- {+126.90-max(0,K-S)}+(spot sell price-spot buy price), Call pair- {-122.25+max(0,S-K)}+(bond sell price-bond buy price)

P&L, Put pair- {126.90-max(0,17250-17550)}+(17266-17550), call pair-{-122.25+max(0,17550-17250)}+(17250-17250)

P&L, Put pair-: 126.90+(-284), Call pair-: 177.75+0

P&L, Put pair= -157.10, Call pair= +177.75

P&L= Put pair P&L + Call pair P&L= -157.10+177.75=20.65/-Rupees

Nifty go down- Nifty price on expiry 16950

P&L, Put pair- {+126.90-MAX(0,K-S)}+(Spot sell price-spot buy price), call pair- {-122.25+max(0,s-k)}+(bond sell price-bond buy price)

P&L, Put pair- {126.90-max(0,17250-16950)}+(17266-16950), Call pair- {-122.25+max(0,16950-17250)}+(17250-17250)

P&L, Put pair-: -173.10+316, Call pair-: -122.25+0

P&L, Put pair= 142.90, Call pair= -122.25

P&L= Put pair P&L + Call pair P&L= 142.90-122.25=20.65/-Rupees

Nifty will be same- Nifty price on expiry 17266

P&L, Put pair- {+126.90-max(0,K-S)}+(spot sell price-spot buy price), Call pair- {-122.25+max(0,S-K)}+(bond sell price-bond buy price)

P&L, Put pair- {126.90-max(0,17250-17266)}+(17266-17266), Call pair-{-122.25+max(0,17266-17250)}+(17250-17250)

P&L, Put pair-: 126.90+0, Call pair-: -106.25+0

P&L, Put pair= 126.90, Call pair= -106.25

P&L= Put pair P&L + Call pair P&L= 126.90-106.25=20.65/-Rupees

Note-we know that I can not sell on spot price more than one day then what we will do?

We can use futures from futures market instead of spot market. Is it feasible? check by own self.

Arbitrage example when P+S<K+C:

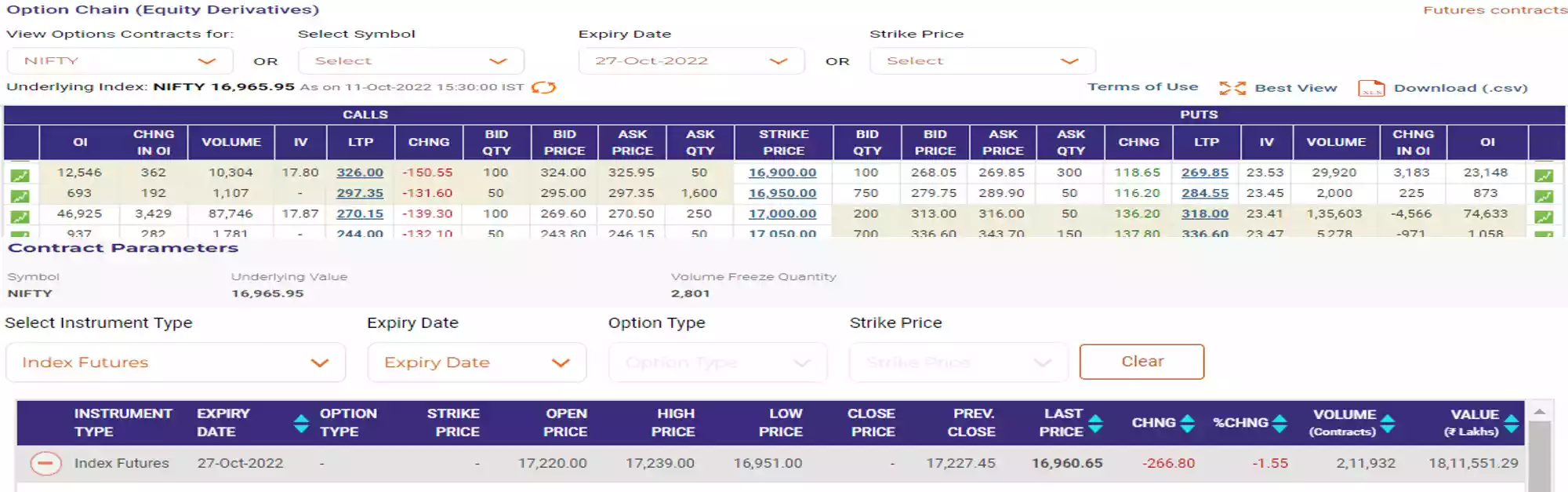

For arbitrage opportunity, P+S ≠ C+K, here S=future price of same underlying & maturity

At strike-16950, Put pair=284.55+16960.65=17245.20, Call pair=297.35+16950=17247.35, Advantage=17247.35-17245.20=2.15/-

Put pair<Call pair, so firstly, buy put pair and sell call pair, and on maturity expires nifty option and nifty future contract on a closing price of spot market on expiry day, because of on expiry settlement price will be same on expiry day closing price of nifty on spot market.

Put option price at strike 16950(284.55)+future price (16960.65)<call option price at strike 16950(297.35) + strike price (16950)

Buy(we buy put option contract and future instead of spot), sell(we sell call option contract and strike price treat as a 0% coupon bond)

3-scenario will arise on expiry(27/10/2022) nifty price goes up, goes down, or will be same

Nifty go up- Nifty price on expiry 17300

P&L, Put pair- {-284.55+max(0,k-s)}+(spot sell price-spot buy price), call pair- {+297.35+max(0,s-k)}+(bond sell price-bond buy price)

P&L, Put pair- {-284.55+max(0,16950-17300)}+(17300-16960.65), Call pair-{+297.35-max(0,17300-16950)}+(16950-16950)

P&L, Put pair-: -284.55+339.35, Call pair-: -52.65+0

P&L, Put pair= +54.8, Call pair= -52.65

P&L= Put pair P&L + Call pair P&L= +54.8-52.65=2.15/-Rupees

Nifty go down- Nifty price on expiry 16600

P&L, Put pair- {-284.55+max(0,K-S)}+(spot sell price-spot buy price), Call pair- {+297.35+max(0,S-K)}+(bond sell price-bond buy price)

P&L, Put pair- {-284.55+max(0,16950-16600)}+(16600-16960.65), Call pair-{+297.35-max(0,16600-16950)}+(16950-16950)

P&L, Put pair-: +65.45-360.65, Call pair-: +297.35+0

P&L, Put pair= -295.20, Call pair= +297.35

P&L= Put pair P&L + Call pair P&L= -295.20+297.35=2.15/-Rupees

Nifty will be same- Nifty price on expiry 16950

P&L, Put pair- {-284.55+max(0,K-S)}+(spot sell price-spot buy price), Call pair- {+297.35+max(0,S-K)}+(bond sell price-bond buy price)

P&L, Put pair- {-284.55+max(0,16950-16950)}+(16950-16960.65), Call pair-{+297.35-max(0,16950-16950)}+(16950-16950)

P&L, Put pair-: -284.55-10.65, Call pair-: +297.35+0

P&L, Put pair= -295.20, Call pair= +297.35

P&L= put pair P&L + call pair P&L= -295.20+297.35=2.15/-Rupees

Other Post: