Options contract:

An options contract is a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price, within a specified time frame. Options are commonly used as a form of investment and risk management.

There are two main types of options: call options and put options. A call option gives the holder the right to purchase the underlying asset at the strike price, while a put option gives the holder the right to sell the underlying asset at the strike price.

Table of Contents

Why options?:

In futures/forwards contract is A commitment to buy/sell the underlying and has A linear pay off, which indicates unlimited losses and profits, but options emerged as A financial instrument, which restricted the losses with A provision of unlimited profits on buy or sell of underlying asset.

What is options:

An option is A contract that gives the right, but not an obligation, to buy or sell the underlying asset on or before A stated date/day at A stated price, for A price.

Buyer/holder- the party taking a long position or buying the option is called buyer/holder of the option.

Seller/writer- the party taking a short position or selling the option is called the seller/writer of the option.

The option writer/seller has the obligation in the contract but the option buyer has the right and no obligation to buy or sell underlying asset. Therefore, option buyer/holder will exercise his option only when the situation is favorable to him, but when he decides to exercise, option writer would be legally bound to honor the contract.

Options may be categorized into two types:

1.Call options

2.Put options

Call options:

Option which gives buyer A right and no obligation to buy the underlying asset is called call option. But in the case of option writer (seller) has obligation to sell the underlying asset for contract honor when option buyer decides to exercise.

Put Options:

Option which gives buyer a right to sell the underlying asset is called put option. But in the case of option writer/seller has obligation to buy the underlying asset for contract honor when option buyer decides to exercise.

Example- the definition of call options and put options is very confusing here, we will discuss both by an example before discuss an example we know basic difference of call options and put options.

Call options means buying or selling the increasing market and put options means buying or selling decreasing market.

What is options and options history:

History of options market:

The options market makes up for A significant part of the derivative market, particularly in India, Internationally, the option market has been very popular here is A quick background on the same-

-Custom options were available as over the counter (OTC) since the 1920’s these options were mainly on commodities.

-Options on equities began trading on the Chicago board options exchange (CBOE) in 1972.

-Options on currencies and bonds began in late 1970’s these were again OTC trades.

-Exchange-traded options on currencies began on Philadelphia stock exchange in 1982.

-Interest rate options began trading on the CME in 1985.

Indian derivative markets:

-June 12th 2000- index futures were launched.

-June 4th 2001- index options were launched.

-July 2nd 2001- stock options were launched.

-November 9th 2001- single stock futures were launched.

Example of an options contract:

For example of an option contract as I know that option contracts have two categories call options and put options. So here I will discuss call option example and put option example with detail explanation with example of stock/index related underlying assets options contract.

Example an a perspective of increasing market (call options):

Consider situation there are two parties, Mr. A and Mr. B, Mr. A want to buy a 1acre land. Mr. B holds (own) a 1acre land outside of Lucknow city at the price of 5lakh rupees.

Due to outside of city there is no perspective for growth so Mr. A buyer hesitate to buy that land but there is a some government proposal to go highway near land within 6 months so price of land will be increase on highs.

Mr. A thinking if government proposal cancel then he will get loss so Mr. A make a clever agreement with Mr. B that I will give you a 1lakh rupees as a token money for promise price of 1 acre land is 5lakh rupees for a six month period. Mr. B agree and deal done. Now 3 scenario will come within 6-months-

Scenario 1- highway proposal executed and land price goes up:

Land price go up in a favor of Mr. A so due to agreement right he will execute the agreement.

Suppose that now 1acre land price is- 10lakh rupees

Mr. A given a token money- 1lakh rupees

According to agreement promise price of land- 5lakh rupees

So, Mr. A cost of 1 acre land- 6lakh rupees

So, profit to Mr. A =10 – 6 =4lakh rupees

Due to agreement honor Mr. B loss occur for 4lakh rupees.

Scenario 2- price goes down due to cancel of highway project:

Now 1acre land price is 3lakh rupees now Mr. A (buyer) has a right to execute or not execute to price of land. Why he has got right because of he has given token money which one is non refundable for 6 month period. So he has got right to not exercise.

So loss to Mr. A- 1lakh rupees

Profit to Mr. B- 1lakh rupees

Scenario 3- price remain unchanged due to highway project extended for next 6 months:

Then, in this situation, is Mr. A execute agreement?

Obviously no because of land price still unchanged so Mr. A loss happen- 1lakh rupees

And Mr. B profit- 1lakh rupees.

Example an a perspective of decreasing market (put options):

Mr. B own a 1acre property in a Lucknow city near a it hub but due to government proposal to shift within 6 month, IT hub at a remote area. So Mr. B is thinking that after shifting of it hub 1acre property price go down. But condition if not shift then make a loss so he want a agreement on a basis of right if price go down then execute the agreement and sell the property.

Mr. A agree for that receive a token money of 1lakh rupees for a promise price of property rupees 5 lakh. So like this Mr. B make a clever deal here Mr. B is a contract agreement as a buyer and Mr. A is a agreement writer/seller. Mr. B has taken a right not obligation to give a token money to Mr. A for 6 month period. Now 3 scenario will overcome after 6month period.

Scenario 1- IT hub shifted, property price go down at rupees 2lakh of 1acre land:

So, Mr. B has a right to sell a property and Mr. A has a obligation to buy a property.

So Mr. B property sell price =promise price-token money=5-1 =4lakh rupees

Mr. A buying price of property =2lakh rupees

So Mr. B profit =4-2 =2lakh rupees

Mr. A loss=2+1-5= 2lakh rupees.

Scenario 2- price go up due to cancel of shifting proposal of IT hub:

In this case Mr. B has right to not exercise. So

Loss of Mr. B= 1lakh rupees (token money)

Profit of Mr. A= 1lakh rupees (received token money)

Scenario 3- price unchanged due to shifting proposal of IT hub extended for next 6months:

In this case also Mr. B not exercise the price of property. So

Mr. B loss= 1lakh rupees.

Mr. A profit= 1lakh rupees.

Example related to stock/index options:

You suppose that current stock price is 100 rupees in a perspective of increasing market (call options) two parties involved make a contract Mr. A and Mr. B, Mr. A is a thinking that price go up in a 1month time period and Mr. B thinks price go down or a same price in a 1month period. Both parties have own thinking and calculation. Now for buying a stock option contract for a price 100 rupees seller demand a premium of 10 rupees.

But in a favor of buyer one contract getting a 17 rupees of a premium for a price of 90 rupees for underlying price of 100 rupees.

In a favor of seller one option contract getting a premium of 7 rupees for a price of 110 rupees for underlying asset (stock/index) price of 100 rupees.

In three option contracts suppose both party agree to 100 rupees of contract price with a 100 rupees of underlying price at a 10 rupees advance money/token money/premium which is not refundable for 1month contract period.

Now three scenario will overcome after 1 month, price go up, price go down, price unchanged.

Scenario 1- price go up at rupees of 120/- in a 1 month:

Mr. A is buyer and take a option contract by paying 10 rupees premium to seller Mr. B for getting right of exercise.

Mr. A profit= 120-100-10 =10 rupees

Loss to Mr. B =100+10-120 =10 rupees

Scenario 2- price go down in a 1month at a 80 rupees:

In this situation Mr. A has right to not exercise

So Mr. A loss =10 rupees

Mr. B profit =10 rupees

Scenario 3- price unchanged in a 1month same as 100 rupees:

Mr. A right to not exercise

Mr. A loss =10 rupees

Mr. B profit =10 rupees

After view of example we have understood some points of option contracts:

- Price buyer (option contract buyer) make profit when price goes up in the case of call options and price buyer (option contract buyer) make profit when price goes down in the case of put options.

- In the case of option seller/writer two scenario favor in call options price go down or same. In put options price go up or same in a time frame.

- Option contract buyer has always right to for exercise of price or not to exercise.

- Option seller has an obligation to exercise if buyer decide to exercise.

- Agreement between buyer and seller called an option agreement.

Options terminology:

We will discuss options terminology of option contract with the help of above example.

Stock options- stock price- 100/-

Contract period- 1 month

Mr. A- buyer

Mr. B- seller

Price for option contract available- 100, 90, 110

Premium for option contract- 10rs for 100rs, 17rs for 90rs, 7rs for 110rs option contract.

Instrument type- stock options

Instrument type:

By name of underlying asset type known as instrument type like as, stock options, index options.

Index options:

These options have index as the underlying asset. For example options on nifty, Sensex, bank nifty etc.

Stock options:

These options have individual stocks as the underlying asset. For example option on ONGC, NTPC, Reliance, Aarti, TCS, Infosys etc.

Underlying asset:

Option contracts which mimics the price of securities that securities known as underlying asset or the underlying asset is whichever asset the option contract is deriving its value from that. As- Nifty, bank nifty, TCS, Infosys etc.

Buyer of an option:

The buyer of an option is one who has a right but not the obligation in the contract. For owning this right, he pays a price to the seller of this right called “option premium” to the option seller.

Writer of an option:

The writer of an option is one who receives the option premium and is there by obliged to sell/buy the asset if the buyer of option exercises his right.

American option:

The owner of such option can exercise his right at any time on or before the expiry date/day of the contract.

European option:

The owner of such option can exercise his right only on the expiry date/day of the contract. He can exercise before expiry only on the premium difference. In India options are European.

Options have two types- call European (CE) and put European (PE)

Option price/premium:

It is the price which the option buyer pays to the option seller. Generally premium shows on quote is single size so for total premium is equal to premium multiply by lot size.

Lot size:

Lot size is the number of units of underlying asset in a contract.

Underlying price/spot price:

A derivative contract derives its value from an underlying asset. The underlying price is the price at which the underlying asset trades in the spot market it is also known as spot price.

Expiration day:

The day on which a derivative contract ceases to exist. It is the last trading date/day of the contract. In fact both futures and options contracts expire on the last Thursday of every month.

Strike price or exercise price:

Consider the strike price as the anchor price at which the two parties (buyer & seller) agree to enter into an options agreement.

Contract cycle:

Time difference between starting date of contract to expiry date of contract known as contract cycle/time cycle of option/futures contract. Due to time cycle its known as weekly option, monthly option etc.

Exercise date:

The date on which the option is actually exercised is called the exercise date. For European options, the exercise date is the same as the expiration date. And for American options, the options contract may be exercised any date between the purchase of the contract and its expiration date.

Open interest:

Open interest is the total number of derivatives(futures or options) contracts outstanding in the market at any given point of time. It is the total number of F&O contracts that are not closed or delivered on a particular day.

Volumes:

Volumes are the quantity traded for a specific period and gives us an idea about the activity for that given period. Volumes always increase by no. 1 if 1 buy and 1 sell done in both case of new contract open position or offset position but in open interest, increase if a open position of contract done but in offset position in decrease.

Moneyness of an option contract:

In the money (ITM) options:

This option would give holder a positive cashflow it it were exercised immediately on the base of contract buyer/holder.

At the money (ATM) options:

At the money options would lead to zero cash flow if it were exercised immediately on the base of contract buyer.

Out of the money (OTM) options:

This option would give the holder a negative cash flow if it were exercised immediately.

| Comparison | Call options | Put options |

| ITM | Strike price<spot price | Strike price>spot price |

| ATM | Strike price=spot price | Strike price=spot price |

| OTM | Strike price>spot price | Strike price<spot price |

Intrinsic value:

Option premium, consists of two components- intrinsic value and time value.

For an option, intrinsic value is the difference of strike price and spot price.

For call option intrinsic value= spot price-strike price

For put option intrinsic value= strike price-spot price, in the case of ITM options.

For ATM & OTM options case both call and put options intrinsic value is equal to zero why?

In the ATM case strike price is equal to spot price so difference is zero.

In the OTM case always difference is negative cash flow in the negative cash flow we are hedged by pay premium so it is also equivalent to zero value.

Time value:

It is the difference between premium and intrinsic value of an option but in the case of ATM & OTM options intrinsic value is zero so time value is equal to premium.

Options settlement:

Option settlement done on the expiry of option contract by the closing price of underlying asset in spot market with deduction of strike price and brokerage+-premium if you want to settle before expiry then premium difference will be settlement value of your option contracts also known as profit and loss of your premium difference in a European options only.

All options contracts are settled in cash on the expiration date. Where as for single stock contracts settled via delivery by your consent on expiry.

Margin payable in options:

When you buy an option contract you don’t need to pay a margin as your loss is limited. You need to pay a premium amount your loss will be limited to the value of premium. When you sell an options contract you need to pay a margin requirement as there is a chance of unlimited loss and limited profit. So you need to maintain the margin amount as decided by the exchange.

Leverage:

An option buyer pays a relatively small premium for market exposure in relation to the contract value. An option seller pays a margin money for holding period like as a future contract and get exposure to the contract value.

Opening a position:

An opening transaction is one that adds to or creates a new trading position it can be either a purchase or a sale with respect to an option transaction.

