What is put ratio in spread option strategy?

Put ratio is the ratio of leg 2(higher strike) quantity and leg 1(lower strike) quantity. So, Put Ratio= Leg 2 Quantity/Leg 1 Quantity. Ensure that put ratio should be less than 0.67. Leg 1 quantity= 2*leg 2 quantity, or leg1 quantity= 1.5*leg 2 quantity.

Generally, in spread option strategy, the positional quantity of leg 1(LK) and leg 2(HK) is equal whether it is bull put spread option strategy or bear put spread option strategy, but in put ratio spread option strategy, the quantity of leg 2(HK) will be half of the quantity of leg 1(LK) or Will be two thirds. Similarly, in put ratio back spread, the quantity of leg 2(HK) and leg 1(LK) also have the same ratio like put ratio spread option strategy but the buying and selling positions are opposite.

Table of Contents

Put ratio spread option strategy:

The Put Ratio Spread option strategy is applicable when participants (traders/investors) place limits on an underlying asset price which means to be sideways on the underlying asset price (stock or index). It means to say that the spot price will neither rise much nor fall much within the time frame (expiry time). When you implement the put ratio spread option strategy, you get limited profit within the range and unlimited loss if the market moves below the range and limited loss if the market (spot price) moves above the range.

Strategy notes for a put ratio spread option strategy:

The put ratio spread option strategy is a 2 leg option strategy with different quantity as it involves buying one or two ATM (higher strike) put options and selling two or three OTM (lower strike) put options.

To implement put ratio spread-

Leg 1- Sell 2-OTM (LK-lower strike) put option

Leg 2- Buy 1-ATM (HK-higher strike) put option

Or

Leg 1- Sell 3-OTM (LK-lower strike) put option

Leg 2- Buy 2-ATM (HK-higher strike) put option

When take positions ensure that both leg option contracts should be same underlying asset, same expiry date, and with different quantity of options. Also ensure that when you take position in both leg then take position in both leg same time.

Example of put ratio spread option strategy:

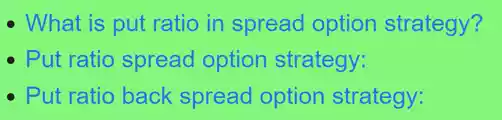

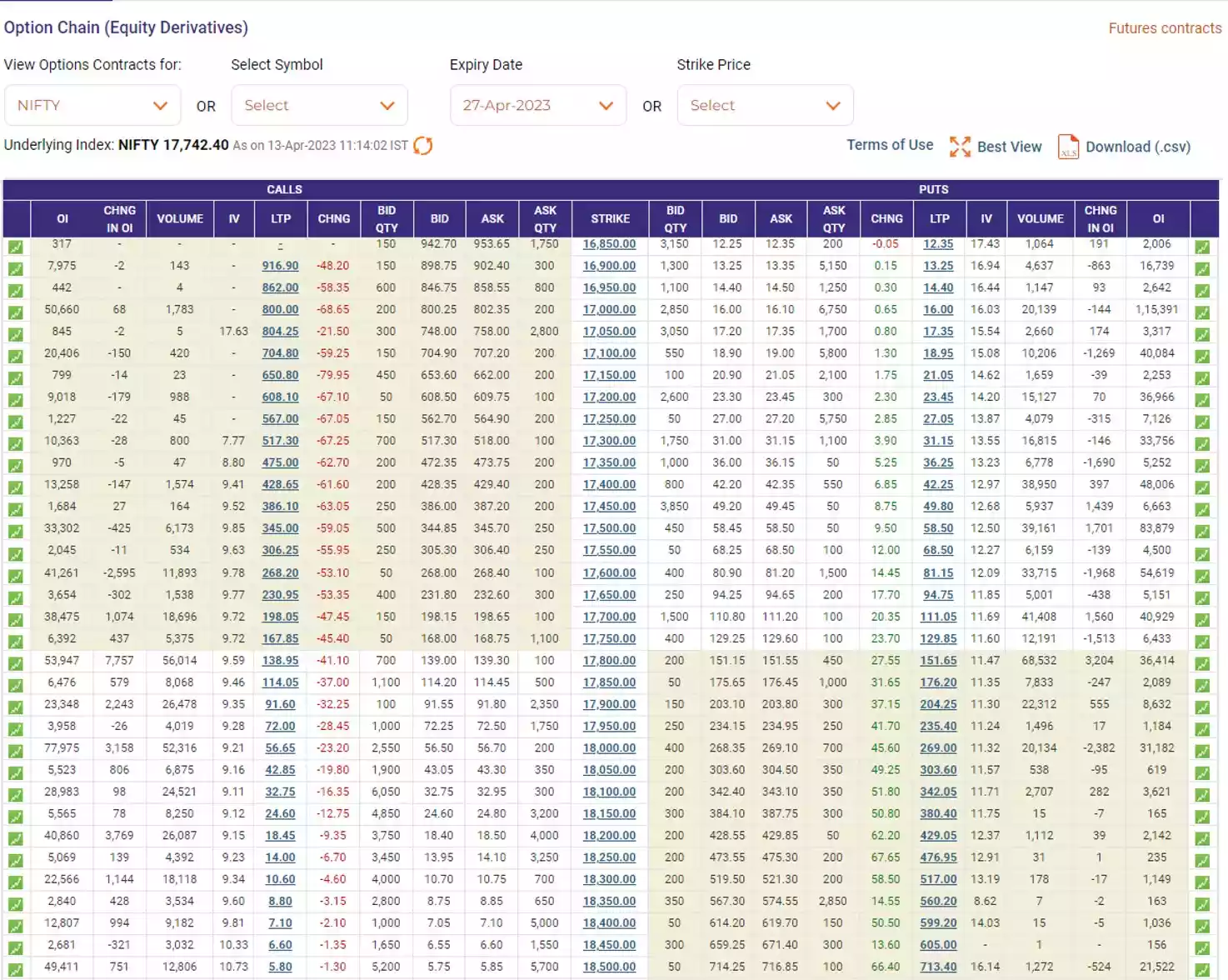

For a example of put ratio spread option strategy, we are taking Nifty options contract.

Option contract- Nifty 27Apr … PE

Today’s date- 13/04/2023

Expiry date- 27/04/2023

Expiry days= expiry date – todays date= 14days

Underlying asset- Nifty 50

Directional view/outlook- Sideways

Spot price (S)- 17742/-

Annual historical volatility- 20%

Lower range (2SD)= 17742-2*17742*(20/100)*√(14/365)= 16352.12./-

Spread and strike price selection for a put ratio spread option strategy:

In the table below, we will look at different spreads and different strike combinations to see which one is better. And also we will compare with put ratio of 0.5 and 0.667.

For spread= 100, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17600 | 17650 | 17700 | 17750 |

| 1-HK | 17700 | 17750 | 17800 | 17850 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PR | 81.15 | 94.75 | 111.05 | 129.85 |

| HK-PP | 111.05 | 129.85 | 151.65 | 176.20 |

| Net debit/credit (-PP+2*PR) | +51.25 | +59.65 | +70.45 | +83.50 |

| Max loss (at lower range=16352.12) | -1096.63 (unlimited) | -1138.23 (unlimited) | -1177.43 (unlimited) | -1214.38 (unlimited) |

| Max profit | 151.25 | 159.65 | 170.45 | 183.50 |

| Lower break even point | 17448.75 | 17490.35 | 17529.55 | 17566.5 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 7.25 | 7.13 | 6.91 | 6.62 |

| Remarks | risk reward ratio is very high | looks like moderate | break even point is very close to spot price | break even point is very close to spot price |

N/A means Not Applicable, the lower break even point will not apply when the strike combination creates a net credit.

According to above table, best combination is 2-OTM+1-ATM.

For spread= 100, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17600 | 17650 | 17700 | 17750 |

| 2-HK | 17700 | 17750 | 17800 | 17850 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PR | 81.15 | 94.75 | 111.05 | 129.85 |

| HK-PP | 111.05 | 129.85 | 151.65 | 176.20 |

| Net debit/credit (-2*PP+3*PR) | +21.35 | +24.55 | +29.85 | +37.15 |

| Max loss (at lower range=16352.12) | -1026.53 (unlimited) | -1073.33 (unlimited) | -1118.03 (unlimited) | -1160.73 (unlimited) |

| Max profit | 221.35 | 224.55 | 229.85 | 237.15 |

| Lower break even point | 17378.65 | 17425.45 | 17470.15 | 17512.85 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 4.64 | 4.78 | 4.86 | 4.89 |

| Remarks | looks like moderate | risk reward ratio is very high | break even point is very close to spot price | break even point is very close to spot price |

According to above table, best combination is 3-OTM+2-OTM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the net credit is less. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

For spread= 200, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17500 | 17550 | 17650 | 17750 |

| 1-HK | 17700 | 17750 | 17850 | 17950 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PR | 58.50 | 68.5 | 94.75 | 129.85 |

| HK-PP | 111.05 | 129.85 | 176.20 | 235.40 |

| Net debit/credit (-PP+2*PR) | +5.95 | +7.15 | +13.3 | +24.3 |

| Max loss (at lower range=16352.12) | -941.93 (unlimited) | -990.73 (unlimited) | -1084.58 (unlimited) | -1173.58 (unlimited) |

| Max profit | 205.95 | 207.15 | 213.3 | 224.30 |

| Lower break even point | 17294.05 | 17342.85 | 17436.70 | 17525.7 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 4.57 | 4.78 | 5.08 | 5.23 |

| Remarks | looks like moderate | risk reward ratio is very high | break even point is very close to spot price | break even point is very close to spot price |

According to above table, best combination is 2-OTM+1-OTM.

For spread= 200, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17500 | 17550 | 17650 | 17750 |

| 2-HK | 17700 | 17750 | 17850 | 17950 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PR | 58.50 | 68.5 | 94.75 | 129.85 |

| HK-PP | 111.05 | 129.85 | 176.20 | 235.40 |

| Net debit/credit (-2*PP+3*PR) | -46.6 | -54.2 | -68.15 | -81.25 |

| Max loss (at lower range=16352.12) | -794.48 (unlimited) | -852.08 (unlimited) | -966.03 (unlimited) | -1079.13 (unlimited) |

| Max profit | 353.40 | 345.80 | 331.85 | 318.75 |

| Lower break even point | 17146.60 | 17204.2 | 17318.15 | 17431.25 |

| Upper break even point | 17676.70 | 17722.90 | 17815.925 | 17909.375 |

| Risk/reward ratio | 2.25 | 2.46 | 2.91 | 3.38 |

| Remarks | looks like moderate | risk reward ratio is very high | break even point is very close to spot price | break even point is very close to spot price |

According to above table, best combination is 3-OTM+2-slightly OTM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the net debit is less. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

For spread= 300, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17400 | 17450 | 17600 | 17750 |

| 1-HK | 17700 | 17750 | 17900 | 18050 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PR | 42.25 | 49.8 | 81.15 | 129.85 |

| HK-PP | 111.05 | 129.85 | 204.25 | 303.6 |

| Net debit/credit (-PP+2*PR) | -26.55 | -30.25 | -41.95 | -43.9 |

| Max loss (at lower range=16352.12) | -774.43 (unlimited) | -828.13 (unlimited) | -989.83 (unlimited) | -1141.78 (unlimited) |

| Max profit | 273.45 | 269.75 | 258.05 | 256.1 |

| Lower break even point | 17126.55 | 17180.25 | 17341.95 | 17493.9 |

| Upper break even point | 17673.45 | 17719.75 | 17858.05 | 18006.1 |

| Risk/reward ratio | 2.83 | 3.07 | 3.84 | 4.46 |

| Remarks | looks like moderate | risk reward ratio is very high | break even point is very close to spot price | break even point is very close to spot price |

According to above table, best combination is 2-OTM+1-slightly OTM.

For spread= 300, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17400 | 17450 | 17600 | 17750 |

| 2-HK | 17700 | 17750 | 17900 | 18050 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PR | 42.25 | 49.8 | 81.15 | 129.85 |

| HK-PP | 111.05 | 129.85 | 204.25 | 303.6 |

| Net debit/credit (-2*PP+3*PR) | -95.35 | -110.3 | -165.05 | -217.65 |

| Max loss (at lower range=16352.12) | -543.23 (unlimited) | -608.18 (unlimited) | -812.93 (unlimited) | -1015.53 (unlimited) |

| Max profit | 504.65 | 489.7 | 434.95 | 382.35 |

| Lower break even point | 16895.35 | 16960.3 | 17165.05 | 17367.65 |

| Upper break even point | 17652.325 | 17694.85 | 17817.475 | 17941.175 |

| Risk/reward ratio | 1.08 | 1.24 | 1.87 | 2.66 |

| Remarks | looks like moderate | risk reward ratio is very high | break even point is very close to spot price | break even point is very close to spot price |

According to above table, best combination is 3-OTM+2-slightly OTM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the net debit is less. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

Put ratio is not the main point of discussion if the spot price will move lower in near term then higher put ratio should be chosen. Similarly, if the spot price has more chances of rise in the near term till expiry, then a lesser put ratio should be chosen.

For the selection of spread, we have seen that lower spread has high lower break even point and higher spread has low lower break even point, so if the spot price is likely to move to maximum value in the near term. Then the higher spread should be chosen.

Here we do not want to go in confusion. So we are taking 300 spread, and 0.667 put ratio, with combination of 3-OTM+2-slightly OTM

Trade setup for a put ratio spread:

Put ratio= 0.667, Spread= 300,

| Leg | Option type | Moneyness | Position | Quantity | Strike price (K) | Premium (P) | Premium type |

| Leg 1 | PE | OTM (LK) | Sell | 3 | 17400/- | 42.25/- | Premium received (PR) |

| Leg 2 | PE | slightly OTM (HK) | Buy | 2 | 17700/- | 111.05/- | Premium paid (PP) |

| Net premium paid/received | -95.35 | -2*PP+3*PR |

After taking position in both leg in a same time, price can move any direction on expiry so we check for various spot price on expiry to get sense of strategy pay offs.

Scenario 1- Spot price expires at below the lower break even point at (S) 16400/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 3*(42.25-max(17400-16400,0)) + 2*(max(17700-16400,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-max(1000,0)) + 2*(max(1300,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-1000) + 2*(1300-111.05)

Pay off (P&L) of strategy= 3*(-957.75) + 2*(1188.95)

Pay off (P&L) of strategy=-2873.25 + 2377.9

Pay off (P&L) of strategy= -495.35/-

Scenario 2- Spot price expires at the lower break even point at (S) 16895.35/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 3*(42.25-max(17400-16895.35,0)) + 2*(max(17700-16895.35,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-max(504.65,0)) + 2*(max(804.65,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-504.65) + 2*(804.65-111.05)

Pay off (P&L) of strategy= 3*(-462.4) + 2*(693.6)

Pay off (P&L) of strategy=-1387.2 + 1387.2

Pay off (P&L) of strategy= 0.00/-

Scenario 3- Spot price expires at the lower strike price at (S) 17400/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 3*(42.25-max(17400-17400,0)) + 2*(max(17700-17400,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-max(0,0)) + 2*(max(300,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-0) + 2*(300-111.05)

Pay off (P&L) of strategy= 3*(42.25) + 2*(188.95)

Pay off (P&L) of strategy= 126.75 + 377.9

Pay off (P&L) of strategy= 504.65/-

Scenario 4- Spot price expires at the higher strike price at (S) 17700/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 3*(42.25-max(17400-17700,0)) + 2*(max(17700-17700,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-max(-300,0)) + 2*(max(0,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-0) + 2*(0-111.05)

Pay off (P&L) of strategy= 3*(42.25) + 2*(-111.05)

Pay off (P&L) of strategy= 126.75 – 222.1

Pay off (P&L) of strategy= -95.35/-

Scenario 5- Spot price expires at the above higher strike price at (S) 17800/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 3*(42.25-max(17400-17800,0)) + 2*(max(17700-17800,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-max(-400,0)) + 2*(max(-100,0)-111.05)

Pay off (P&L) of strategy= 3*(42.25-0) + 2*(0-111.05)

Pay off (P&L) of strategy= 3*(42.25) + 2*(-111.05)

Pay off (P&L) of strategy= 126.75 – 221.1

Pay off (P&L) of strategy= -95.35/-

We have seen that when spot price expires at higher strike or above the higher strike then maximum loss is equal to net premium paid (-95.35/-). And when spot price expires at lower strike then maximum profit is equal to 504.65/-, means this profit is equal to double of difference between strike prices minus net premium paid. And when spot price expires at below lower strike minus max profit (504.65/-) Then the loss starts from here and the higher the spot price falls, the higher the loss

Strategy generalization for a put ratio spread option strategy:

Spread= Difference between the higher strike and lower strike price

Spread= 18050-17850

Spread= 200

Net debit/credit= lower strike qty*premium received for lower strike – higher strike qty*premium paid for higher strike

Note- If the result is negative then net debit if the result is positive then net credit.

Net debit/credit= 3*42.25-2*111.05

Net debit/credit= 126.75-222.1

Net debit= -95.35/-

Max profit= higher strike qty*spread + net debit/credit

Max profit= 2*300 – 95.35

Max profit= 504.65/-

Upper break even point= upper strike price – ABS(net debit/higher strike qty)

Where, ABS stands for absolute value, and qty stands for quantity.

Note- In a net credit, upper break even point will be not applicable.

Upper break even point= 17700 – ABS(-95.35/2)

Lower break even point= 17700 – 47.675

Upper break even point= 17652.325/–

Lower break even point= lower strike price – max profit/(lower strike qty-higher strike qty)

Lower break even point= 17400 – 504.65/(3-2)

