What is put spread option strategy?

The put spread option strategy is similar to the call spread option strategy. Just like call option contracts are executed in call spread option strategy, similarly put option contracts are executed in put spread option strategy. Put spread option strategy using put option contracts for taking positions. Maximum and minimum two positions taken in the put spread option strategy. In a put spread option strategy potential losses limited so as on potential profit also limited.

Table of Contents

Bull put spread option strategy:

Bull put spread is similar to the bull call spread. In bull put spread strategy uses put options instead of call options. This strategy used when trader moderately bullish on stock/index. Difference between bull put spread and bull call spread is cash flow means bull put spread is credit cash flow and bull call spread is debit cash flow. Due to Receiving and paying cash flow bull put spread option strategy known as credit strategy, and bull call spread option strategy known aa debit strategy.

Here we will understand the market outlook or directional view of underlying asset price by analysis of underlying asset such analysis as economy analysis, industry/sector analysis, technical analysis, fundamental analysis etc. With these analysis keep in mind current news and events of underlying asset and also all market events. Because of we have understand all above written analysis in call spread option strategy so here we will not discussed.

Strategy notes for a bull put spread option strategy:

The bull put spread option strategy comes usable when you have a moderately bullish view on the stock/index. The bull put spread is a two leg option strategy mostly involving OTM and ITM options.

To implement bull put spread-

Leg 1- Buy 1-OTM (LK-lower strike) put option

Leg 2- Sell 1-ITM (HK-higher strike) put option

When take positions ensure that both leg option contracts should be same underlying asset, same expiry date, and with same quantity of options. Also ensure that when you take position in both leg then take position in both leg same time.

Example of bull put spread option strategy:

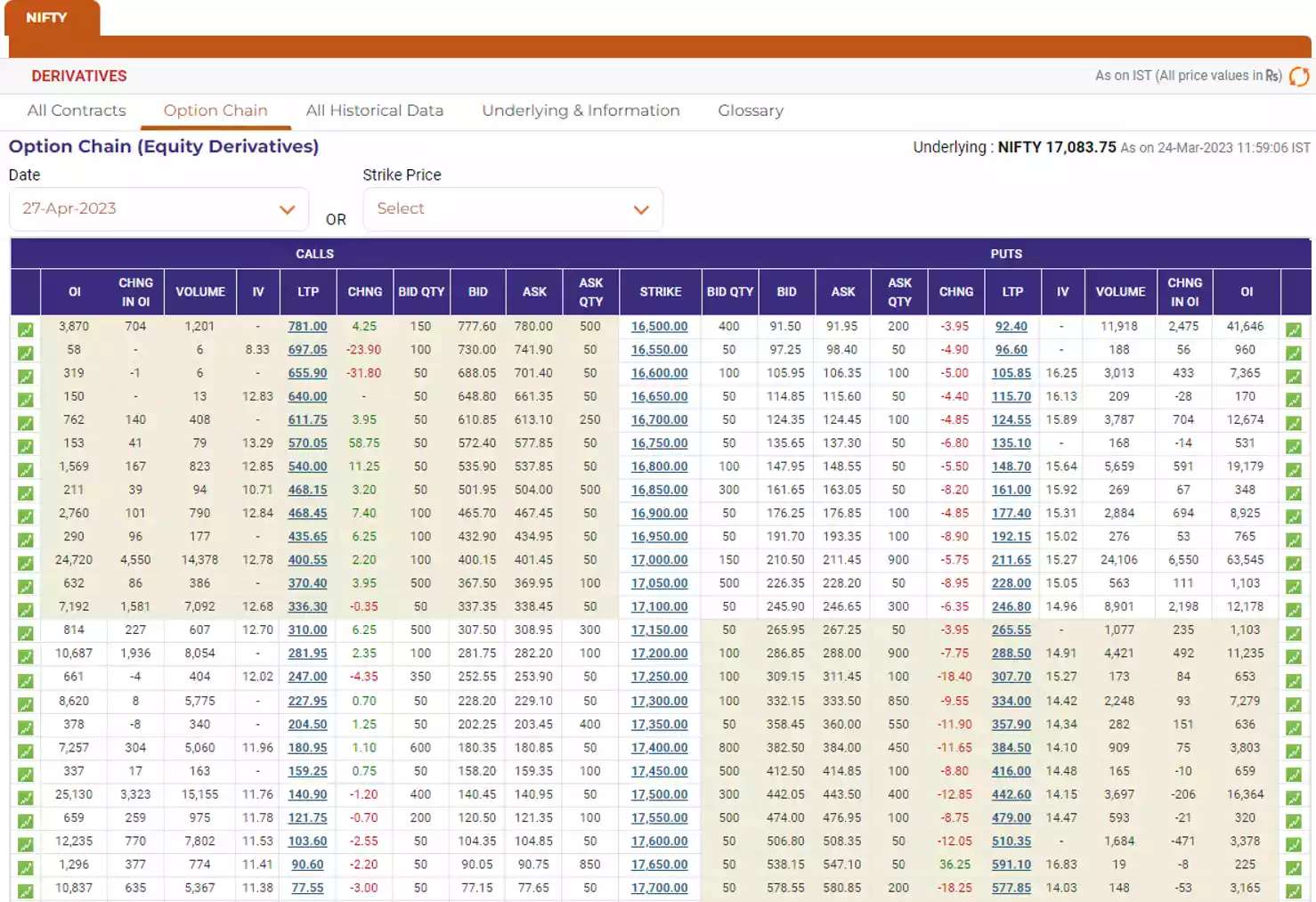

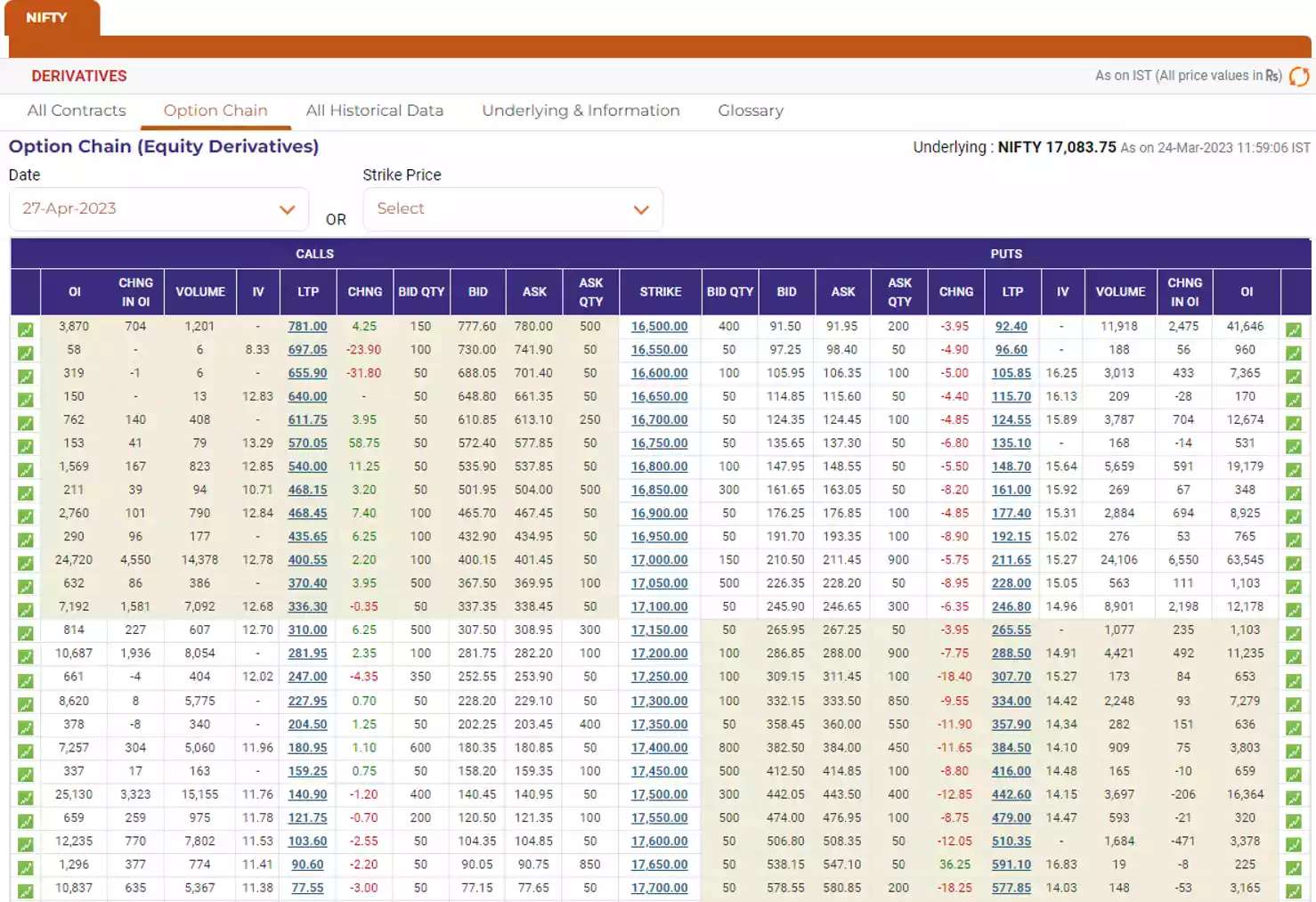

For a example of bull put spread option strategy, we are taking Nifty options contract.

Option contract- Nifty 27Apr … PE

Today’s date- 24/03/2023

Expiry date- 27/04/2023

Underlying asset- Nifty 50

Directional view/outlook- Moderately bullish

Spot price (S)- 17084/-

Spread and strike price selection for a bull put spread option strategy:

As we know that spread is the difference between higher strike price minus lower strike price. For a near strike lower is the spread and for a far strike higher is the spread. So for a lower spread required movement of underlying asset price (spot price) lower and for a higher spread required movement of spot price higher.

So according to your spot price movement or your target price you should select spread. Some strike differences or spread is which mostly used are 100/-, 200/-, 300/-. Also keep in mind for what time period this spread or target price is for.

Mostly used strike combination is OTM+ITM. but also used other strike combination of OTM+OTM, OTM+ATM, and ATM+ITM.

In the table below, we will look at different spreads and different strike combinations to see which one is better.

For spread= 100,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 17000 | 17050 | 17100 | 17150 |

| HK | 17100 | 17150 | 17200 | 17250 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PP | 211.65 | 228 | 246.80 | 265.55 |

| HK-PR | 246.80 | 265.55 | 288.50 | 307.70 |

| Net credit | 35.15 | 37.55 | 41.70 | 42.15 |

| Max loss | 64.85 | 62.45 | 58.3 | 57.85 |

| Max profit | 35.15 | 37.55 | 41.70 | 42.15 |

| Break even point | 17064.85 | 17112.45 | 17158.30 | 17207.85 |

| Risk/reward ratio | 1.85 | 1.66 | 1.4 | 1.37 |

| Remarks | risk reward ratio is very high | profit is very less | looks like moderate | break even point is very high |

According to above table, best combination is OTM+ITM.

For spread= 200,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 16900 | 16950 | 17050 | 17150 |

| HK | 17100 | 17150 | 17250 | 17350 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PP | 177.40 | 192.15 | 228 | 265.55 |

| HK-PR | 246.80 | 265.55 | 307.70 | 357.90 |

| Net credit | 69.4 | 73.4 | 79.7 | 92.35 |

| Max loss | 130.6 | 126.6 | 120.3 | 107.65 |

| Max profit | 69.4 | 73.4 | 79.7 | 92.35 |

| Break even point | 17030.6 | 17076.6 | 17170.3 | 17257.65 |

| Risk/reward ratio | 1.88 | 1.72 | 1.51 | 1.17 |

| Remarks | risk reward ratio is very high | profit is very less | looks like moderate | break even point is very high |

According to above table, best combination is OTM+ITM.

For spread= 300,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 16800 | 16850 | 17000 | 17150 |

| HK | 17100 | 17150 | 17300 | 17450 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PP | 148.70 | 161.0 | 211.65 | 265.55 |

| HK-PR | 246.80 | 265.55 | 334.0 | 416.0 |

| Net credit | 98.1 | 104.55 | 122.35 | 150.45 |

| Max loss | 201.90 | 195.45 | 177.65 | 149.55 |

| Max profit | 98.1 | 104.55 | 122.35 | 150.45 |

| Break even point | 17001.90 | 17045.45 | 17177.65 | 17299.55 |

| Risk/reward ratio | 2.1 | 1.87 | 1.45 | 0.99 |

| Remarks | risk reward ratio is very high | profit is very less | looks like moderate | break even point is very high |

According to above table, best combination is OTM+ITM.

According to above generalization of various combinations of strike with various spreads is sure that when we will go towards deep ITM combinations then profit will be more but Break even point is high means loss chances is very high. like that when we will go towards OTM combinations then profit is very less but due to less break even point chances of profit very high. So for bull put spread option strategy best strike combination is OTM+ITM.

The selection of spread depends on the target price. Use higher spread if your target price is higher and use lower spread if your target price is lower. Generally lower spread is used for shorter expiry time and higher spread is used for longer expiry time e.g. Weekly/Half monthly option contract is used for spread up to 100-150, for spread up to 150-250 Half monthly/monthly option contracts are used, and for spreads above 250, monthly to quarterly options contracts are used etc.

Trade setup for a bull put spread:

| Leg | Option type | Moneyness | Position | Quantity | Strike price (K) | Premium (P) | Premium type |

| Leg 1 | PE | OTM (LK) | Buy | 1 | 17000/- | 211.65/- | Premium paid (PP) |

| Leg 2 | PE | ITM (HK) | Sell | 1 | 17300/- | 334.00/- | Premium received (PR) |

| Net premium received | 122.35/- | PR – PP |

Buy OTM put option and sell ITM put option so for this both premium difference in credit. Due to net premium received or in credit so this strategy also known as credit bull spread.

After taking position in both leg in a same time price can move any direction on expiry so we check for various spot price on expiry to get sense of strategy pay offs.

Scenario 1- Spot price expires at below the lower strike price at (S) 16900/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(max(LK-S,0) – PP) + Qty*(PR – max(HK-S,0))

Pay off (P&L) of strategy= 1*(max(17000-16900,0) – 211.65) + 1*(334.00 – max(17300-16900,0))

Pay off (P&L) of strategy= (max(100,0) – 211.65) + (334.0 – max(400,0))

Pay off (P&L) of strategy= (100 – 211.65) + (334.00 – 400)

Pay off (P&L) of strategy= -111.65 – 66.00

Pay off (P&L) of strategy= -177.65/-

Scenario 2- Spot price expires at the lower strike price at (S) 17000/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(max(LK-S,0) – PP) + Qty*(PR – max(HK-S,0))

Pay off (P&L) of strategy= 1*(max(17000-17000,0) – 211.65) + 1*(334.00 – max(17300-17000,0))

Pay off (P&L) of strategy= (max(0,0) – 211.65) + (334.0 – max(300,0))

Pay off (P&L) of strategy= (0 – 211.65) + (334.00 – 300)

Pay off (P&L) of strategy= -211.65 + 34.00

Pay off (P&L) of strategy= -177.65/-

Scenario 3- Spot price expires at the higher strike price at (S) 17300/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(max(LK-S,0) – PP) + Qty*(PR – max(HK-S,0))

Pay off (P&L) of strategy= 1*(max(17000-17300,0) – 211.65) + 1*(334.00 – max(17300-17300,0))

Pay off (P&L) of strategy= (max(-300,0) – 211.65) + (334.0 – max(0,0))

Pay off (P&L) of strategy= (0 – 211.65) + (334.00 – 0)

Pay off (P&L) of strategy= -211.65 + 334.00

Pay off (P&L) of strategy= 122.35/-

Scenario 4- Spot price expires at above the higher strike price at (S) 17400/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(max(LK-S,0) – PP) + Qty*(PR – max(HK-S,0))

Pay off (P&L) of strategy= 1*(max(17000-17400,0) – 211.65) + 1*(334.00 – max(17300-17400,0))

Pay off (P&L) of strategy= (max(-400,0) – 211.65) + (334.0 – max(-100,0))

Pay off (P&L) of strategy= (0 – 211.65) + (334.00 – 0)

Pay off (P&L) of strategy= -211.65 + 334.00

Pay off (P&L) of strategy= 122.35/-

We have seen that when spot price expires at lower strike or below the lower strike then maximum loss is equal to net premium received minus spread (177.65). And when spot price expires at higher strike or above higher strike then maximum profit is equal to 122.35/-.