Closing a position:

A closing transaction is one that reduces or eliminates an existing position by an appropriate offsetting purchase or sale. This is also known as “squaring off” your position or ‘covering’ a position.

Covered calls:

A call option position that is covered by an opposite position in the underlying instrument (for example- share, commodities etc.) is called a covered call.

Naked calls:

Naked calls are there is no opposite position in the underlying or futures known as naked calls.

The significant differences in futures and options are as under:

- Futures are agreements/contracts to buy or sell a specified quantity of the underlying assets at a price agreed upon by the buyer and seller on or before a specified time. Both the buyer and seller are obligated to buy/sell the underlying asset in the case of options the buyer enjoys the right and not the obligation to buy or sell the underlying asset.

- Futures contracts have a symmetric risk profile for both the buyer as well as the seller where as options have an asymmetric risk profile. In case of options for a buyer or holder of the options the downside is limited to the premium (option price) he has paid while the profits may be unlimited. For a seller or writer of an option however, the downside is unlimited while profits are limited to the premium he has received from the buyer.

- The futures contracts prices are affected mainly by the prices of the underlying asset the prices of options are however, affected by prices of the underlying asset, time remaining for expiry of the contract, interest rate and volatility of the underlying asset.

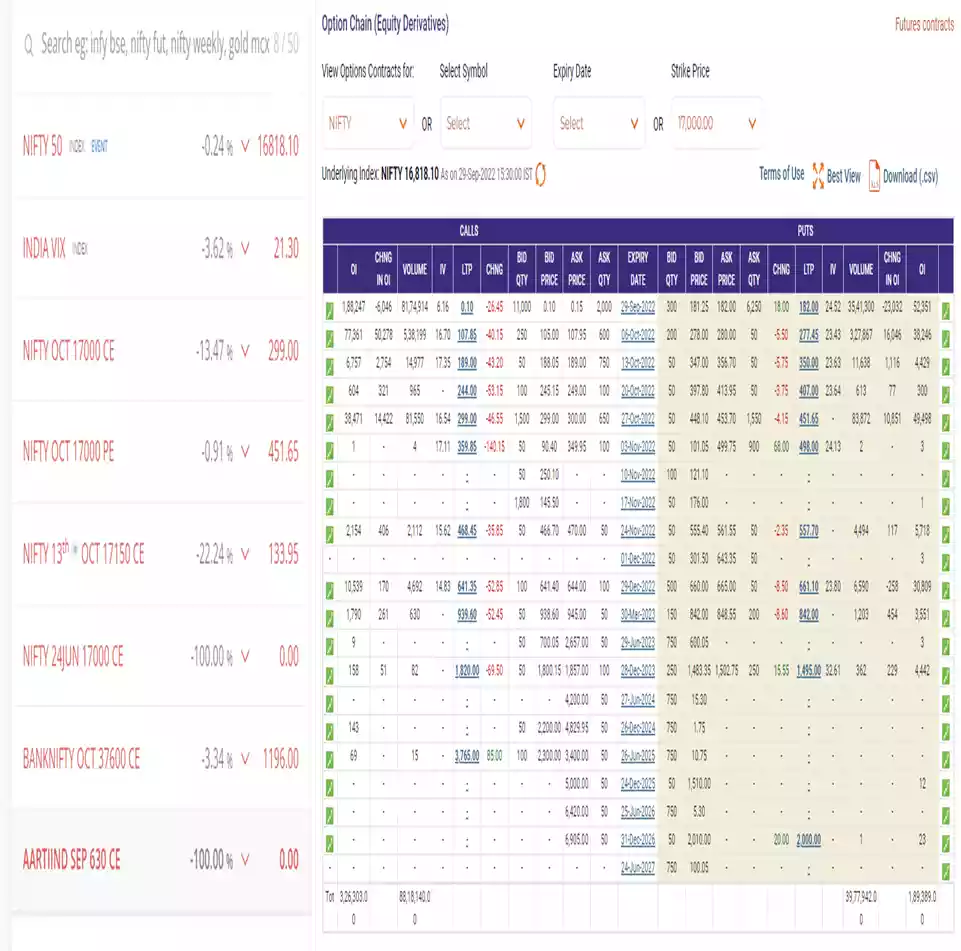

Types of options contract available on exchange:

| Underlying asset name (Index symbol name/Co. Symbol name) | Month name symbol or week expiry date & month symbol or year last two digit & month symbol | Strike price | CE/PE (Ce-call European, PE-put European |