Lower break even point= 17400 – 504.65

Lower break even point= 16895.35/–

Max loss= lower range – lower break even point

Where lower range= expected spot price fall till expiry

Here we take lower range= Current spot price- 2*SD*current spot price

If annual SD=20%, and expiry days= 14,

Lower range (2SD)= 17742-2*17742*(20/100)*√(14/365)= 16352.12/-

Max loss= 16352.12-16895.35

Max loss= -543.23/-

Max profit at strike price= at lower strike

Max profit at strike price= 17400/-

Max loss at spot price= at below lower break even point same as lower range

Max loss at spot price= 16352.12/-

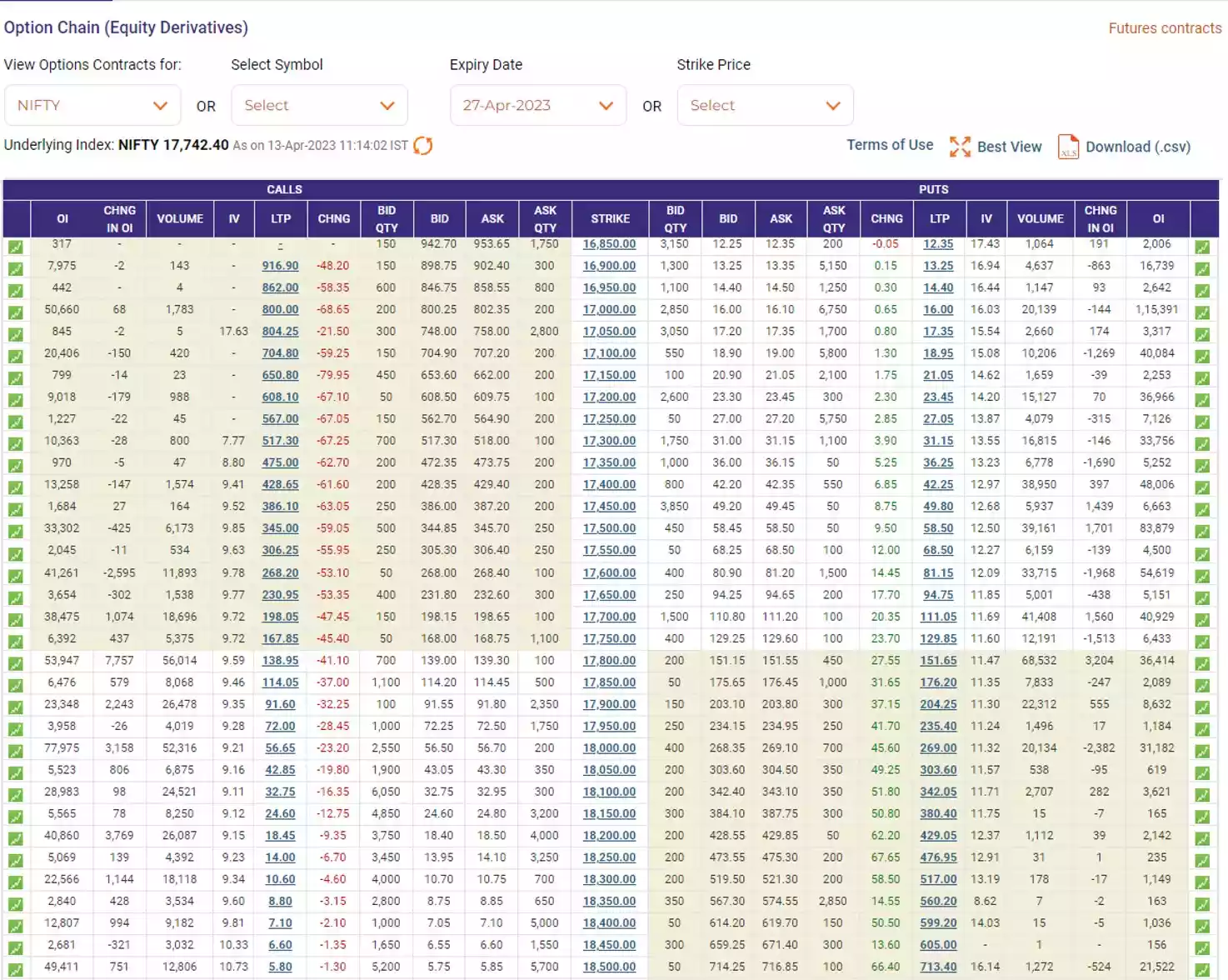

Strategy pay off (P&L) table for put ratio spread option strategy:

Strategy pay off or profit and loss of put ratio spread option strategy is combined profit and loss of leg 1 and leg 2 positions for various spot prices on expiry.

Use calculator for calculation of pay off schedule or profit and loss:

Pay of schedule:

| Various spot prices on expiry (Sf) | Pay off or profit and loss of strategy |

| 16352.11 | -543.24 |

| 16533.19 | -362.16 |

| 16714.27 | -181.08 |

| 16895.35 | 0.00 |

| 17400 | 504.65 |

| 17550 | 204.65 |

| 17652.325 | 0.00 |

| 17700 | -95.35 |

| 18177.3 | -95.35 |

| 18654.60 | -95.35 |

| 19131.90 | -95.35 |

Strategy pay off (P&L) chart for put ratio spread option strategy:

Strategy pay off chart is the presentation of profit and loss on y-axis and various spot prices on x-axis.

Why should I use this put ratio spread option strategy?

If using Bull put spread option strategy then you will have to pay more net debit than put ratio spread option strategy and also get less profit from this strategy. But the loss of this strategy is limitless. So if your expected spot price lower limit is less than the lower break even point then definitely use put ratio spread option strategy as profit potential is better than bull put spread option strategy.