Strategy generalization for a bull put spread option strategy:

Spread= Difference between the higher strike and lower strike price

Spread= 17300-17000

Spread= 300

Net credit= premium received for higher strike – premium paid for lower strike

Net credit= 334.00 – 211.65

Net credit= 122.35/-

Max profit= net credit

Max profit= 122.35

Max loss= spread – net credit

Max loss= 300 – 122.35

Max loss= 177.65/-

Break even point= higher strike – net credit

Break even point= 17300 – 122.35

Break even point= 17177.65/–

Max profit at most strike price= at higher strike

Max profit at most strike price= 17300/-

Max loss at lowest strike price= at lower strike

Max loss at lowest strike price= 17000/-

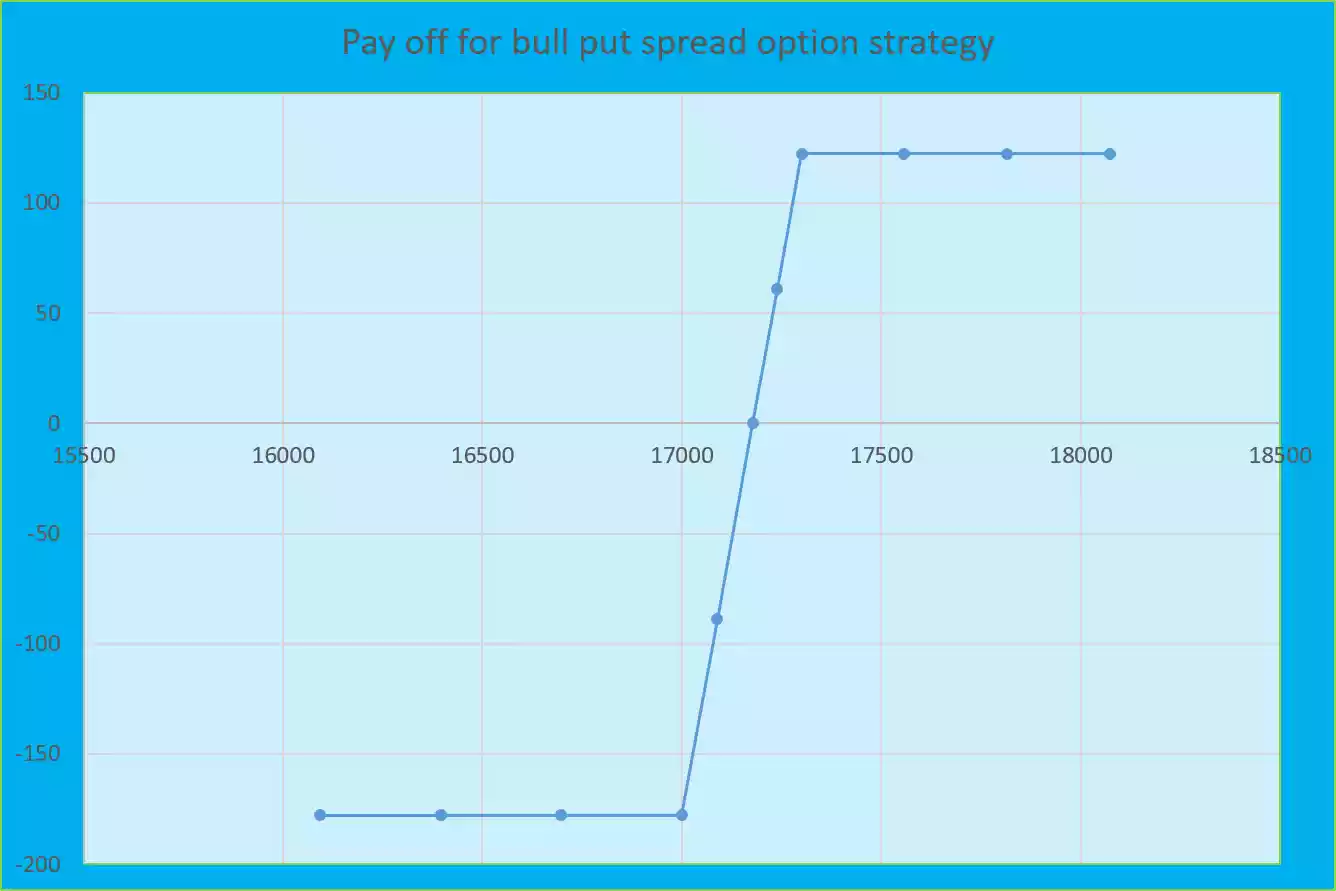

Strategy pay off (P&L) table for bull put spread option strategy:

Strategy pay off or profit and loss of bull put spread option strategy is combined profit and loss of leg 1 and leg 2 positions for various spot prices on expiry.