Now if you want nifty 50 index futures on your trading platform so go on watch list search option and write-

For nifty 50 underlying-

1.NIFTY OCT 17000 CE (monthly option contract)

2.NIFTY OCT 17000 PE

3.NIFTY 13th OCT 17150 CE (weekly option contract)

4.NIFTY 24June 17000 CE ( half yearly option contract)

For underlying nifty bank futures-

BANKNIFTY OCT 37600 CE

For equity stock underlying-(Aarti industries limited) stock futures

AARTIIND SEP 630 CE

Types of options contract available on exchange source and snapshot:

Source- https://kite.zerodha.com/

Source- https://www.nseindia.com/option-chain

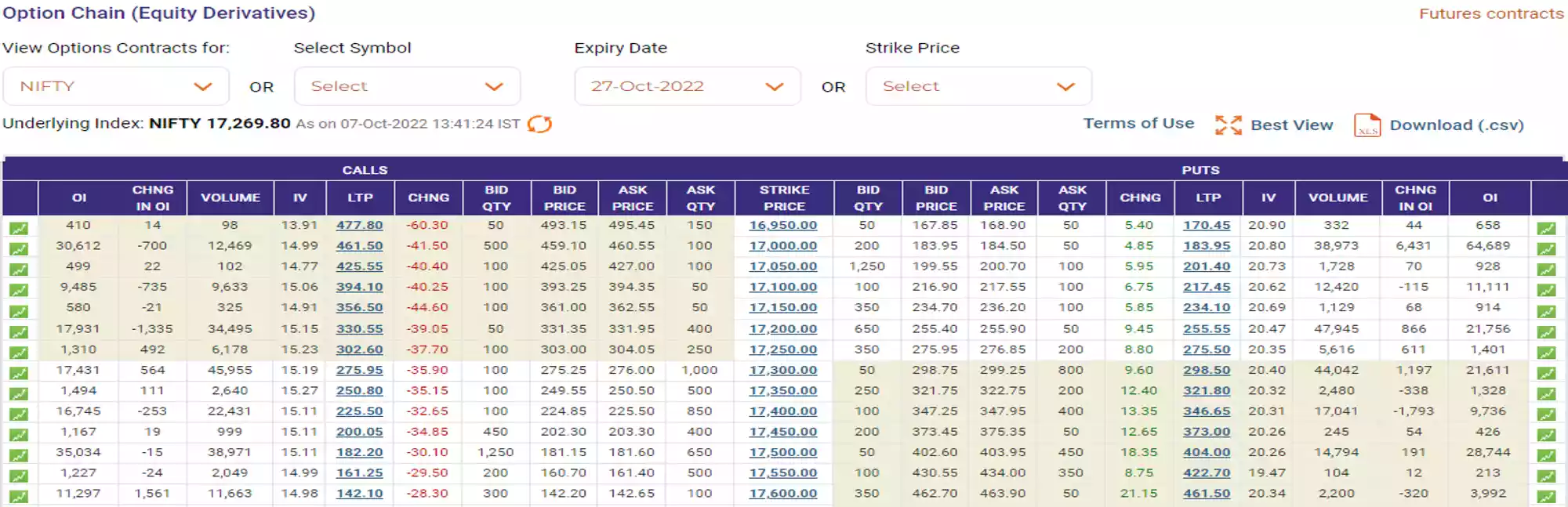

Moneyness of option contracts:

The moneyness of an option contract is a classification method where in each option strike gets classified as either- in the money(ITM), at the money(ATM), or out of the money(OTM) options, the classification helps the trader to decide which strike to trade, given a particular circumstances in the market. Before, go in detail know intrinsic value-

1.Intrinsic value of an option is the amount of money you would make if you were do exercise the option contract.

2.Intrinsic value on an options contract can never be negative it can be either zero or a positive number.

3.Call option intrinsic value= spot price – strike price

4.Put option intrinsic value= strike price – spot price

Moneyness of a call option:

Moneyness of an option is a classification method which classifies each option strike based on how much money a trader is likely to make if he were to exercise his option contract today. There are 3 broad classification-

1.In the money(ITM)

2.At the money(ATM)

3.Out of the money(OTM)

For practical purpose add 2 more classification-

4. Deep in the money (deep ITM)

5. Deep out of the money (deep OTM)

Understanding these option strike classification is very easy. All you need to do is figure out the intrinsic value. If the intrinsic value is a non zero number then the option strike is considered ‘in the money’ if the intrinsic value is a zero the option strike is called ‘out of the money’ the strike which is closest to the spot price is called ‘at the money’ let us take up an example to understand this well.