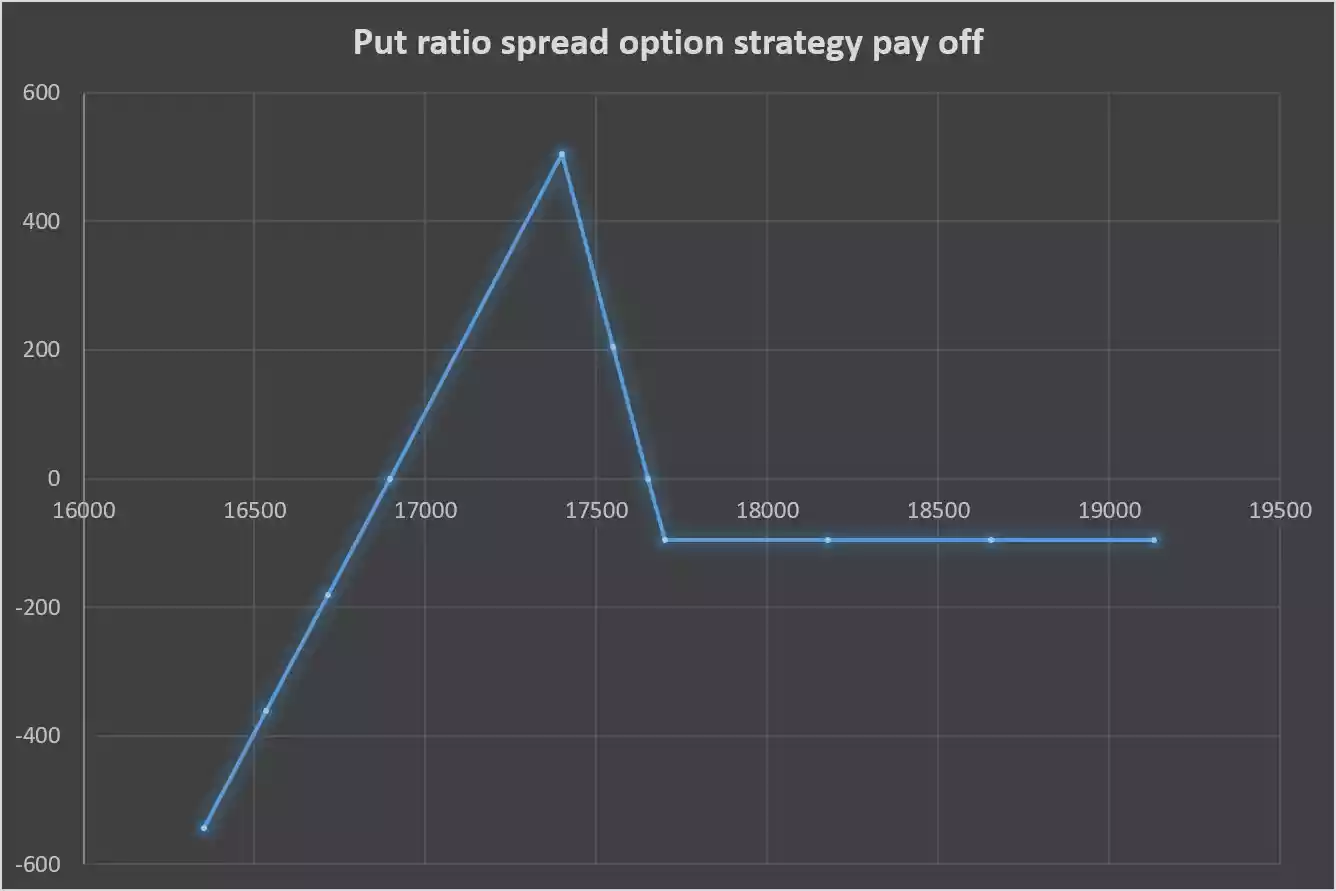

Put ratio spread option strategy associated Greeks:

Option strategy Greeks is the sum of leg 1 option contract Greeks and leg 2 option contract Greeks.

Below is the put ratio spread option strategy associated Greeks snapshot, for leg 1 and leg 2 positions-

Associated Greeks add with associated premium when spot price rise and Associated Greeks minus with associated premium when spot price fall.

All associated option Greeks will not be the same during the life of the option, it will change from change in option pricing variables.

Overall, a put ratio spread is a unlimited-risk, limited-reward options strategy that can be used to profit from a limited bearish range (up to lower strike) in the underlying asset. But according to Associated Option Greeks, gains and losses don’t happen overnight, it takes time to expire.

Put ratio back spread option strategy:

When you are bearish on any underlying asset use put ratio back spread. When you implement the put ratio back spread you get unlimited profit if the market goes down, limited profit if market goes up, and a predefined loss if the market stands within a range. The put ratio back spread is deployed for net credit.

Strategy notes for a put ratio back spread option strategy:

The put ratio back spread option strategy is a 2 leg option strategy with different quantity as it involves buying two or three OTM (lower strike) put options and selling one or two ITM (higher strike) put options.

To implement put ratio back spread-

Leg 1- Buy 2-ATM (LK-lower strike) put option

Leg 2- Sell 1-ITM (HK-higher strike) put option

Or

Leg 1- Buy 3-ATM (LK-lower strike) put option

Leg 2- Sell 2-ITM (HK-higher strike) put option

When take positions ensure that both leg option contracts should be same underlying asset, same expiry date, and with different quantity of options. Also ensure that when you take position in both leg then take position in both leg same time.

Example of put ratio back spread option strategy:

For a example of put ratio back spread option strategy, we are taking Nifty options contract.

Option contract- Nifty 27Apr … PE

Today’s date- 13/04/2023

Expiry date- 27/04/2023

Expiry days= expiry date – todays date= 14days

Underlying asset- Nifty 50

Directional view/outlook- Bearish

Spot price (S)- 17742/-

Annual historical volatility- 20%

Lower range (2SD)= 17742-2*17742*(20/100)*√(14/365)= 16352.12./-

Spread and strike price selection for a put ratio back spread option strategy:

In the table below, we will look at different spreads and different strike combinations to see which one is better. And also we will compare with put ratio of 0.5 and 0.667.

For spread= 100, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17600 | 17650 | 17700 | 17750 |

| 1-HK | 17700 | 17750 | 17800 | 17850 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PP | 81.15 | 94.75 | 111.05 | 129.85 |

| HK-PR | 111.05 | 129.85 | 151.65 | 176.20 |

| Net debit/credit (PR-2*PP) | -51.25 | -59.65 | -70.45 | -83.50 |

| Max profit (at lower range=16352.12) | 1096.63 (unlimited) | 1138.23 (unlimited) | 1177.43 (unlimited) | 1214.38 (unlimited) |

| Max loss | -151.25 | -159.65 | -170.45 | -183.50 |

| Lower break even point | 17448.75 | 17490.35 | 17529.55 | 17566.5 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 0.138 | 0.140 | 0.145 | 0.151 |

| Remarks | break even point is very far to spot price | break even point is very far to spot price | looks like moderate | risk reward ratio is very high |

N/A means Not Applicable, the lower break even point will not apply when the strike combination creates a net debit.

According to above table, best combination is 2-OTM+1-ITM.