Use calculator for calculation of pay off schedule or profit and loss:

Pay of schedule:

| Various spot prices on expiry (Sf) | Pay off or profit and loss of strategy |

| 16093 | -177.65 |

| 16395 | -177.65 |

| 16697 | -177.65 |

| 17000 | -177.65 |

| 17088.83 | -88.82 |

| 17177.65 | 00 |

| 17238.83 | 61.18 |

| 17300 | 122.35 |

| 17558 | 122.35 |

| 17816 | 122.35 |

| 18074 | 122.35 |

Strategy pay off (P&L) chart for bull put spread option strategy:

Strategy pay off chart is the presentation of profit and loss on y-axis and various spot prices on x-axis.

Why should I use this bull put spread option strategy?

Why I will use this strategy because of I can use short put naked option strategy. Well, the main reason is the protect downside fall.

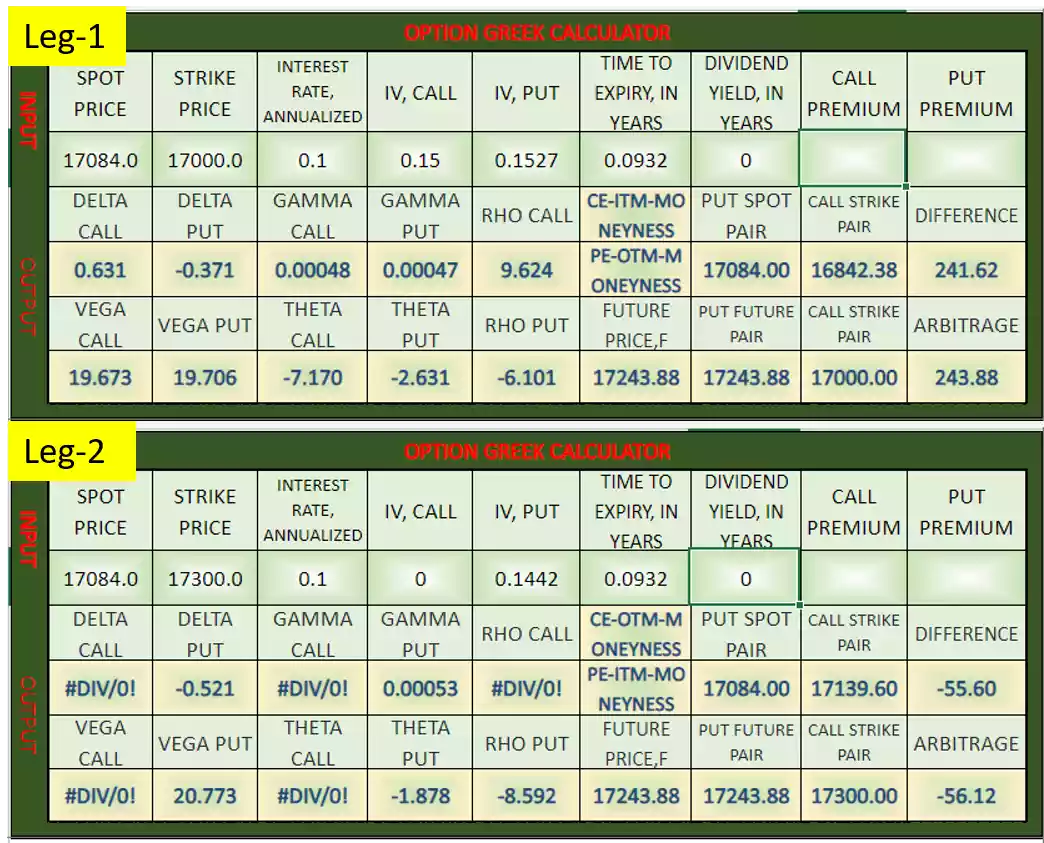

Bull put spread option strategy Greeks:

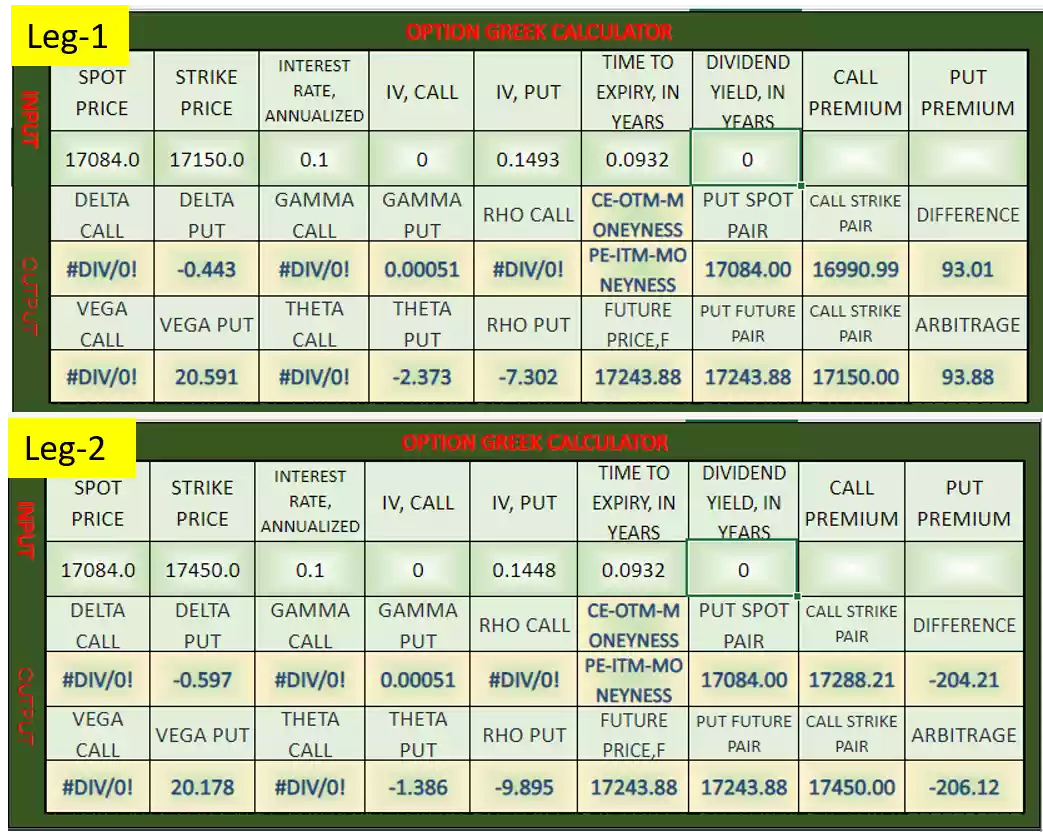

Below is the option Greeks snapshot, for leg 1 and leg 2 positions-

Here are the Greeks associated with a bull put spread:

Delta:

Delta for leg 1 (buy position)= -0.371

Delta for leg 2 (sell position)= -0.521

Associated Delta for bull put spread= -Delta for leg 1 +Delta for leg 2

Negative sign for buy position in leg 1 as a paid and positive sign for sell position in leg 2 as a received.

So Associated Delta= -(-0.371) + (-0.521)= -0.15

Associated Delta add with associated premium(net debit or net credit) if spot price increase, and associated Delta minus with associated premium(net debit or net credit) if spot price decrease.

Gamma:

Gamma for leg 1 (buy position)= 0.00047

Gamma for leg 2 (sell position)= 0.00053

Associated Gamma for bull put spread= -Gamma for leg 1 + Gamma for leg 2

Negative sign for buy position in leg 1 as a paid and positive sign for sell position in leg 2 as a received.

So Associated Gamma= -0.00047 +0.00053= 0.00006

Associated Gamma add with associated Delta if spot price increase, and associated Gamma minus with associated Delta if spot price decrease.

Theta:

Theta for leg 1 (buy position)= -2.631

Theta for leg 2 (sell position)= -1.878

Associated Theta for bull put spread= -absolute value of Theta for leg 1 + absolute value of Theta for leg 2

Negative sign for buy position in leg 1 as a paid and positive sign for sell position in leg 2 as a received.

So Associated Theta= -2.631 + 1.878= -0.753

Associated Theta add with associated premium(net debit or net credit) if time increase, and associated Theta minus with associated premium(net debit or net credit) if time decrease.

Vega:

Vega for leg 1 (buy position)= 19.706

Vega for leg 2 (sell position)= 20.773

Associated Vega for bull put spread= -Vega for leg 1 + Vega for leg 2

Negative sign for buy position in leg 1 as a paid and positive sign for sell position in leg 2 as a received.

So Associated Vega= -19.706 +20.773= 1.067

Associated Vega add with associated premium(net debit or net credit) if implied volatility increase, and associated Vega minus with associated premium(net debit or net credit) if implied volatility decrease.

Rho:

Rho for leg 1 (buy position)= -6.101

Rho for leg 2 (sell position)= -8.592

Associated Rho for bull put spread= -Rho for leg 1 + Rho for leg 2

Negative sign for buy position in leg 1 as a paid and positive sign for sell position in leg 2 as a received.

So Associated Rho= -(-6.101) + (-8.592)= -2.491

Associated Rho add with associated premium(net debit or net credit) if interest rate increase, and associated Rho minus with associated premium(net debit or net credit) if interest rate decrease.

All associated option Greeks will not be the same during the life of the option, it will change from time to time, and will change with the movement of the spot price and the other variables.

Overall, a bull put spread is a limited-risk, limited-reward options strategy that can be used to profit from bullish moves in the underlying asset. But according to Associated Option Greeks, gains and losses don’t happen overnight, it takes time to expire.

Bear put spread option strategy:

When the market outlook is moderately bearish trader can use bear put spread option strategy. Mean when you expect market go down in the near term but not too much.

Strategy notes for a bear put spread option strategy:

The bear put spread option strategy comes usable when you have a moderately bearish view on the stock/index. The bear put spread is a two leg option strategy mostly involving OTM and ITM options.

To implement bear put spread-

Leg 1- Sell 1-OTM (LK-lower strike) put option

Leg 2- Buy 1-ITM (HK-higher strike) put option

There is no any hard and fast rule to select strike, you can choose any strike by your aggressiveness of trade but remember always buy higher strike and sell lower strike.

When take positions ensure that both leg option contracts should be same underlying asset, same expiry date, and with same quantity of options. Also ensure that when you take position in both leg then take position in both leg same time.

Example of bear put spread option strategy:

For a example of bear put spread option strategy, we are taking Nifty options contract.

Option contract- Nifty 27Apr … PE

Today’s date- 24/03/2023

Expiry date- 27/04/2023

Underlying asset- Nifty 50

Directional view/outlook- Moderately bearish

Spot price (S)- 17084/-

Spread and strike price selection for a bear put spread option strategy:

In the table below, we will look at different spreads and different strike combinations to see which one is better. The different strike combination is OTM+ITM, OTM+OTM, OTM+ATM, and ATM+ITM. And different spread is 100, 200, 300 etc.