As on date (07/10/2022) Nifty October option contract option chain snapshot is below:

NSE presents ITM options with a pale yellow background and all OTM options have a regular white background. Deep ITM & OTM options no any hard rule you have to choose deep ITM < ATM strike – ATM premium, deep OTM > ATM strike + ATM premium.

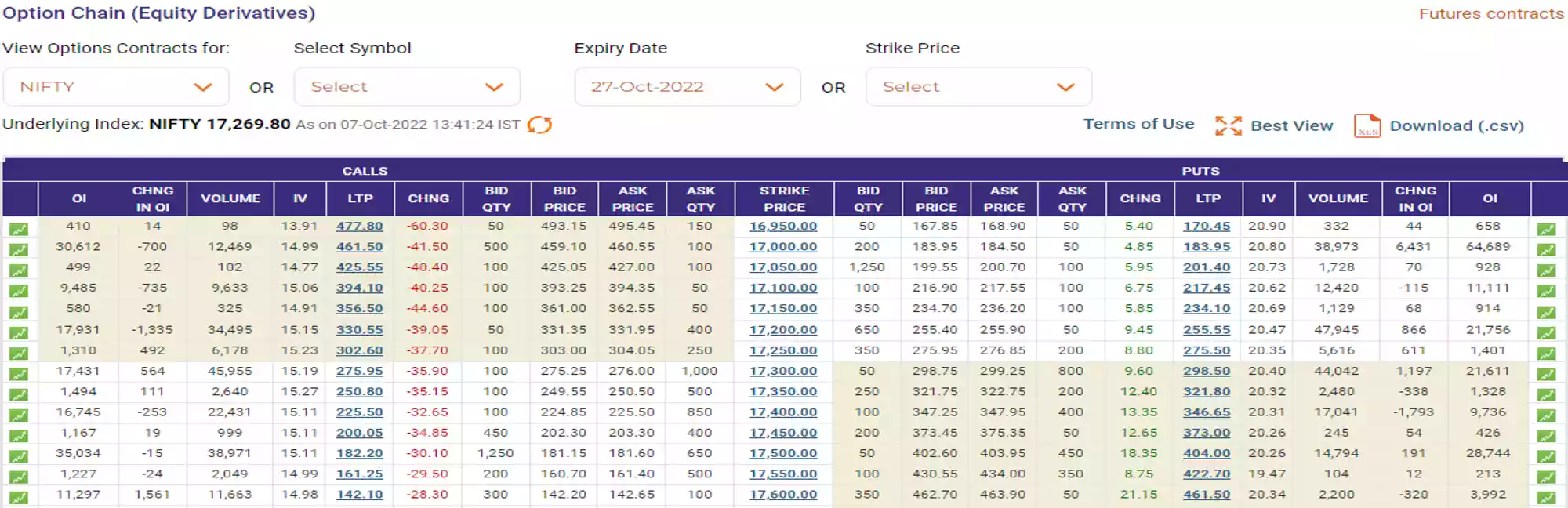

Moneyness of a put option:

Same exercise like moneyness of a call option put on date (7/10/22) a snapshot of option chain from NSE website and discuss according to intrinsic value of put option in various strike values,

Intrinsic value= strike price – spot price

1.All strikes higher than ATM options are considered ITM options

2.All strikes lower than ATM options are considered OTM options

Summary of call & put option:

| Summary points | Call option buyer | Call option seller | Put option buyer | Put option seller |

| Directional view | Bullish | Flat or bearish | Bearish | Flat or bullish |

| Position known as | Long call | Short call | Long put | Short put |

| Other alternative | Buy future, buy spot | Sell future | Sell future | Buy future, buy spot |

| Premium | Pay | Receive | Pay | Receive |

| Intrinsic value | Max{0,spot price-strike price) | Max{0,spot price-strike price) | Max{0,strike price-spot price} | Max{0,strike price-spot price} |

| P&L | Intrinsic value-premium paid | Premium received-intrinsic value | Intrinsic value-premium paid | Premium received-intrinsic value |

| Profit | Unlimited | Limited | Unlimited | Limited |

| Loss | Limited | Unlimited | Limited | Unlimited |

| Break even point | Strike price + premium paid | Strike price + premium received | Strike price-premium paid | Strike price-premium received |