For spread= 100, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17600 | 17650 | 17700 | 17750 |

| 2-HK | 17700 | 17750 | 17800 | 17850 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PP | 81.15 | 94.75 | 111.05 | 129.85 |

| HK-PR | 111.05 | 129.85 | 151.65 | 176.20 |

| Net debit/credit (2*PR-3*PP) | -21.35 | -24.55 | -29.85 | -37.15 |

| Max profit (at lower range=16352.12) | 1026.53 (unlimited) | 1073.33 (unlimited) | 1118.03 (unlimited) | 1160.73 (unlimited) |

| Max loss | -221.35 | -224.55 | -229.85 | -237.15 |

| Lower break even point | 17378.65 | 17425.45 | 17470.15 | 17512.85 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 0.216 | 0.209 | 0.206 | 0.204 |

| Remarks | break even point is very far to spot price/risk reward ratio is very high | break even point is very far to spot price | break even point is very far to spot price | looks like moderate |

According to above table, best combination is 3-ATM+2-ITM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the max loss is high. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

For spread= 200, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17500 | 17550 | 17650 | 17750 |

| 1-HK | 17700 | 17750 | 17850 | 17950 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PP | 58.50 | 68.5 | 94.75 | 129.85 |

| HK-PR | 111.05 | 129.85 | 176.20 | 235.40 |

| Net debit/credit (PR-2*PP) | -5.95 | -7.15 | -13.3 | -24.3 |

| Max profit (at lower range=16352.12) | 941.93 (unlimited) | 990.73 (unlimited) | 1084.58 (unlimited) | 1173.58 (unlimited) |

| Max loss | -205.95 | -207.15 | -213.3 | -224.30 |

| Lower break even point | 17294.05 | 17342.85 | 17436.70 | 17525.7 |

| Upper break even point | N/A | N/A | N/A | N/A |

| Risk/reward ratio | 0.219 | 0.209 | 0.197 | 0.191 |

| Remarks | break even point is very far to spot price/risk reward ratio is very high | break even point is very far to spot price | break even point is very far to spot price | looks like moderate |

According to above table, best combination is 2-ATM+1-ITM.

For spread= 200, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17500 | 17550 | 17650 | 17750 |

| 2-HK | 17700 | 17750 | 17850 | 17950 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PP | 58.50 | 68.5 | 94.75 | 129.85 |

| HK-PR | 111.05 | 129.85 | 176.20 | 235.40 |

| Net debit/credit (2*PR-3*PP) | +46.6 | +54.2 | +68.15 | +81.25 |

| Max profit (at lower range=16352.12) | 794.48 (unlimited) | 852.08 (unlimited) | 966.03 (unlimited) | 1079.13 (unlimited) |

| Max loss | -353.40 | -345.80 | -331.85 | -318.75 |

| Lower break even point | 17146.60 | 17204.2 | 17318.15 | 17431.25 |

| Upper break even point | 17676.70 | 17722.90 | 17815.925 | 17909.375 |

| Risk/reward ratio | 0.445 | 0.406 | 0.344 | 0.295 |

| Remarks | lower break even point is very far to spot price/risk reward ratio is very high | lower break even point is very far to spot price | lower break even point is very far to spot price | looks like moderate |

According to above table, best combination is 3-ATM+2-ITM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the max loss is high. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

For spread= 300, and put ratio= 0.5,

| Generalization | 2-OTM+1-OTM | 2-OTM+1-ATM | 2-OTM+1-ITM | 2-ATM+1-ITM |

| 2-LK | 17400 | 17450 | 17600 | 17750 |

| 1-HK | 17700 | 17750 | 17900 | 18050 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PP | 42.25 | 49.8 | 81.15 | 129.85 |

| HK-PR | 111.05 | 129.85 | 204.25 | 303.6 |

| Net debit/credit (PR-2*PP) | +26.55 | +30.25 | +41.95 | +43.9 |

| Max profit (at lower range=16352.12) | 774.43 (unlimited) | 828.13 (unlimited) | 989.83 (unlimited) | 1141.78 (unlimited) |

| Max loss | -273.45 | -269.75 | -258.05 | -256.1 |

| Lower break even point | 17126.55 | 17180.25 | 17341.95 | 17493.9 |

| Upper break even point | 17673.45 | 17719.75 | 17858.05 | 18006.1 |

| Risk/reward ratio | 0.353 | 0.326 | 0.261 | 0.224 |

| Remarks | lower break even point is very far to spot price/risk reward ratio is very high | lower break even point is very far to spot price | lower break even point is very far to spot price | looks like moderate |

According to above table, best combination is 2-ATM+1-ITM.

For spread= 300, and put ratio= 0.667,

| Generalization | 3-OTM+2-OTM | 3-OTM+2-ATM | 3-OTM+2-ITM | 3-ATM+2-ITM |

| 3-LK | 17400 | 17450 | 17600 | 17750 |

| 2-HK | 17700 | 17750 | 17900 | 18050 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PP | 42.25 | 49.8 | 81.15 | 129.85 |

| HK-PR | 111.05 | 129.85 | 204.25 | 303.6 |

| Net debit/credit (2*PR-3*PP) | +95.35 | +110.3 | +165.05 | +217.65 |

| Max profit (at lower range=16352.12) | 543.23 (unlimited) | 608.18 (unlimited) | 812.93 (unlimited) | 1015.53 (unlimited) |

| Max loss | -504.65 | -489.7 | -434.95 | -382.35 |

| Lower break even point | 16895.35 | 16960.3 | 17165.05 | 17367.65 |

| Upper break even point | 17652.325 | 17694.85 | 17817.475 | 17941.175 |

| Risk/reward ratio | 0.929 | 0.805 | 0.535 | 0.377 |

| Remarks | lower break even point is very far to spot price/risk reward ratio is very high | lower break even point is very far to spot price | lower break even point is very far to spot price | looks like moderate |

According to above table, best combination is 3-ATM+2-ITM,

And the best put ratio is 0.667, because of lower break even point is lesser than lower break even point of put ratio 0.5, but the max loss is high. So if the spot price is going to fall in the time frame, then take a strike combination with a put ratio of 0.667.

Here we do not want to go in confusion. So we are taking randomly 200 spread, and 0.5 put ratio, with combination of 2-ATM+1-ITM

Trade setup for a put ratio spread:

Put ratio= 0.5, Spread= 200,

| Leg | Option type | Moneyness | Position | Quantity | Strike price (K) | Premium (P) | Premium type |

| Leg 1 | PE | ATM (LK) | Buy | 2 | 17750/- | 129.85/- | Premium received (PR) |

| Leg 2 | PE | ITM (HK) | Sell | 1 | 17950/- | 235.40/- | Premium paid (PP) |

| Net premium paid/received | -24.3 | -2*PP+1*PR |

After taking position in both leg in a same time, price can move any direction on expiry so we check for various spot price on expiry to get sense of strategy pay offs.