For spread= 100,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 17000 | 17050 | 17100 | 17150 |

| HK | 17100 | 17150 | 17200 | 17250 |

| Spread | 100 | 100 | 100 | 100 |

| LK-PR | 211.65 | 228 | 246.80 | 265.55 |

| HK-PP | 246.80 | 265.55 | 288.50 | 307.70 |

| Net debit | 35.15 | 37.55 | 41.70 | 42.15 |

| Max profit | 64.85 | 62.45 | 58.3 | 57.85 |

| Max loss | 35.15 | 37.55 | 41.70 | 42.15 |

| Break even point | 17064.85 | 17112.45 | 17158.30 | 17207.85 |

| Risk/reward ratio | 0.54 | 0.6 | 0.72 | 0.73 |

| Remarks | break even point is very less | break even point is very less | break even point is very less | looks like moderate |

According to above table, best combination is ATM+ITM.

For spread= 200,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 16900 | 16950 | 17050 | 17150 |

| HK | 17100 | 17150 | 17250 | 17350 |

| Spread | 200 | 200 | 200 | 200 |

| LK-PR | 177.40 | 192.15 | 228 | 265.55 |

| HK-PP | 246.80 | 265.55 | 307.70 | 357.90 |

| Net debit | 69.4 | 73.4 | 79.7 | 92.35 |

| Max profit | 130.6 | 126.6 | 120.3 | 107.65 |

| Max loss | 69.4 | 73.4 | 79.7 | 92.35 |

| Break even point | 17030.6 | 17076.6 | 17170.3 | 17257.65 |

| Risk/reward ratio | 0.53 | 0.58 | 0.66 | 0.86 |

| Remarks | break even point is very less | break even point is very less | break even point is very less | looks like moderate |

According to above table, best combination is ATM+ITM.

For spread= 300,

| Generalization | OTM+OTM | OTM+ATM | OTM+ITM | ATM+ITM |

| LK | 16800 | 16850 | 17000 | 17150 |

| HK | 17100 | 17150 | 17300 | 17450 |

| Spread | 300 | 300 | 300 | 300 |

| LK-PR | 148.70 | 161.0 | 211.65 | 265.55 |

| HK-PP | 246.80 | 265.55 | 334.0 | 416.0 |

| Net debit | 98.1 | 104.55 | 122.35 | 150.45 |

| Max profit | 201.90 | 195.45 | 177.65 | 149.55 |

| Max loss | 98.1 | 104.55 | 122.35 | 150.45 |

| Break even point | 17001.90 | 17045.45 | 17177.65 | 17299.55 |

| Risk/reward ratio | 0.49 | 0.54 | 0.69 | 1.01 |

| Remarks | break even point is very less | break even point is very less | looks like moderate | looks like moderate |

According to above table, best combination is OTM+ITM Or ATM+ITM

According to above generalization of various combinations of strike with various spreads is sure that when we will go towards deep ITM combinations then profit will be less but Break even point is high means profit chances is very high. like that when we will go towards OTM combinations then profit is very high but due to less break even point chances of profit very less. So for bear put spread option strategy best strike combination is ATM+ITM.

Trade setup for a bear put spread:

| Leg | Option type | Moneyness | Position | Quantity | Strike price (K) | Premium (P) | Premium type |

| Leg 1 | PE | ATM (LK) | Sell | 1 | 17150/- | 265.55/- | Premium paid (PR) |

| Leg 2 | PE | ITM (HK) | Buy | 1 | 17450/- | 416.00/- | Premium received (PP) |

| Net premium paid | 150.45/- | PP – PR |

Sell ATM put option and buy ITM put option so for this both premium difference in debit. Due to net premium paid or in debit so this strategy also known as debit bear spread.

After taking position in both leg in a same time price can move any direction on expiry so we check for various spot price on expiry to get sense of strategy pay offs.

Scenario 1- Spot price expires at below the lower strike price at (S) 16900/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 1*(265.55 – max(17150-16900,0)) + 1*(max(17450-16900,0) – 416.0)

Pay off (P&L) of strategy= (265.55 – max(250,0)) + (max(550,0) – 416.00)

Pay off (P&L) of strategy=(265.55 – 250) + (550 – 416.00)

Pay off (P&L) of strategy= 15.55 + 134

Pay off (P&L) of strategy= 149.55/-

Scenario 2- Spot price expires at the lower strike price at (S) 17150/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 1*(265.55 – max(17150-17150,0)) + 1*(max(17450-17150,0) – 416.0)

Pay off (P&L) of strategy= (265.55 – max(0,0)) + (max(300,0) – 416.00)

Pay off (P&L) of strategy=(265.55 – 0) + (300 – 416.00)

Pay off (P&L) of strategy= 265.55 – 116

Pay off (P&L) of strategy= 149.55/-

Scenario 3- Spot price expires at the higher strike price at (S) 17450/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 1*(265.55 – max(17150-17450,0)) + 1*(max(17450-17450,0) – 416.0)

Pay off (P&L) of strategy= (265.55 – max(-300,0)) + (max(0,0) – 416.00)

Pay off (P&L) of strategy=(265.55 – 0) + (0 – 416.00)

Pay off (P&L) of strategy= 265.55 – 416

Pay off (P&L) of strategy= -150.45/-

Scenario 4- Spot price expires at above the higher strike price at (S) 17500/-

Pay off (P&L) of strategy= P&L for leg 1 + P&L for leg 2

Pay off (P&L) of strategy= Qty*(PR – max(LK-S,0)) + Qty*(max(HK-S,0) – PP)

Pay off (P&L) of strategy= 1*(265.55 – max(17150-17500,0)) + 1*(max(17450-17500,0) – 416.0)

Pay off (P&L) of strategy= (265.55 – max(-350,0)) + (max(-50,0) – 416.00)

Pay off (P&L) of strategy=(265.55 – 0) + (0 – 416.00)

Pay off (P&L) of strategy= 265.55 – 416

Pay off (P&L) of strategy= -150.45/-

We have seen that when spot price expires at lower strike or below the lower strike then maximum profit is equal to spread minus net premium paid (150.45/-). And when spot price expires at higher strike or above higher strike then maximum loss is equal to net debit 150.45/-.