Scenario 1- Spot price expires at below the lower break even point at (S) 17150/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(-PP + max(LK-S,0)) + Qty*(-max(HK-S,0) + PR)

Pay off (P&L) of strategy= 2*(-129.85+max(17750-17150,0)) + 1*(-max(17950-17150,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+max(600,0)) + 1*(-max(800,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+600) + 1*(-800+235.40)

Pay off (P&L) of strategy= 2*(470.15) + 1*(-564.6)

Pay off (P&L) of strategy= 940.3-564.6

Pay off (P&L) of strategy= 375.7/-

Scenario 2- Spot price expires at the lower break even point at (S) 17525.7/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(-PP + max(LK-S,0)) + Qty*(-max(HK-S,0) + PR)

Pay off (P&L) of strategy= 2*(-129.85+max(17750-17525.7,0)) + 1*(-max(17950-17525.7,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+max(224.3,0)) + 1*(-max(424.3,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+224.3) + 1*(-424.3+235.40)

Pay off (P&L) of strategy= 2*(94.45) + 1*(-188.9)

Pay off (P&L) of strategy= 188.9-188.9

Pay off (P&L) of strategy= 0.00/-

Scenario 3- Spot price expires at the lower strike price at (S) 17750/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(-PP + max(LK-S,0)) + Qty*(-max(HK-S,0) + PR)

Pay off (P&L) of strategy= 2*(-129.85+max(17750-17750,0)) + 1*(-max(17950-17750,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+max(0,0)) + 1*(-max(200,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+0) + 1*(-200+235.40)

Pay off (P&L) of strategy= 2*(-129.85) + 1*(35.40)

Pay off (P&L) of strategy= -259.7+35.40

Pay off (P&L) of strategy= -224.3/-

Scenario 4- Spot price expires at the higher strike price at (S) 17950/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(-PP + max(LK-S,0)) + Qty*(-max(HK-S,0) + PR)

Pay off (P&L) of strategy= 2*(-129.85+max(17750-17950,0)) + 1*(-max(17950-17950,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+max(-200,0)) + 1*(-max(0,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+0) + 1*(-0.0+235.40)

Pay off (P&L) of strategy= 2*(-129.85) + 1*(235.4)

Pay off (P&L) of strategy= -259.7+235.4

Pay off (P&L) of strategy= -24.3/-

Scenario 5- Spot price expires at the above higher strike price at (S) 18250/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(-PP + max(LK-S,0)) + Qty*(-max(HK-S,0) + PR)

Pay off (P&L) of strategy= 2*(-129.85+max(17750-18250,0)) + 1*(-max(17950-18250,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+max(-500,0)) + 1*(-max(-300,0)+235.40)

Pay off (P&L) of strategy= 2*(-129.85+0) + 1*(-0+235.40)

Pay off (P&L) of strategy= 2*(-129.85) + 1*(235.40)

Pay off (P&L) of strategy= -259.7+235.4

Pay off (P&L) of strategy= -24.3/-

We have seen that when spot price expires at higher strike or above the higher strike then maximum loss is equal to net premium paid (-24.3/-). And when spot price expires at lower strike then maximum loss is equal to 224.3/-, means this profit is equal to difference between strike prices plus net premium paid. And when spot price expires at below lower strike minus max loss (224.3/-) Then the loss starts from here and the higher the spot price falls, the higher the loss.

Strategy generalization for a put ratio back spread option strategy:

Spread= Difference between the higher strike and lower strike price

Spread= 17850 – 17650

Spread= 200

Net debit/credit= -lower strike qty*premium paid for lower strike + higher strike qty*premium received for higher strike

Note- If the result is negative then net debit if the result is positive then net credit.

Net debit/credit= -2*129.85 + 1*235.40

Net debit/credit= -259.7+235.40

Net debit= -24.3/-

Max loss= -higher strike qty*spread + net debit/credit

Max loss= -1*200 -24.3

Max loss= -224.3/-

Upper break even point=higher strike price – net credit/higher strike qty

Note- In a net debit, lower break even point will be not applicable.

Upper break even point= N/A

Lower break even point= lower strike price – ABS(max loss)/(lower strike qty-higher strike qty)

Where, ABS stands for absolute value, and qty stands for quantity.

Lower break even point= 17750 – ABS(-224.3)/(2-1)

Lower break even point= 17750 – 224.3

Lower break even point= 17525.7/–

Max profit= lower break even point – lower range

Where lower range= expected spot price rise till expiry

Here we take lower range= Current spot price- 2*SD*current spot price

If annual SD=20%, and expiry days= 14,

Lower range (2SD)= 17742-2*17742*(20/100)*√(14/365)= 16352.12/-

Max profit= 17525.7-16352.12

Max profit= 1173.58/-

Max profit at spot price= at lower range

Max profit at spot price= 16352.12

Max loss at spot price= at lower strike price

Max loss at spot price= 17750/-

Strategy pay off (P&L) table for put ratio back spread option strategy:

Strategy pay off or profit and loss of put ratio back spread option strategy is combined profit and loss of leg 1 and leg 2 positions for various spot prices on expiry.

Use calculator for calculation of pay off schedule or profit and loss:

Pay of schedule:

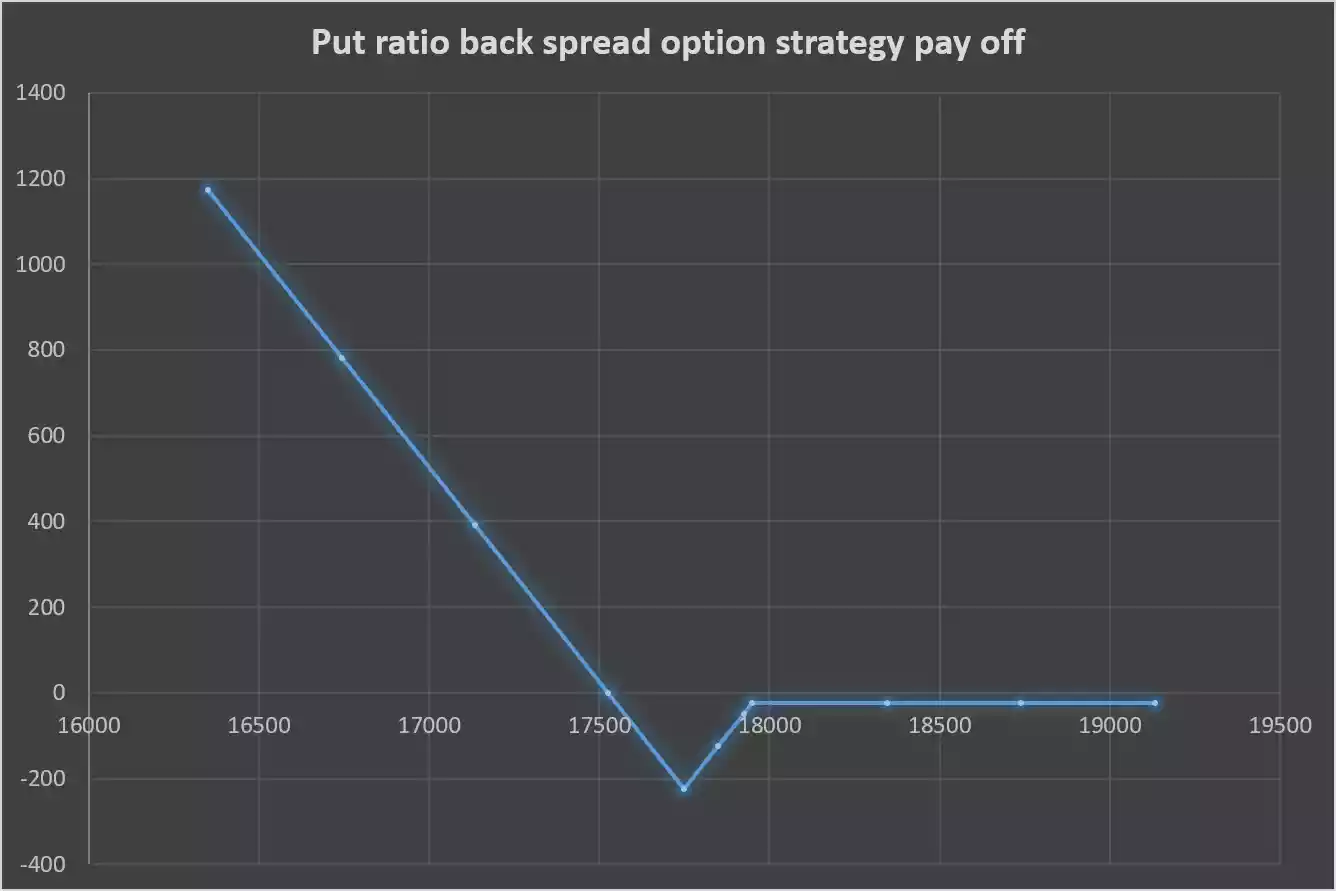

| Various spot prices on expiry (Sf) | Pay off or profit and loss of strategy |

| 16352.10 | 1173.60 |

| 16743.30 | 782.40 |

| 17134.50 | 391.20 |

| 17525.70 | 0.00 |

| 17750 | -224.3 |

| 17850 | -124.3 |

| 17925.70 | -48.6 |

| 17950 | -24.3 |

| 18343.96 | -24.3 |

| 18737.92 | -24.3 |

| 19131.88 | -24.3 |

Strategy pay off (P&L) chart for put ratio back spread option strategy:

Strategy pay off chart is the presentation of profit and loss on y-axis and various spot prices on x-axis.

Why should I use this put ratio back spread option strategy?

You should choose this strategy if you expect the spot price to move beyond the range of Upper Break Even Point and Lower Break Even Point to any side.

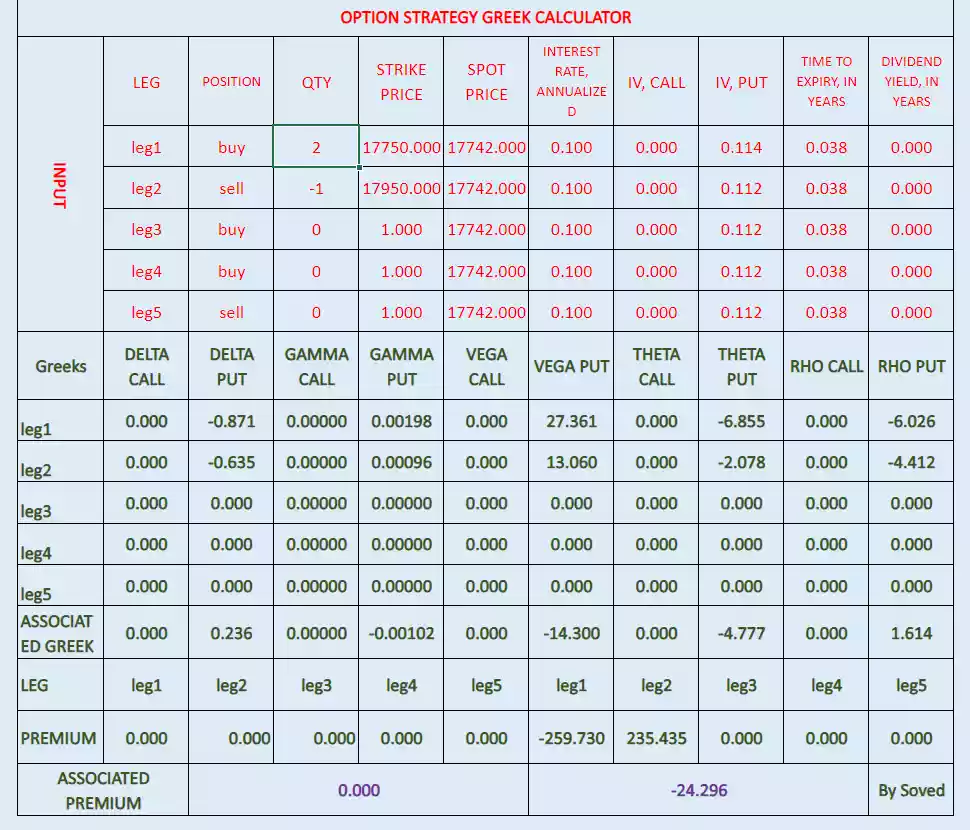

Put ratio back spread option strategy Greeks:

Option strategy Greeks is the sum of leg 1 option contract Greeks and leg 2 option contract Greeks.

Below is the put ratio back spread option strategy associated Greeks snapshot, for leg 1 and leg 2 positions-

Associated Greeks add with associated premium when spot price rise and Associated Greeks minus with associated premium when spot price fall.

All associated option Greeks will not be the same during the life of the option, it will change from change in option pricing variables.

Overall, a put ratio back spread is a limited-risk, unlimited-reward options strategy that can be used to profit from a bearish move below the lower break even point in the underlying asset. But according to Associated Option Greeks, gains and losses don’t happen overnight, it takes time to expire.