Strategy generalization for a bull put spread option strategy:

Spread= Difference between the higher strike and lower strike price

Spread= 17450-17150

Spread= 300

Net debit= premium paid for higher strike – premium received for lower strike

Net debit= 416.00 – 265.55

Net debit= 150.45/-

Max loss= net debit

Max loss= 150.45

Max profit= spread – net debit

Max profit= 300 – 150.45

Max profit= 149.55/-

Break even point= higher strike – net debit

Break even point= 17450 – 150.45

Break even point= 17299.55/–

Max profit at lowest strike price= at lower strike

Max profit at lowest strike price= 17150/-

Max loss at most strike price= at higher strike

Max loss at most strike price= 17450/-

Strategy pay off (P&L) table for bear put spread option strategy:

Strategy pay off or profit and loss of bear put spread option strategy is combined profit and loss of leg 1 and leg 2 positions for various spot prices on expiry.

Use calculator for calculation of pay off schedule or profit and loss:

Pay of schedule:

| Various spot prices on expiry (Sf) | Pay off or profit and loss of strategy |

| 16093 | 149.55 |

| 16445 | 149.55 |

| 16797 | 149.55 |

| 17150 | 149.55 |

| 17224.78 | 74.77 |

| 17299.55 | 00 |

| 17374.78 | -75.23 |

| 17450 | -150.45 |

| 17658 | -150.45 |

| 17866 | -150.45 |

| 18074 | -150.45 |

Strategy pay off (P&L) chart for bear put spread option strategy:

Strategy pay off chart is the presentation of profit and loss on y-axis and various spot prices on x-axis.

Why should I use this bear put spread option strategy?

Why I will use this strategy because of I can use long put naked option strategy. Well, the main reason is the reduced cost.

Bear put spread option strategy Greeks:

Below is the option Greeks snapshot, for leg 1 and leg 2 positions-

Here are the Greeks associated with a bear put spread:

Delta:

Delta for leg 1 (sell position)= -0.443

Delta for leg 2 (buy position)= -0.597

Associated Delta for bear put spread= Delta for leg 1 – Delta for leg 2

Negative sign for buy position in leg 2 as a paid and positive sign for sell position in leg 1 as a received.

So Associated Delta= (- 0.443) – (-0.597)= 0.154

Associated Delta add with associated premium(net debit or net credit) if spot price increase, and associated Delta minus with associated premium(net debit or net credit) if spot price decrease.

Gamma:

Gamma for leg 1 (sell position)= 0.00051

Gamma for leg 2 ( (buy position)= 0.00051

Associated Gamma for bear put spread= Gamma for leg 1 – Gamma for leg 2

Negative sign for buy position in leg 2 as a paid and positive sign for sell position in leg 1 as a received.

So Associated Gamma= 0.00051 – 0.00051= 0.00000

Associated Gamma add with associated Delta if spot price increase, and associated Gamma minus with associated Delta if spot price decrease.

Theta:

Theta for leg 1 (sell position)= -2.373

Theta for leg 2 (buy position)= -1.386

Associated Theta for bear put spread= absolute value of Theta for leg 1 – absolute value of Theta for leg 2

Negative sign for buy position in leg 2 as a paid and positive sign for sell position in leg 1 as a received.

So Associated Theta= 2.373 – 1.386= 0.987

Associated Theta add with associated premium(net debit or net credit) if time increase, and associated Theta minus with associated premium(net debit or net credit) if time decrease.

Vega:

Vega for leg 1 (sell position)= 20.591

Vega for leg 2 (buy position)= 20.178

Associated Vega for bear put spread= Vega for leg 1 – Vega for leg 2

Negative sign for buy position in leg 2 as a paid and positive sign for sell position in leg 1 as a received.

So Associated Vega= 20.591 – 20.178= 0.413

Associated Vega add with associated premium(net debit or net credit) if implied volatility increase, and associated Vega minus with associated premium(net debit or net credit) if implied volatility decrease.

Rho:

Rho for leg 1 (sell position)= -7.302

Rho for leg 2 (buy position)= -9.895

Associated Rho for bear put spread= Rho for leg 1 – Rho for leg 2

Negative sign for buy position in leg 2 as a paid and positive sign for sell position in leg 1 as a received.

So Associated Rho= (-7.302) – (-9.895)= 2.593

Associated Rho add with associated premium(net debit or net credit) if interest rate increase, and associated Rho minus with associated premium(net debit or net credit) if interest rate decrease..

All associated option Greeks will not be the same during the life of the option, it will change from time to time, and will change with the movement of the spot price and the other variables.

Overall, a bear put spread is a limited-risk, limited-reward options strategy that can be used to profit from bearish moves in the underlying asset. But according to Associated Option Greeks, gains and losses don’t happen overnight, it takes time to expire.